This version of the form is not currently in use and is provided for reference only. Download this version of

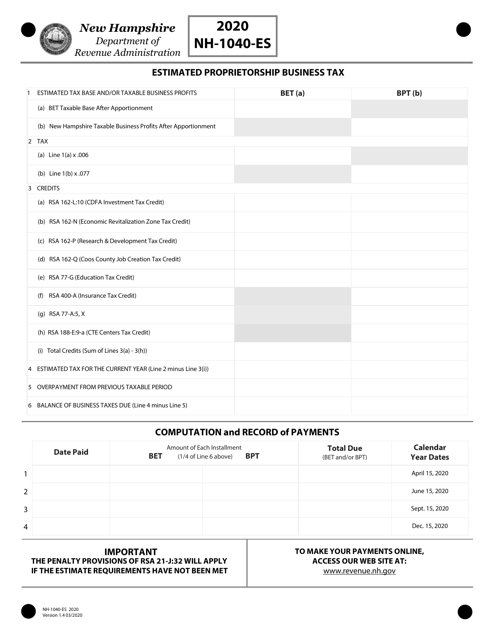

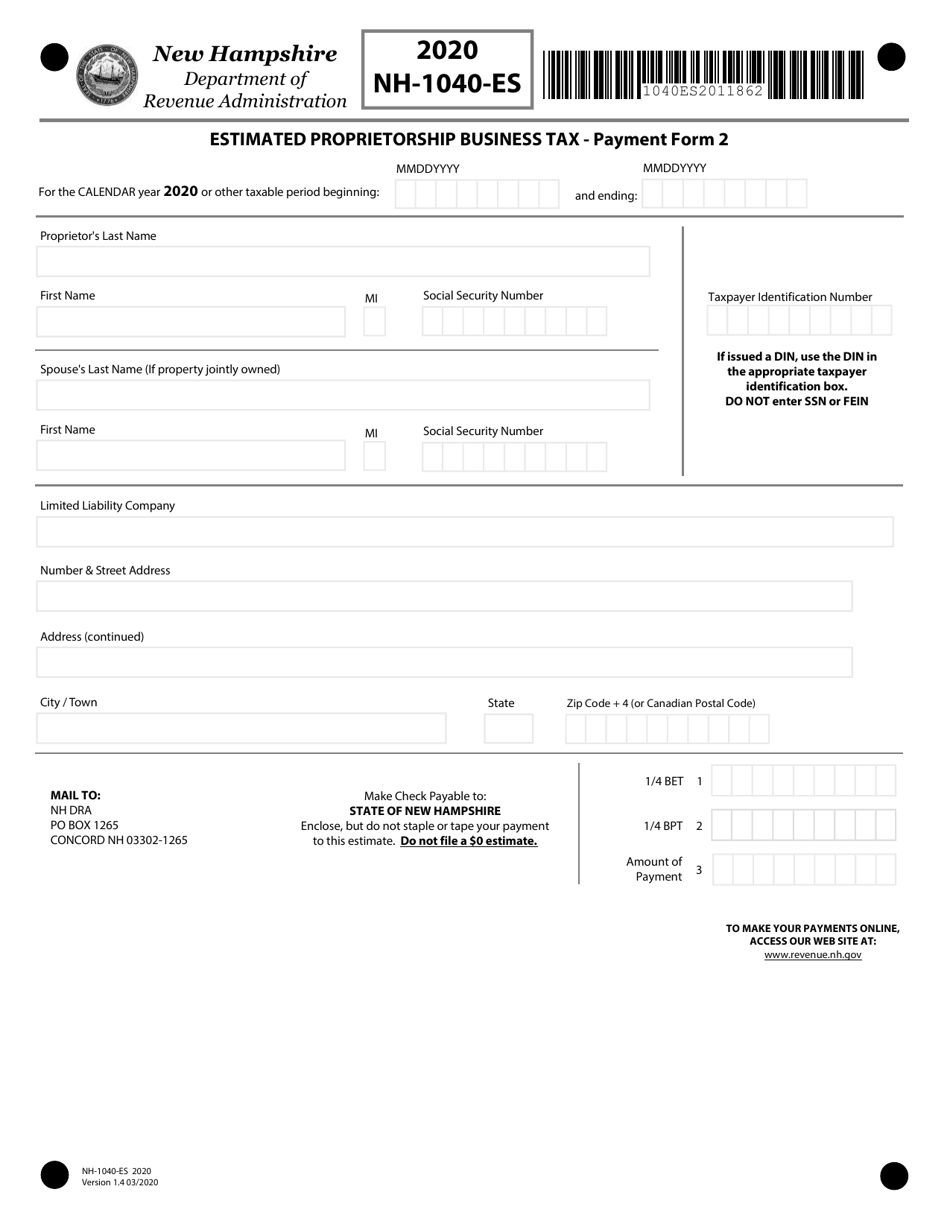

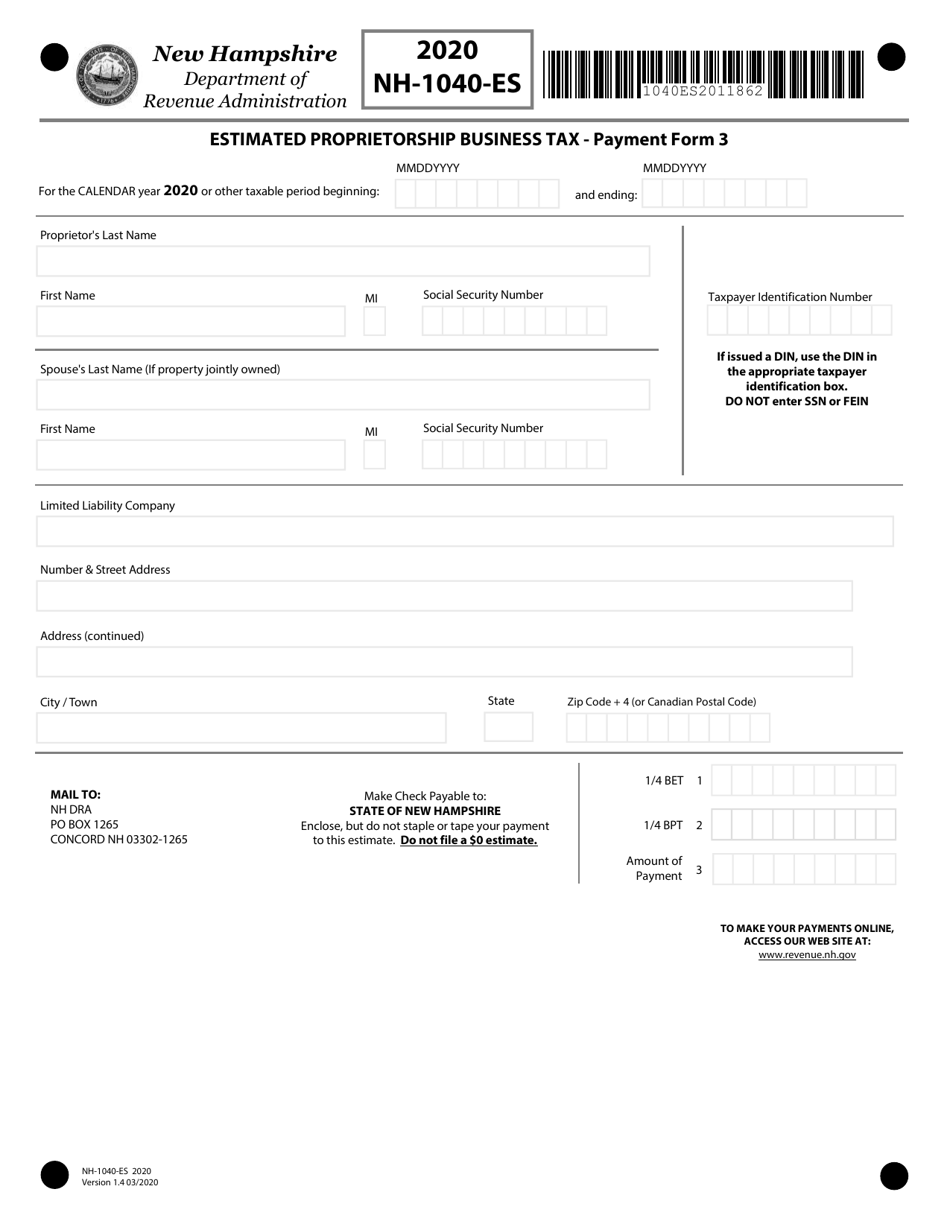

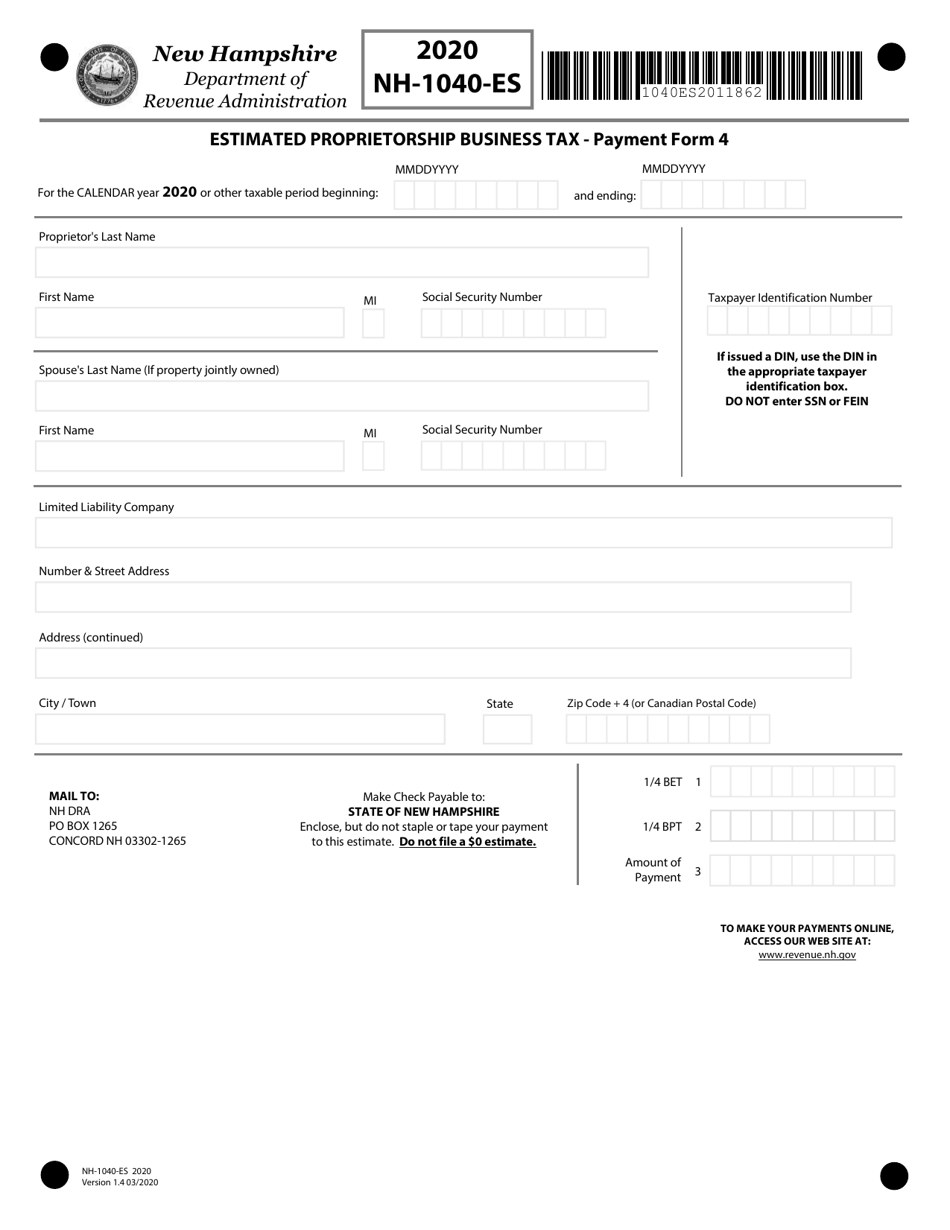

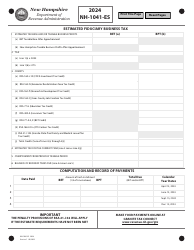

Form NH-1040-ES

for the current year.

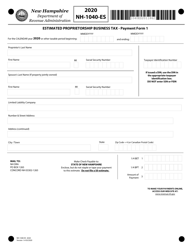

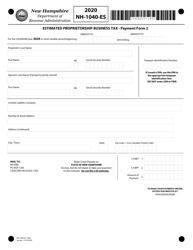

Form NH-1040-ES Estimated Proprietorship Business Tax - New Hampshire

What Is Form NH-1040-ES?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NH-1040-ES?

A: Form NH-1040-ES is the estimated tax voucher for proprietors doing business in New Hampshire.

Q: What is the purpose of Form NH-1040-ES?

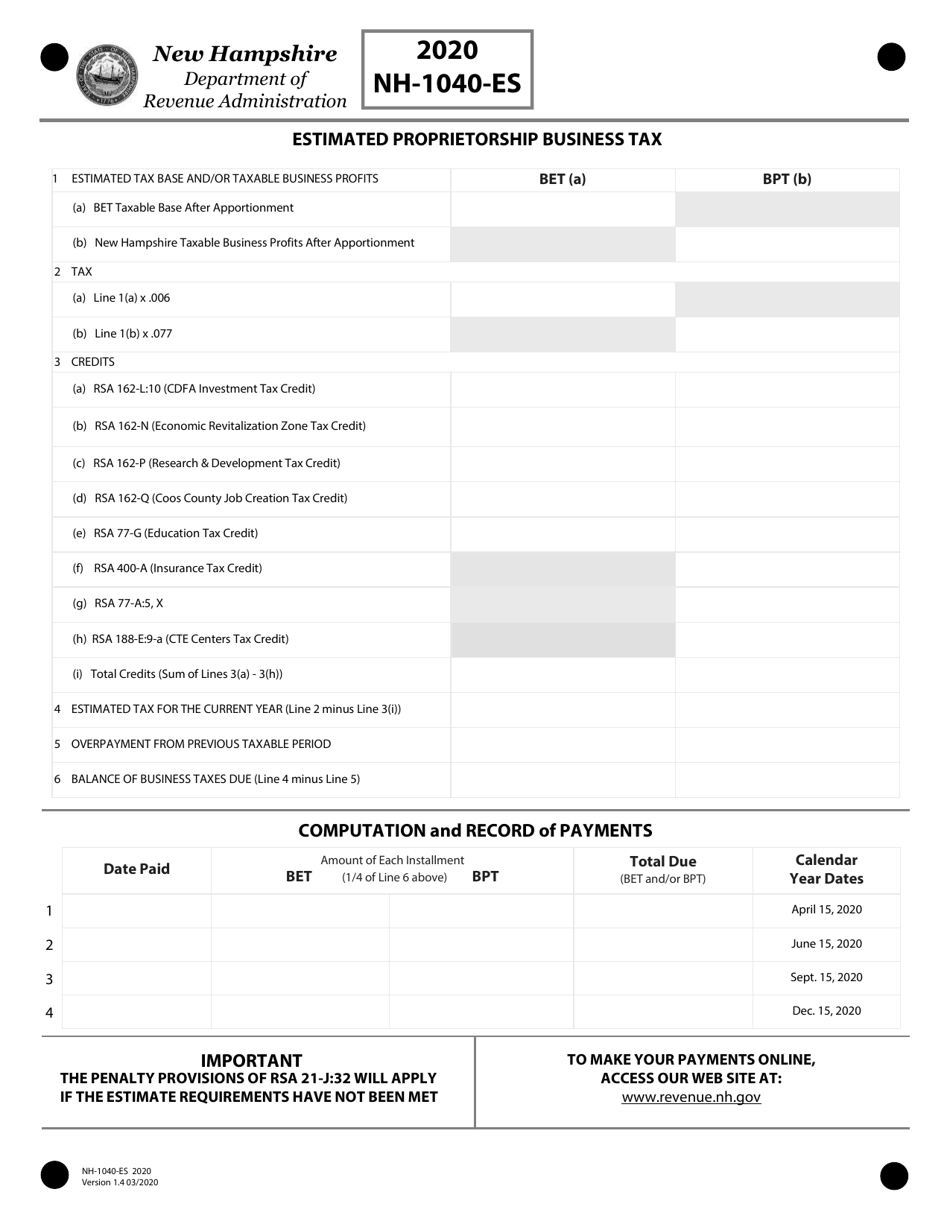

A: The purpose of Form NH-1040-ES is to make estimated tax payments on income from a proprietorship business in New Hampshire.

Q: Who needs to file Form NH-1040-ES?

A: Proprietors who are doing business in New Hampshire and need to make estimated tax payments on their business income.

Q: When is Form NH-1040-ES due?

A: Form NH-1040-ES is typically due on the 15th day of the fourth, sixth, ninth, and twelfth months of the tax year.

Q: Are there any penalties for not filing Form NH-1040-ES?

A: There may be penalties for not filing Form NH-1040-ES or for underpaying estimated taxes. It is important to timely file and pay the estimated tax to avoid penalties.

Q: Are there any exceptions or exemptions for filing Form NH-1040-ES?

A: There may be exceptions or exemptions for filing Form NH-1040-ES. It is recommended to consult the official instructions or seek professional tax advice for specific circumstances.

Q: What other forms may be required for a proprietorship business in New Hampshire?

A: Other forms that may be required for a proprietorship business in New Hampshire include Form NH-1040, Business Profits Tax forms, and Business Entity Income Tax forms.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1040-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.