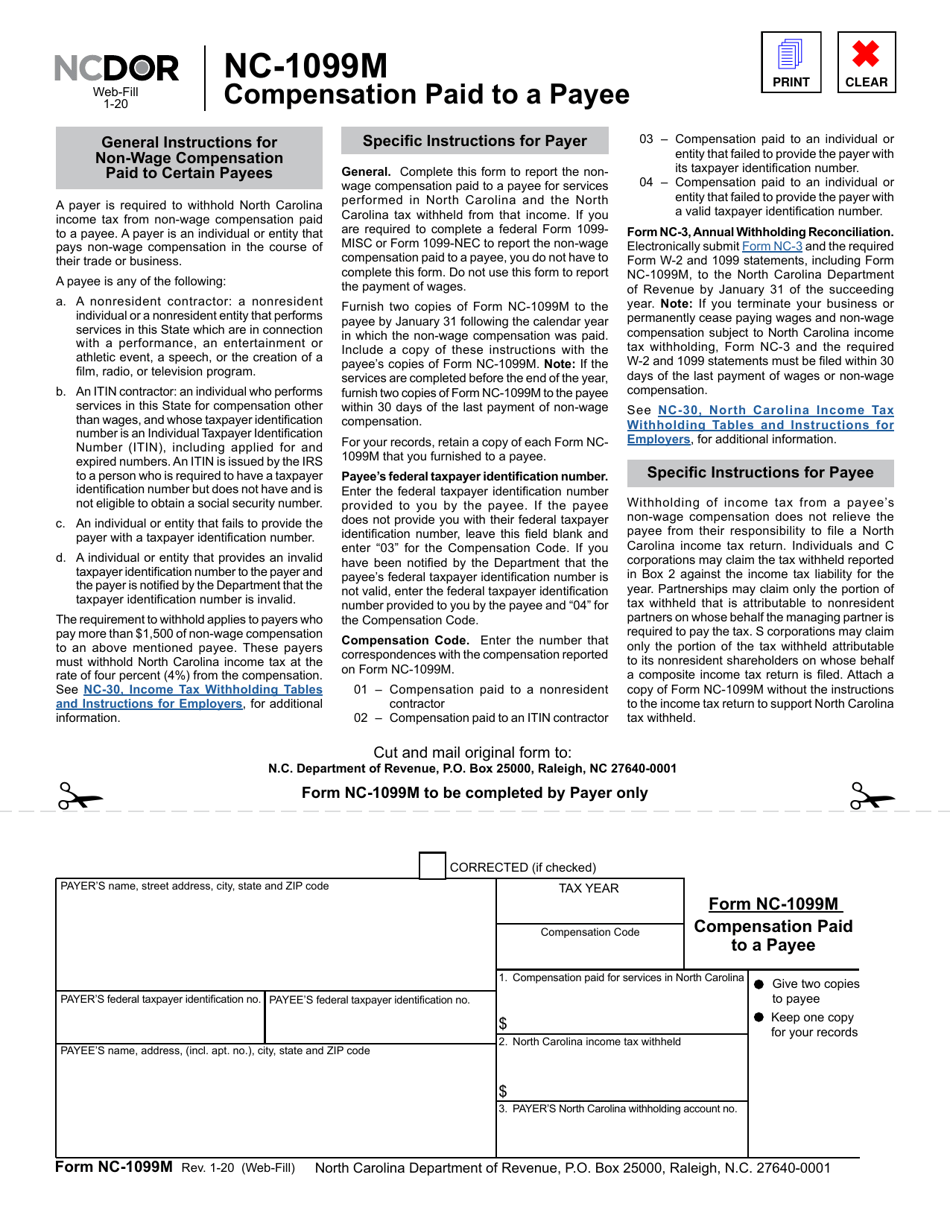

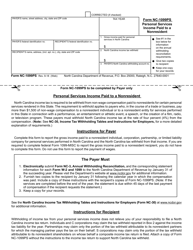

Form NC-1099M Compensation Paid to a Payee - North Carolina

What Is Form NC-1099M?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NC-1099M?

A: Form NC-1099M is a tax form used in North Carolina to report compensation paid to a payee.

Q: Who is required to file Form NC-1099M?

A: Any person or business that paid compensation of $600 or more to a payee in North Carolina is required to file Form NC-1099M.

Q: What is considered as compensation for Form NC-1099M?

A: Compensation includes wages, salaries, tips, bonuses, commissions, and other forms of payment for services performed.

Q: When is the deadline to file Form NC-1099M?

A: Form NC-1099M must be filed by January 31st of the following year.

Q: Are there any penalties for not filing Form NC-1099M?

A: Yes, failure to file Form NC-1099M or filing it late may result in penalties imposed by the North Carolina Department of Revenue.

Q: Is Form NC-1099M the same as Form 1099-MISC?

A: No, Form NC-1099M is specific to North Carolina, while Form 1099-MISC is used for federal reporting.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NC-1099M by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.