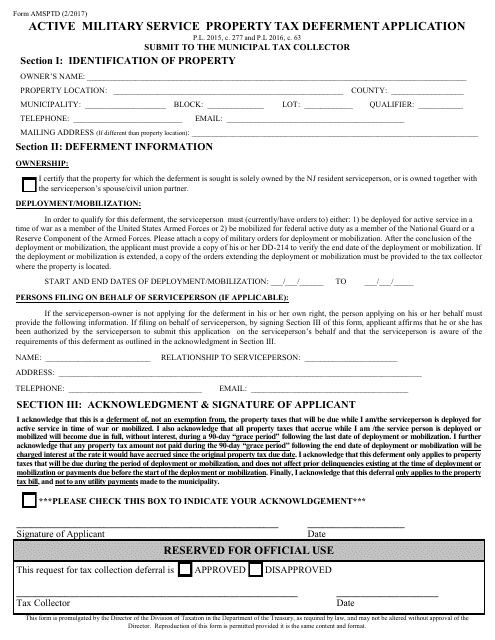

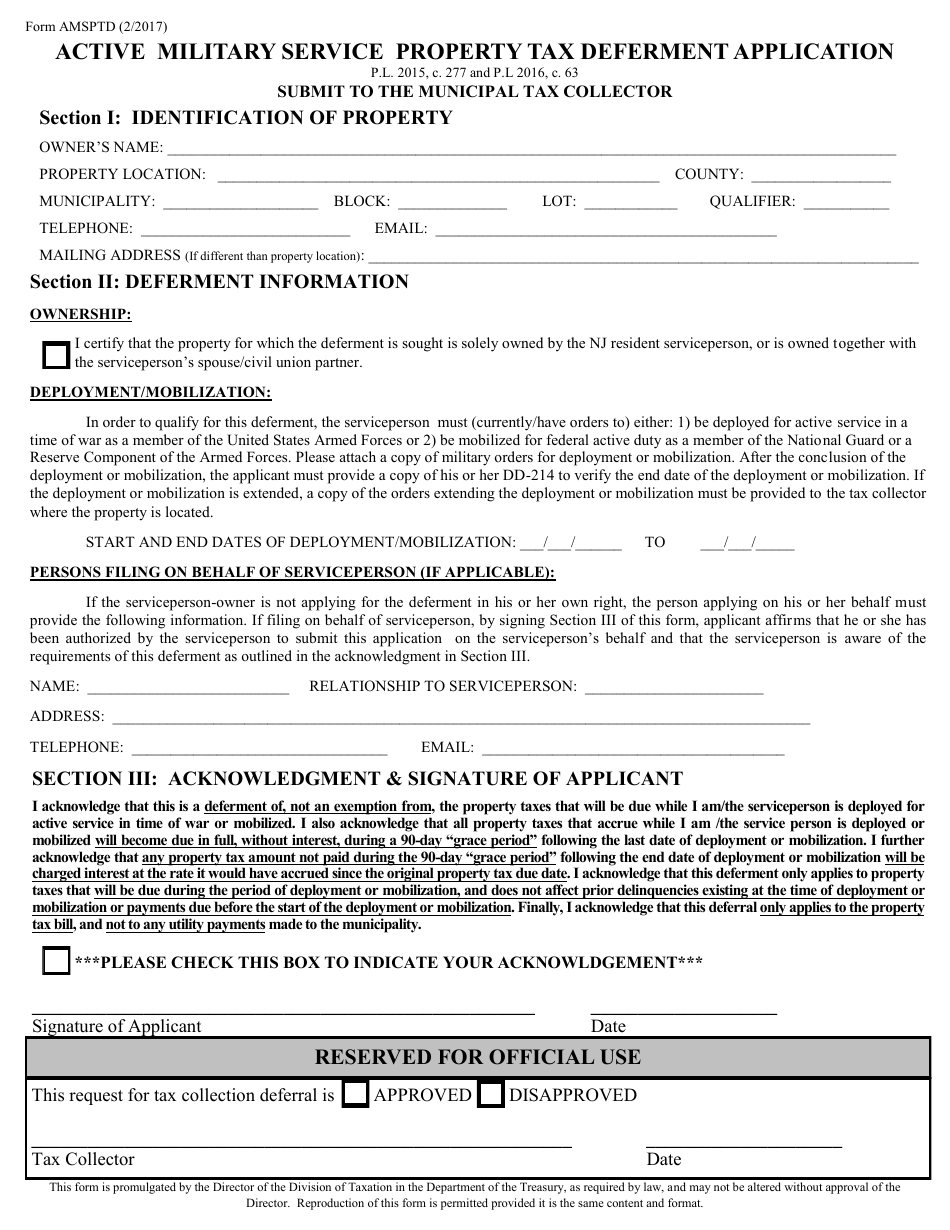

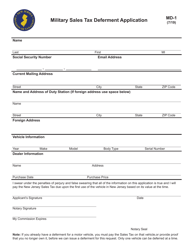

Form AMSPTD Active Military Service Property Tax Deferment Application - New Jersey

What Is Form AMSPTD?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the AMSPTD?

A: AMSPTD stands for Active Military Service Property Tax Deferment.

Q: What is the purpose of the AMSPTD?

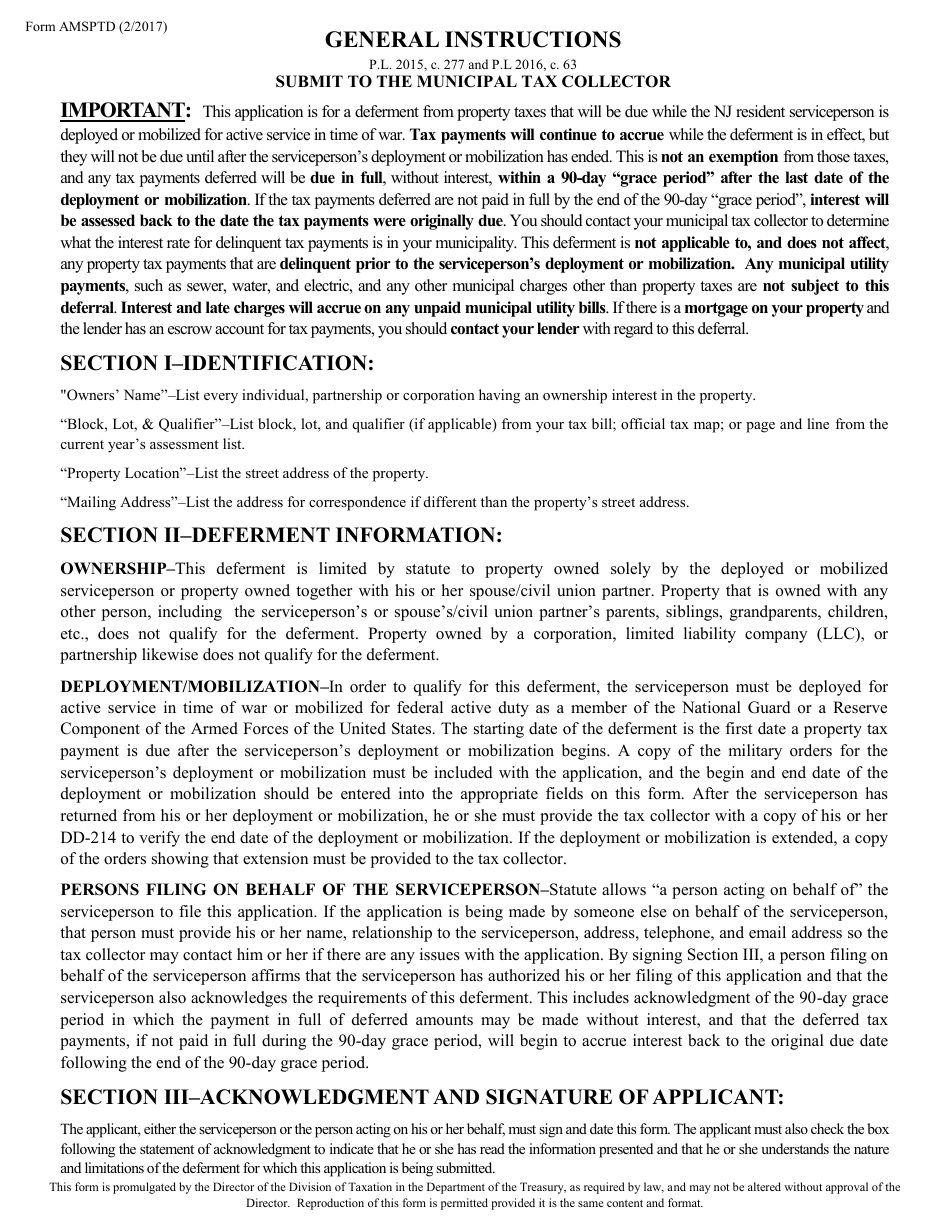

A: The purpose of the AMSPTD is to allow eligible members of the military to defer payment of property taxes.

Q: Who is eligible for the AMSPTD?

A: Eligibility for the AMSPTD is limited to active duty members of the military.

Q: How can I apply for the AMSPTD?

A: You can apply for the AMSPTD by completing and submitting the application form.

Q: What is the deadline for submitting the AMSPTD application?

A: The deadline for submitting the AMSPTD application is usually November 1st.

Q: What happens if I am approved for the AMSPTD?

A: If approved, your property tax payment will be deferred until you are no longer on active duty.

Q: Are there any fees associated with the AMSPTD?

A: No, there are no fees associated with the AMSPTD.

Q: Can I use the AMSPTD for all of my properties?

A: Yes, you can use the AMSPTD for all properties that you own.

Q: Is the AMSPTD available in all counties in New Jersey?

A: Yes, the AMSPTD is available in all counties in New Jersey.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AMSPTD by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.