This version of the form is not currently in use and is provided for reference only. Download this version of

Form IB-33

for the current year.

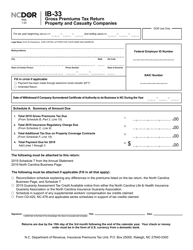

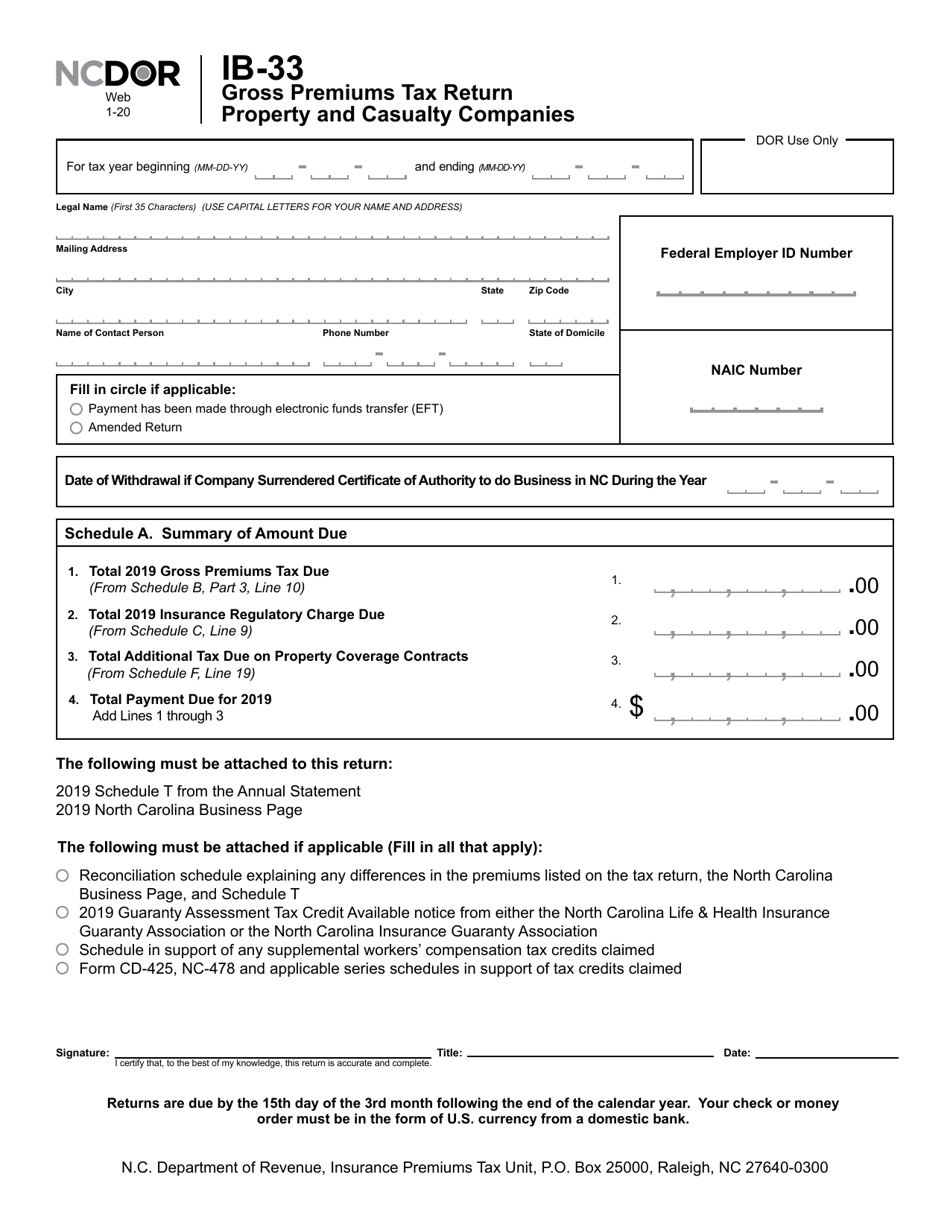

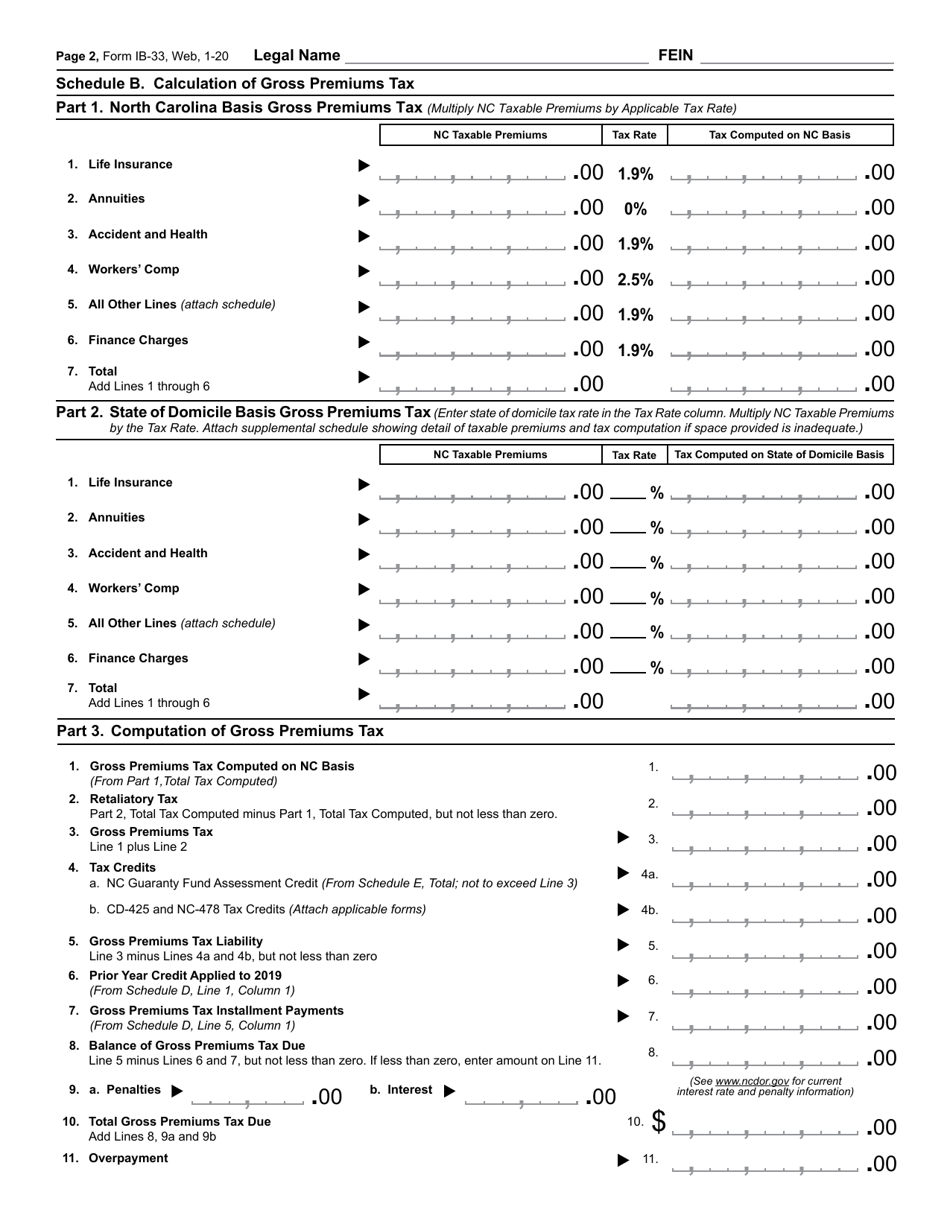

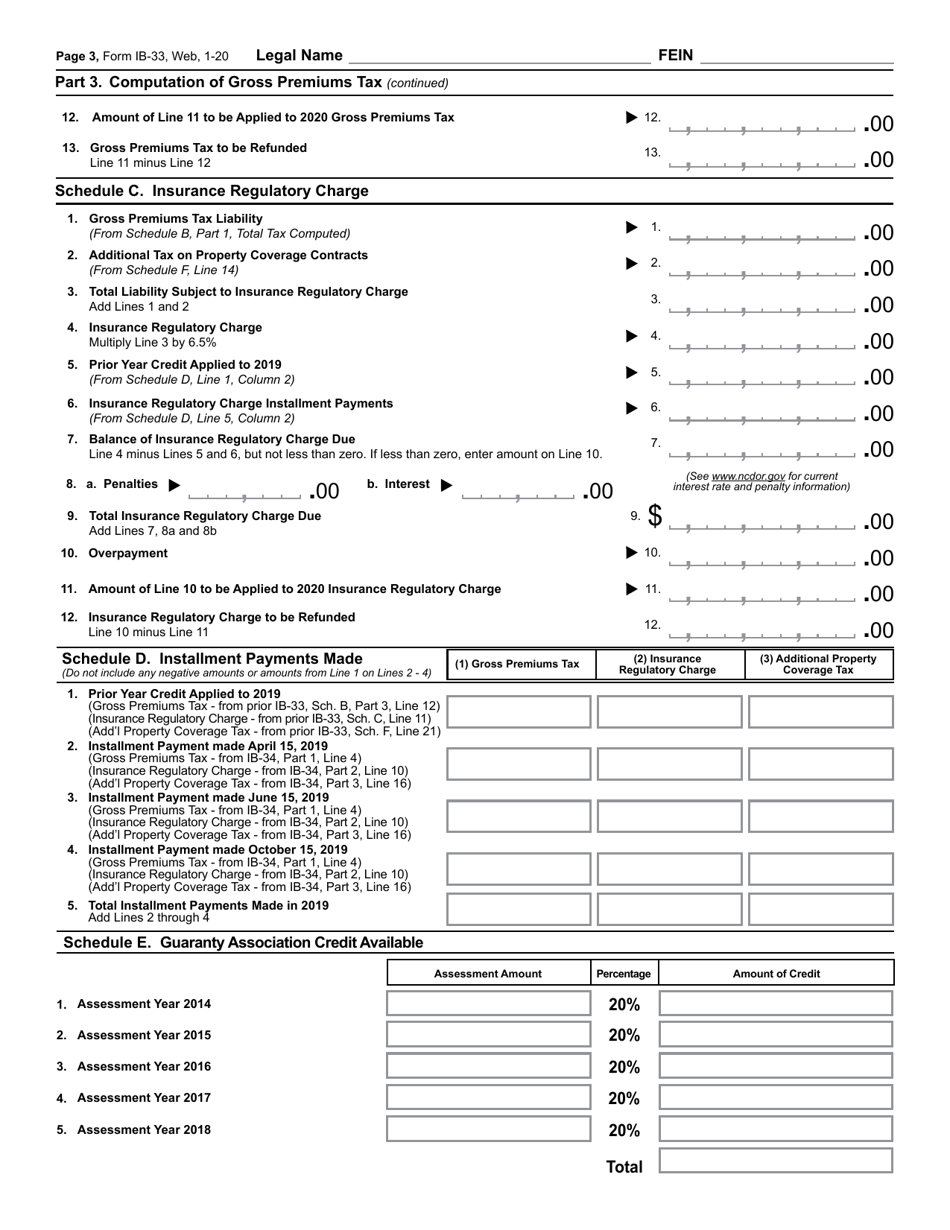

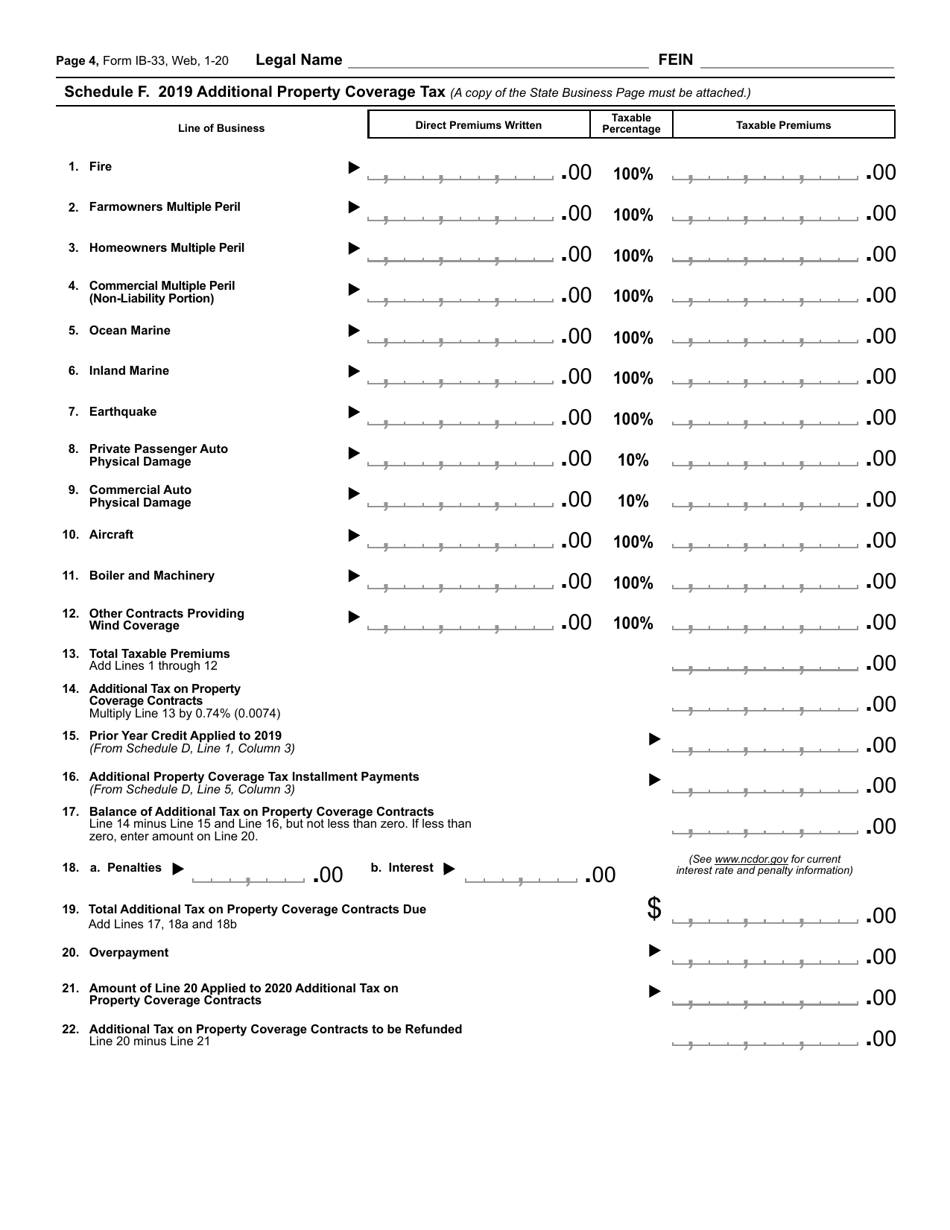

Form IB-33 Gross Premiums Tax Return Property and Casualty Companies - North Carolina

What Is Form IB-33?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IB-33?

A: Form IB-33 is a Gross Premiums Tax Return for Property and Casualty Companies in North Carolina.

Q: Who is required to file Form IB-33?

A: Property and Casualty Companies in North Carolina are required to file Form IB-33.

Q: What is the purpose of Form IB-33?

A: The purpose of Form IB-33 is to report and pay the gross premiums tax for property and casualtyinsurance companies in North Carolina.

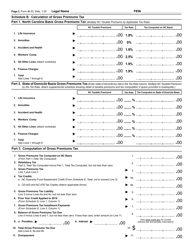

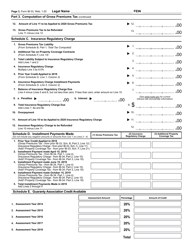

Q: What information is required on Form IB-33?

A: Form IB-33 requires information about the company's gross premiums, deductions, credits, and the amount of tax due.

Q: When is Form IB-33 due?

A: Form IB-33 is due on or before the fifteenth day of the third month following the end of the company's fiscal year.

Q: Are there any penalties for late filing or payment of Form IB-33?

A: Yes, there are penalties for late filing or payment of Form IB-33. It is important to file and pay on time to avoid penalties.

Q: What should I do if I have questions or need assistance with Form IB-33?

A: If you have questions or need assistance with Form IB-33, you should contact the North Carolina Department of Revenue for guidance.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

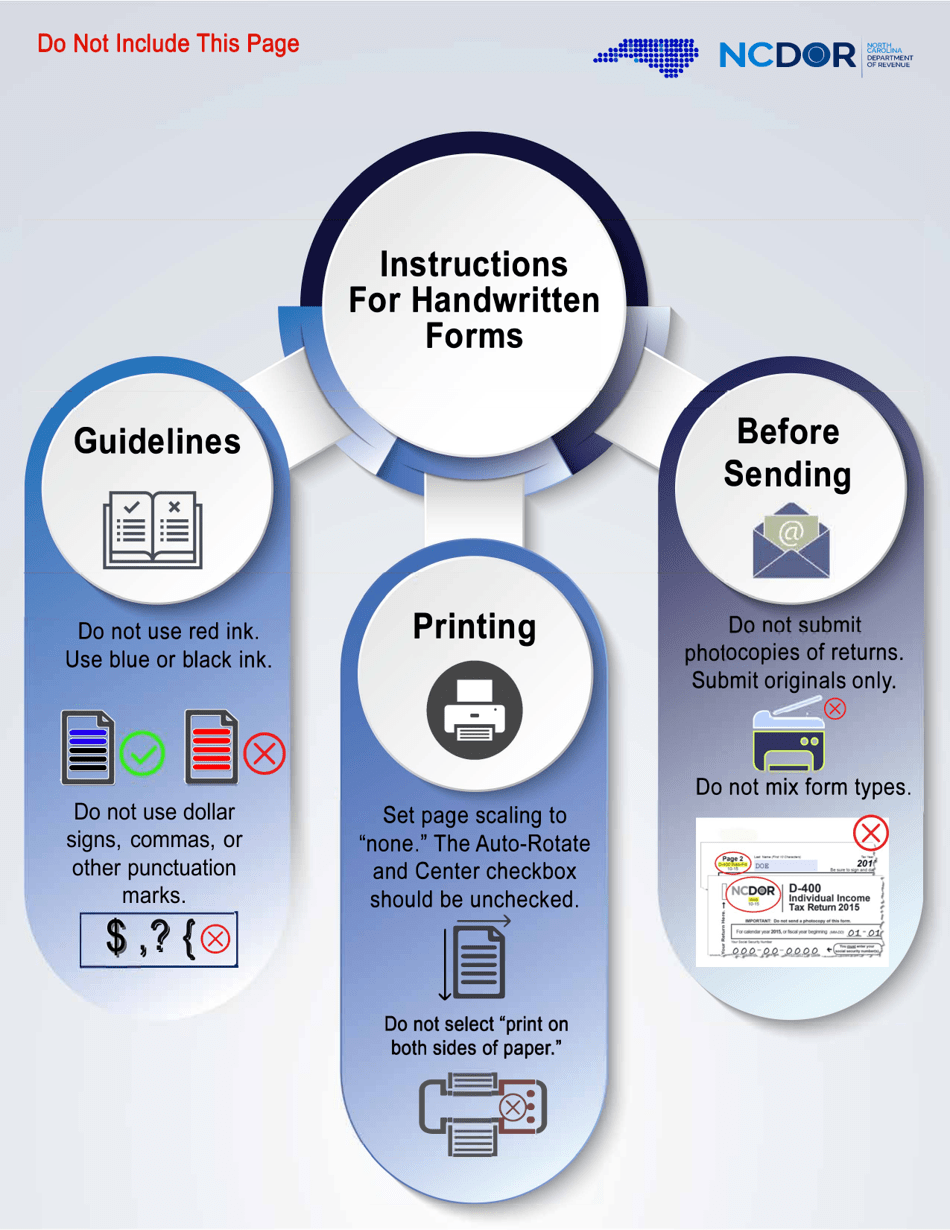

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IB-33 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.