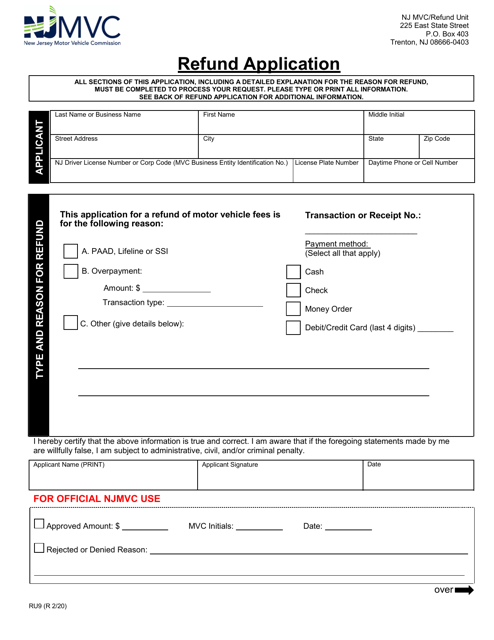

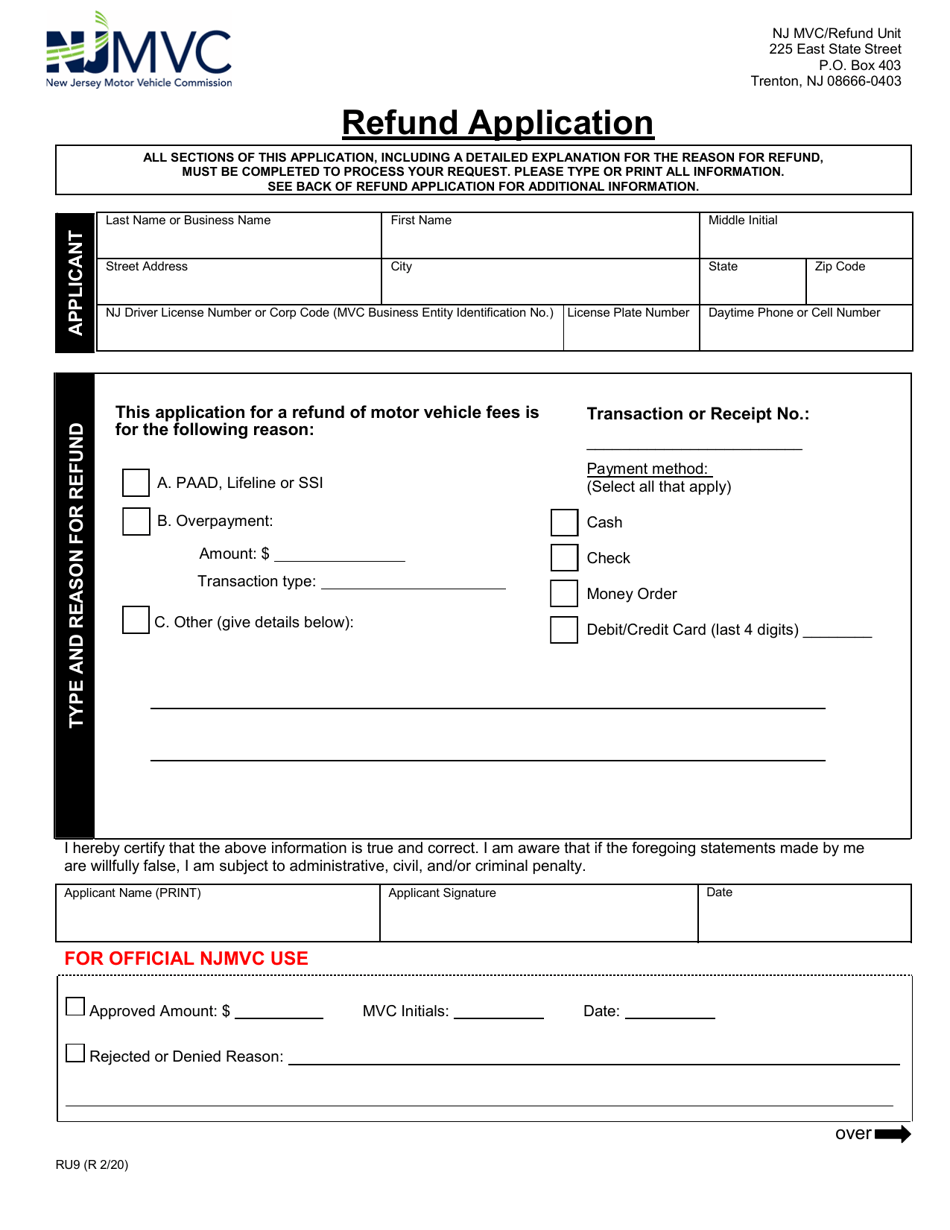

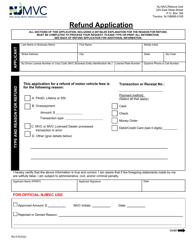

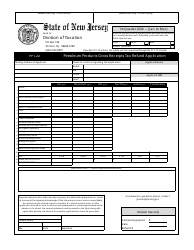

Form RU9 Refund Application - New Jersey

What Is Form RU9?

This is a legal form that was released by the New Jersey Motor Vehicle Commission - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

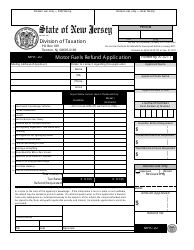

Q: What is an RU9 refund application?

A: An RU9 refund application is a form used to request a refund for overpaid taxes in the state of New Jersey.

Q: What information is required on the RU9 refund application?

A: The RU9 refund application requires information such as your name, Social Security number, tax year for which the refund is being requested, and details of the overpayment.

Q: How long does it take to receive a refund after submitting the RU9 refund application?

A: The processing time for an RU9 refund application can vary, but typically it takes about 4-6 weeks to receive a refund.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the New Jersey Motor Vehicle Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RU9 by clicking the link below or browse more documents and templates provided by the New Jersey Motor Vehicle Commission.