This version of the form is not currently in use and is provided for reference only. Download this version of

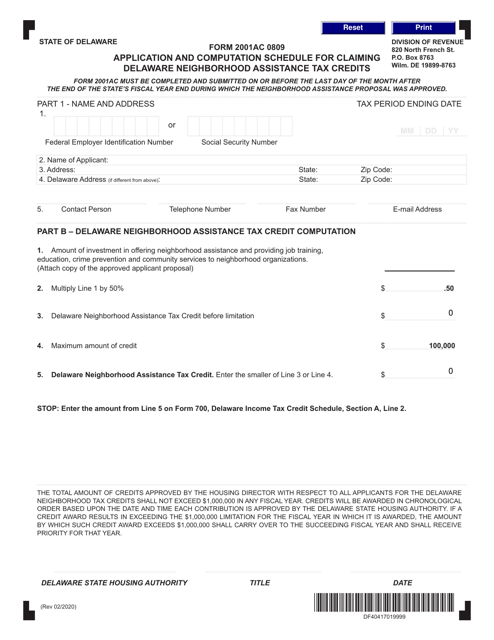

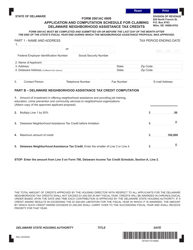

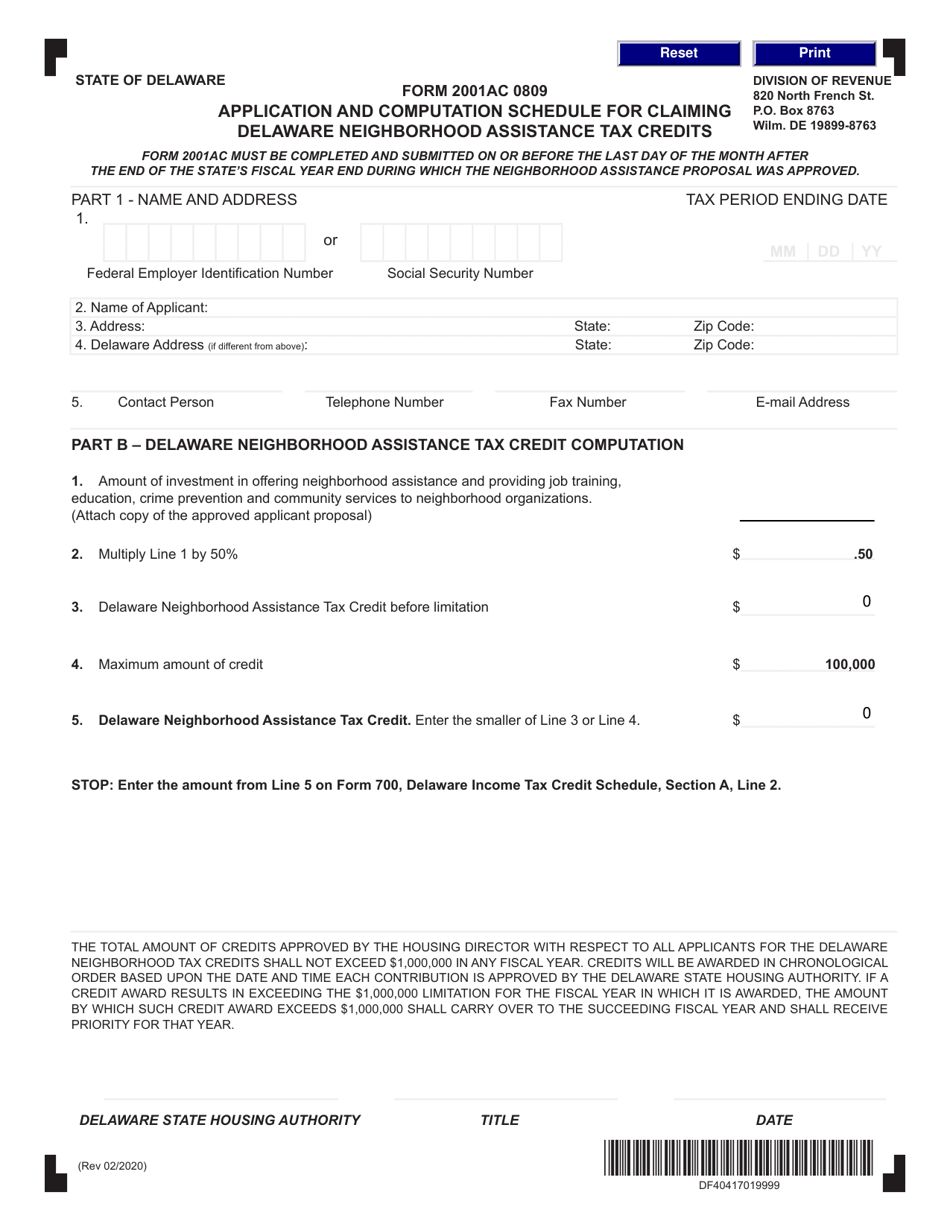

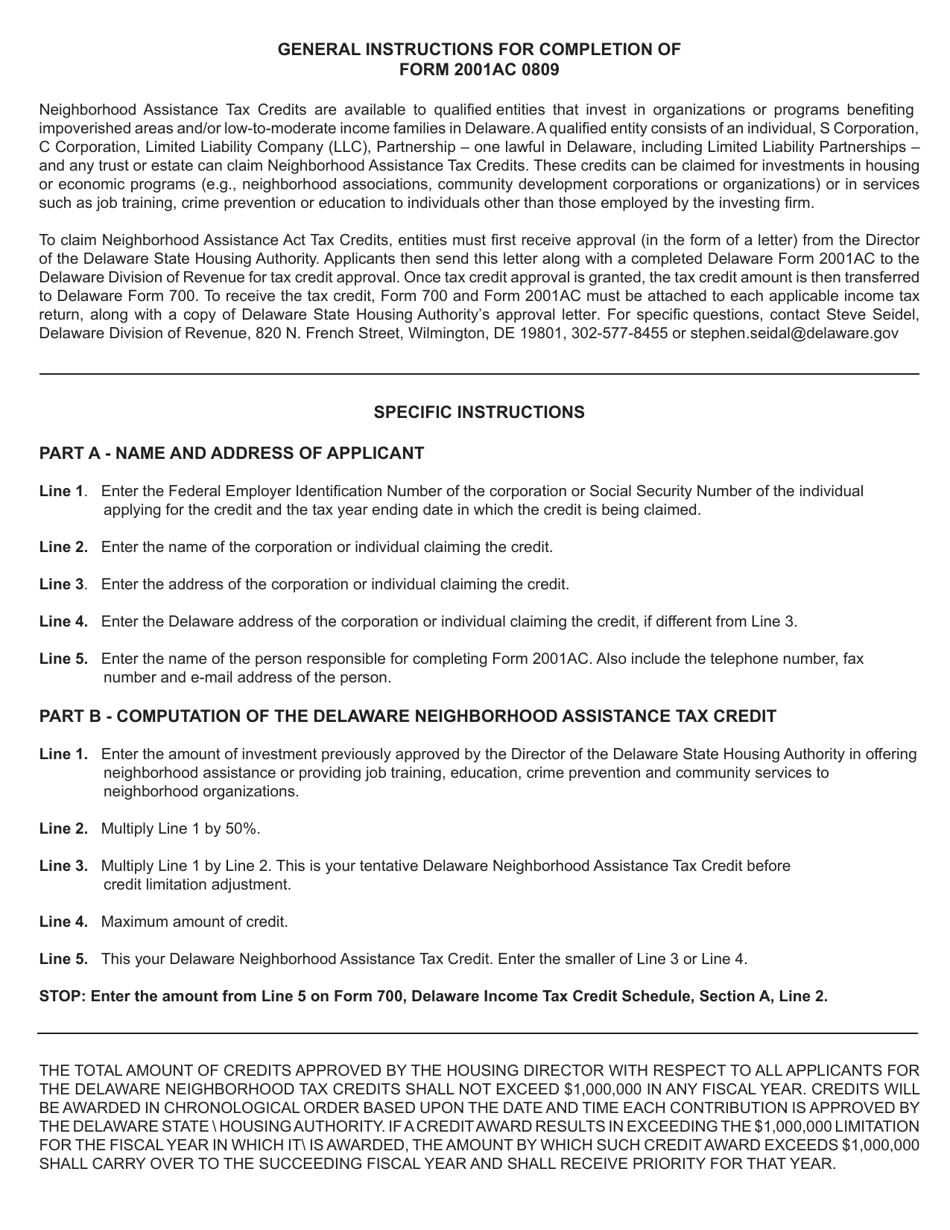

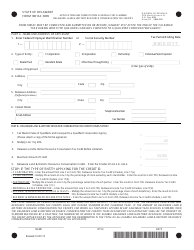

Form 2001AC 0809

for the current year.

Form 2001AC 0809 Application and Computation Schedule for Claiming Delaware Neighborhood Assistance Tax Credits - Delaware

What Is Form 2001AC 0809?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2001AC 0809?

A: Form 2001AC 0809 is the Application and Computation Schedule for Claiming Delaware Neighborhood Assistance Tax Credits.

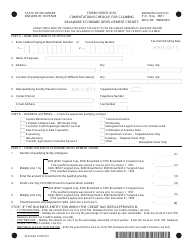

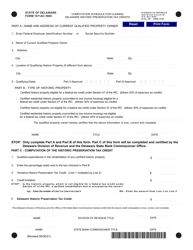

Q: What are Delaware Neighborhood Assistance Tax Credits?

A: Delaware Neighborhood Assistance Tax Credits are credits that individuals or businesses can claim for making qualified contributions to approved community service organizations in Delaware.

Q: How do I claim Delaware Neighborhood Assistance Tax Credits?

A: You can claim Delaware Neighborhood Assistance Tax Credits by completing and filing Form 2001AC 0809 with the Delaware Division of Revenue.

Q: What is the purpose of Form 2001AC 0809?

A: The purpose of Form 2001AC 0809 is to apply for and calculate the amount of Delaware Neighborhood Assistance Tax Credits that can be claimed for qualified contributions.

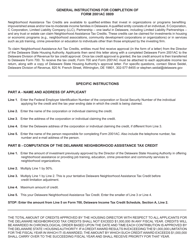

Q: What information do I need to complete Form 2001AC 0809?

A: To complete Form 2001AC 0809, you will need information about your qualified contributions and the approved community service organization to which you made the contributions.

Q: When is the deadline for filing Form 2001AC 0809?

A: The deadline for filing Form 2001AC 0809 is determined by the Delaware Division of Revenue and may vary each year. It is important to check the current year's deadline to ensure you file on time.

Q: Are there any limitations or restrictions on claiming Delaware Neighborhood Assistance Tax Credits?

A: Yes, there are limitations and restrictions on claiming Delaware Neighborhood Assistance Tax Credits. These may include maximum credit amounts, eligibility criteria, and specific requirements for qualifying contributions. It is important to review the instructions and guidelines provided with Form 2001AC 0809.

Q: Can individuals and businesses both claim Delaware Neighborhood Assistance Tax Credits?

A: Yes, both individuals and businesses can claim Delaware Neighborhood Assistance Tax Credits as long as they meet the eligibility criteria and have made qualified contributions to approved community service organizations.

Q: What are the benefits of claiming Delaware Neighborhood Assistance Tax Credits?

A: The benefits of claiming Delaware Neighborhood Assistance Tax Credits include reducing your state tax liability and supporting community service organizations in Delaware.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2001AC 0809 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.