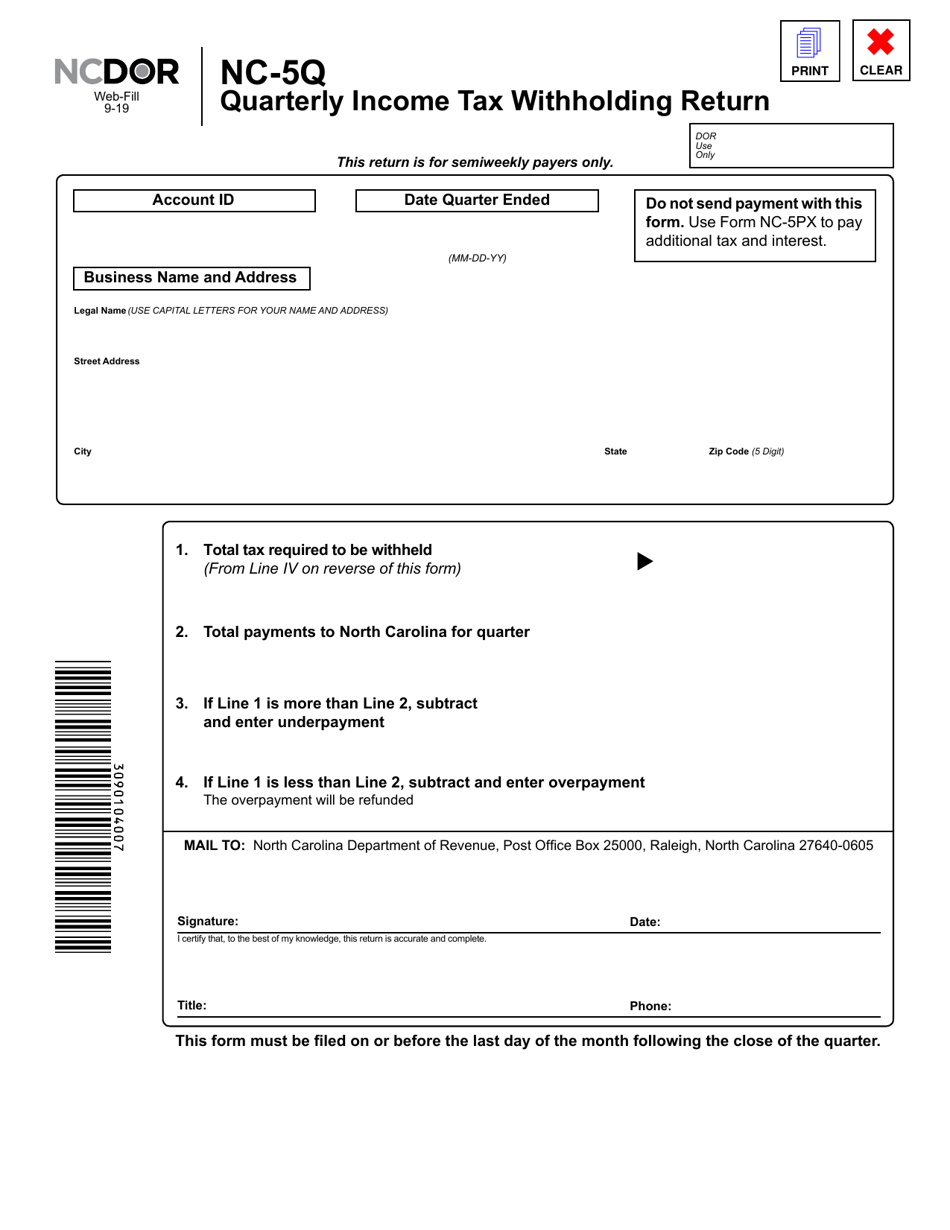

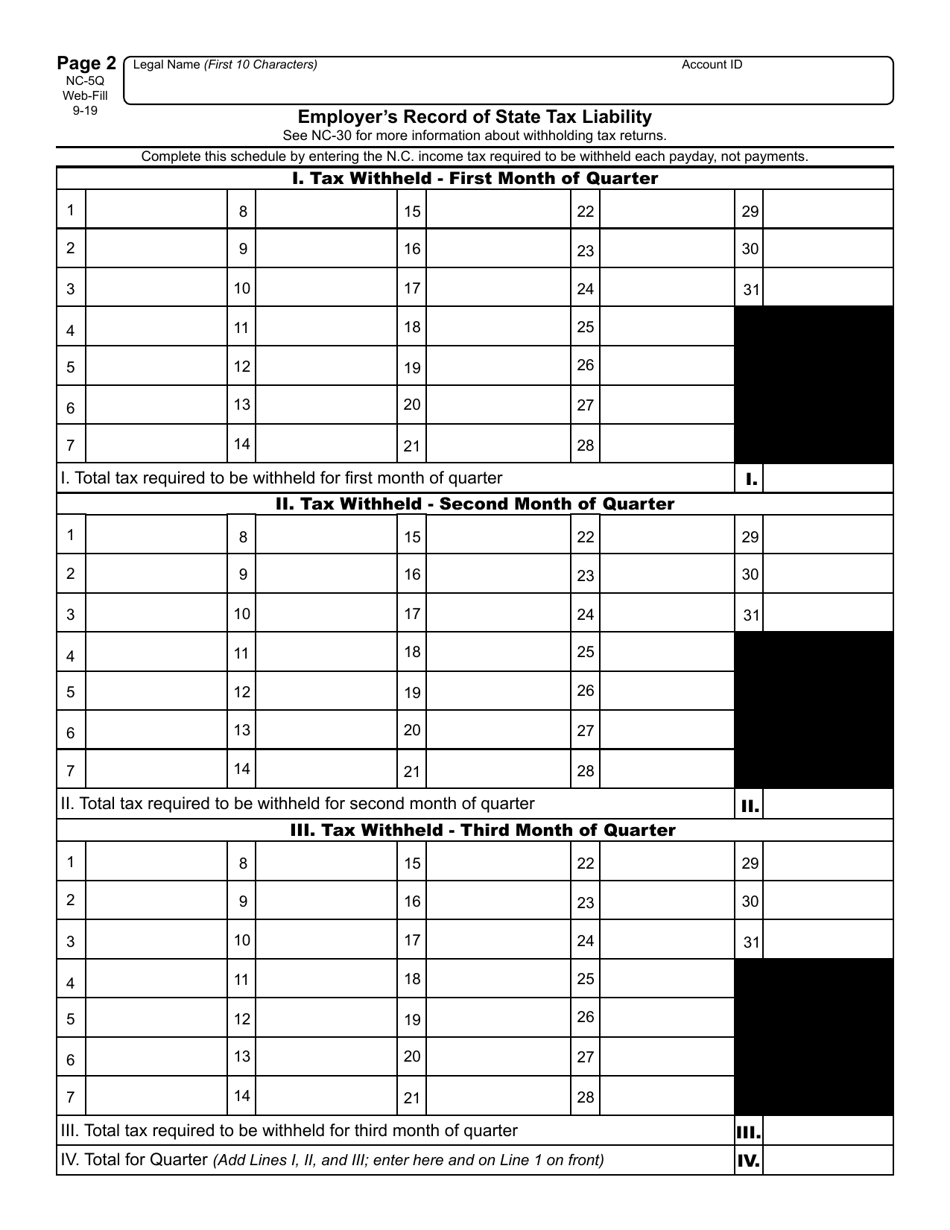

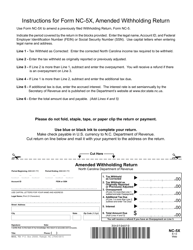

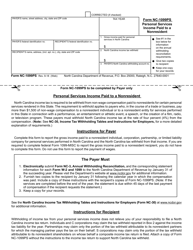

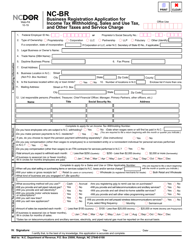

Form NC-5Q Quarterly Income Tax Withholding Return - North Carolina

What Is Form NC-5Q?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form NC-5Q?

A: Form NC-5Q is the Quarterly Income Tax Withholding Return for the state of North Carolina.

Q: Who needs to file form NC-5Q?

A: Employers in North Carolina who withhold state income tax from their employees' wages are required to file form NC-5Q.

Q: What is the purpose of form NC-5Q?

A: Form NC-5Q is used to report income tax withheld from employees' wages and remit the withheld taxes to the North Carolina Department of Revenue.

Q: When is form NC-5Q due?

A: Form NC-5Q is due on a quarterly basis. The due dates are April 30, July 31, October 31, and January 31.

Q: What information is required on form NC-5Q?

A: Form NC-5Q requires information such as the employer's name and address, the number of employees, the total wages paid, and the amount of state income tax withheld.

Q: Are there any penalties for late filing of form NC-5Q?

A: Yes, there are penalties for late filing of form NC-5Q. The penalty amount varies based on the number of days the return is late.

Q: Is form NC-5Q specific to North Carolina?

A: Yes, form NC-5Q is specific to the state of North Carolina and is not used for any other state.

Q: Can I request an extension to file form NC-5Q?

A: No, there is no provision for an extension to file form NC-5Q. It must be filed by the due date.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

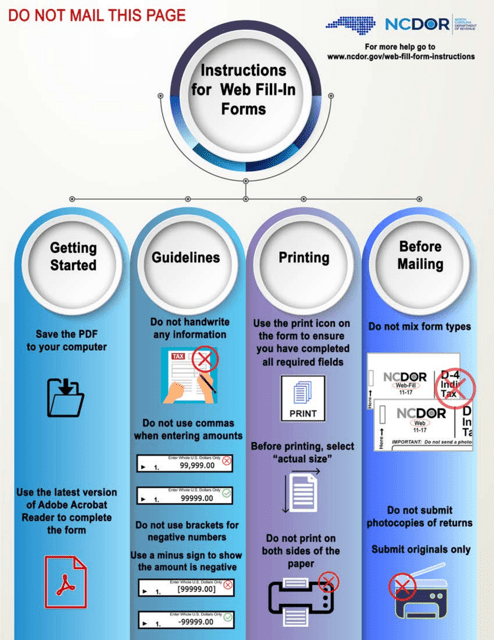

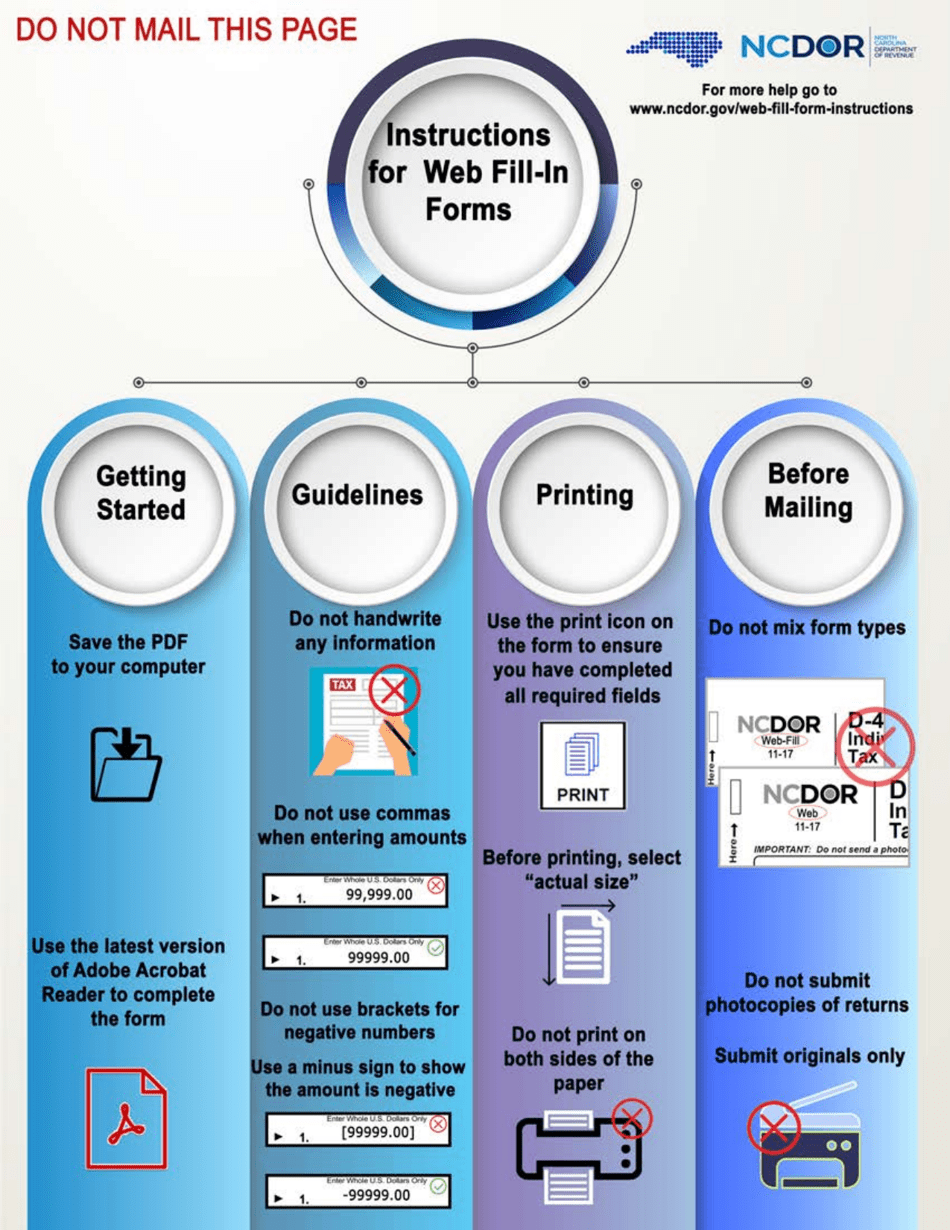

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NC-5Q by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.