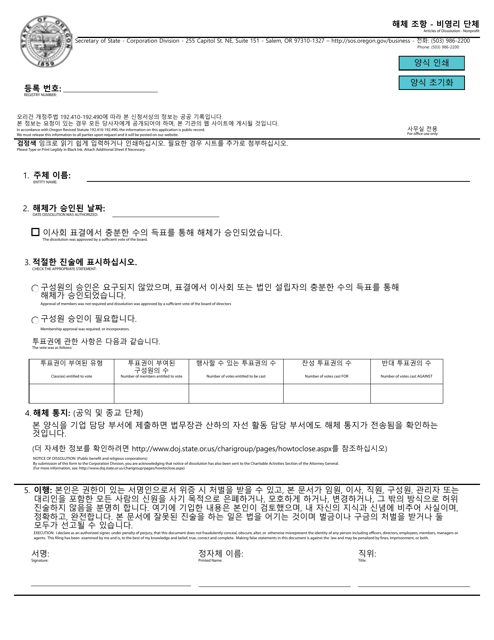

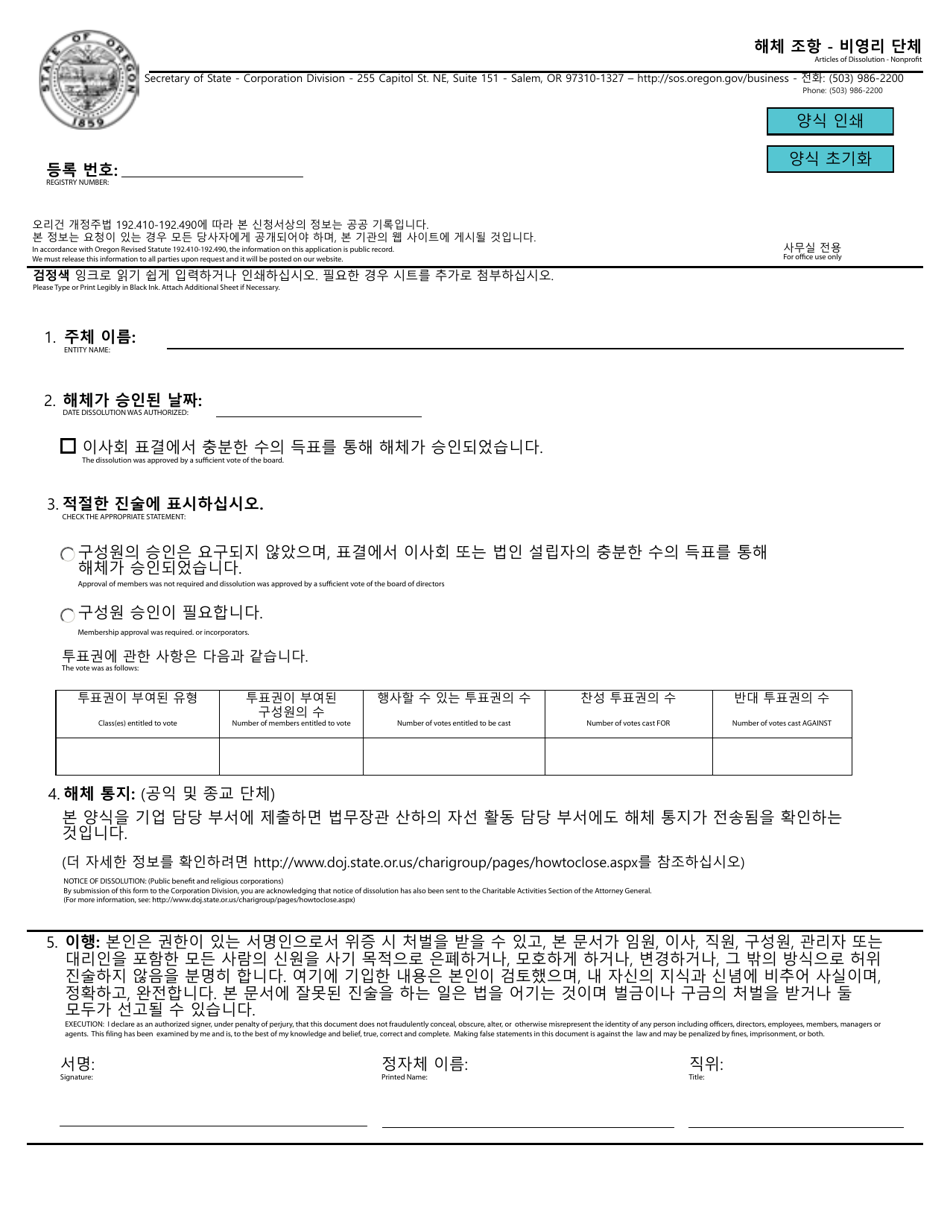

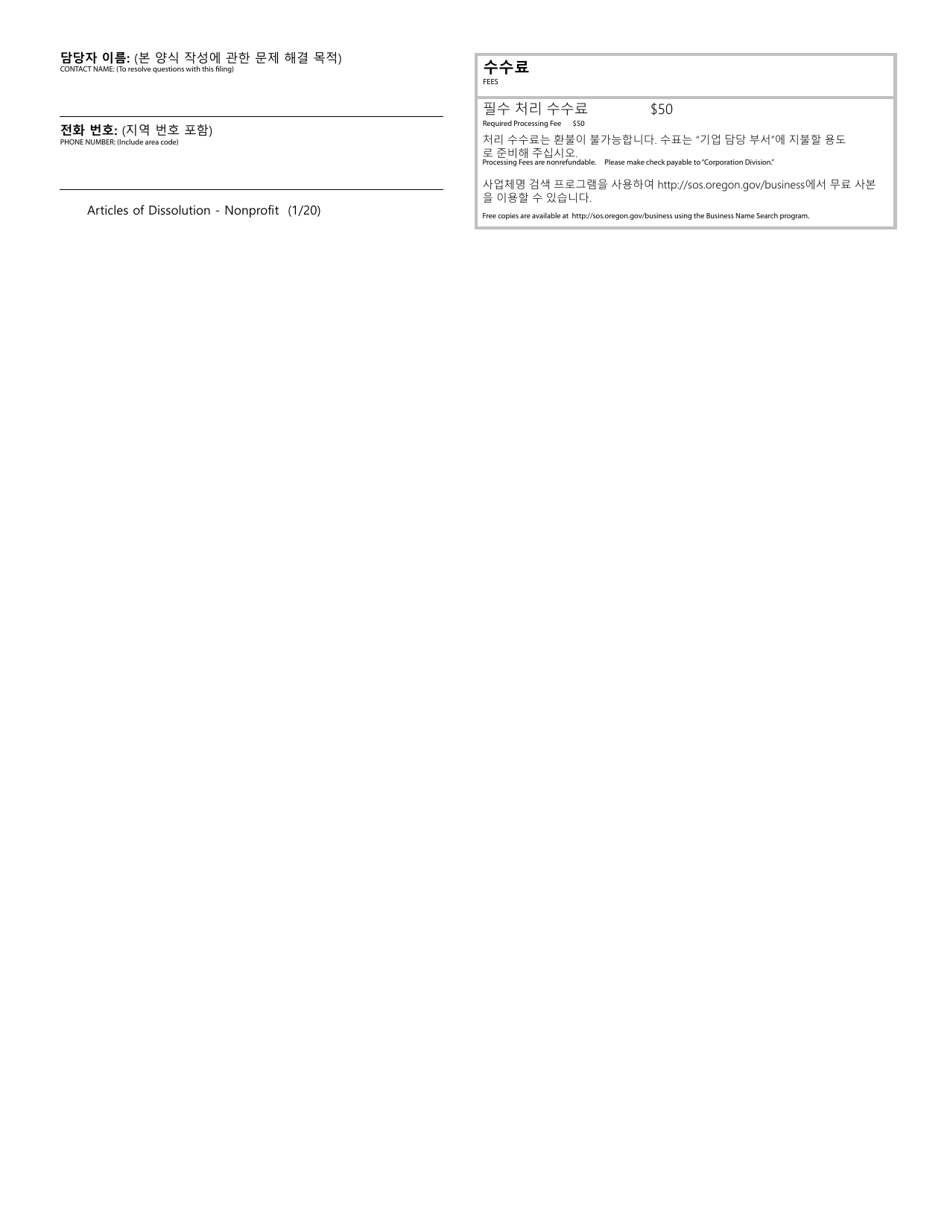

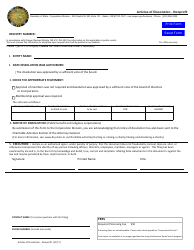

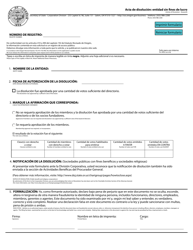

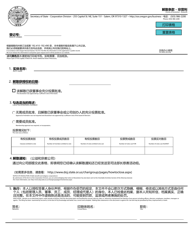

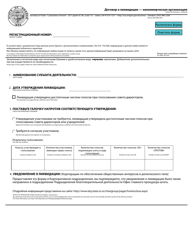

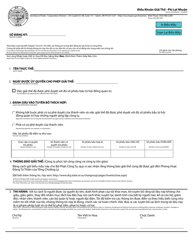

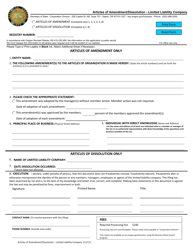

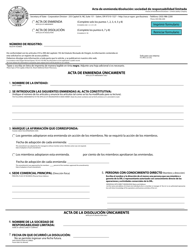

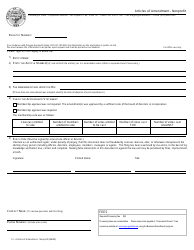

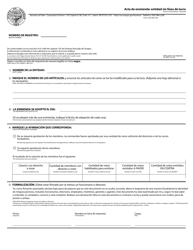

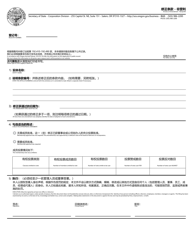

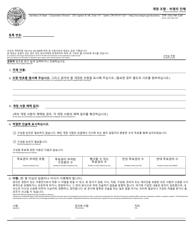

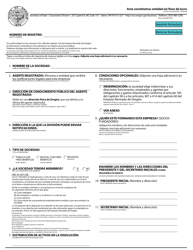

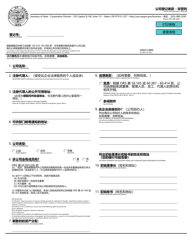

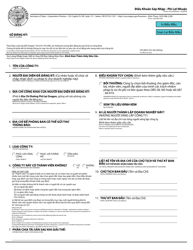

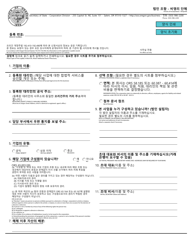

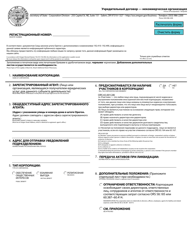

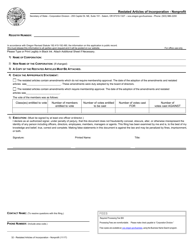

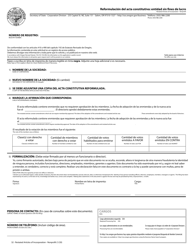

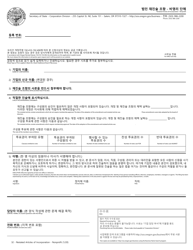

Articles of Dissolution - Nonprofit - Oregon (English / Korean)

Articles of Dissolution - Nonprofit is a legal document that was released by the Oregon Secretary of State - a government authority operating within Oregon.

FAQ

Q: What is an Articles of Dissolution?

A: Articles of Dissolution is a legal document that officially terminates the existence of a nonprofit organization.

Q: What is a nonprofit organization?

A: A nonprofit organization is a type of organization that operates for charitable, educational, religious, or scientific purposes, rather than for generating profits.

Q: Why would a nonprofit organization file Articles of Dissolution?

A: A nonprofit organization may file Articles of Dissolution if it decides to cease its operations, has completed its mission, or is unable to sustain its activities.

Q: What information is required in the Articles of Dissolution?

A: The Articles of Dissolution typically require information about the nonprofit organization's name, date of incorporation, reason for dissolution, and the approval of its governing board.

Q: Do I need to notify the IRS when filing Articles of Dissolution?

A: Yes, you should notify the IRS by submitting the final return and checking the box that indicates the organization is being dissolved.

Q: Can a dissolved nonprofit organization be revived or reinstated?

A: In some cases, a dissolved nonprofit organization may be able to apply for reinstatement or revival if certain requirements are met, such as filing appropriate documents and paying any outstanding fees or taxes.

Q: Can I still be liable for the nonprofit organization's debts after filing Articles of Dissolution?

A: In general, once Articles of Dissolution are filed, the nonprofit organization's liability for debts typically ends, but it is recommended to seek legal advice to understand any potential liability.

Form Details:

- Released on January 1, 2020;

- The latest edition currently provided by the Oregon Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Secretary of State.