This version of the form is not currently in use and is provided for reference only. Download this version of

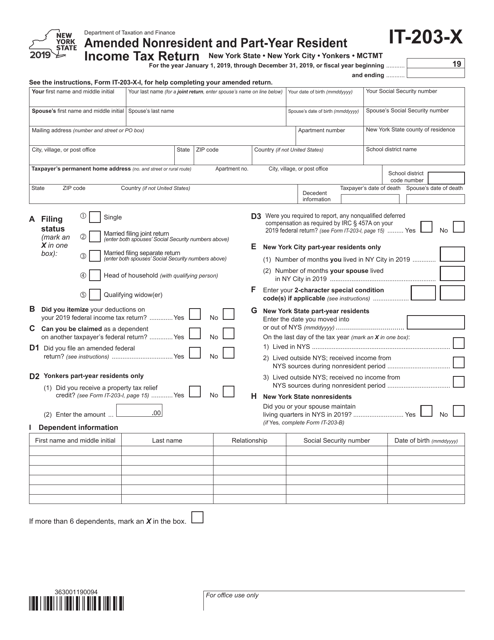

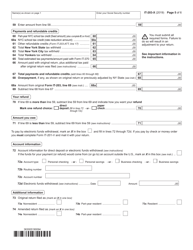

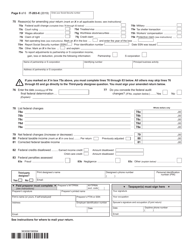

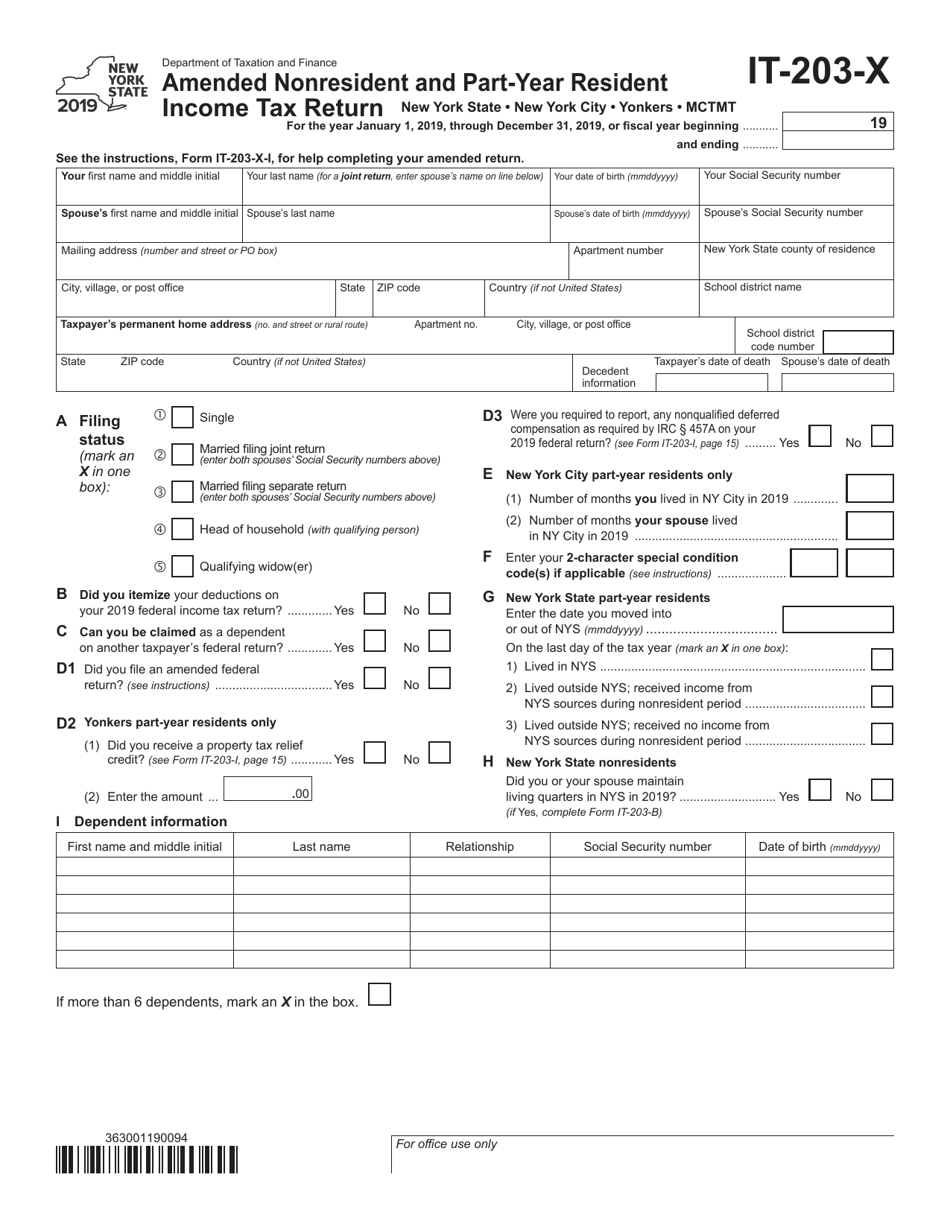

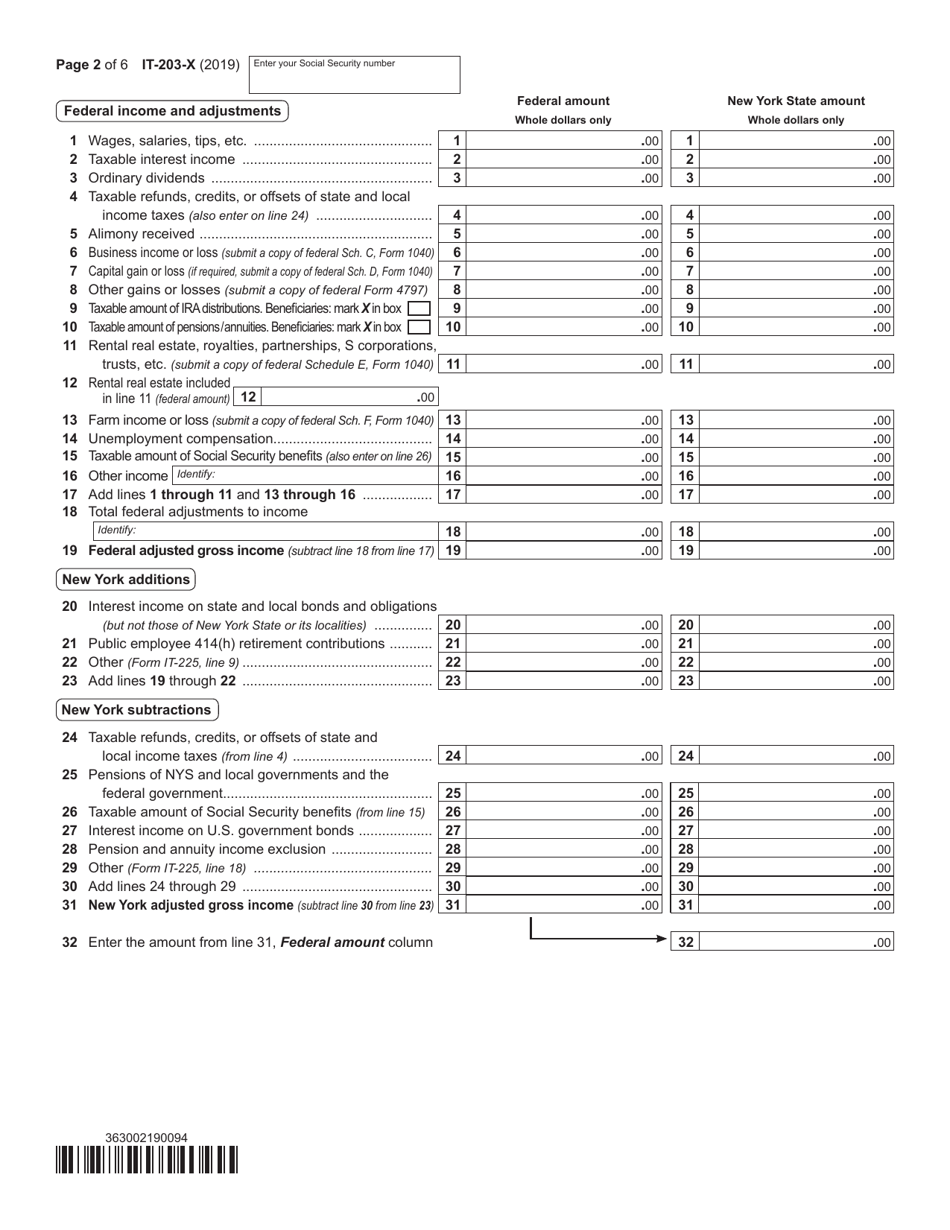

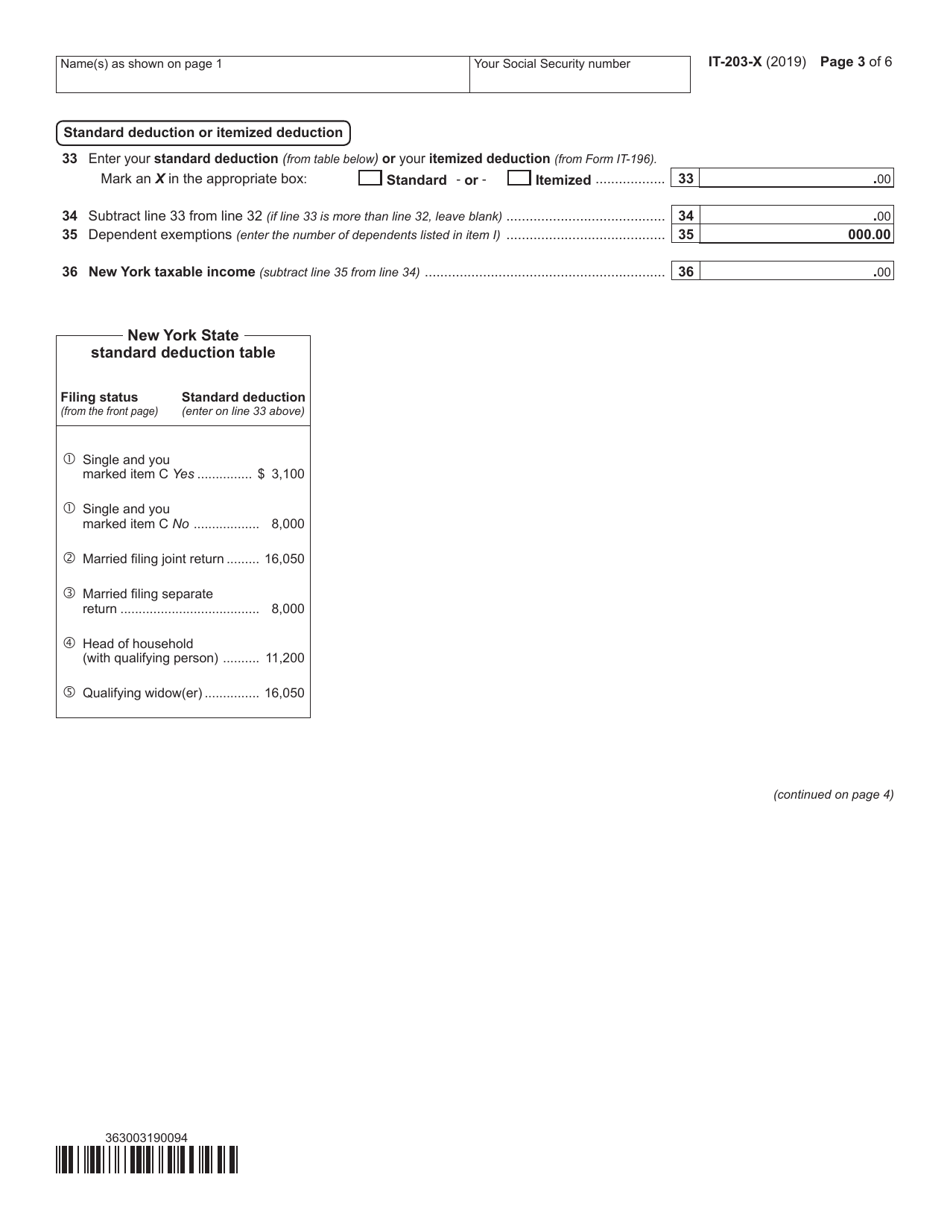

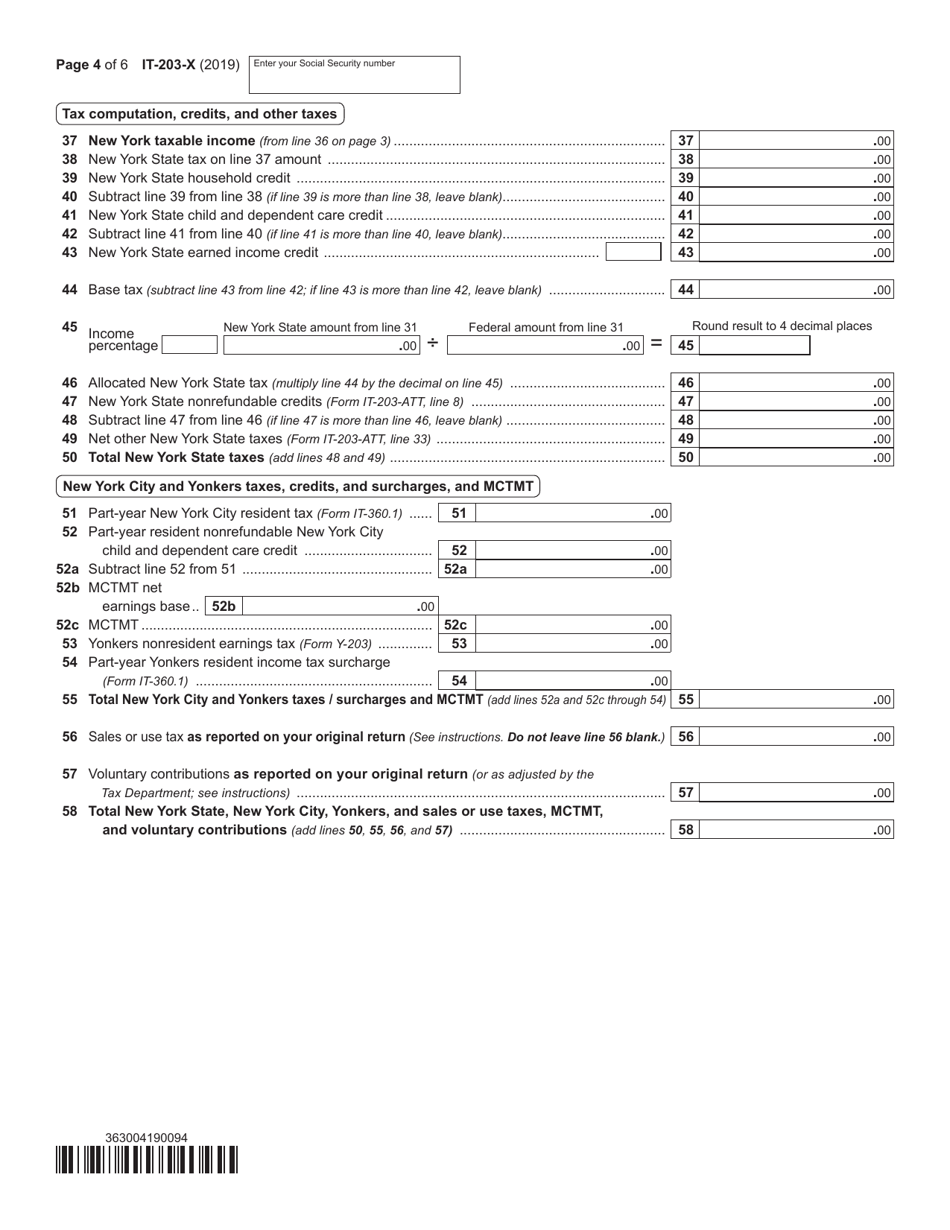

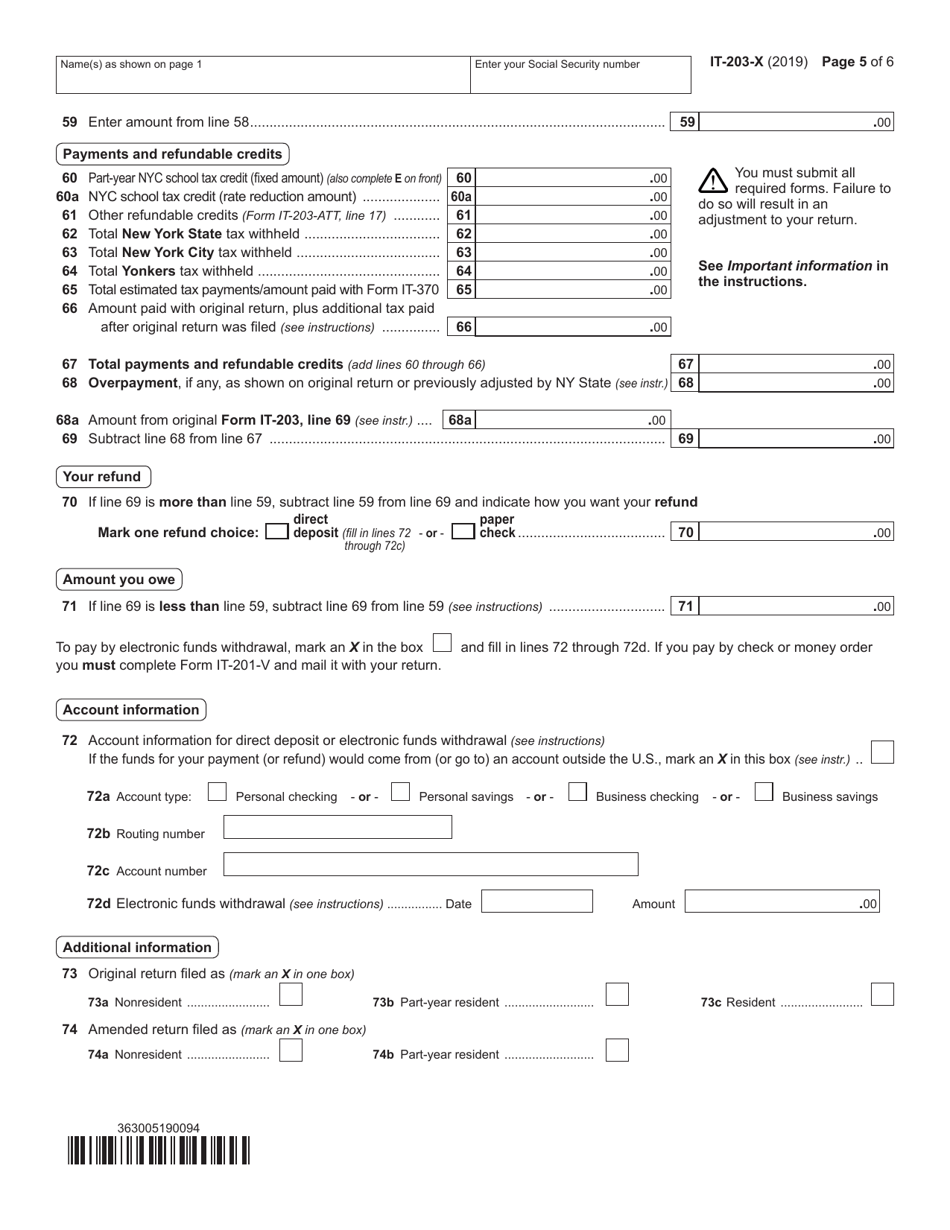

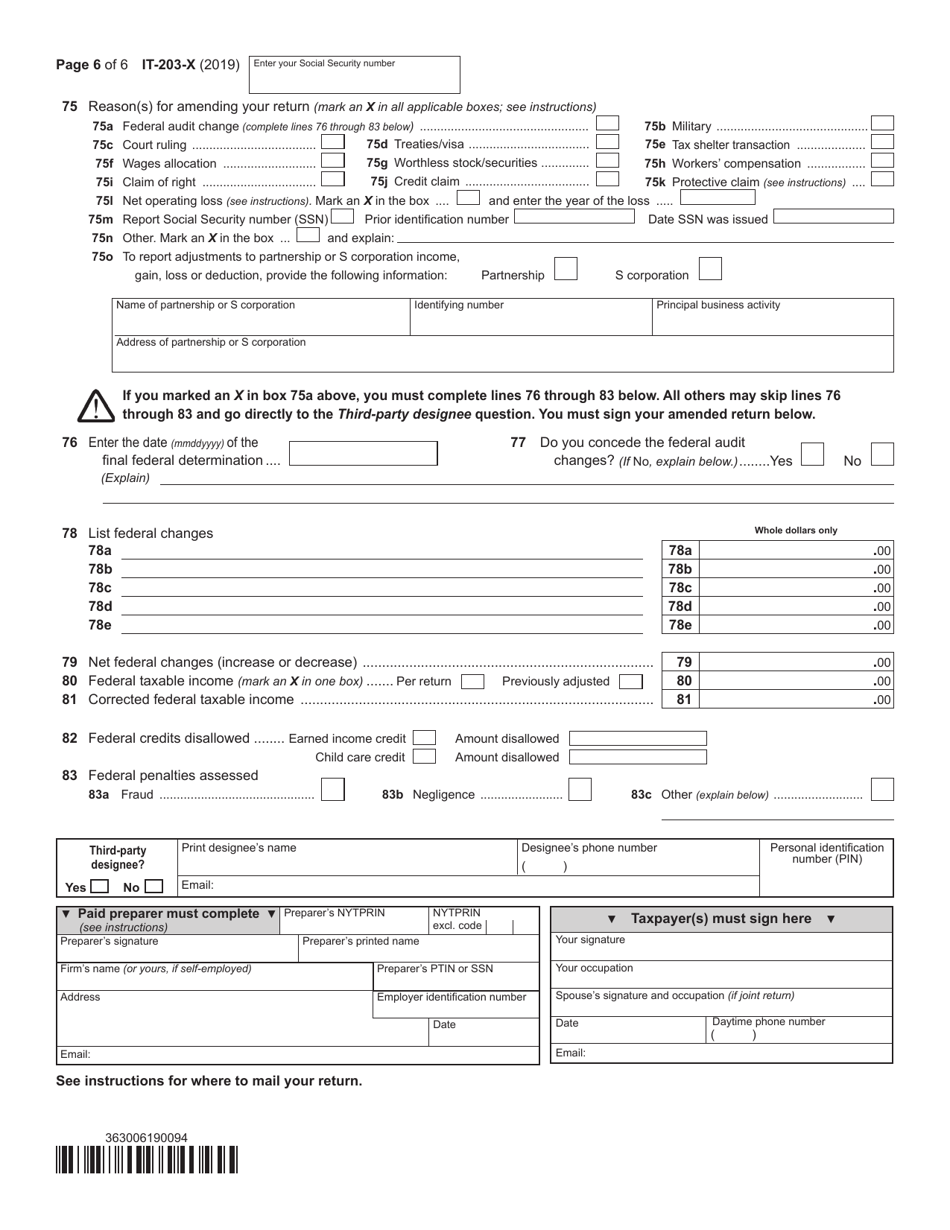

Form IT-203-X

for the current year.

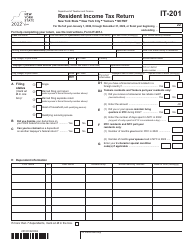

Form IT-203-X Amended Nonresident and Part-Year Resident Income Tax Return - New York

What Is Form IT-203-X?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-203-X?

A: Form IT-203-X is the Amended Nonresident and Part-Year Resident Income Tax Return for the state of New York.

Q: Who needs to file Form IT-203-X?

A: Form IT-203-X must be filed by individuals who need to amend their nonresident or part-year resident income tax return in New York.

Q: Can I use Form IT-203-X to amend my federal tax return?

A: No, Form IT-203-X is only used to amend your New York state income tax return. You will need to use a separate form to amend your federal tax return.

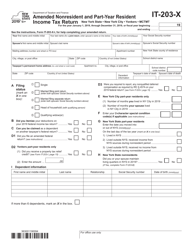

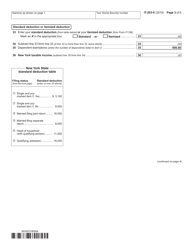

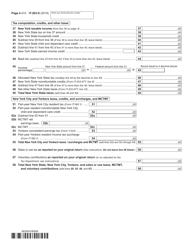

Q: What information do I need to complete the form?

A: To complete Form IT-203-X, you will need your original Form IT-203, the changes you need to make, and any supporting documentation.

Q: Is there a deadline to file Form IT-203-X?

A: Yes, Form IT-203-X must be filed within three years from the original due date of the tax return or within two years from the date the tax was paid, whichever is later.

Q: What should I do if I made a mistake on my tax return?

A: If you made a mistake on your New York state income tax return, you should file Form IT-203-X to correct the error.

Q: Do I need to attach any documents to Form IT-203-X?

A: Yes, you may need to attach supporting documentation to Form IT-203-X, depending on the changes you are making.

Q: Can I e-file Form IT-203-X?

A: No, Form IT-203-X cannot be e-filed. It must be filed by mail.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-X by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.