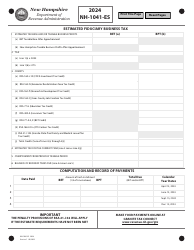

This version of the form is not currently in use and is provided for reference only. Download this version of

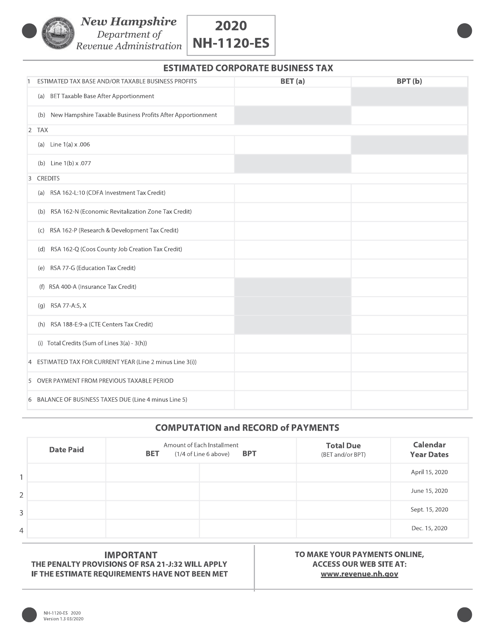

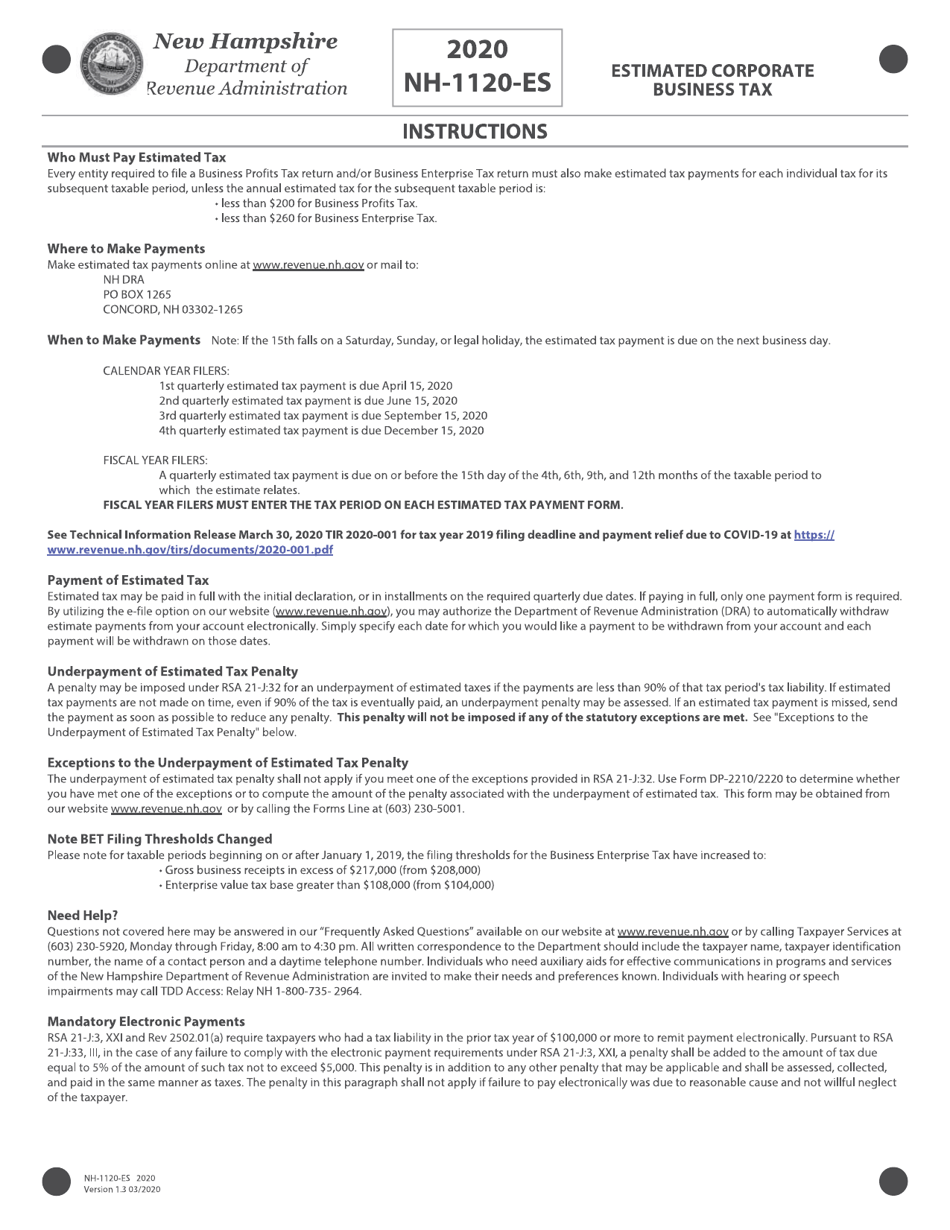

Form NH-1120-ES

for the current year.

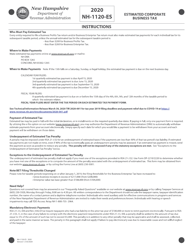

Form NH-1120-ES Corporate Business Profits Tax Estimates - New Hampshire

What Is Form NH-1120-ES?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NH-1120-ES?

A: Form NH-1120-ES is a tax form used for corporate business profits tax estimates in New Hampshire.

Q: Who needs to file Form NH-1120-ES?

A: Corporations in New Hampshire that are required to make estimated tax payments for their business profits tax.

Q: Why do corporations need to file Form NH-1120-ES?

A: Corporations need to file Form NH-1120-ES to ensure they are making accurate and timely estimated tax payments for their business profits tax.

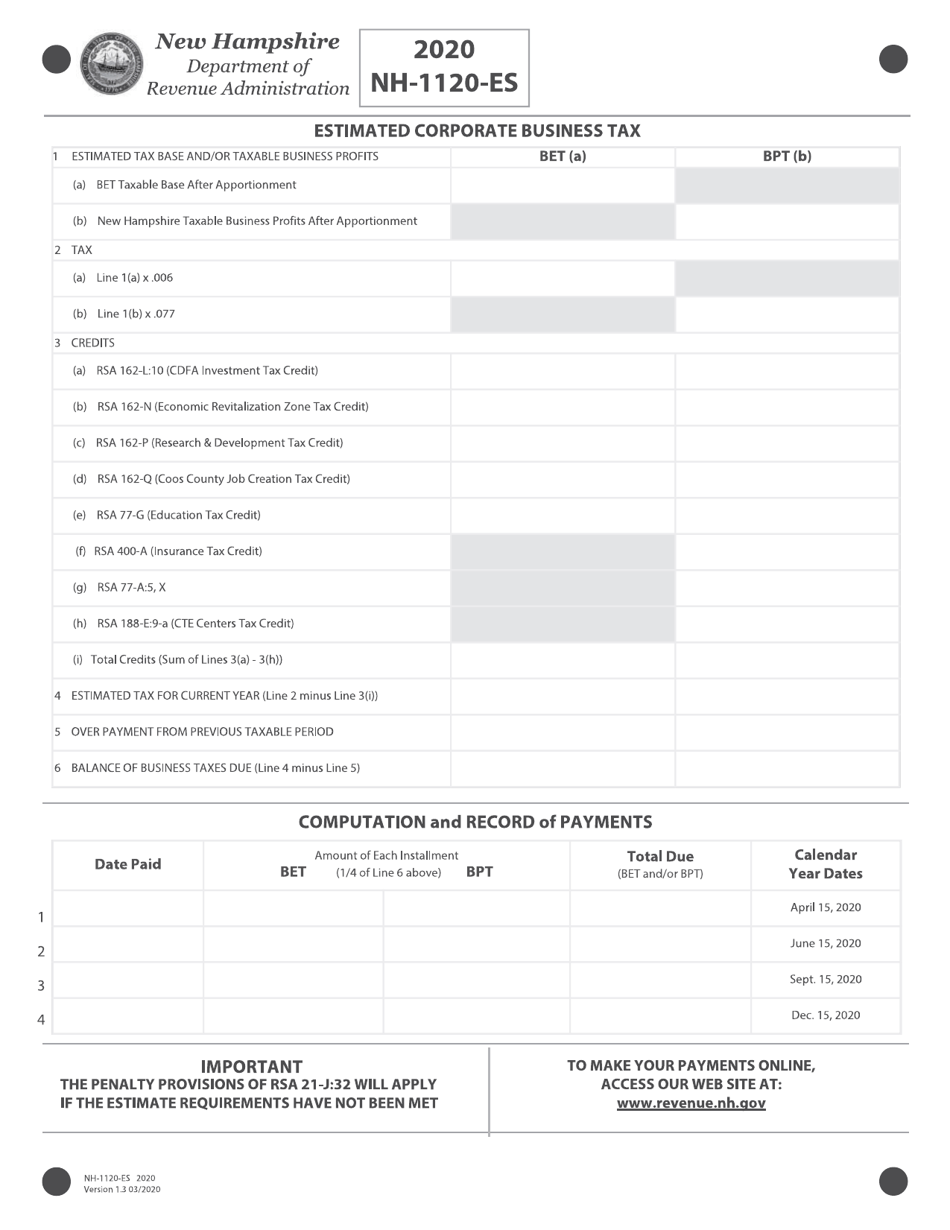

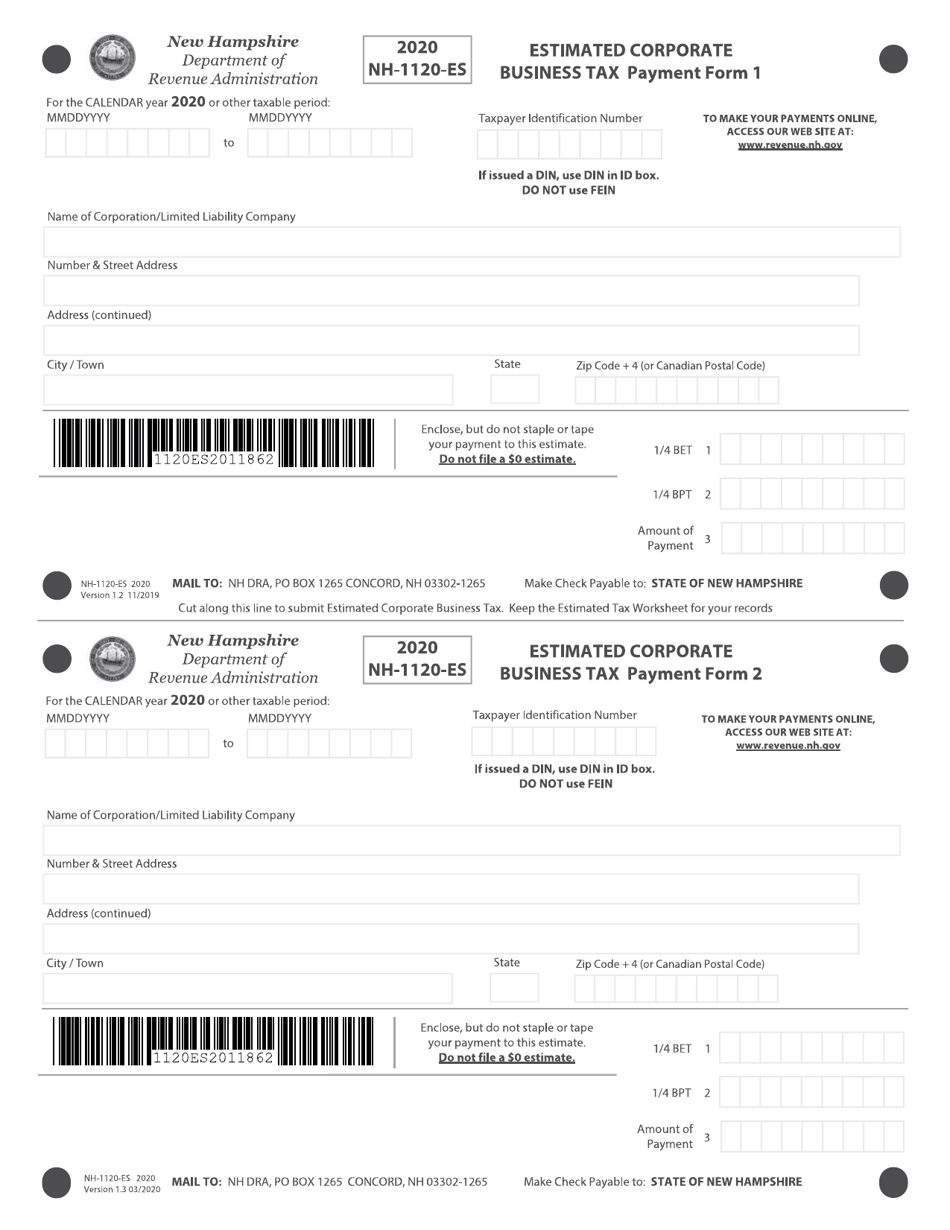

Q: What information is required on Form NH-1120-ES?

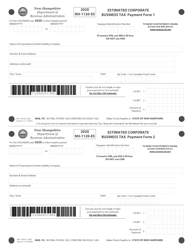

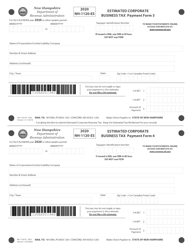

A: Form NH-1120-ES requires information such as the corporation's name, address, federal employer identification number (FEIN), estimated tax liability, and payment details.

Q: When is Form NH-1120-ES due?

A: Form NH-1120-ES is due on or before the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1120-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.