This version of the form is not currently in use and is provided for reference only. Download this version of

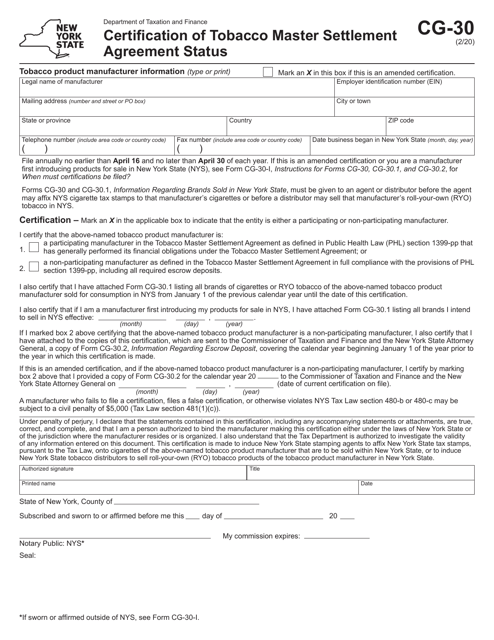

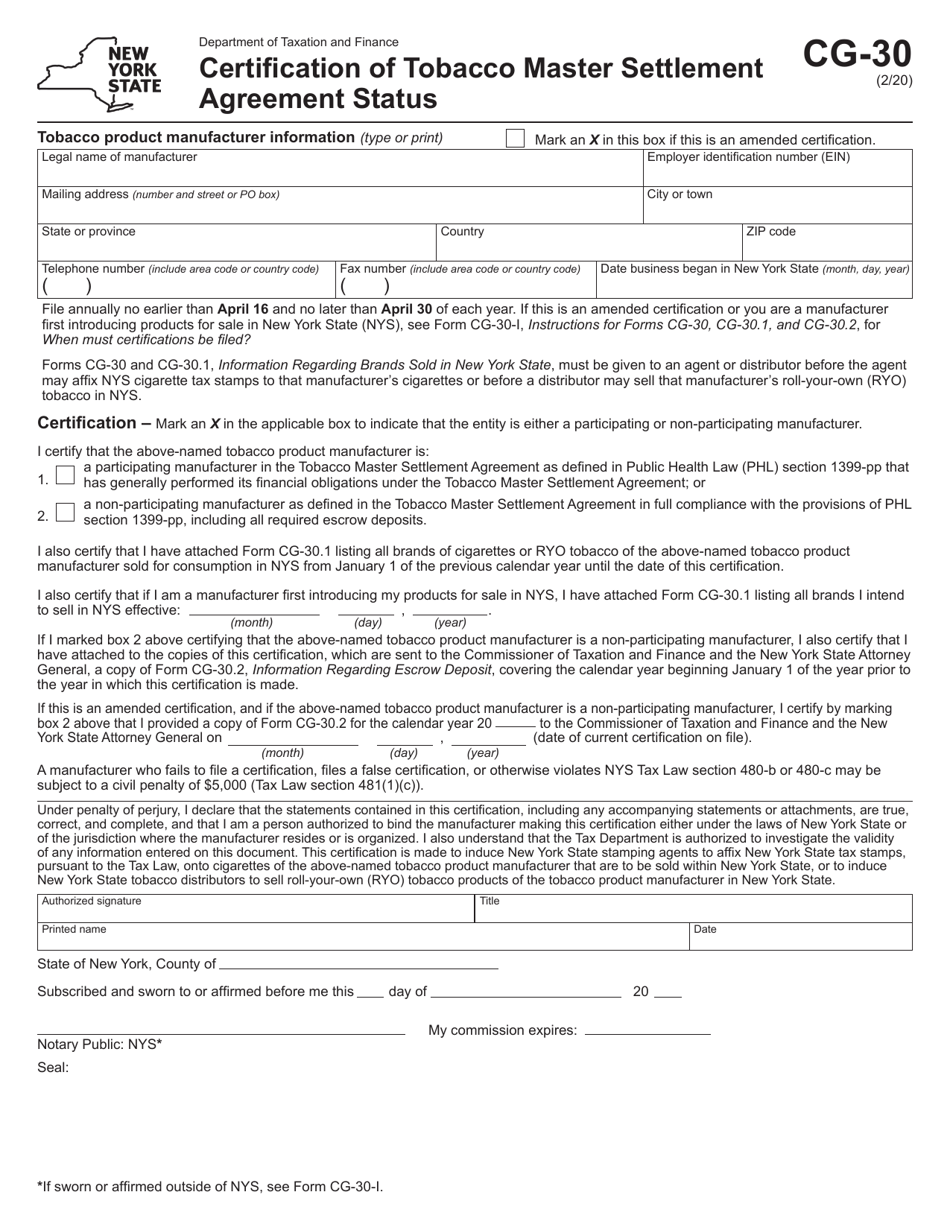

Form CG-30

for the current year.

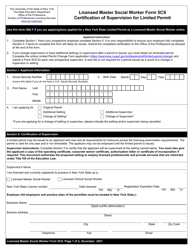

Form CG-30 Certification of Tobacco Master Settlement Agreement Status - New York

What Is Form CG-30?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CG-30?

A: Form CG-30 is the Certification of Tobacco Master Settlement Agreement Status New York.

Q: What is the Tobacco Master Settlement Agreement?

A: The Tobacco Master Settlement Agreement is an agreement between the tobacco industry and various states in the United States.

Q: What does the Form CG-30 certify?

A: Form CG-30 certifies the status of compliance by cigarette manufacturers with the Tobacco Master Settlement Agreement.

Q: Who is required to submit Form CG-30?

A: Cigarette manufacturers who are participating in the Tobacco Master Settlement Agreement are required to submit Form CG-30.

Q: Is there a deadline for submitting Form CG-30?

A: Yes, cigarette manufacturers must submit Form CG-30 by October 1st of each year.

Q: What happens if a cigarette manufacturer fails to submit Form CG-30?

A: If a cigarette manufacturer fails to submit Form CG-30 by the deadline, they may face penalties or other enforcement actions.

Q: Can the information provided in Form CG-30 be made public?

A: Yes, the information provided in Form CG-30 is considered public information and may be subject to disclosure.

Q: Are there any exemptions to the requirement of submitting Form CG-30?

A: Yes, certain cigarette manufacturers may be exempt from the requirement of submitting Form CG-30, such as those who have settled their liabilities under the Tobacco Master Settlement Agreement.

Q: Who can I contact for more information about Form CG-30?

A: For more information about Form CG-30, you can contact the New York Department of Taxation and Finance.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CG-30 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.