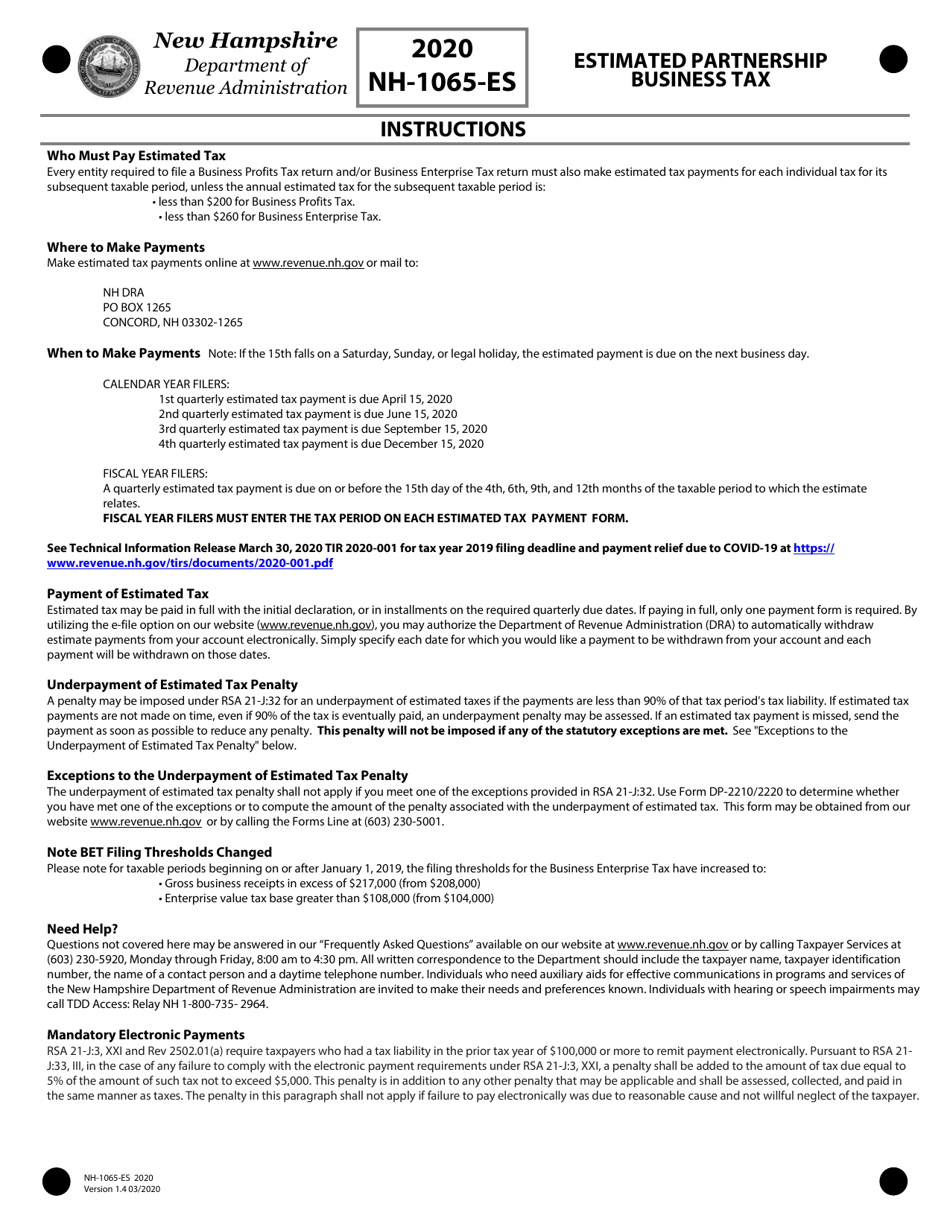

This version of the form is not currently in use and is provided for reference only. Download this version of

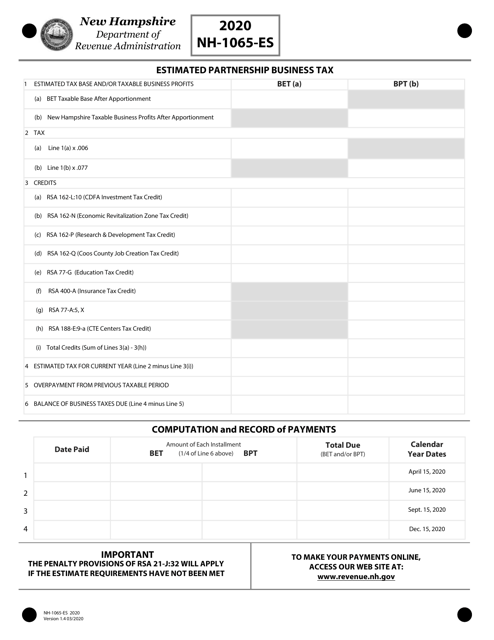

Form NH-1065-ES

for the current year.

Form NH-1065-ES Estimated Partnership Business Tax - New Hampshire

What Is Form NH-1065-ES?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

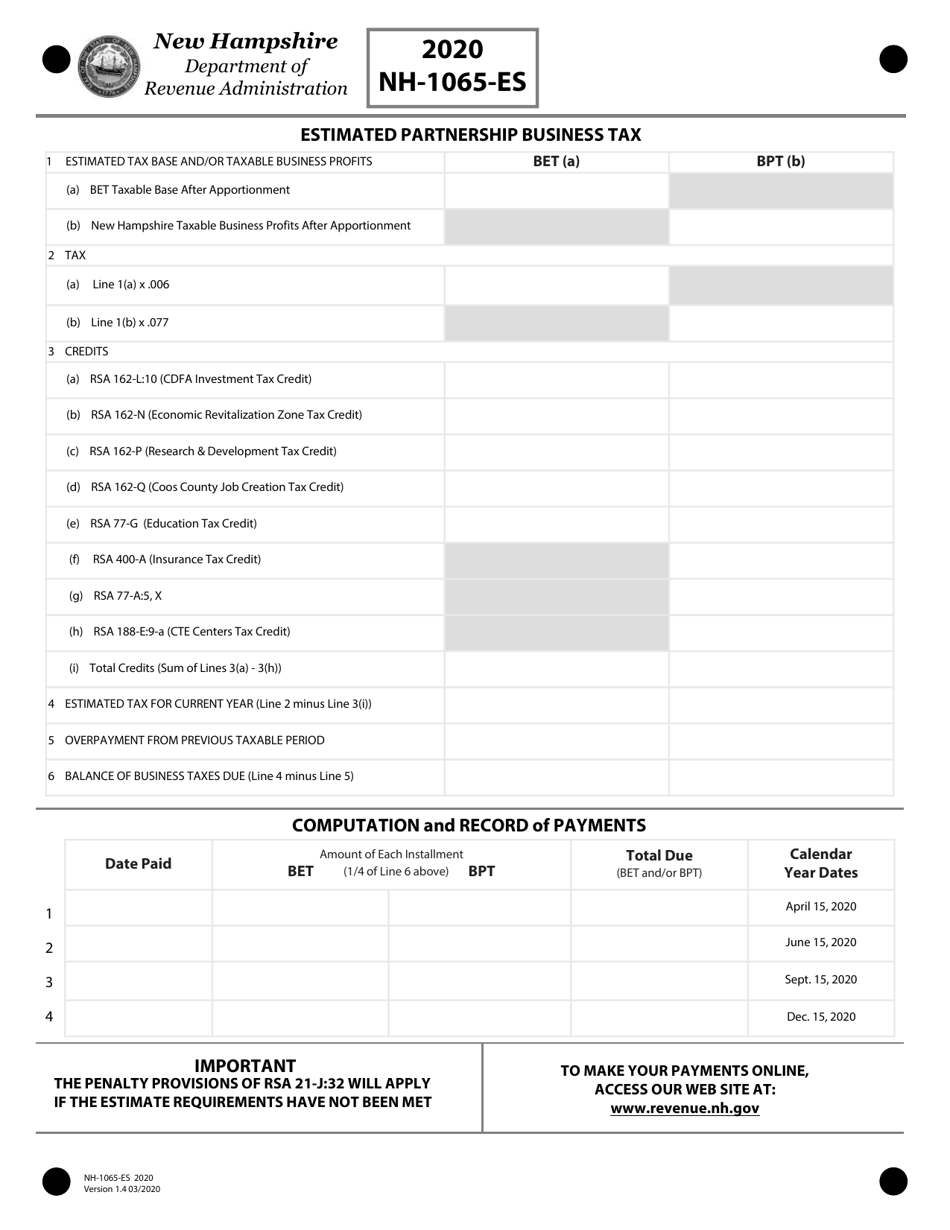

Q: What is NH-1065-ES?

A: NH-1065-ES is a form used to pay estimated partnership business tax in New Hampshire.

Q: Who needs to file NH-1065-ES?

A: Partnership businesses in New Hampshire need to file NH-1065-ES if they are required to make estimated tax payments.

Q: What is partnership business tax?

A: Partnership business tax is a tax imposed on the income of partnership businesses in New Hampshire.

Q: What are estimated tax payments?

A: Estimated tax payments are required periodic payments made by businesses to cover their income tax liability.

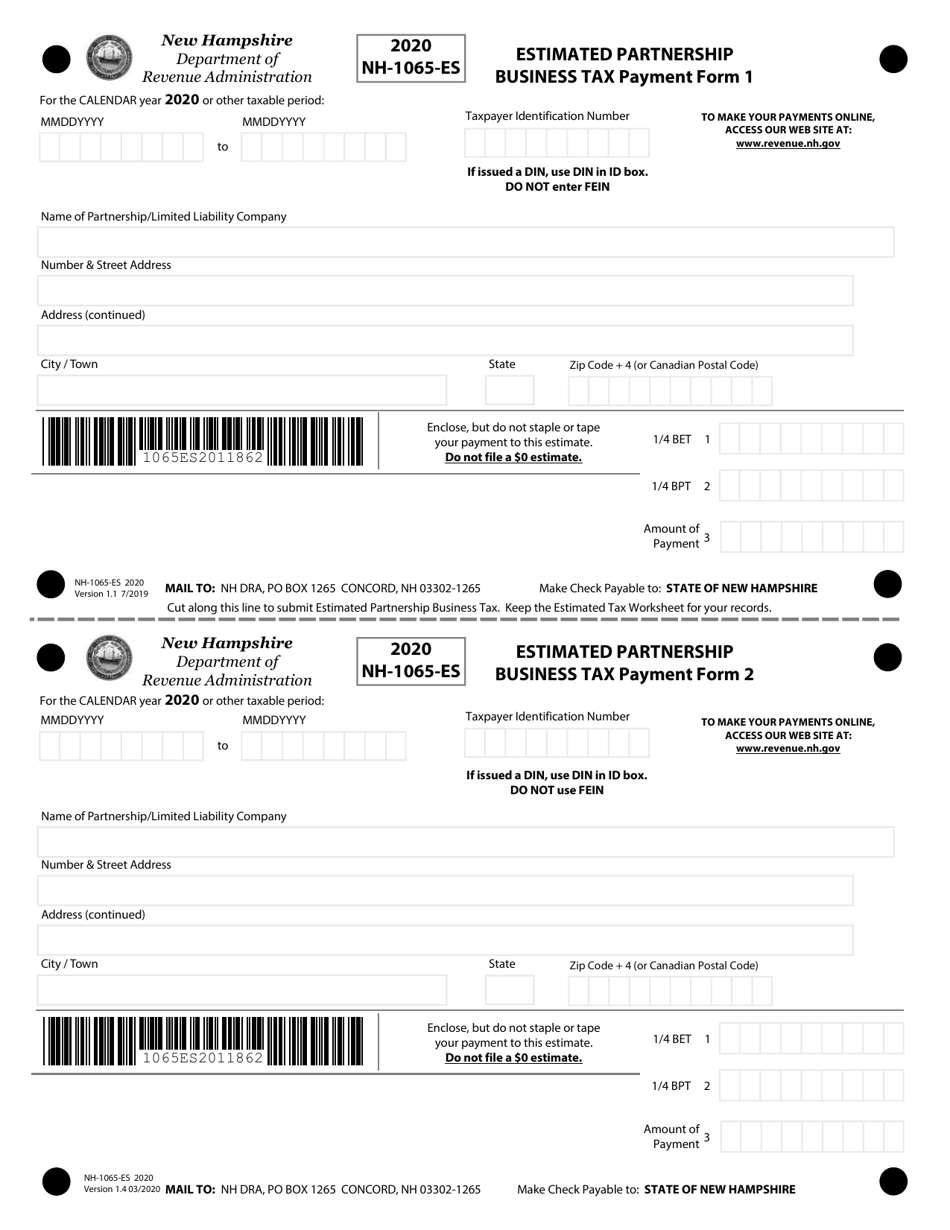

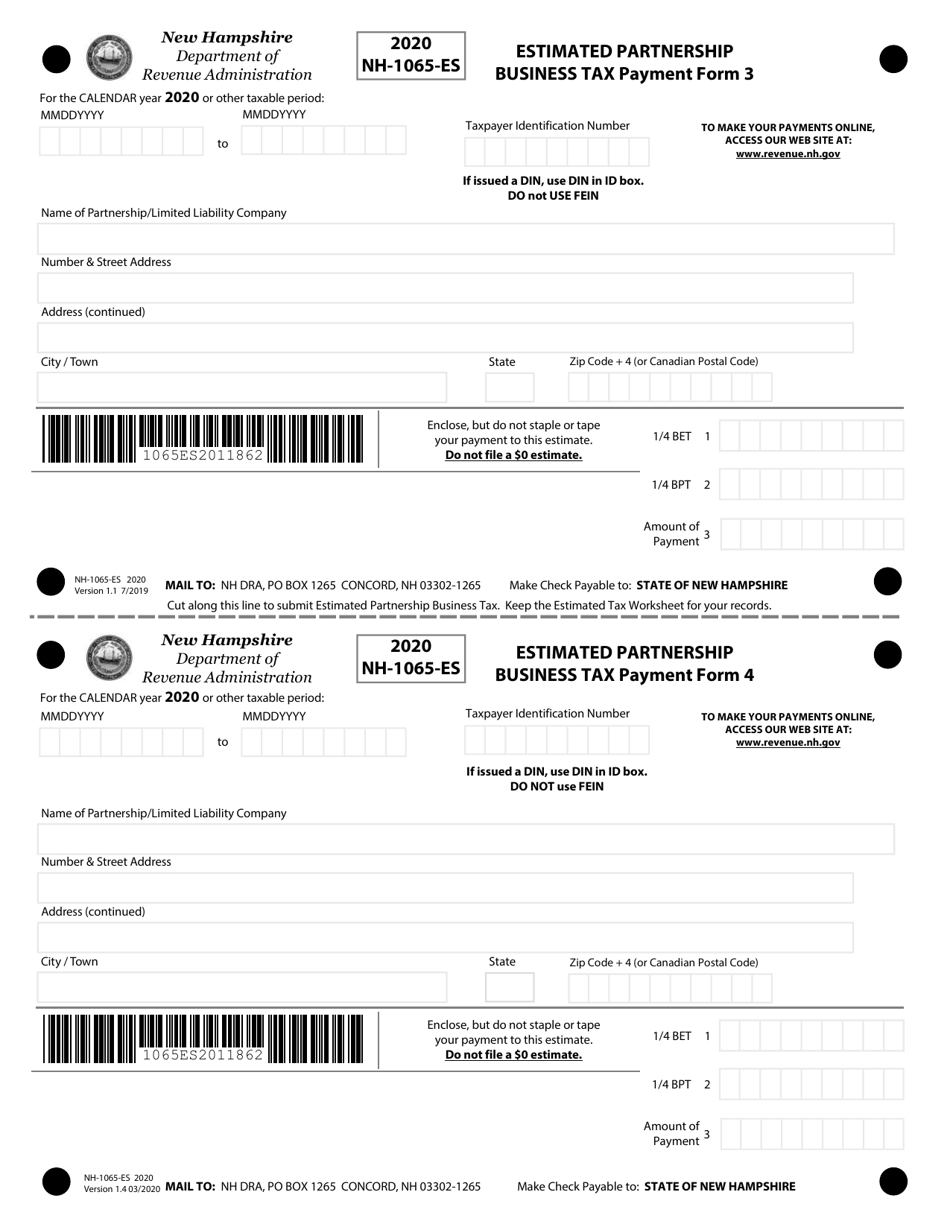

Q: How often do partnership businesses need to make estimated tax payments?

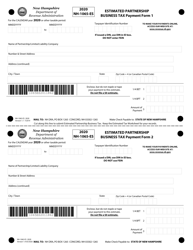

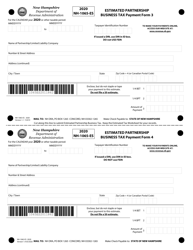

A: Partnership businesses in New Hampshire are required to make estimated tax payments quarterly.

Q: When is the deadline for filing NH-1065-ES?

A: The deadline for filing NH-1065-ES varies depending on the tax year. It is generally due on the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

Q: Are there any penalties for not filing NH-1065-ES?

A: Yes, there are penalties for not filing NH-1065-ES or for underpayment of estimated tax. It is important to ensure timely and accurate filing to avoid penalties.

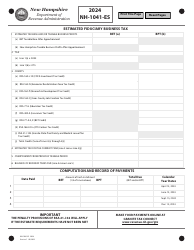

Q: What information do I need to provide on NH-1065-ES?

A: On NH-1065-ES form, you will need to provide your partnership's name, federal employer identification number (EIN), address, estimated tax amount, and other relevant information.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1065-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.