This version of the form is not currently in use and is provided for reference only. Download this version of

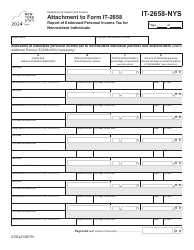

Form IT-2658

for the current year.

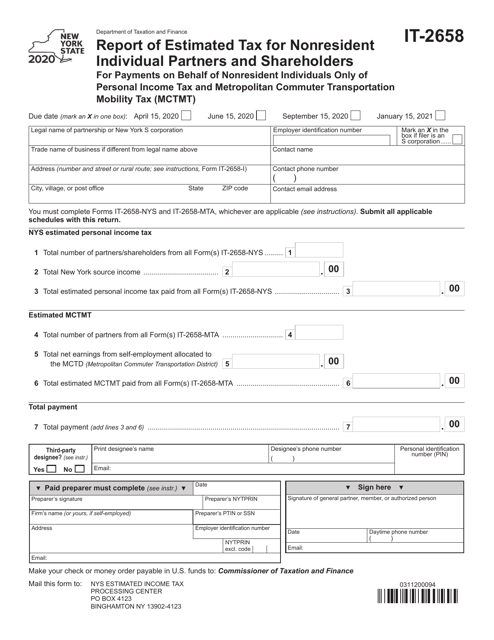

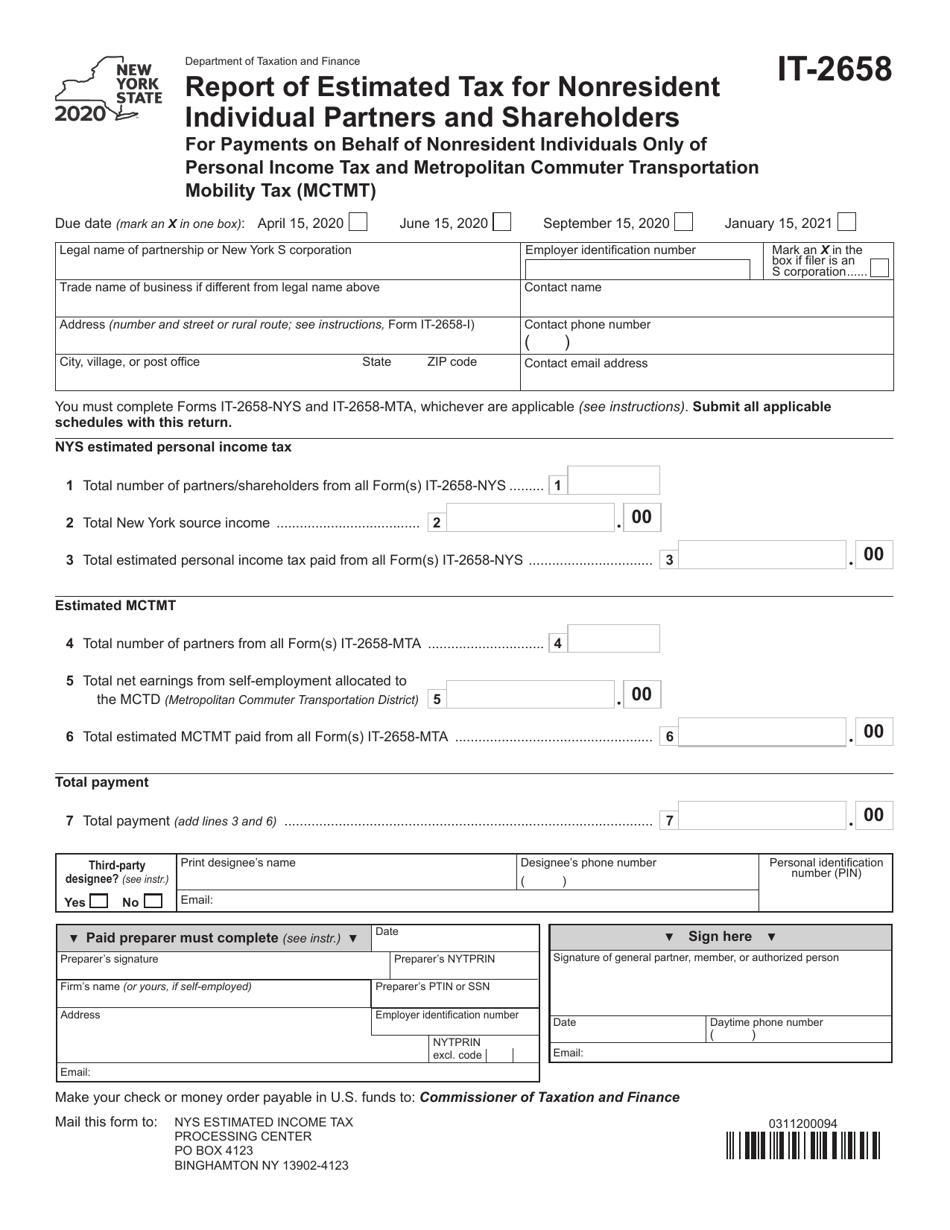

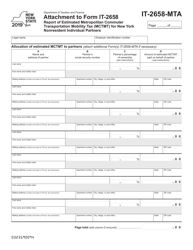

Form IT-2658 Report of Estimated Tax for Nonresident Individual Partners and Shareholders for Payments on Behalf of Nonresident Individuals Only of Personal Income Tax and Metropolitan Commuter Transportation Mobility Tax (Mctmt) - New York

What Is Form IT-2658?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-2658?

A: Form IT-2658 is a report of estimated tax for nonresident individual partners and shareholders for payments on behalf of nonresident individuals only of personal income tax and Metropolitan Commuter Transportation Mobility Tax (MCTMT) in New York.

Q: Who needs to file Form IT-2658?

A: Nonresident individual partners and shareholders who are making estimated tax payments on behalf of nonresident individuals only of personal income tax and MCTMT in New York need to file Form IT-2658.

Q: What is the purpose of Form IT-2658?

A: The purpose of Form IT-2658 is to report estimated tax payments made on behalf of nonresident individuals for personal income tax and MCTMT in New York.

Q: Is Form IT-2658 specific to New York?

A: Yes, Form IT-2658 is specific to New York and is used to report estimated tax payments for nonresident individuals of personal income tax and MCTMT in New York.

Q: Are there any specific instructions for filling out Form IT-2658?

A: Yes, there are specific instructions provided by the New York State Department of Taxation and Finance on how tofill out and submit Form IT-2658.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2658 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.