This version of the form is not currently in use and is provided for reference only. Download this version of

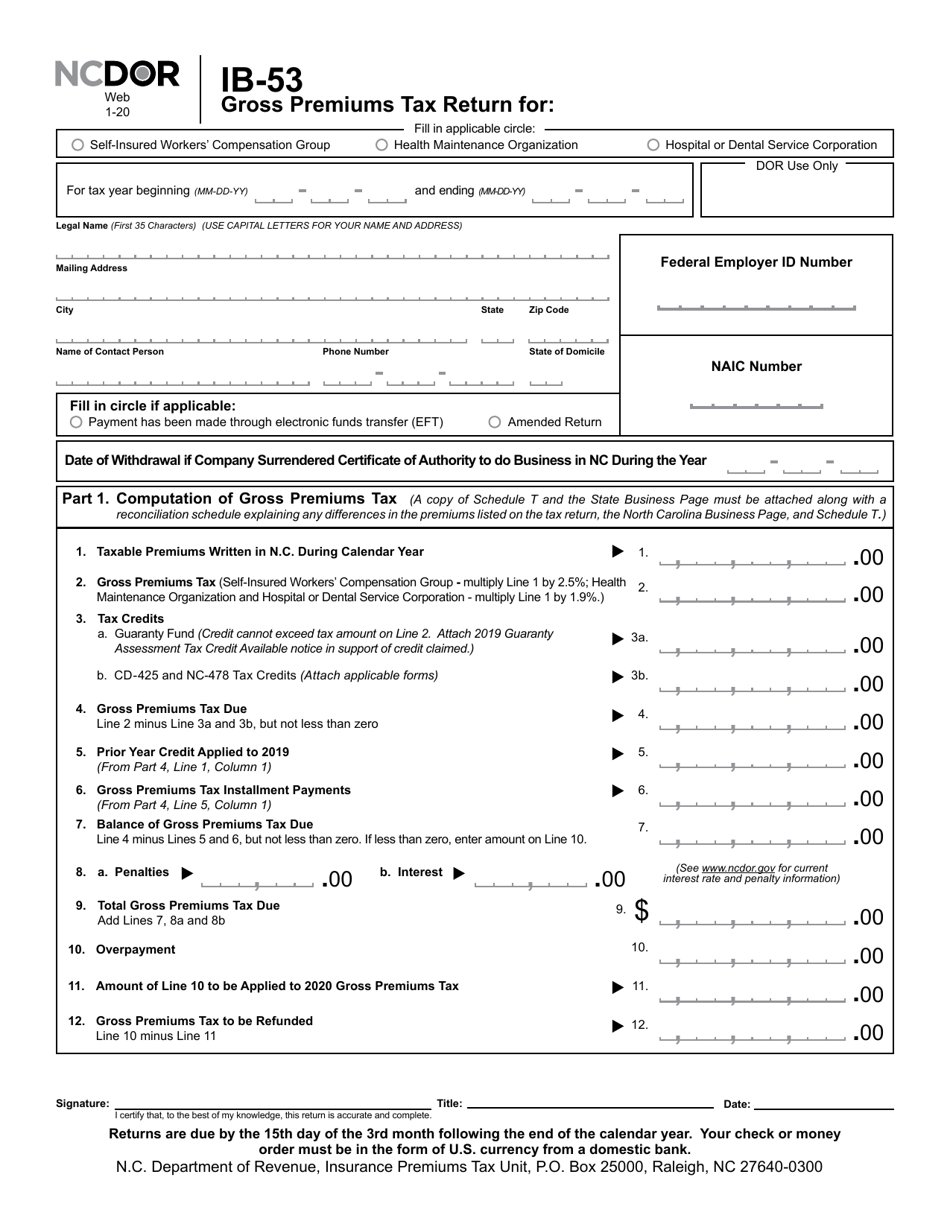

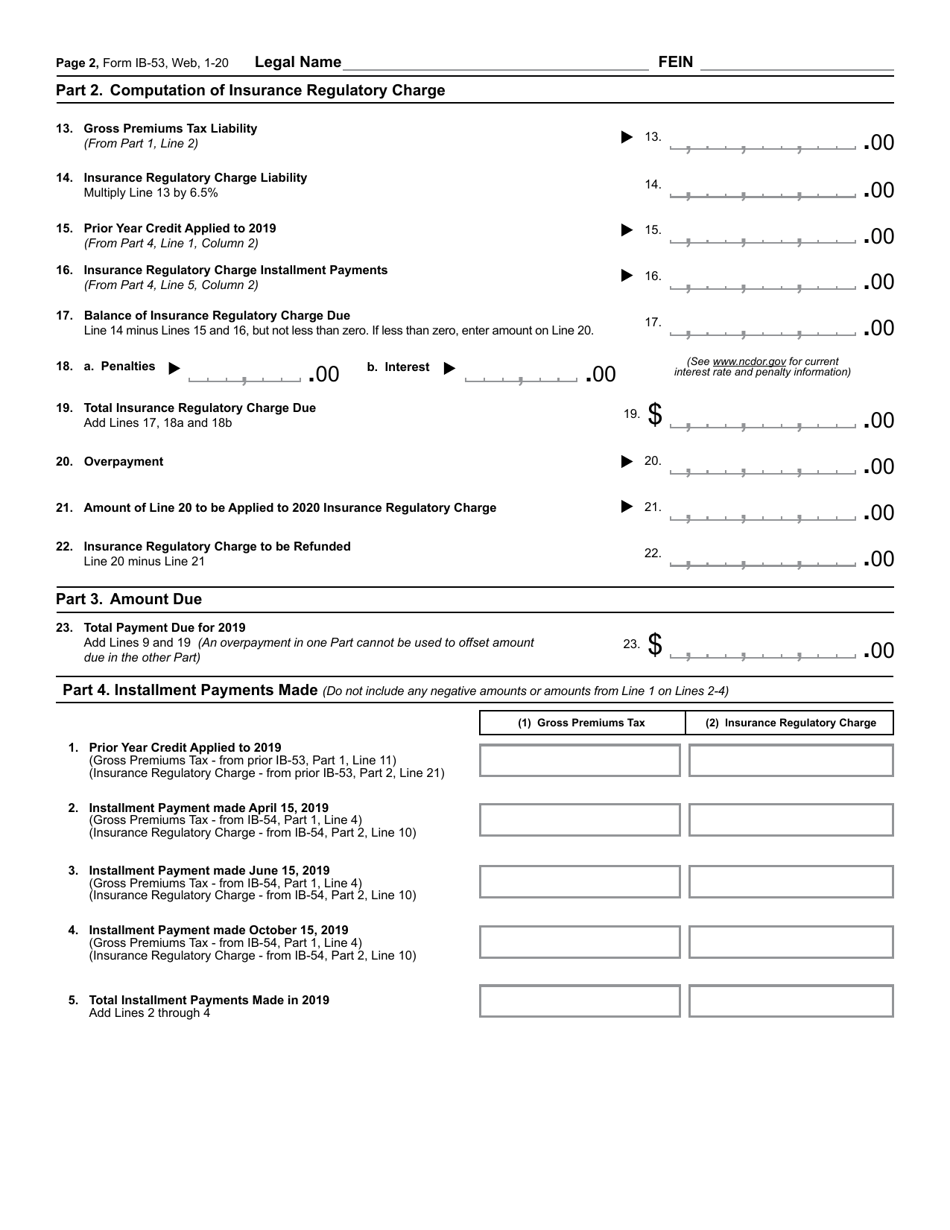

Form IB-53

for the current year.

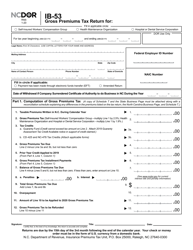

Form IB-53 Gross Premiums Tax Return - North Carolina

What Is Form IB-53?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IB-53?

A: Form IB-53 is the Gross Premiums Tax Return.

Q: What is the purpose of Form IB-53?

A: The purpose of Form IB-53 is to report and pay the gross premiums tax in North Carolina.

Q: Who is required to file Form IB-53?

A: Insurance companies and other entities engaged in insurance business in North Carolina are required to file Form IB-53.

Q: What is the gross premiums tax?

A: The gross premiums tax is a tax imposed on insurance companies and other entities based on their gross premiums collected in North Carolina.

Q: When is Form IB-53 due?

A: Form IB-53 is due on or before the 15th day of the fourth month following the close of the taxable year.

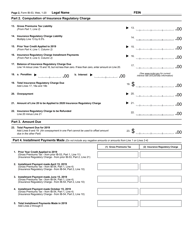

Q: What information is required to be reported on Form IB-53?

A: Form IB-53 requires reporting of gross premiums received in North Carolina, deductions, and calculation of the gross premiums tax liability.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance with the gross premiums tax requirements. It is important to file Form IB-53 timely and accurately to avoid penalties.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

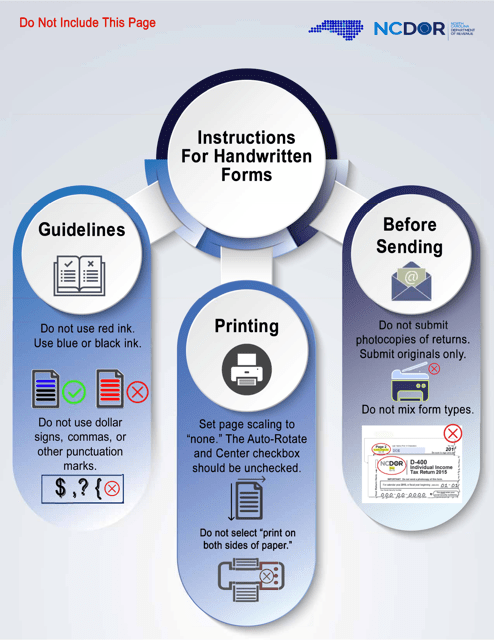

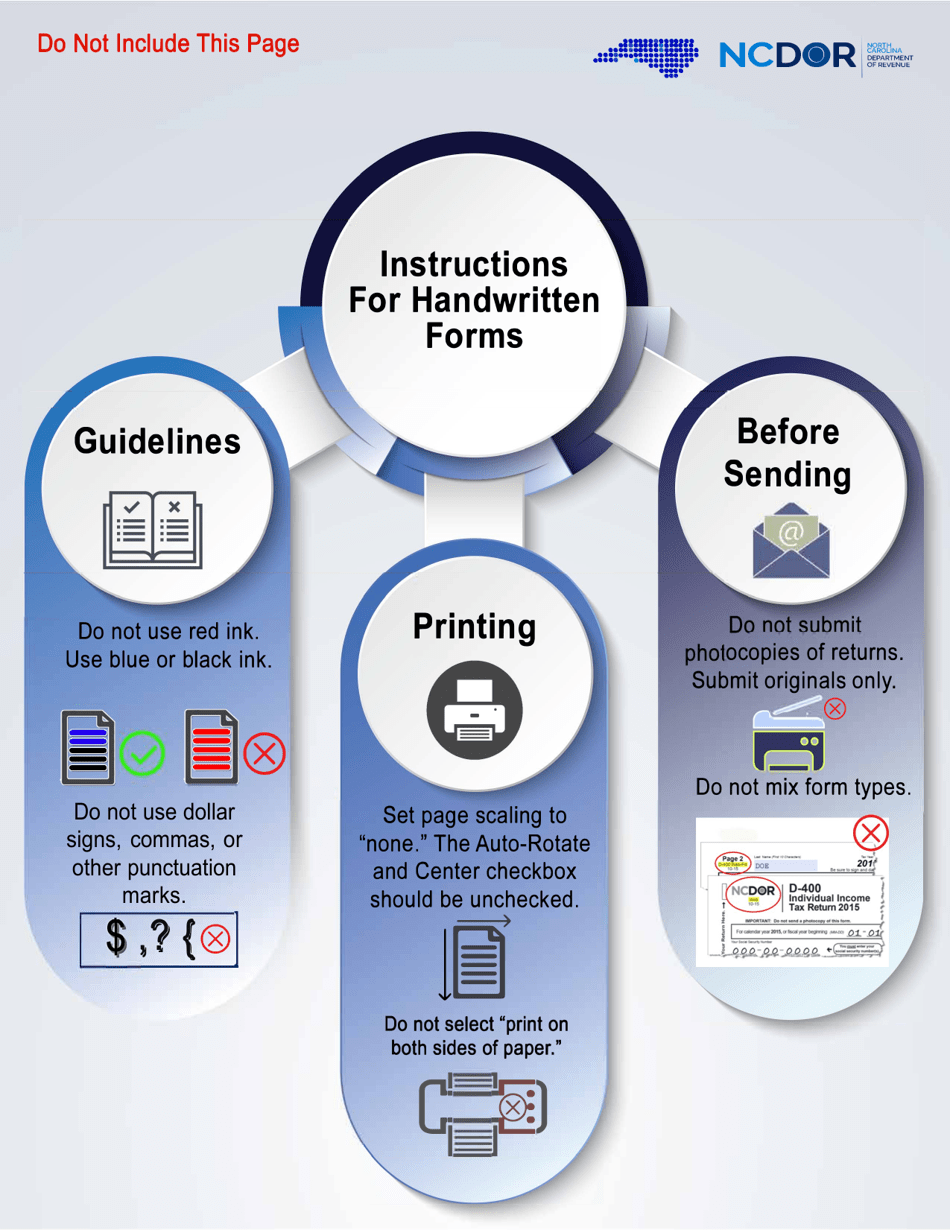

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IB-53 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.