This version of the form is not currently in use and is provided for reference only. Download this version of

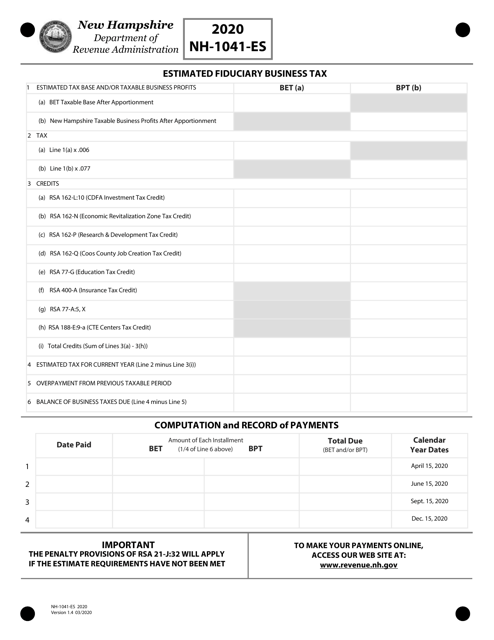

Form NH-1041-ES

for the current year.

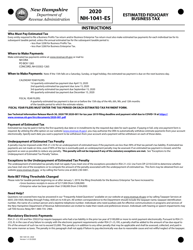

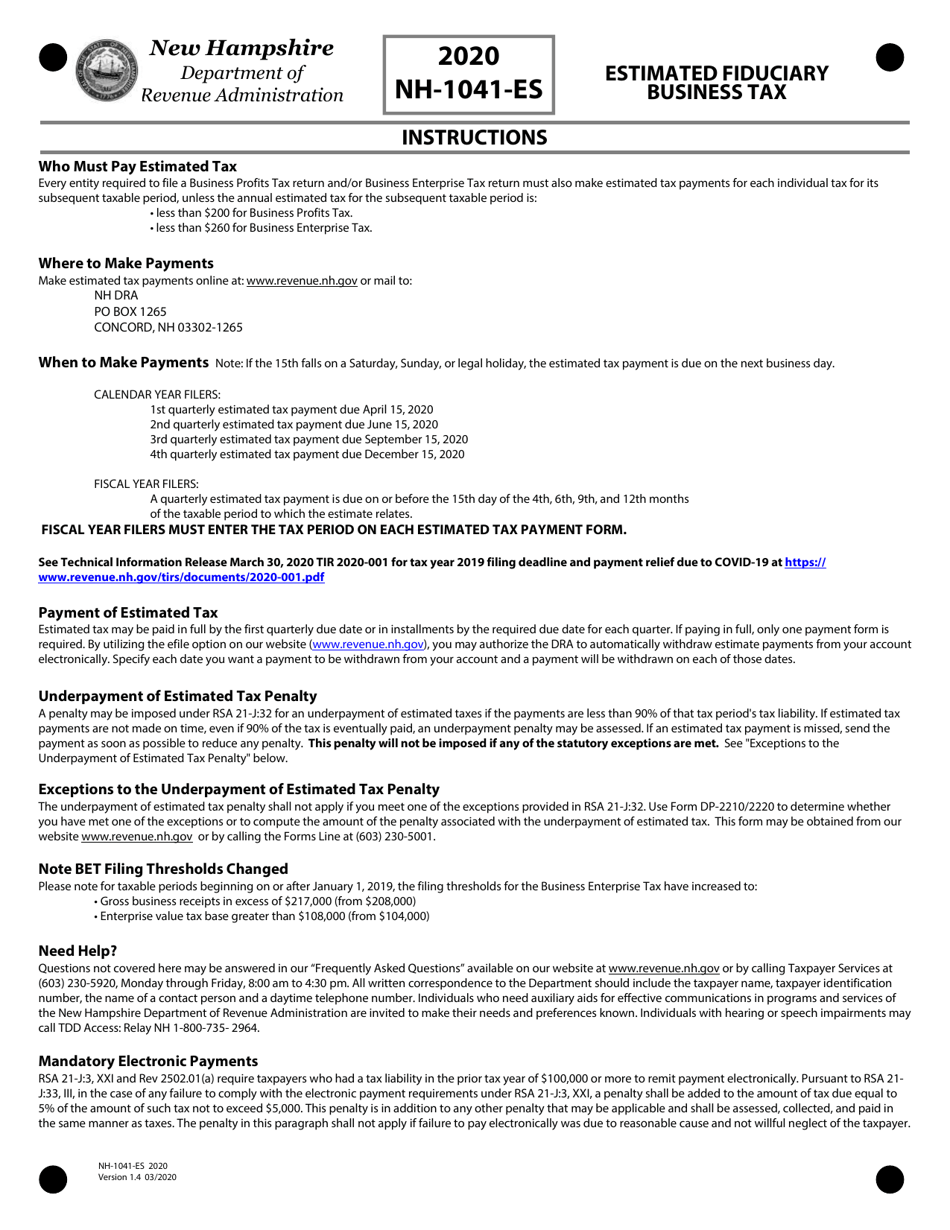

Form NH-1041-ES Estimated Fiduciary Business Tax - New Hampshire

What Is Form NH-1041-ES?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NH-1041-ES?

A: NH-1041-ES is a form used to make estimated tax payments for fiduciary business tax in New Hampshire.

Q: Who needs to file NH-1041-ES?

A: Fiduciaries who are engaged in a business in New Hampshire and have estimated tax liability are required to file NH-1041-ES.

Q: What is fiduciary business tax?

A: Fiduciary business tax is a tax imposed on the income derived from a business or trade conducted by a fiduciary in New Hampshire.

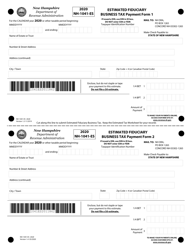

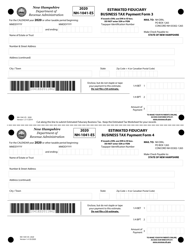

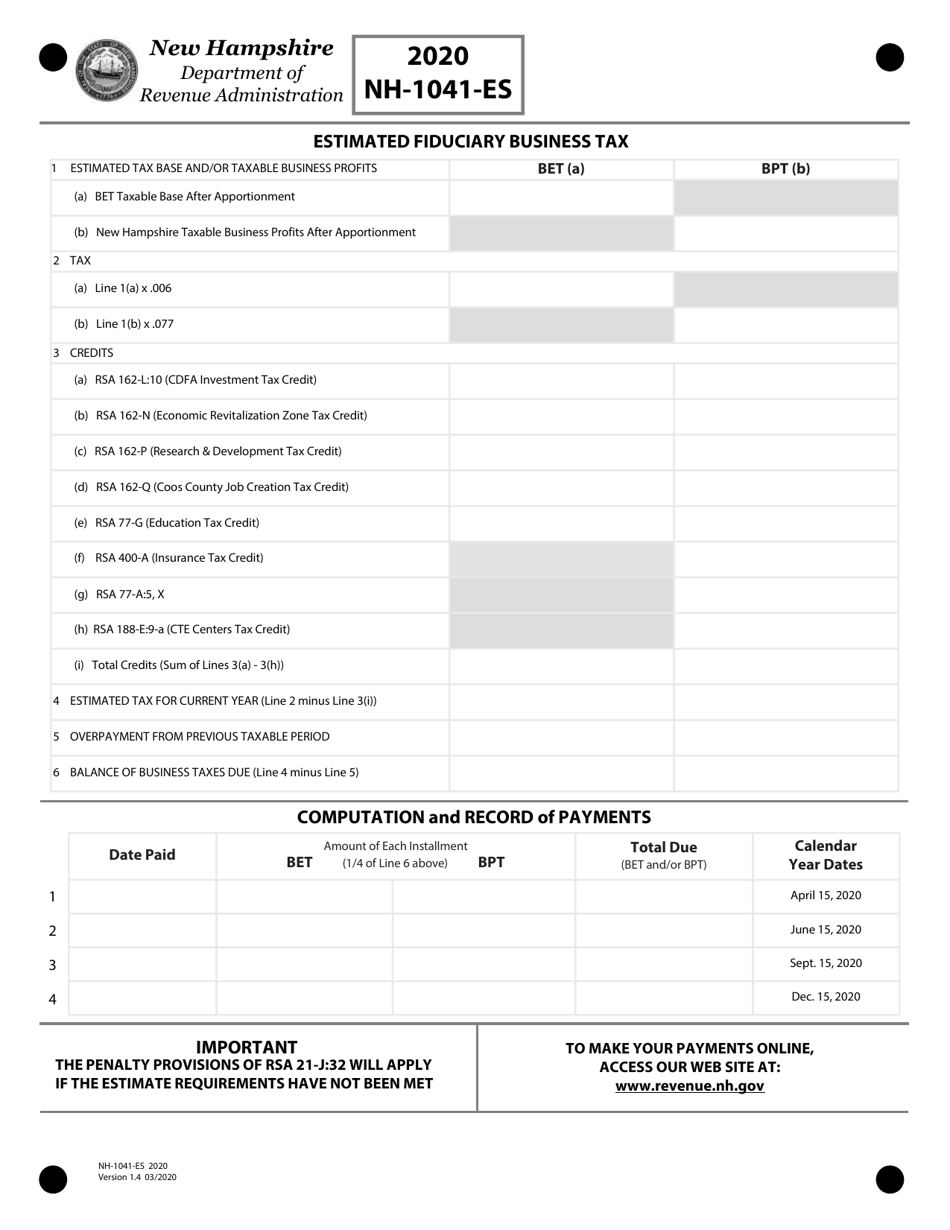

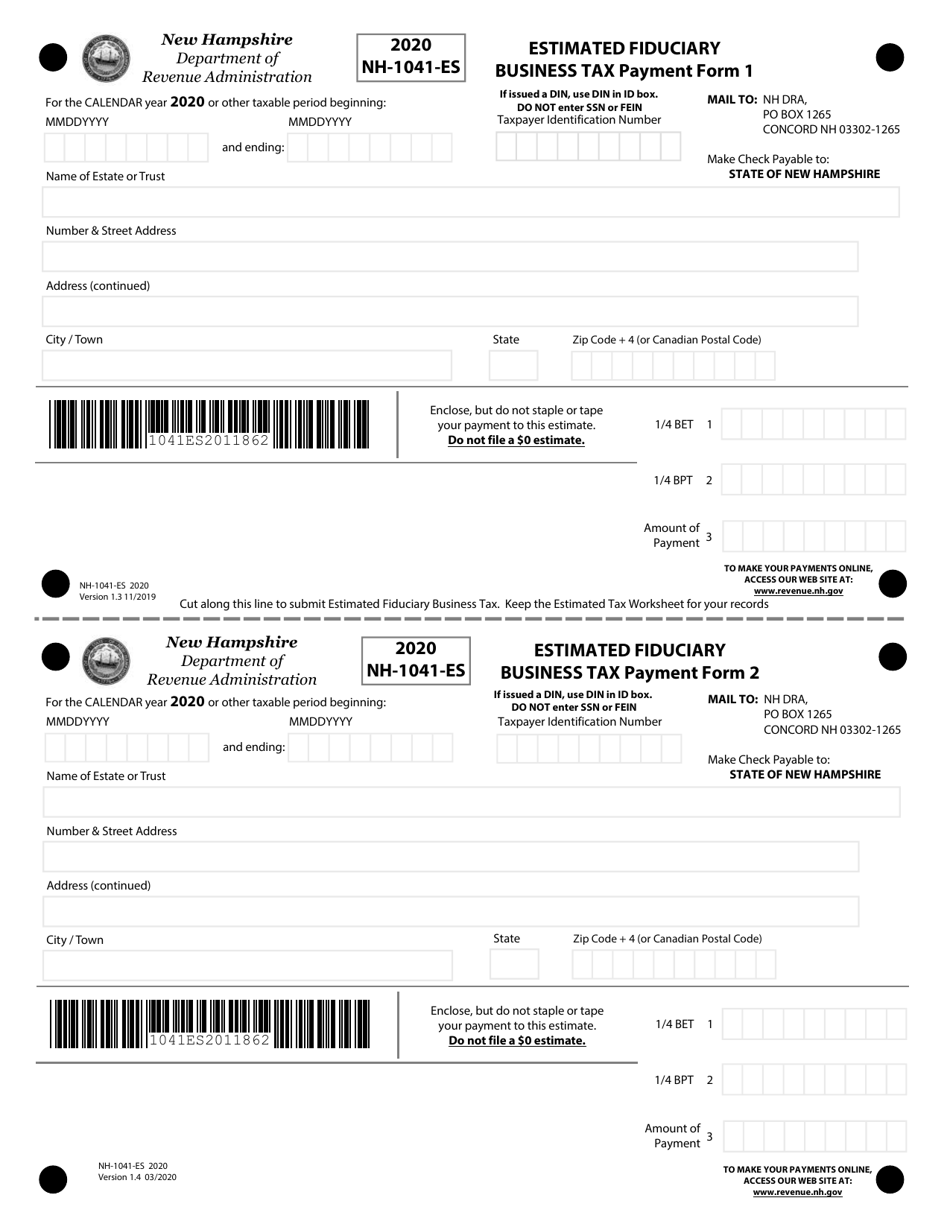

Q: When is NH-1041-ES due?

A: NH-1041-ES is due on a quarterly basis. The due dates are April 15th, June 15th, September 15th, and December 15th.

Q: How do I fill out NH-1041-ES?

A: You will need to provide your personal information, estimate your tax liability, and make a payment with the form.

Q: What happens if I don't file NH-1041-ES?

A: If you don't file NH-1041-ES or underpay your estimated taxes, you may be subject to penalties and interest.

Q: Can I amend NH-1041-ES?

A: Yes, if you made an error on your NH-1041-ES, you can file an amended form to correct the mistake.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1041-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.