This version of the form is not currently in use and is provided for reference only. Download this version of

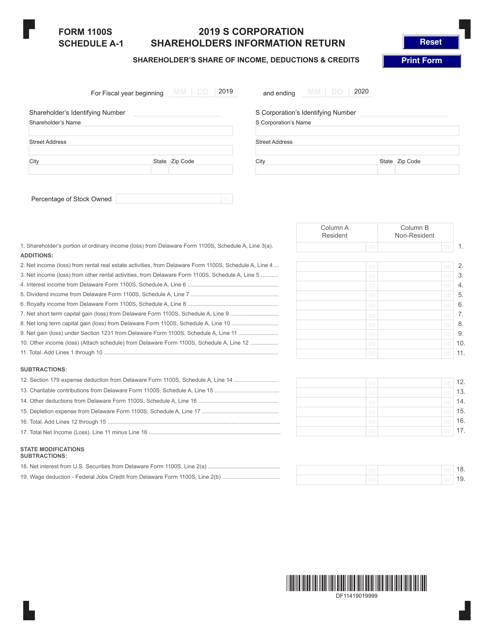

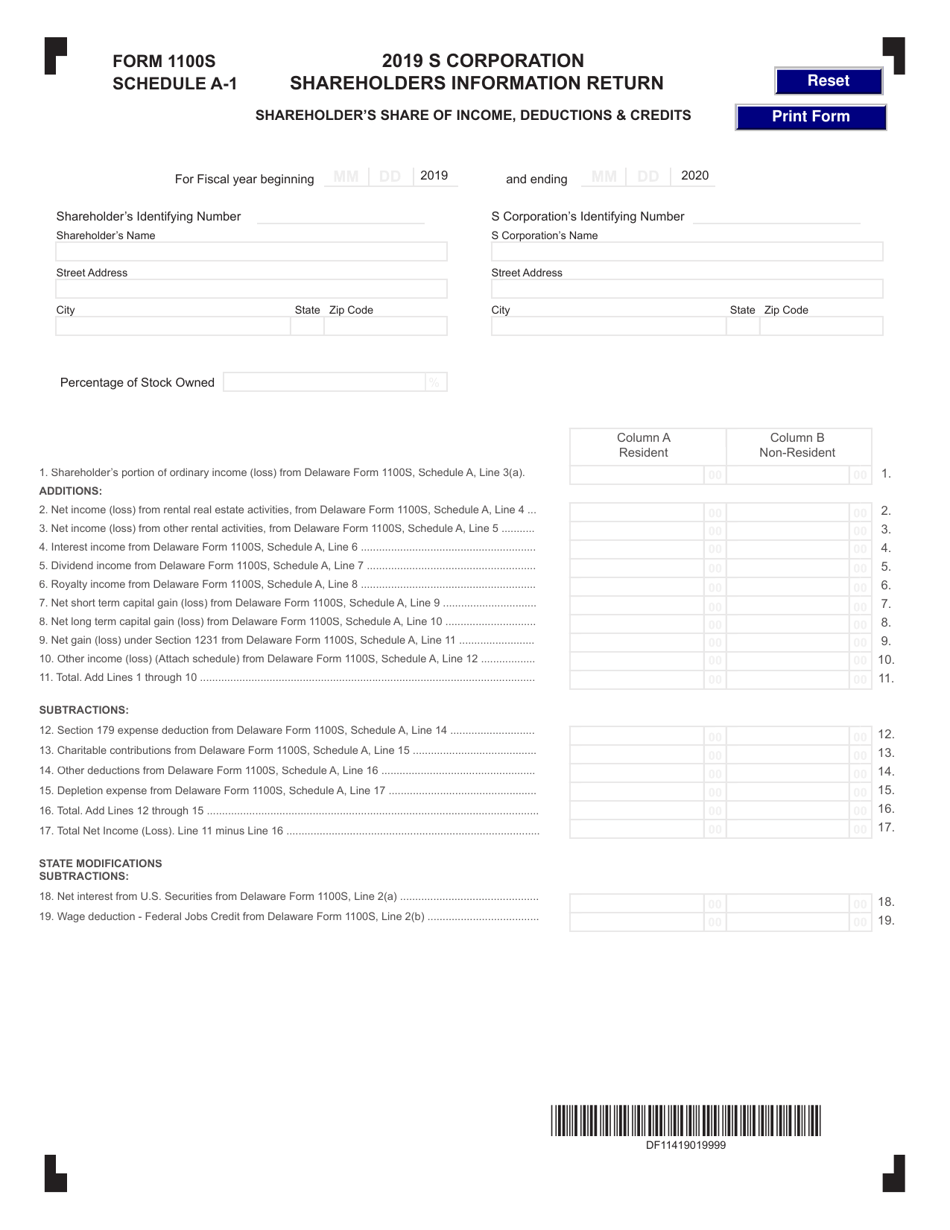

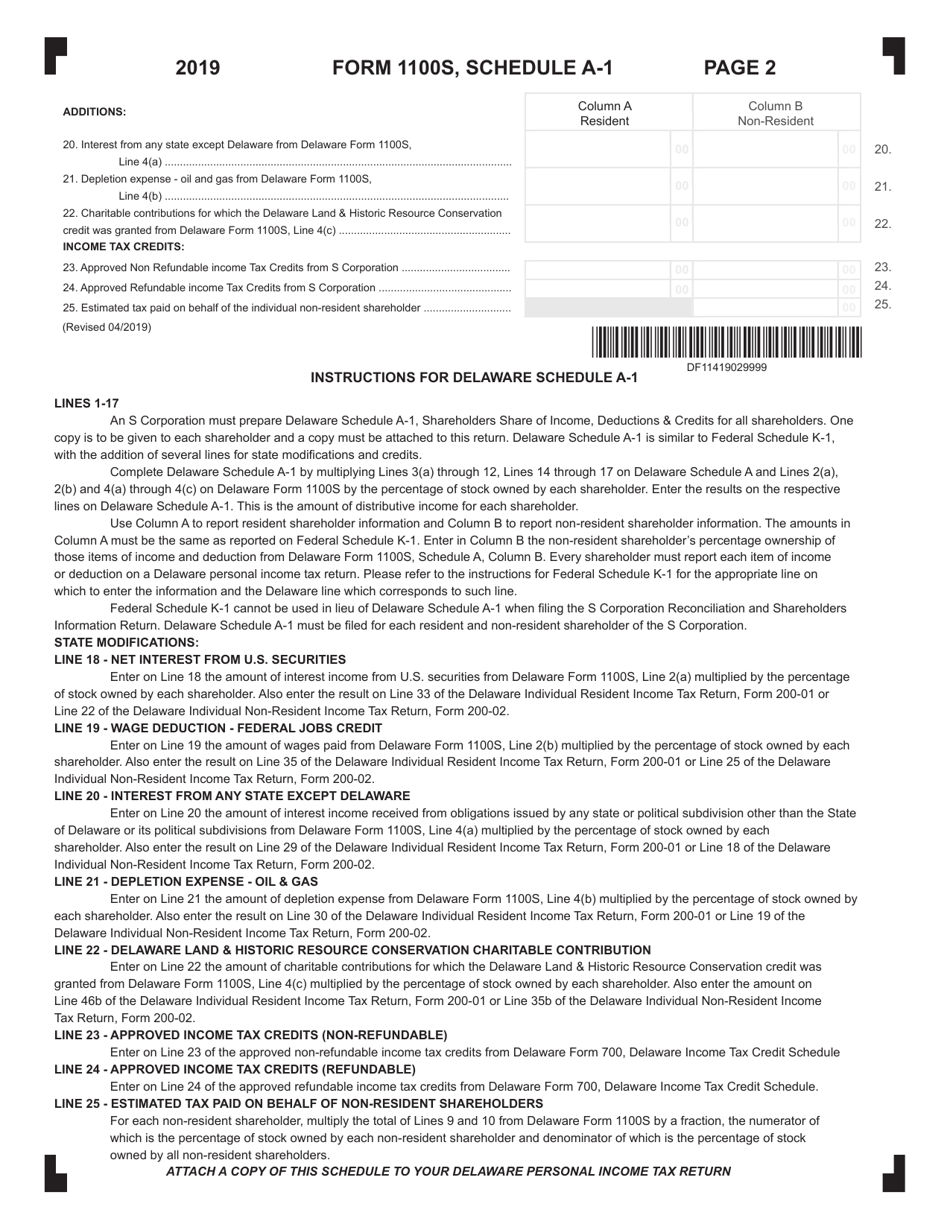

Form 1100S Schedule A-1

for the current year.

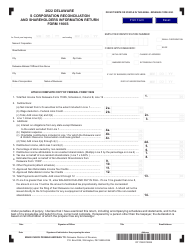

Form 1100S Schedule A-1 Shareholders Information Return - Delaware

What Is Form 1100S Schedule A-1?

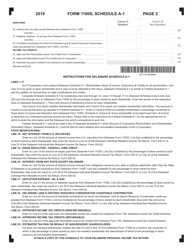

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware.The document is a supplement to Form 1100S, S Corporation Reconciliation and Shareholders Information Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1100S Schedule A-1?

A: Form 1100S Schedule A-1 is the Shareholders Information Return for S Corporations in Delaware.

Q: Who needs to file Form 1100S Schedule A-1?

A: S Corporations in Delaware need to file Form 1100S Schedule A-1.

Q: What information is required on Form 1100S Schedule A-1?

A: Form 1100S Schedule A-1 requires information about the shareholders of the S Corporation, including their names, addresses, and ownership percentages.

Q: When is the deadline to file Form 1100S Schedule A-1?

A: The deadline to file Form 1100S Schedule A-1 is the same as the S Corporation's federal tax return deadline, which is usually March 15th.

Q: Are there any penalties for not filing Form 1100S Schedule A-1?

A: Yes, there can be penalties for not filing Form 1100S Schedule A-1, including late filing penalties and interest on any unpaid taxes.

Form Details:

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1100S Schedule A-1 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.