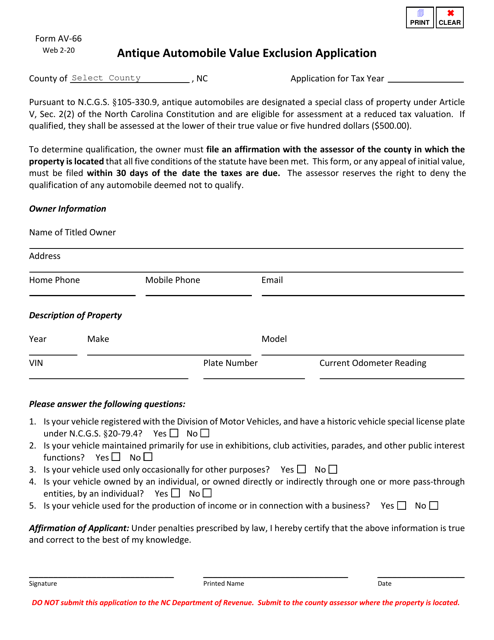

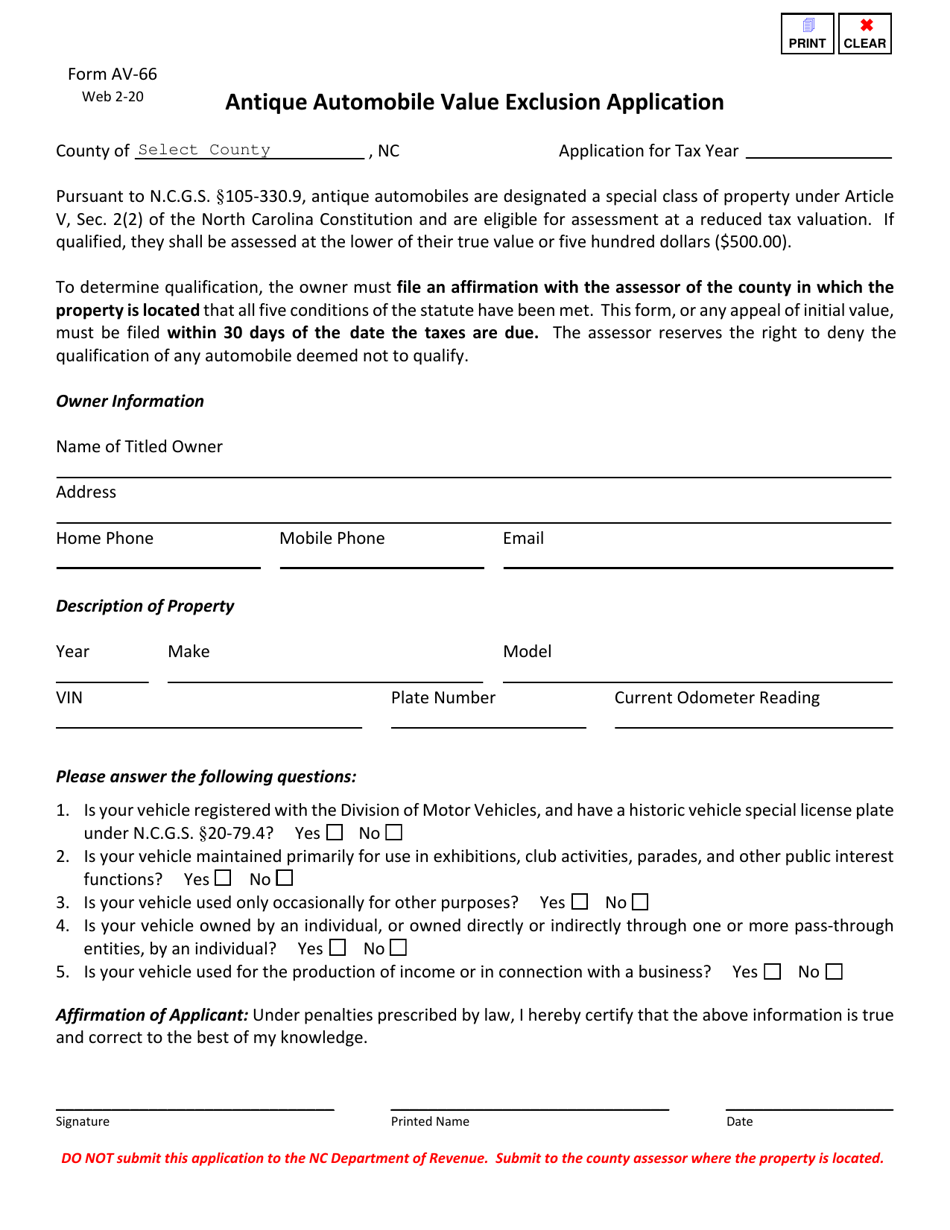

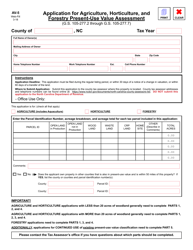

Form AV-66 Antique Automobile Value Exclusion Application - North Carolina

What Is Form AV-66?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form AV-66?

A: Form AV-66 is used to apply for an Antique Automobile Value Exclusion in North Carolina.

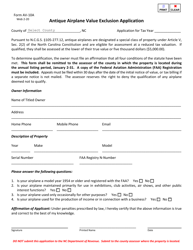

Q: What is an Antique Automobile Value Exclusion?

A: An Antique Automobile Value Exclusion is a tax benefit that allows qualifying antique vehicles to be exempt from property taxes.

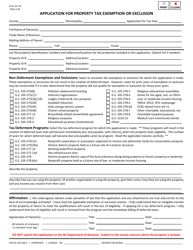

Q: Who can apply for an Antique Automobile Value Exclusion?

A: Any North Carolina resident who owns an antique vehicle that meets the eligibility criteria can apply for this exclusion.

Q: What are the eligibility criteria for the Antique Automobile Value Exclusion?

A: To be eligible, the vehicle must be 35 years old or older, driven only for events, exhibitions, and parades, and not used for general transportation purposes.

Q: Is there a deadline for submitting Form AV-66?

A: Yes, the application must be submitted to the county tax office on or before the business day before the listing period begins.

Q: What documentation is required to accompany Form AV-66?

A: The application must be accompanied by a copy of the vehicle's title or registration, as well as a notarized statement certifying the vehicle's limited use and purpose.

Q: How long does the Antique Automobile Value Exclusion last?

A: Once approved, the exclusion remains in effect until the vehicle is sold or no longer meets the eligibility criteria.

Q: Are there any fees associated with the Antique Automobile Value Exclusion?

A: There is no fee to apply for the exclusion, but regular registration fees and property taxes still apply.

Q: What happens if the vehicle is found to be in violation of the exclusion requirements?

A: If the vehicle is found to be in violation, the owner may be subject to penalties and the exemption could be revoked.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AV-66 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.