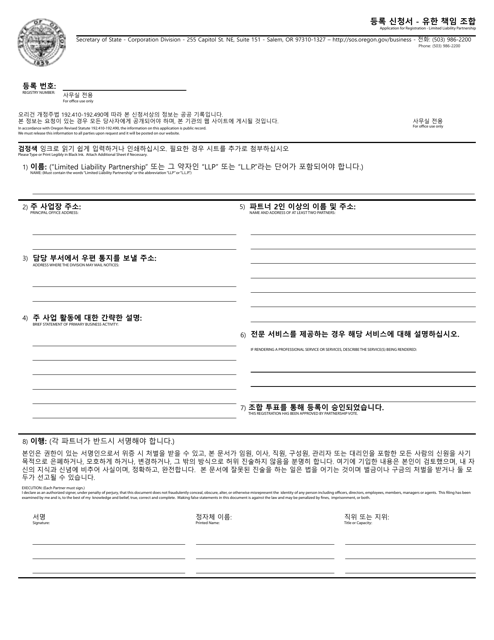

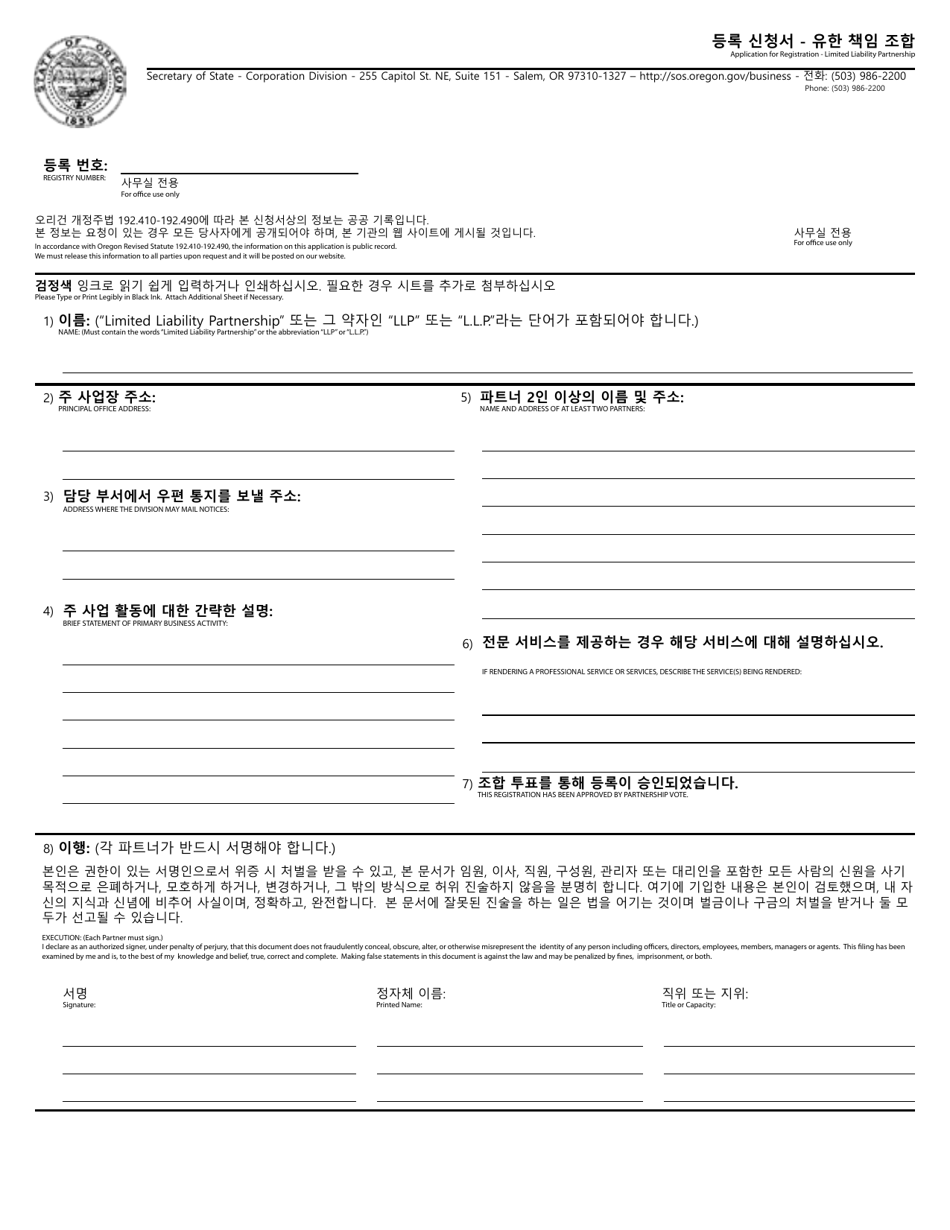

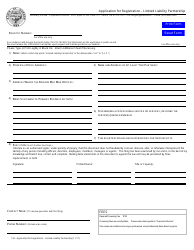

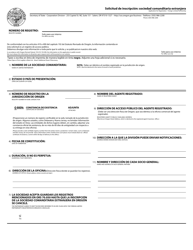

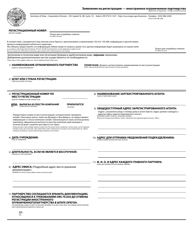

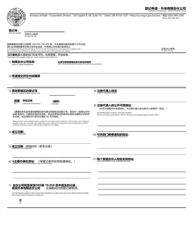

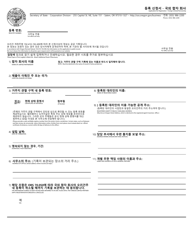

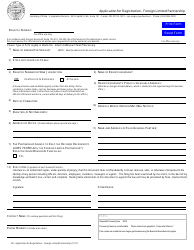

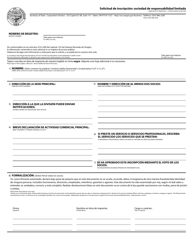

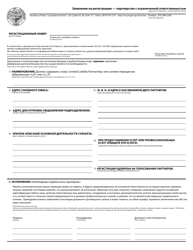

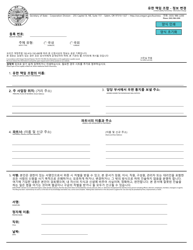

Application for Registration - Limited Liability Partnership - Oregon (English / Korean)

Application for Registration - Limited Liability Partnership is a legal document that was released by the Oregon Secretary of State - a government authority operating within Oregon.

FAQ

Q: What is a Limited Liability Partnership?

A: A Limited Liability Partnership (LLP) is a type of business entity that offers both the limited liability of a corporation and the tax advantages of a partnership.

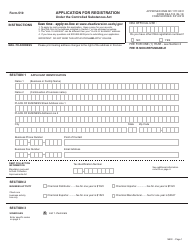

Q: How do I register a Limited Liability Partnership in Oregon?

A: To register a LLP in Oregon, you need to file an Application for Registration with the Oregon Secretary of State, Corporation Division.

Q: What information do I need to provide in the Application for Registration?

A: In the Application for Registration, you need to provide the LLP name, principal office address, registered agent information, and the signature of a general partner.

Q: Can I register a Limited Liability Partnership in Oregon if I am not a US citizen?

A: Yes, non-US citizens can register a LLP in Oregon as long as they meet the requirements specified by the Oregon Secretary of State, Corporation Division.

Q: Do I need to publish a notice of intent to form a Limited Liability Partnership in a newspaper?

A: No, in Oregon, LLPs are not required to publish a notice of intent to form in a newspaper.

Q: What is the difference between a Limited Liability Partnership and a Limited Liability Company?

A: The main difference between a LLP and a LLC is the way they are taxed. LLPs are taxed as partnerships, while LLCs can choose to be taxed as a partnership, corporation, or sole proprietorship.

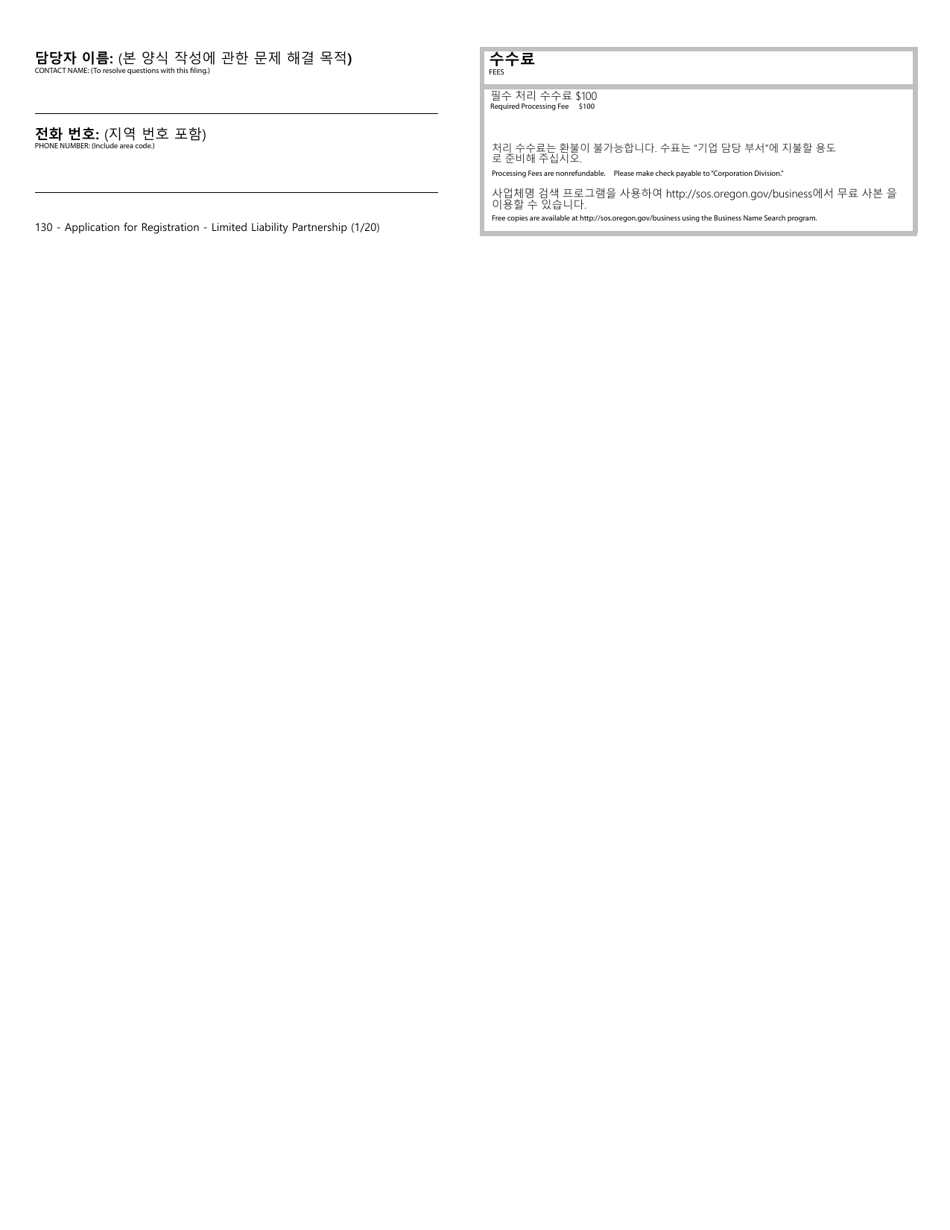

Form Details:

- Released on January 1, 2020;

- The latest edition currently provided by the Oregon Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Secretary of State.