This version of the form is not currently in use and is provided for reference only. Download this version of

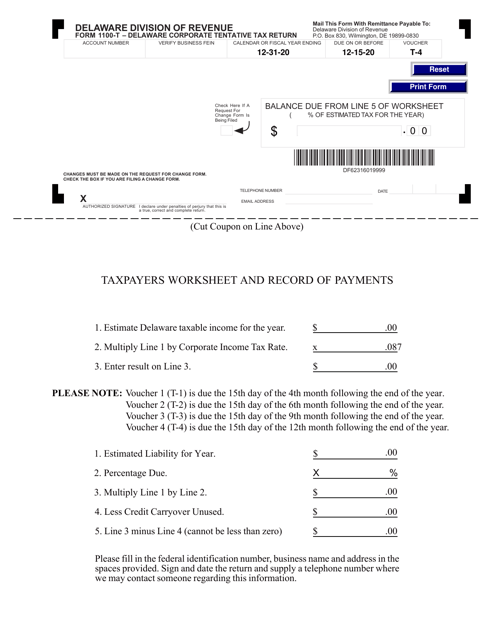

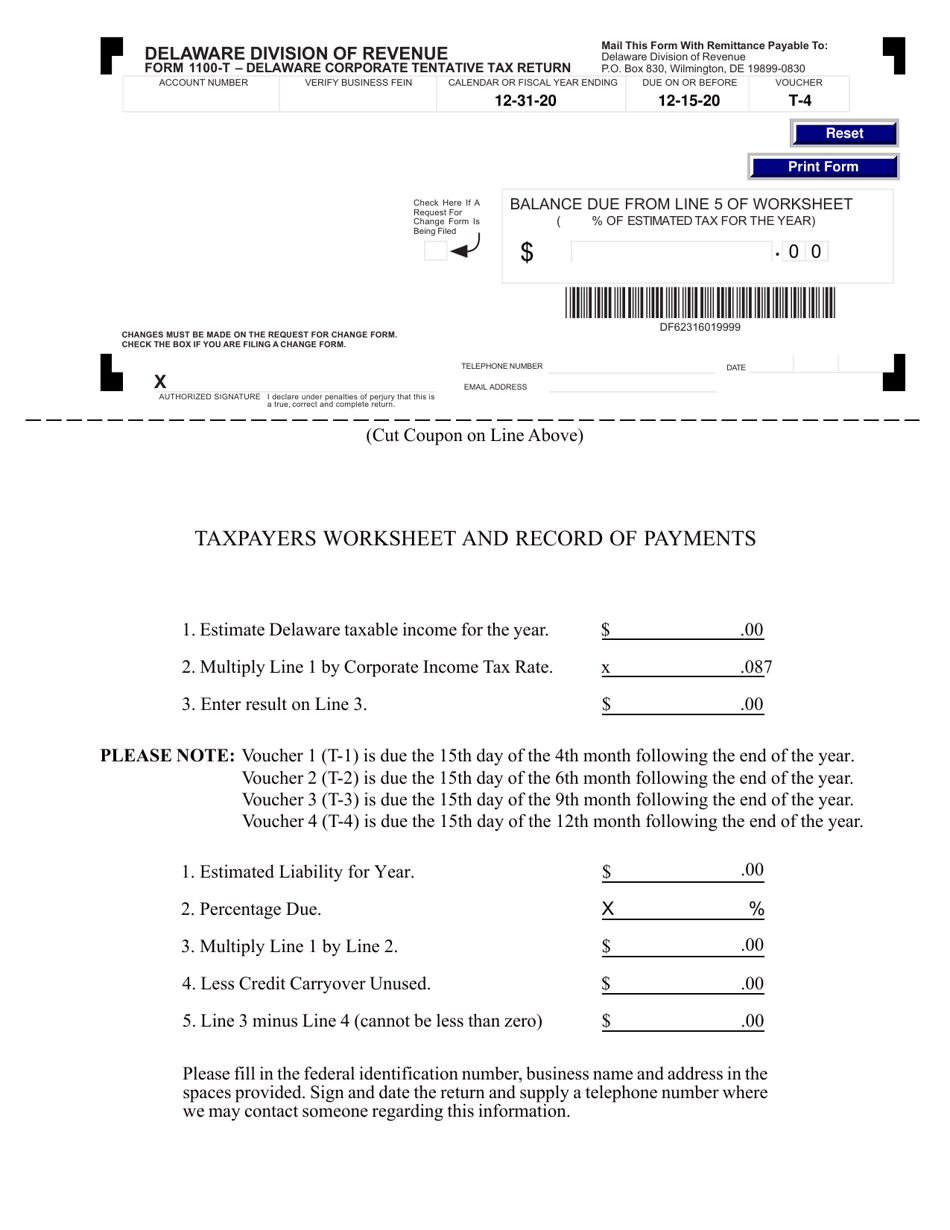

Form 1100T-4

for the current year.

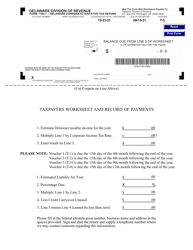

Form 1100T-4 Delaware Corporate Tentative Tax Return - Delaware

What Is Form 1100T-4?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1100T-4?

A: Form 1100T-4 is the Delaware Corporate Tentative Tax Return.

Q: Who needs to file Form 1100T-4?

A: All Delaware corporations are required to file Form 1100T-4.

Q: What is the purpose of Form 1100T-4?

A: The purpose of Form 1100T-4 is to report and pay the tentative tax for Delaware corporations.

Q: When is Form 1100T-4 due?

A: Form 1100T-4 is due on or before June 1st of each year.

Q: What happens if I don't file Form 1100T-4?

A: Failure to file Form 1100T-4 may result in penalties and interest.

Q: Can I e-file Form 1100T-4?

A: Yes, you can e-file Form 1100T-4 using approved software.

Q: Are there any exceptions to filing Form 1100T-4?

A: There are no exceptions to filing Form 1100T-4 for Delaware corporations.

Form Details:

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1100T-4 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.