This version of the form is not currently in use and is provided for reference only. Download this version of

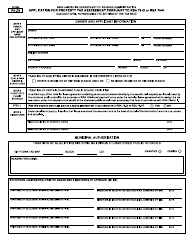

Form PA-21

for the current year.

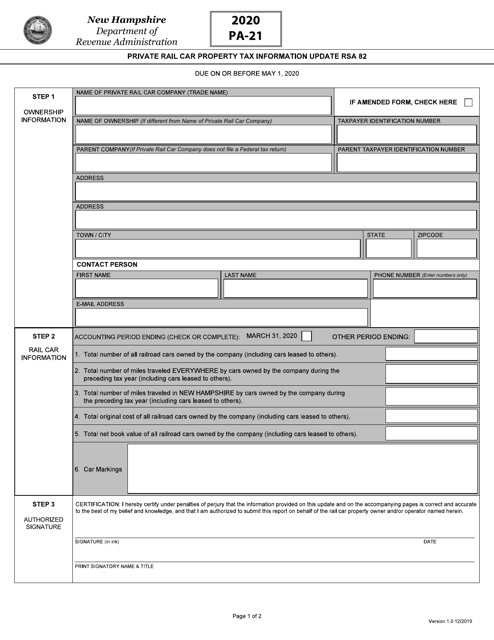

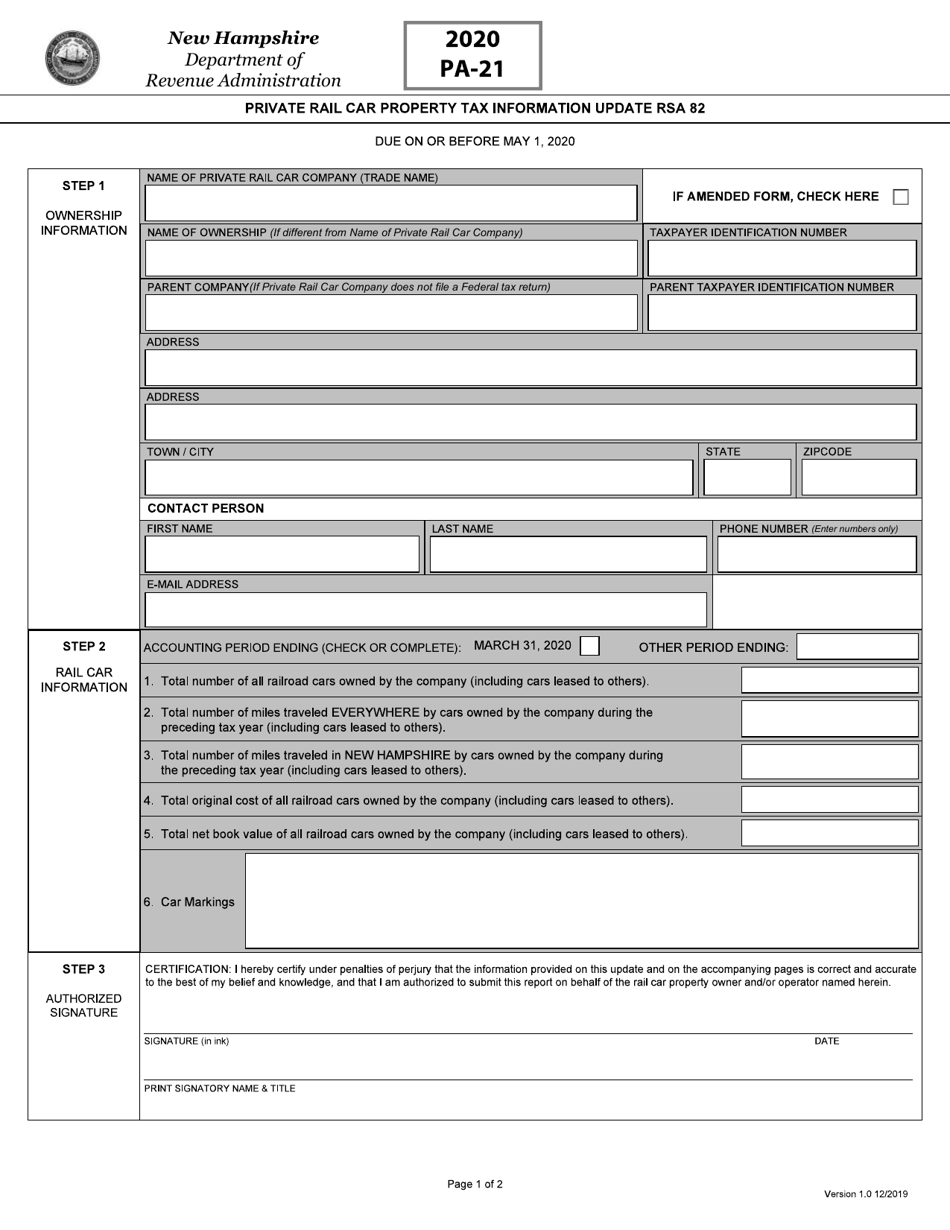

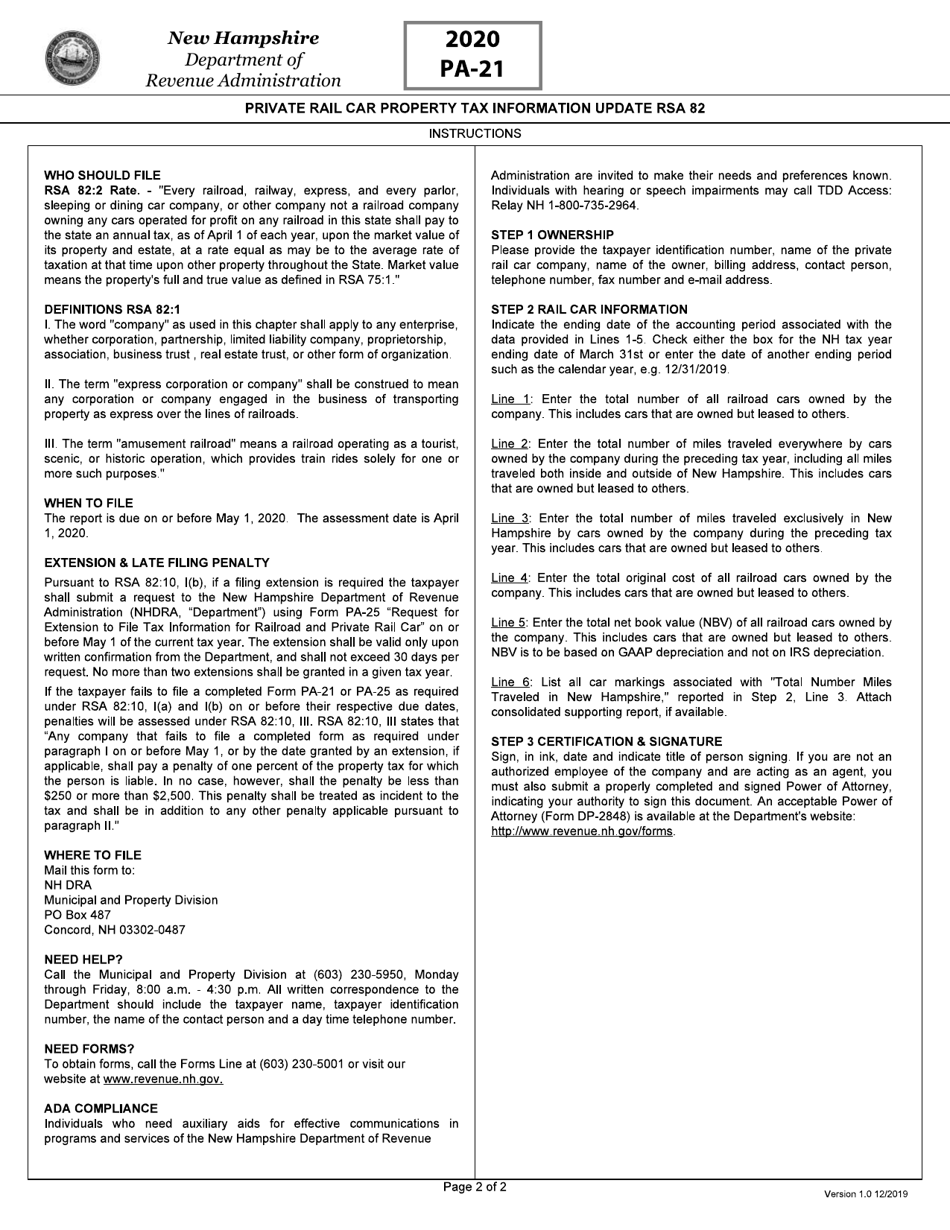

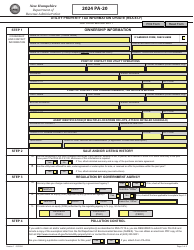

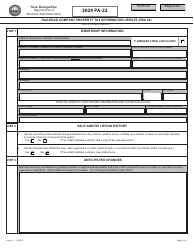

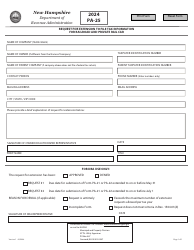

Form PA-21 Private Railcar Property Private Railcar Property Tax Information Update - New Hampshire

What Is Form PA-21?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-21?

A: Form PA-21 is the Private Railcar Property Tax Information Update form.

Q: What is Private Railcar Property?

A: Private Railcar Property refers to any railcar that is owned or leased by a private individual or entity.

Q: Who needs to file Form PA-21?

A: Owners or lessees of private railcars in New Hampshire need to file Form PA-21.

Q: What is the purpose of filing Form PA-21?

A: The purpose of filing Form PA-21 is to provide updated information about private railcar property for tax assessment purposes.

Q: When is Form PA-21 due?

A: Form PA-21 is due by April 15th of each year.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing of Form PA-21. Late filing may result in a daily penalty.

Q: Are there any exemptions for private railcar property?

A: Yes, there are certain exemptions available for private railcar property. You should consult the New Hampshire Department of Revenue Administration for more information.

Q: What should I do if I have sold or disposed of my private railcar?

A: If you have sold or disposed of your private railcar, you should notify the New Hampshire Department of Revenue Administration in writing.

Q: Is there an alternative to filing Form PA-21?

A: No, there is no alternative form for reporting private railcar property in New Hampshire. Form PA-21 is the required form.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-21 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.