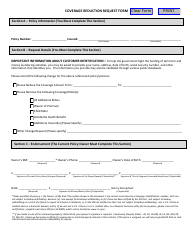

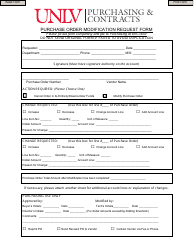

This version of the form is not currently in use and is provided for reference only. Download this version of

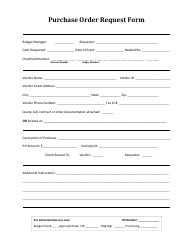

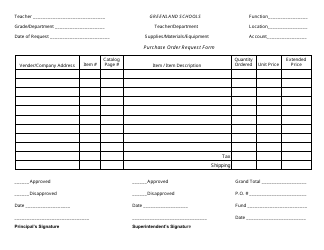

Form U-59 (BWC-7563)

for the current year.

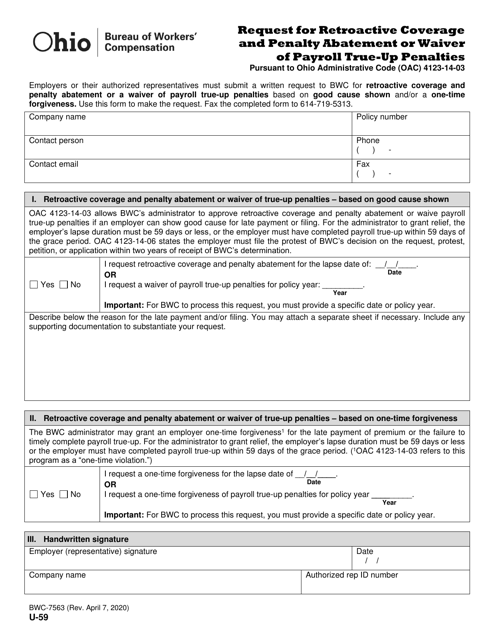

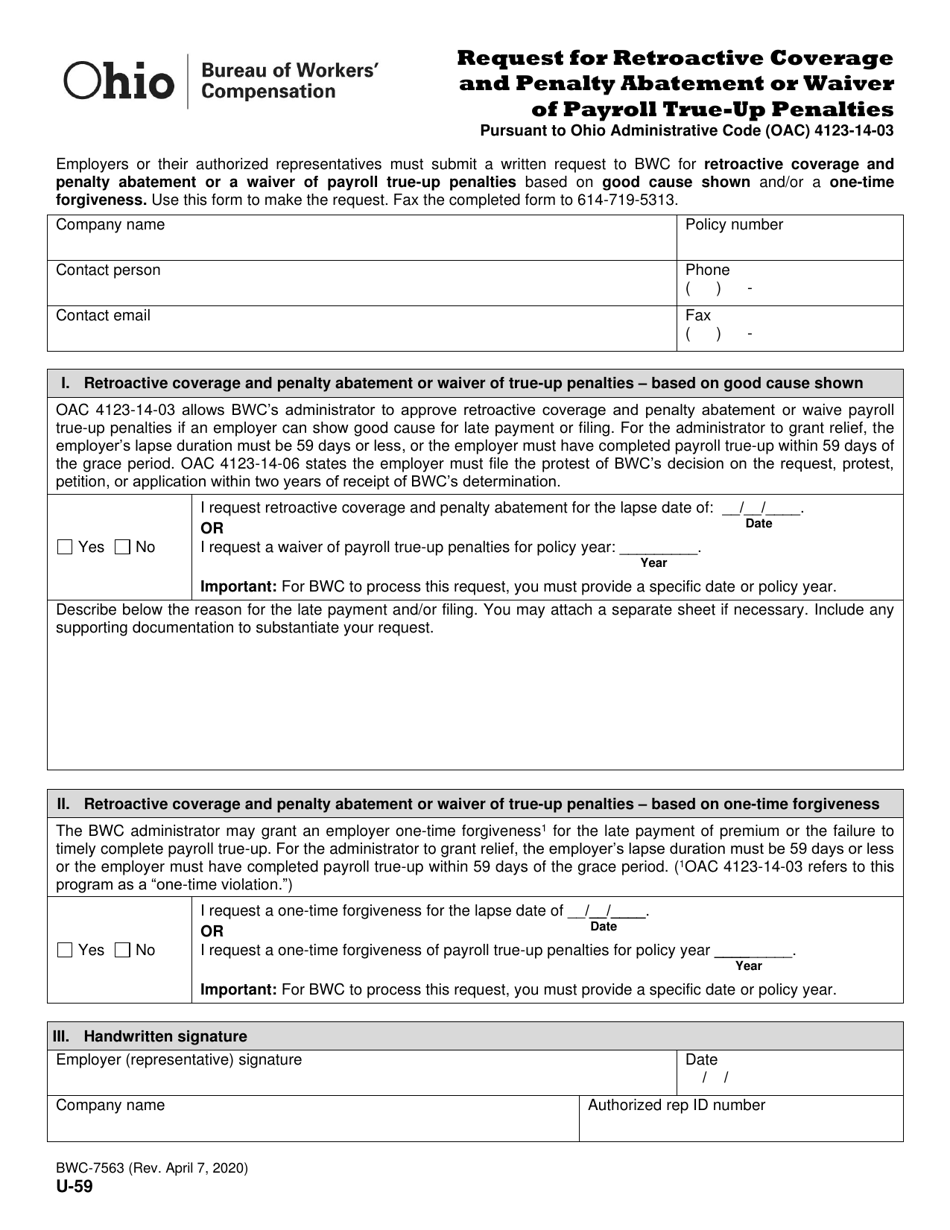

Form U-59 (BWC-7563) Request for Retroactive Coverage and Penalty Abatement or Waiver of Payroll True-Up Penalties - Ohio

What Is Form U-59 (BWC-7563)?

This is a legal form that was released by the Ohio Bureau of Workers' Compensation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form U-59?

A: Form U-59 is a request form used in Ohio to request retroactive coverage and penalty abatement or waiver of payroll true-up penalties.

Q: What is the purpose of Form U-59?

A: The purpose of Form U-59 is to request retroactive coverage and penalty abatement or waiver of payroll true-up penalties in Ohio.

Q: Who can use Form U-59?

A: Employers in Ohio can use Form U-59 to request retroactive coverage and penalty abatement or waiver of payroll true-up penalties.

Q: What is retroactive coverage?

A: Retroactive coverage refers to applying coverage to a specific period in the past.

Q: What are payroll true-up penalties?

A: Payroll true-up penalties in Ohio are penalties imposed on employers for underreporting or underpaying workers' compensation premiums.

Q: How can Form U-59 help with penalty abatement or waiver?

A: By submitting Form U-59, employers can request penalty abatement or waiver for payroll true-up penalties.

Q: Are there any eligibility requirements to use Form U-59?

A: Yes, employers must meet certain criteria to be eligible for retroactive coverage and penalty abatement or waiver of payroll true-up penalties.

Q: Is there a deadline for submitting Form U-59?

A: Yes, employers must submit Form U-59 within a specified time period to be considered for retroactive coverage and penalty abatement or waiver.

Q: Can I get assistance with filling out Form U-59?

A: Yes, employers can contact the Ohio Bureau of Workers' Compensation for assistance with filling out Form U-59.

Form Details:

- Released on April 7, 2020;

- The latest edition provided by the Ohio Bureau of Workers' Compensation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form U-59 (BWC-7563) by clicking the link below or browse more documents and templates provided by the Ohio Bureau of Workers' Compensation.