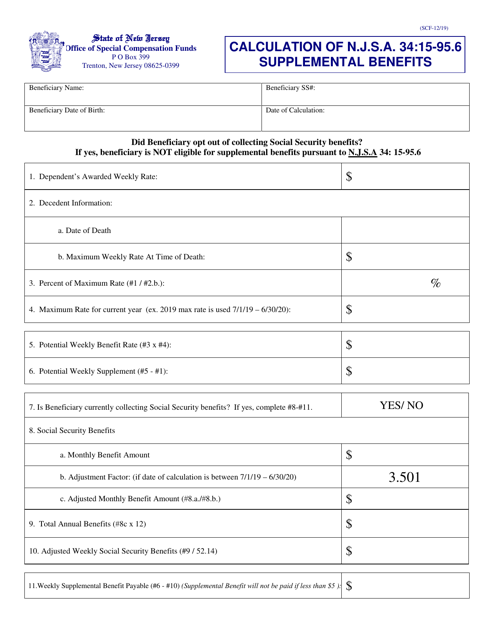

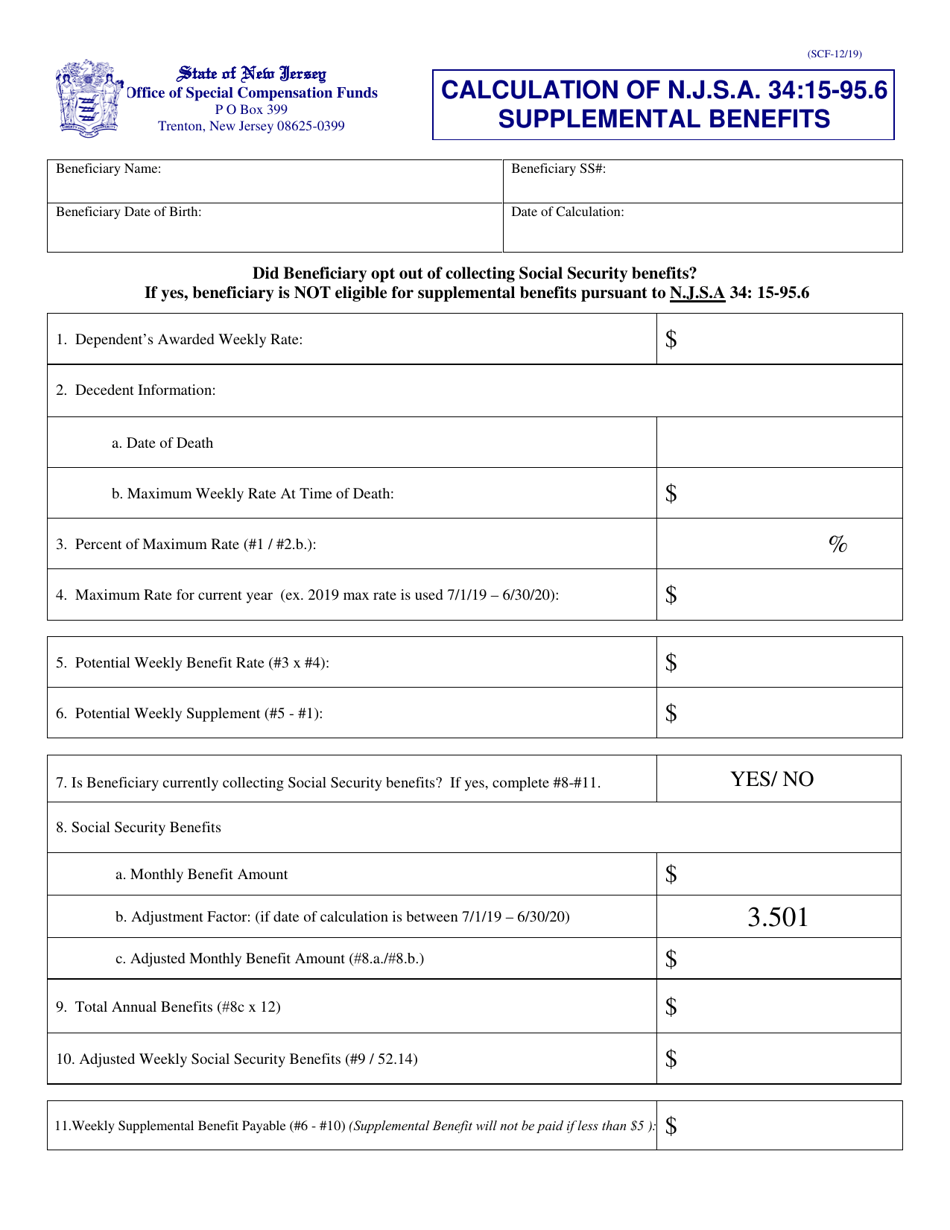

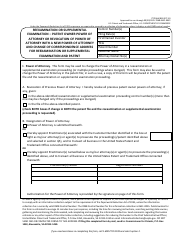

Calculation of N.j.s.a. 34:15-95.6 Supplemental Benefits - New Jersey

Calculation of N.j.s.a. 34:15-95.6 Supplemental Benefits is a legal document that was released by the New Jersey Department of Labor & Workforce Development - a government authority operating within New Jersey.

FAQ

Q: What is N.J.S.A. 34:15-95.6?

A: N.J.S.A. 34:15-95.6 is a New Jersey law that governs supplemental benefits in workers' compensation cases.

Q: What are supplemental benefits?

A: Supplemental benefits are additional payments that injured workers may be entitled to receive.

Q: Who is eligible for supplemental benefits under N.J.S.A. 34:15-95.6?

A: Eligibility for supplemental benefits under N.J.S.A. 34:15-95.6 depends on the severity of the injury and the loss of earning capacity.

Q: How are supplemental benefits calculated?

A: Supplemental benefits are calculated based on a percentage of the injured worker's wage loss.

Q: How long can someone receive supplemental benefits?

A: The duration of supplemental benefits is determined by a formula based on the severity of the injury.

Q: Are supplemental benefits taxable?

A: Supplemental benefits are not subject to federal income tax, but may be subject to state income tax.

Q: What should I do if I believe I am entitled to supplemental benefits?

A: If you believe you are entitled to supplemental benefits, you should consult with an experienced workers' compensation attorney in New Jersey.

Form Details:

- Released on December 1, 2019;

- The latest edition currently provided by the New Jersey Department of Labor & Workforce Development;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of Labor & Workforce Development.