This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 150-101-007 Schedule OR-A

for the current year.

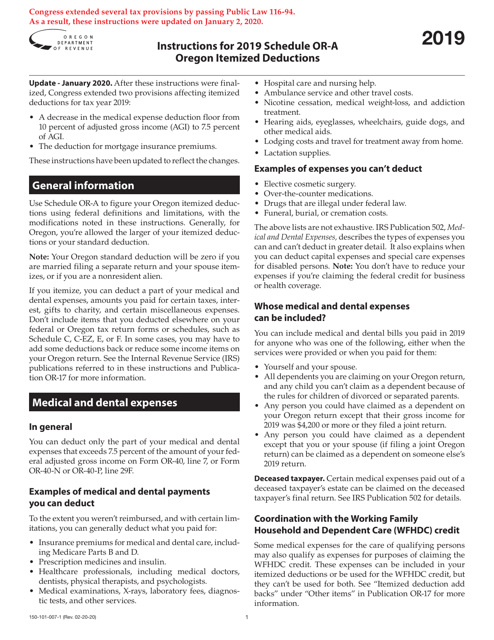

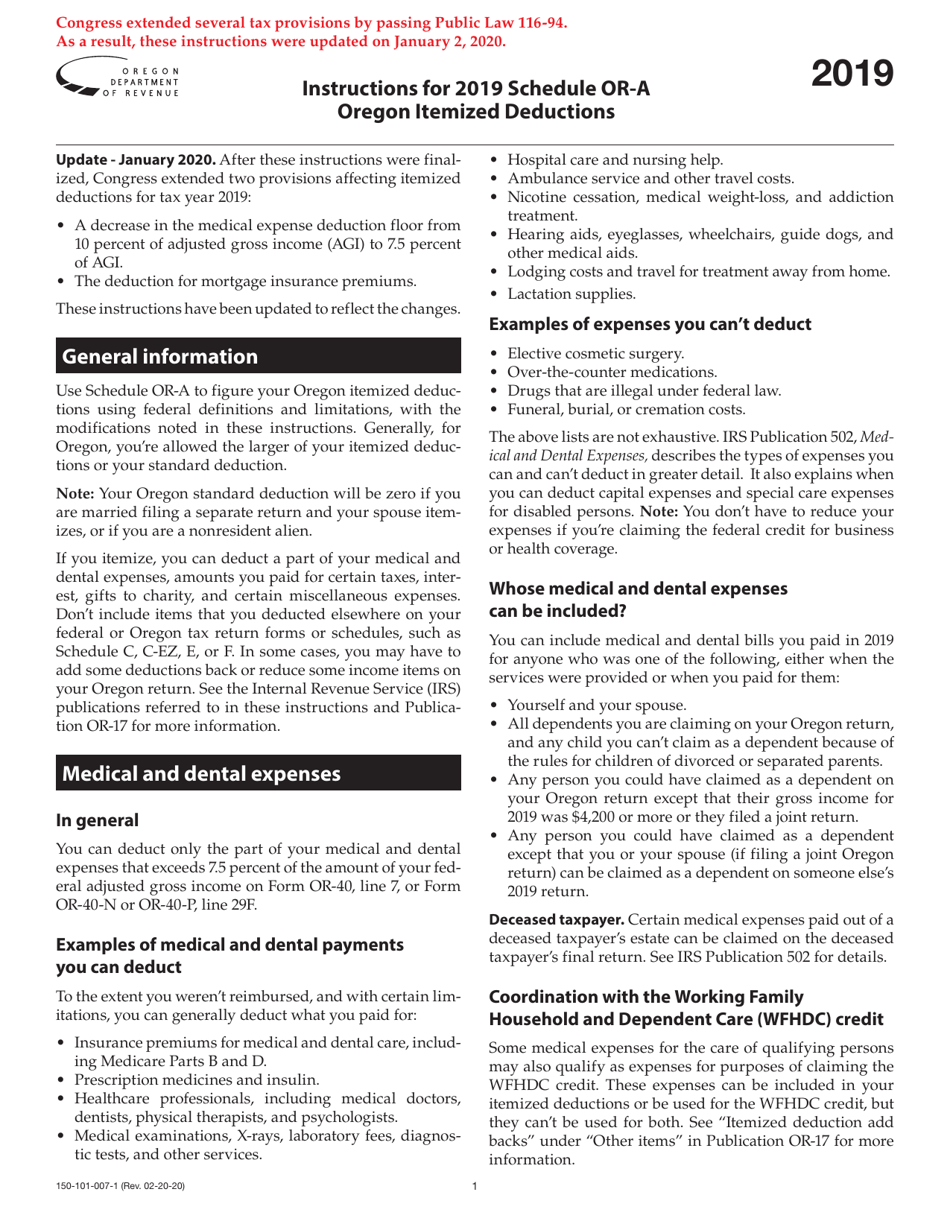

Instructions for Form 150-101-007 Schedule OR-A Oregon Itemized Deductions - Oregon

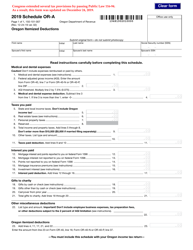

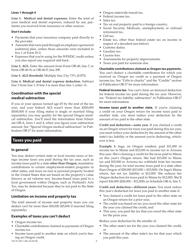

This document contains official instructions for Form 150-101-007 Schedule OR-A, Oregon Itemized Deductions - a form released and collected by the Oregon Department of Revenue. An up-to-date fillable Form 150-101-007 Schedule OR-A is available for download through this link.

FAQ

Q: What is Form 150-101-007 Schedule OR-A?

A: Form 150-101-007 Schedule OR-A is a tax form used to report itemized deductions for Oregon residents.

Q: Who needs to file Form 150-101-007 Schedule OR-A?

A: Oregon residents who want to claim itemized deductions on their state tax return need to file Form 150-101-007 Schedule OR-A.

Q: What are itemized deductions?

A: Itemized deductions are expenses that you can subtract from your adjusted gross income to reduce your taxable income.

Q: What expenses can be claimed as itemized deductions on Form 150-101-007 Schedule OR-A?

A: Expenses such as medical and dental expenses, home mortgage interest, charitable contributions, and state and local taxes can be claimed as itemized deductions on Form 150-101-007 Schedule OR-A.

Q: Is it better to claim itemized deductions or take the standard deduction?

A: It depends on your individual circumstances. If your total itemized deductions exceed the standard deduction amount, it may be beneficial for you to itemize deductions on Form 150-101-007 Schedule OR-A.

Q: Is there a deadline for filing Form 150-101-007 Schedule OR-A?

A: Form 150-101-007 Schedule OR-A must be filed by the same deadline as your Oregon state tax return, which is usually April 15th of the following year.

Q: What should I do if I need help filling out Form 150-101-007 Schedule OR-A?

A: If you need assistance with filling out Form 150-101-007 Schedule OR-A, you can consult the instructions provided with the form or seek help from a tax professional.

Instruction Details:

- This 5-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.