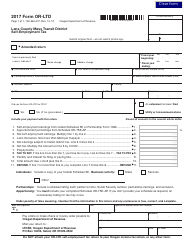

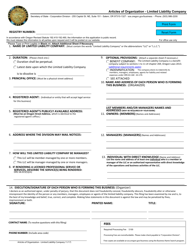

This version of the form is not currently in use and is provided for reference only. Download this version of

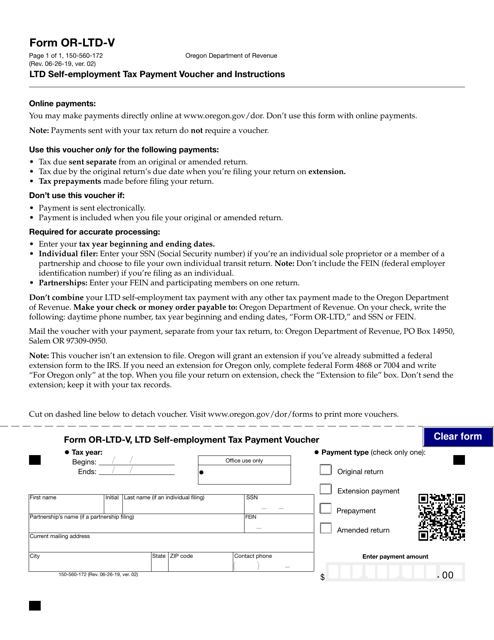

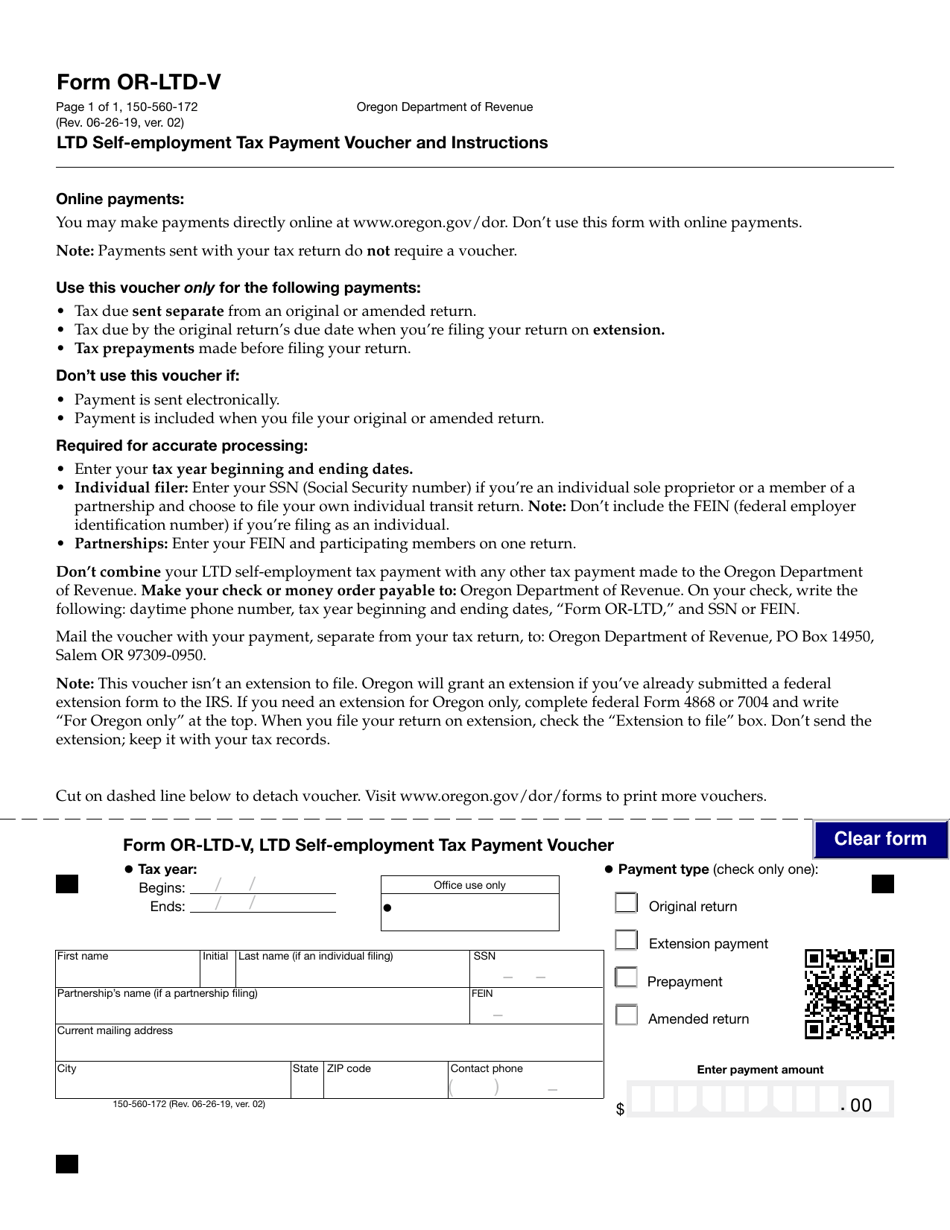

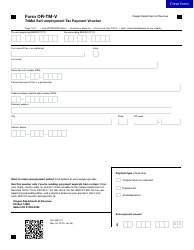

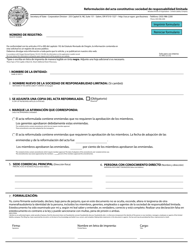

Form OR-LTD-V (150-560-172)

for the current year.

Form OR-LTD-V (150-560-172) Ltd Self-employment Tax Payment Voucher - Oregon

What Is Form OR-LTD-V (150-560-172)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

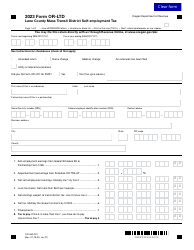

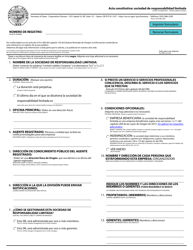

Q: What is the Form OR-LTD-V?

A: The Form OR-LTD-V is a self-employment tax payment voucher for limited liability companies (LLCs) in Oregon.

Q: What is the purpose of Form OR-LTD-V?

A: The purpose of Form OR-LTD-V is to make tax payments for self-employment taxes owed by limited liability companies (LLCs) in Oregon.

Q: Who needs to use Form OR-LTD-V?

A: Limited liability companies (LLCs) in Oregon who are subject to self-employment taxes need to use Form OR-LTD-V to make tax payments.

Q: Is Form OR-LTD-V specific to Oregon?

A: Yes, Form OR-LTD-V is specific to Oregon and is used for self-employment tax payments for limited liability companies (LLCs) in the state.

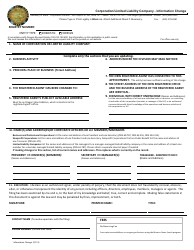

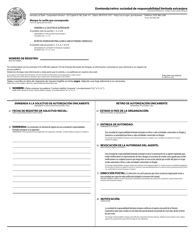

Form Details:

- Released on June 26, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-LTD-V (150-560-172) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.