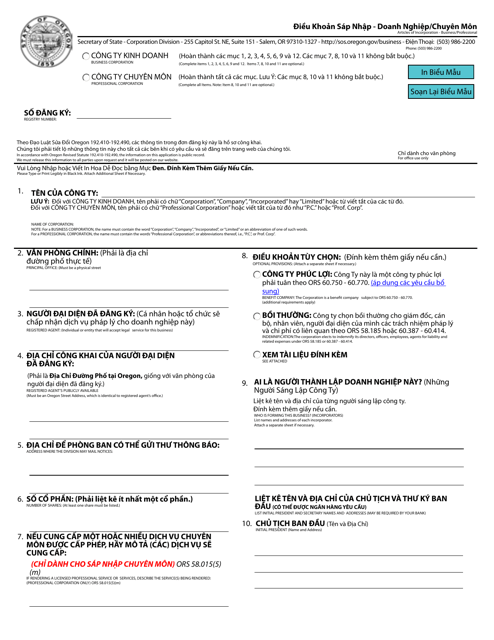

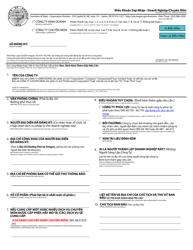

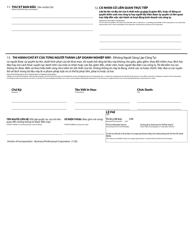

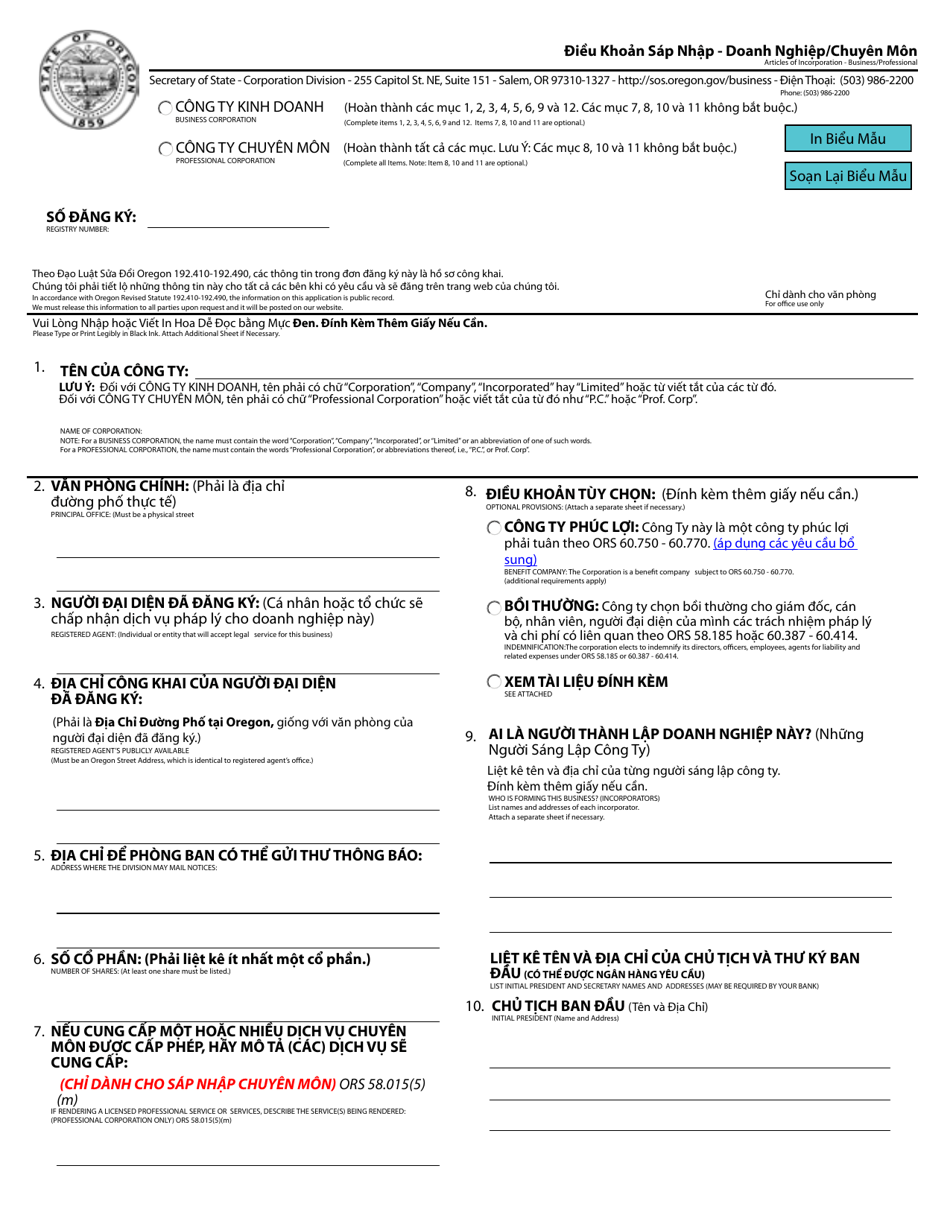

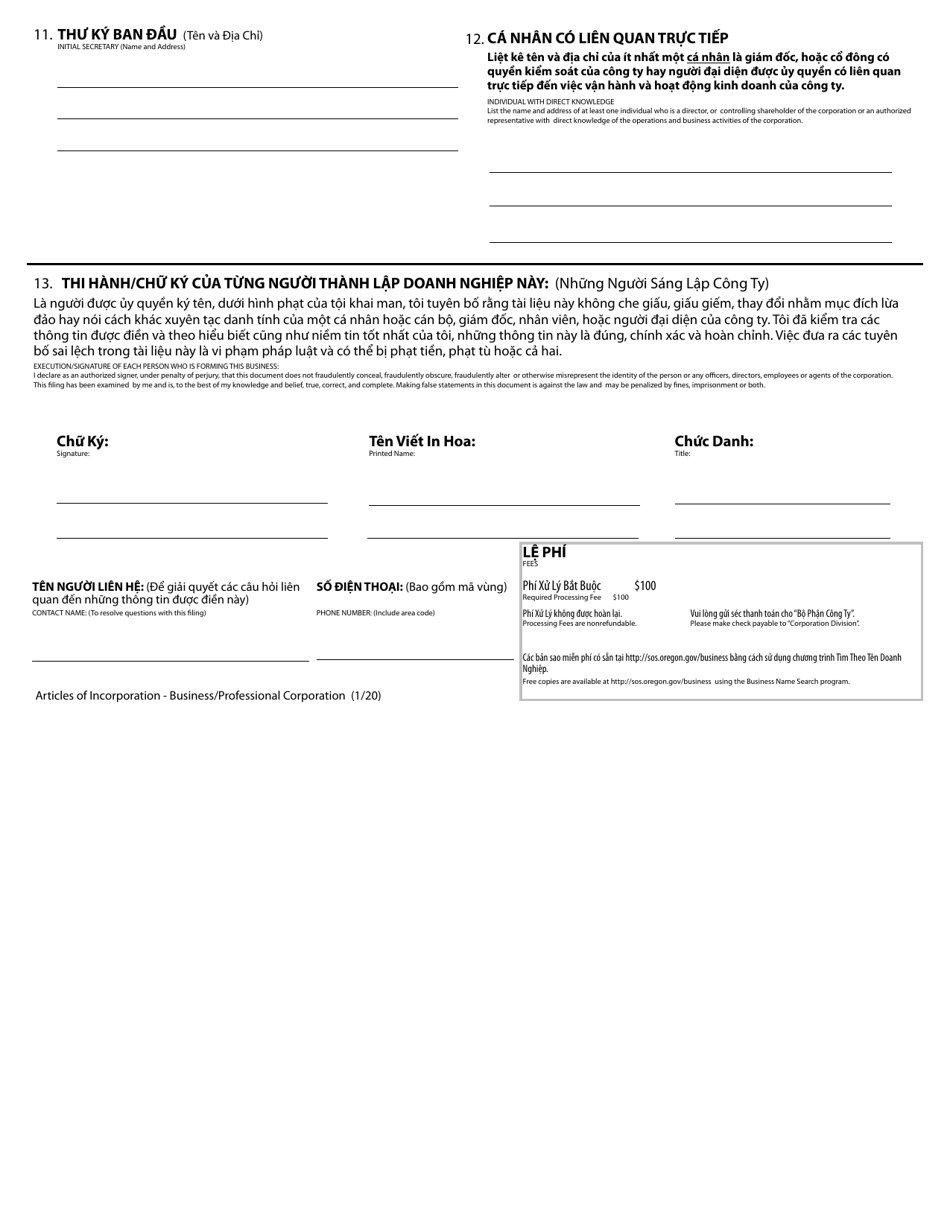

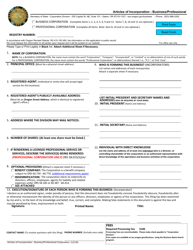

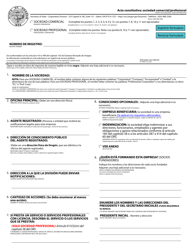

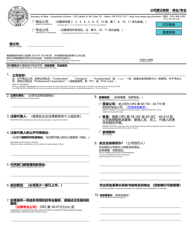

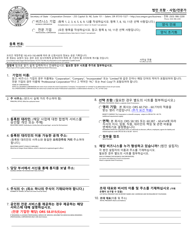

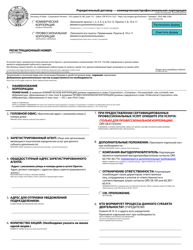

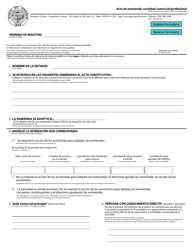

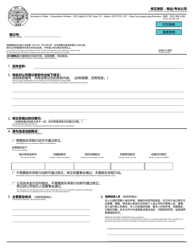

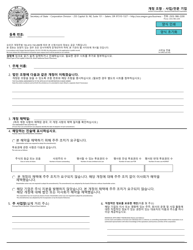

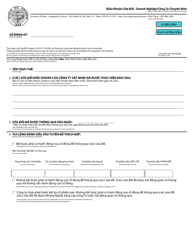

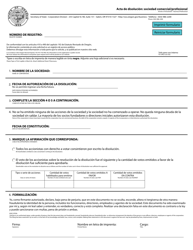

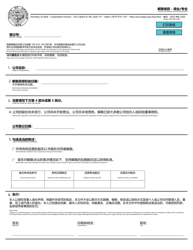

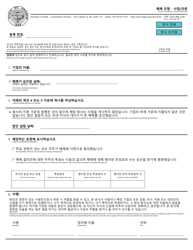

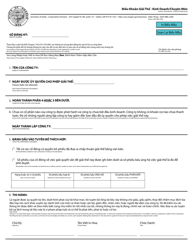

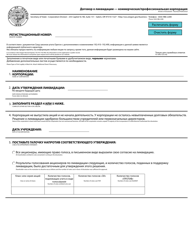

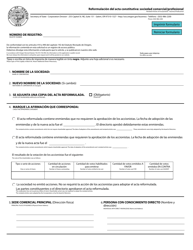

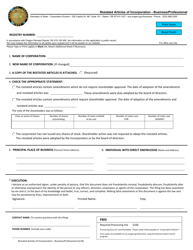

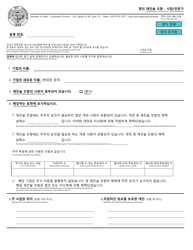

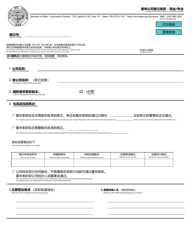

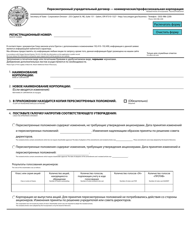

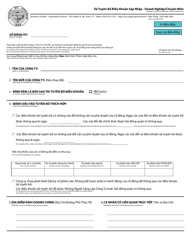

Articles of Incorporation - Business / Professional - Oregon (English / Vietnamese)

Articles of Incorporation - Business/Professional is a legal document that was released by the Oregon Secretary of State - a government authority operating within Oregon.

FAQ

Q: What is an Articles of Incorporation?

A: Articles of Incorporation are legal documents that establish a corporation and outline its purpose, structure, and regulations.

Q: Why do I need Articles of Incorporation?

A: You need Articles of Incorporation to formally create a corporation and gain legal recognition as a separate entity.

Q: What is the process of filing Articles of Incorporation in Oregon?

A: To file Articles of Incorporation in Oregon, you need to complete the necessary forms, pay the filing fee, and submit them to the Oregon Secretary of State.

Q: What information is required in the Articles of Incorporation?

A: The Articles of Incorporation typically require information such as the corporation's name, purpose, registered agent, and the names and addresses of the incorporators.

Q: Can I file Articles of Incorporation in both English and Vietnamese?

A: Yes, in Oregon, you have the option to file Articles of Incorporation in both English and Vietnamese.

Q: How much does it cost to file Articles of Incorporation?

A: The filing fee for Articles of Incorporation in Oregon is $100.

Q: What happens after I file Articles of Incorporation?

A: After you file Articles of Incorporation, the Secretary of State will review the documents and, if everything is in order, issue a certificate of incorporation.

Q: Do I need an attorney to file Articles of Incorporation?

A: While you don't necessarily need an attorney to file Articles of Incorporation, it can be beneficial to seek legal advice to ensure compliance with all requirements.

Q: Can I amend the Articles of Incorporation at a later time?

A: Yes, you can amend the Articles of Incorporation at a later time by submitting the necessary documents and paying the filing fee.

Q: What are the benefits of incorporating a business?

A: Incorporating a business offers benefits such as limited liability protection, potential tax advantages, and the ability to raise capital by selling shares.

Form Details:

- Released on January 1, 2020;

- The latest edition currently provided by the Oregon Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Secretary of State.