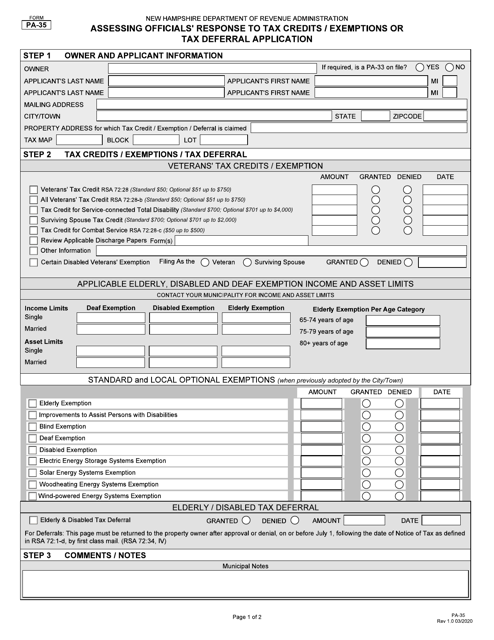

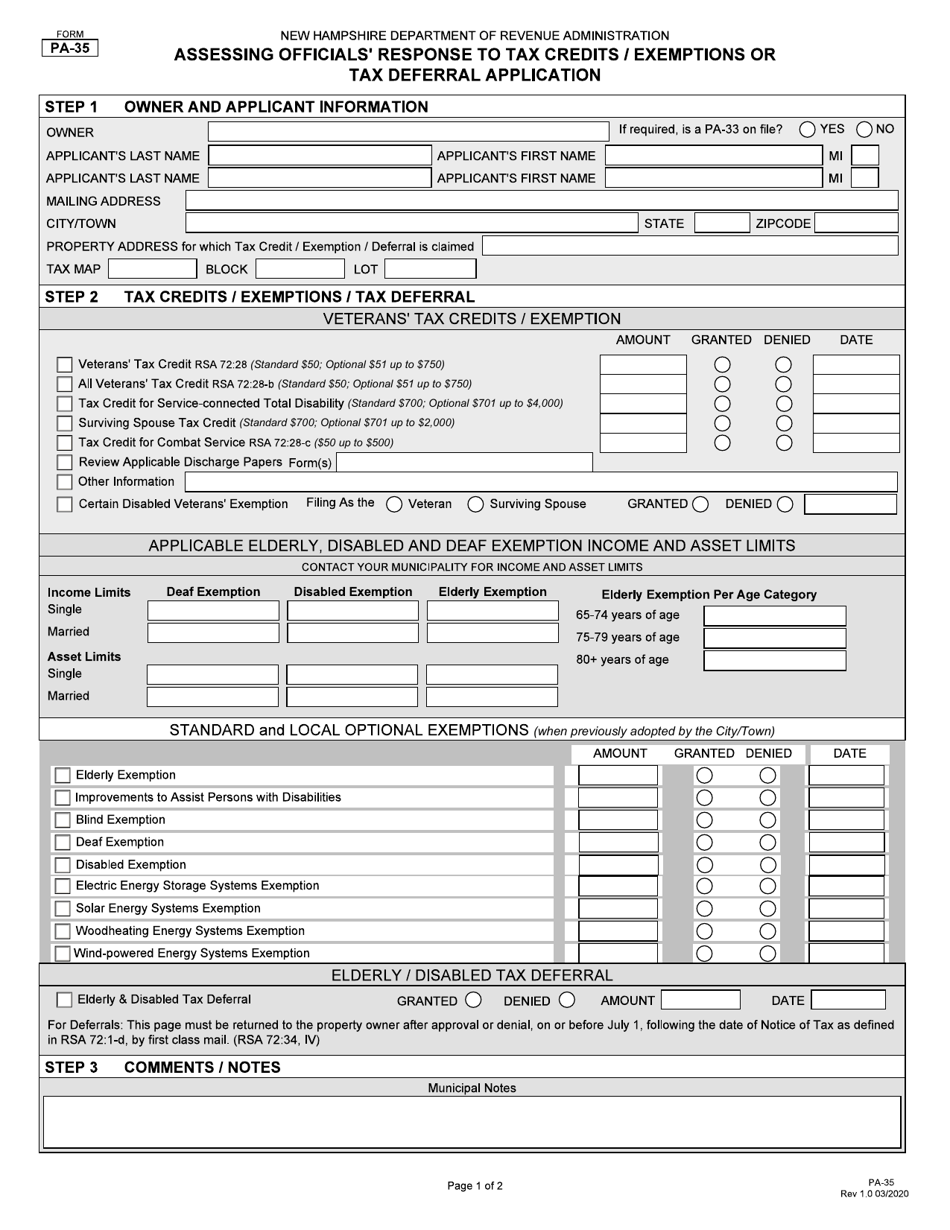

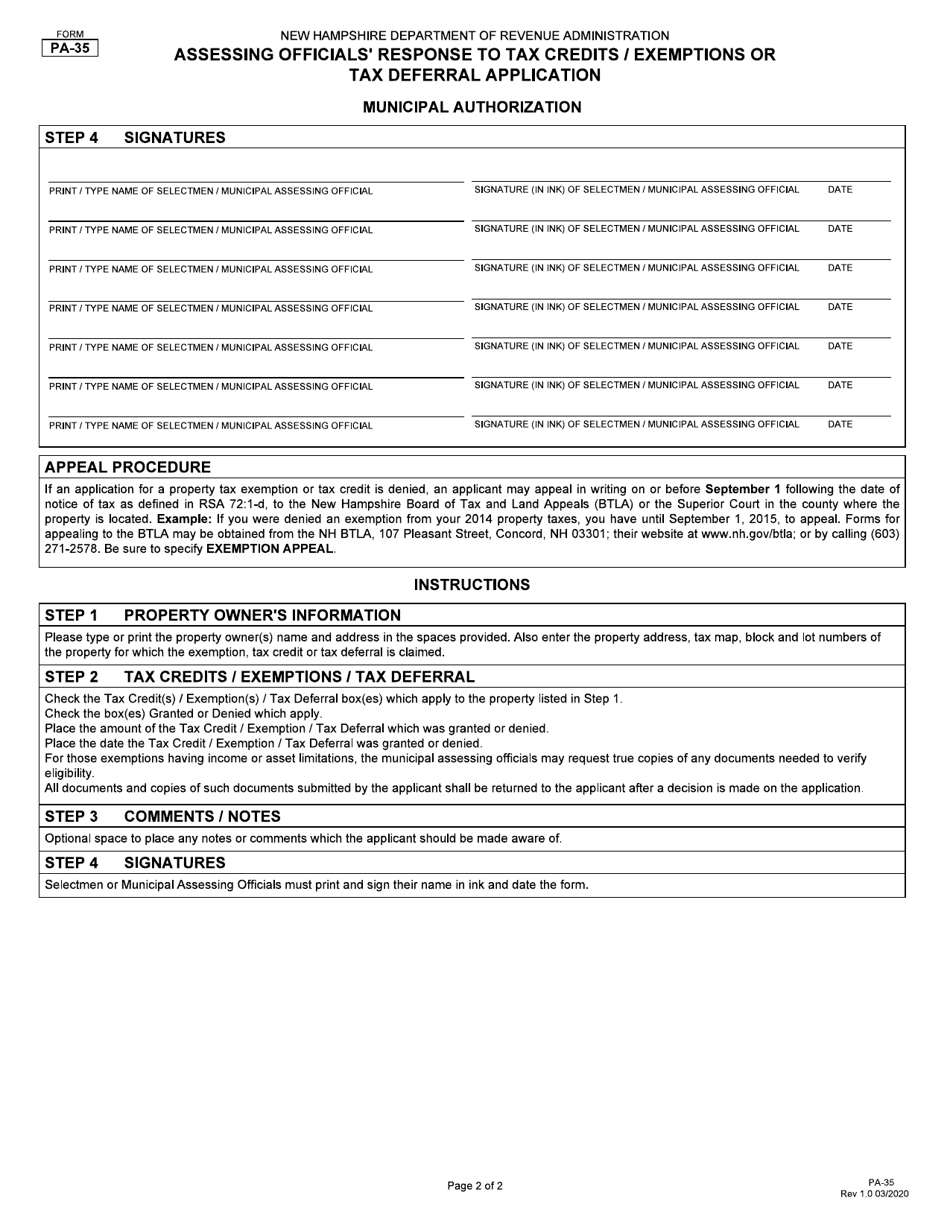

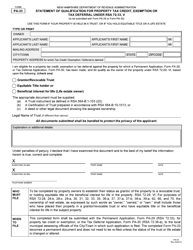

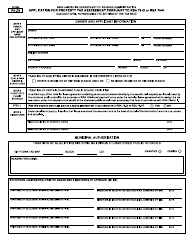

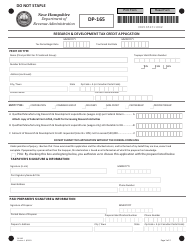

Form PA-35 Assessing Official's Response to Exemptions / Tax Credits / Deferral Application - New Hampshire

What Is Form PA-35?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-35?

A: Form PA-35 is the Assessing Official's Response to Exemptions/Tax Credits/Deferral Application in New Hampshire.

Q: Who needs to fill out Form PA-35?

A: Form PA-35 needs to be filled out by the Assessing Official in response to an application for exemptions, tax credits, or deferral in New Hampshire.

Q: What is the purpose of Form PA-35?

A: The purpose of Form PA-35 is for the Assessing Official to provide a response to an application for exemptions, tax credits, or deferral in New Hampshire.

Q: Is Form PA-35 specific to New Hampshire?

A: Yes, Form PA-35 is specific to New Hampshire.

Q: What information is required on Form PA-35?

A: Form PA-35 requires information regarding the application for exemptions, tax credits, or deferral, as well as the assessing official's response.

Q: Is there a deadline for submitting Form PA-35?

A: Yes, the assessing official should provide a response within a certain timeframe, as specified by the New Hampshire Department of Revenue Administration.

Q: What should I do if I have questions about Form PA-35?

A: If you have questions about Form PA-35, you should contact the New Hampshire Department of Revenue Administration for assistance.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-35 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.