This version of the form is not currently in use and is provided for reference only. Download this version of

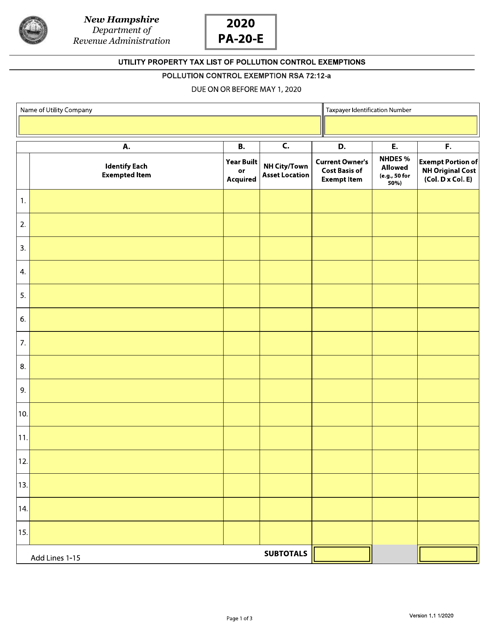

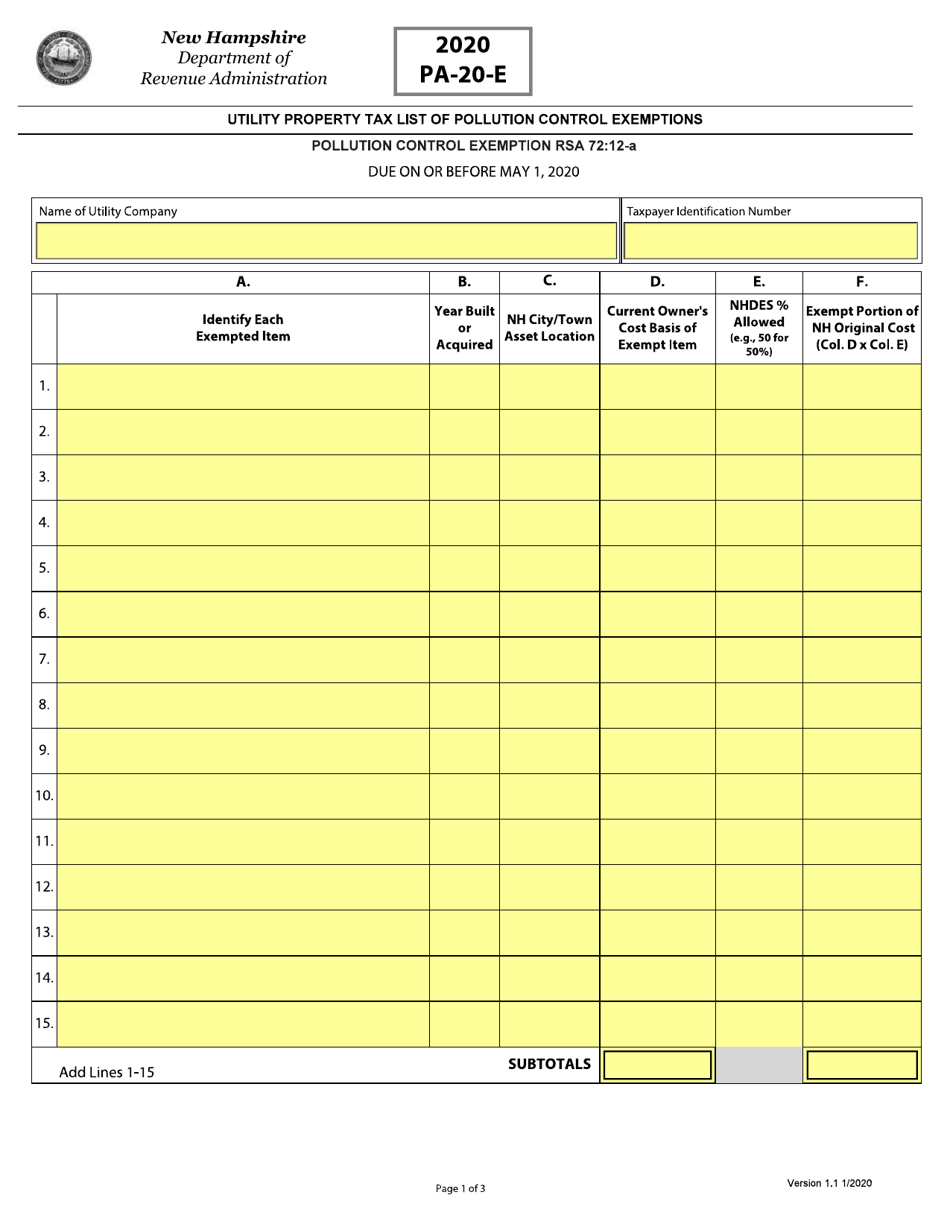

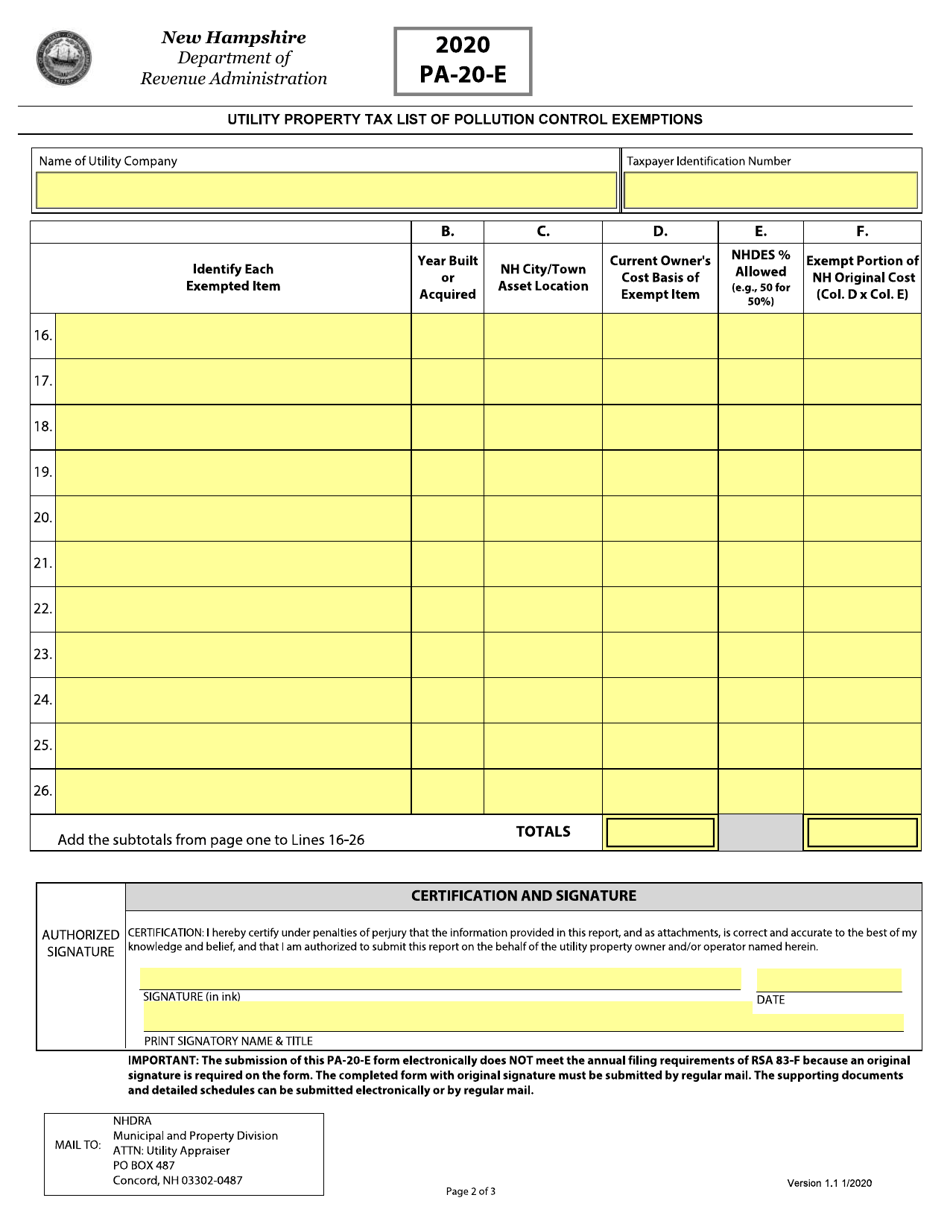

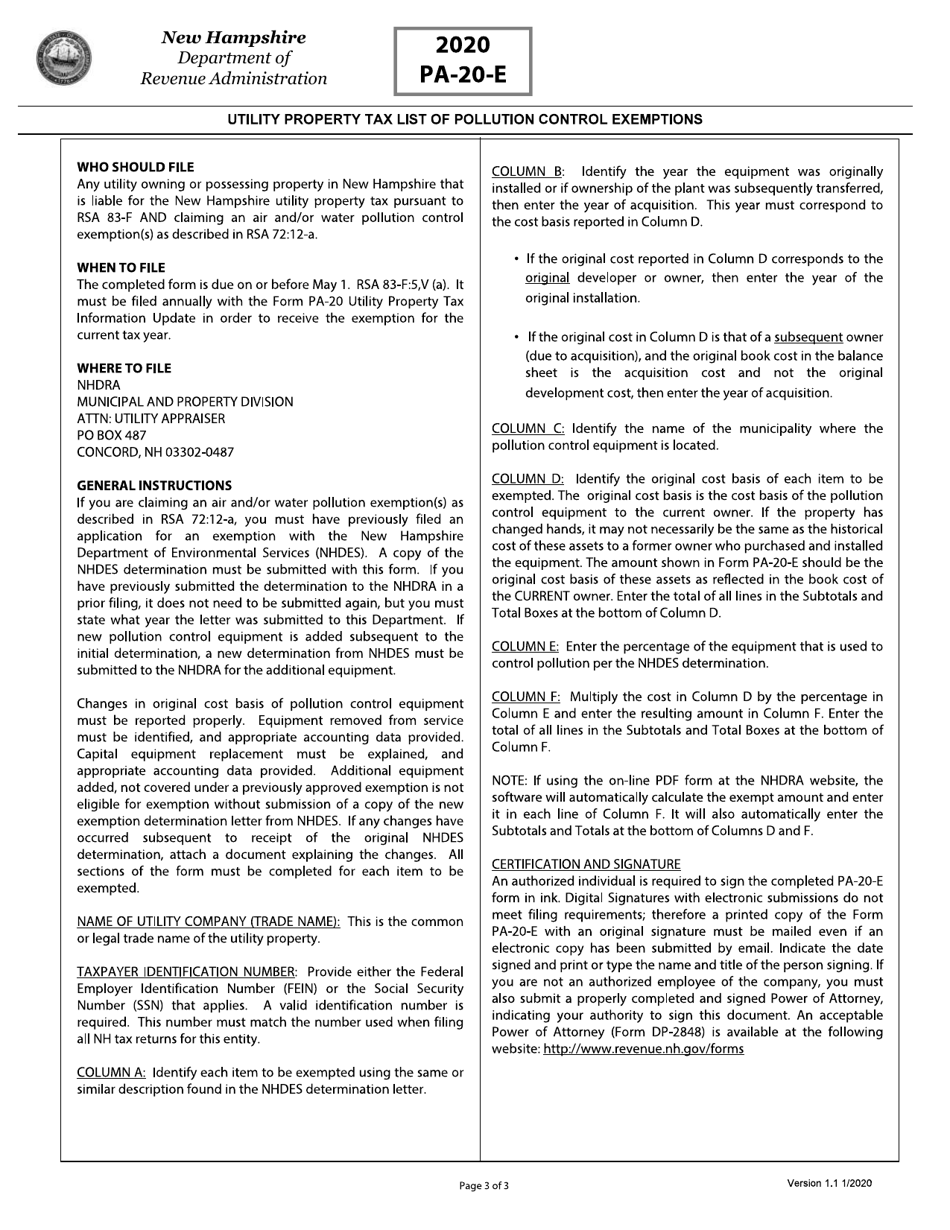

Form PA-20-E

for the current year.

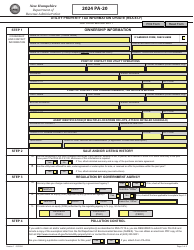

Form PA-20-E Utility Property Tax List of Pollution Control Exemption - New Hampshire

What Is Form PA-20-E?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

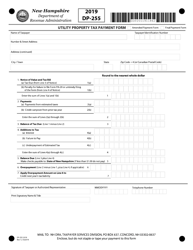

Q: What is the PA-20-E Utility Property Tax List of Pollution Control Exemption in New Hampshire?

A: The PA-20-E is a form used to apply for a property tax exemption for pollution control equipment owned by utilities in New Hampshire.

Q: Who is eligible for the pollution control exemption in New Hampshire?

A: Utilities that own and operate pollution control equipment to reduce or eliminate pollutants are eligible for this exemption.

Q: What types of pollution control equipment are eligible for the exemption?

A: Equipment such as air pollutioncontrol devices, water treatment systems, and solid waste management facilities may be eligible for the exemption.

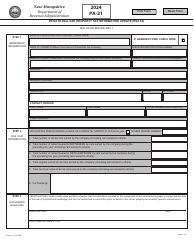

Q: How can I apply for the PA-20-E exemption in New Hampshire?

A: To apply for the exemption, you need to complete and submit the PA-20-E form to the New Hampshire Department of Revenue Administration.

Q: Are there any deadlines for applying for the pollution control exemption?

A: The PA-20-E form must be filed annually by April 15th.

Q: What are the benefits of the pollution control exemption?

A: If approved, the exemption can reduce or eliminate the property taxes on pollution control equipment owned by utilities.

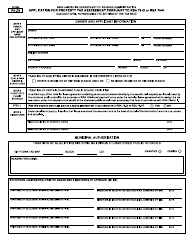

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20-E by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.