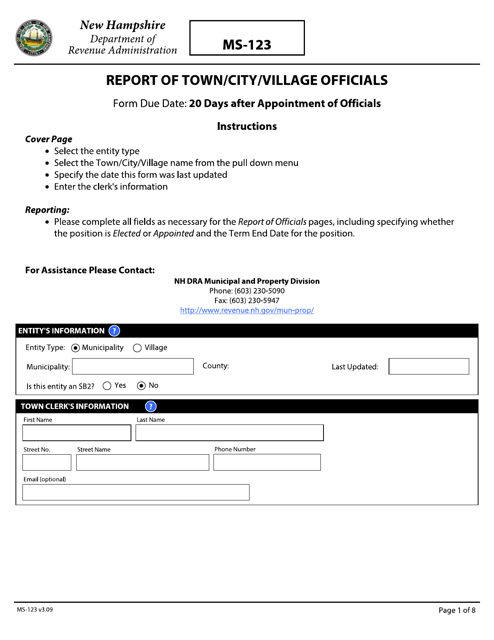

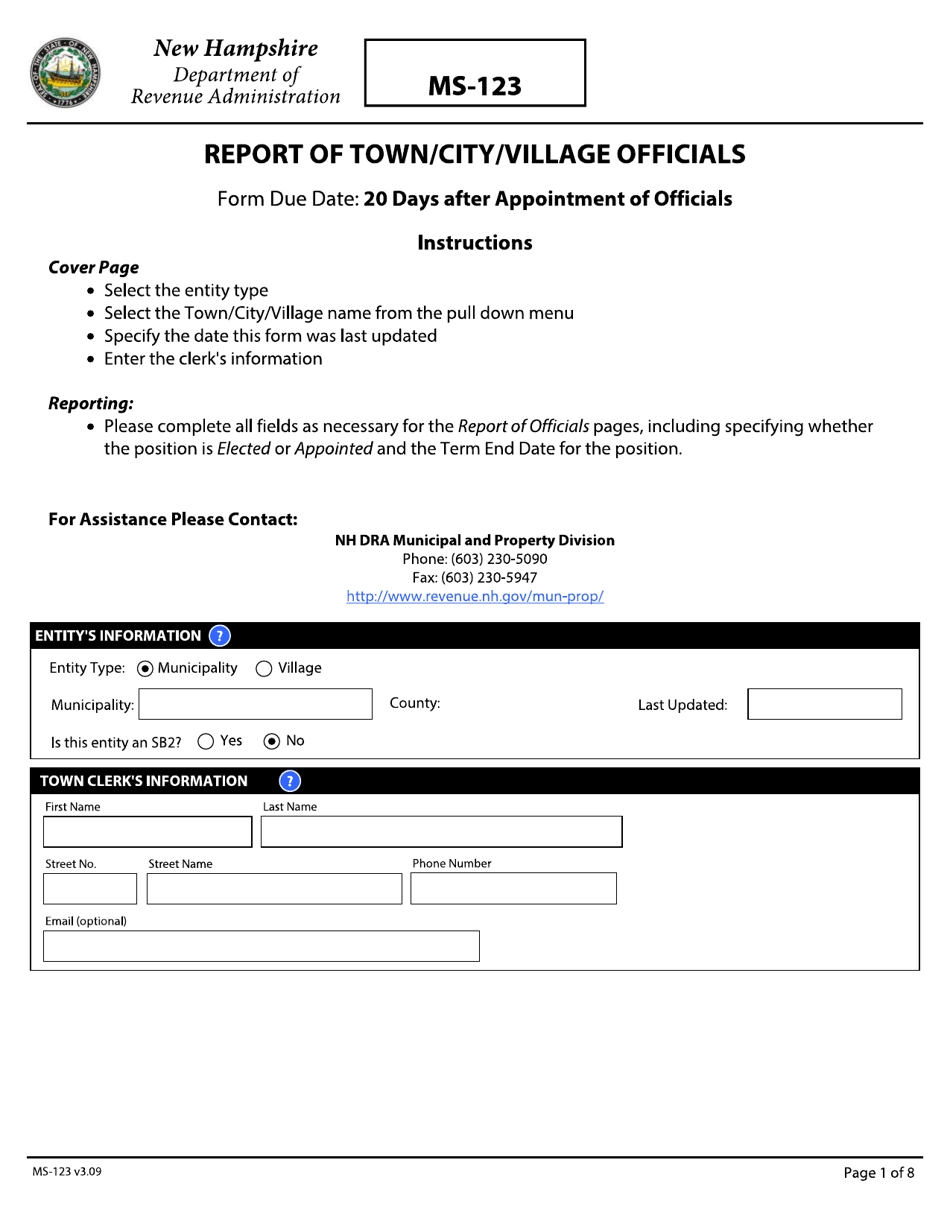

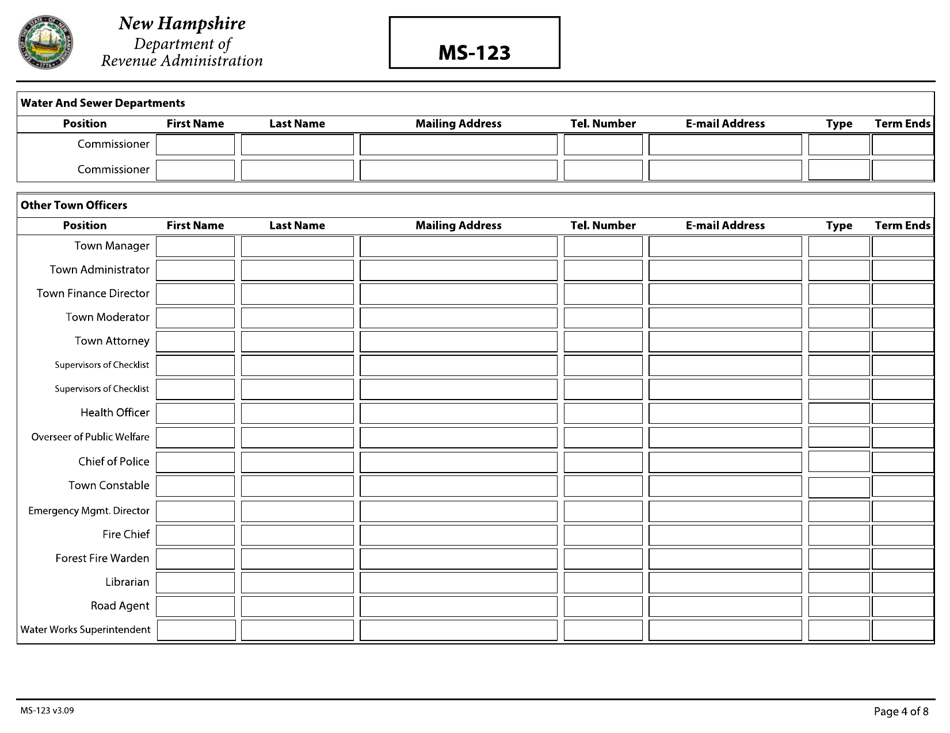

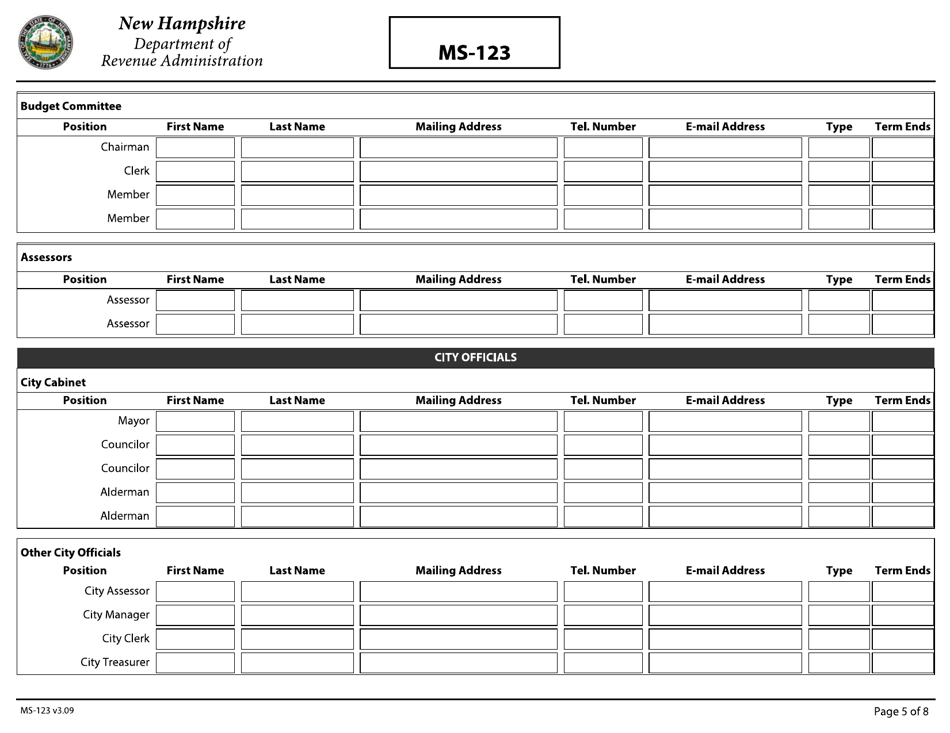

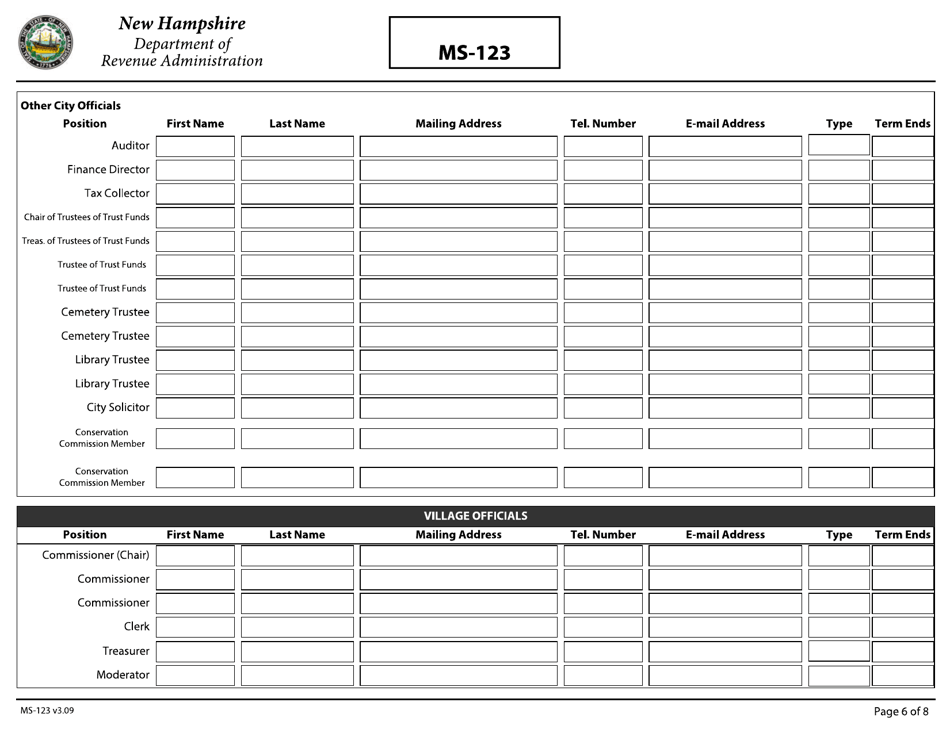

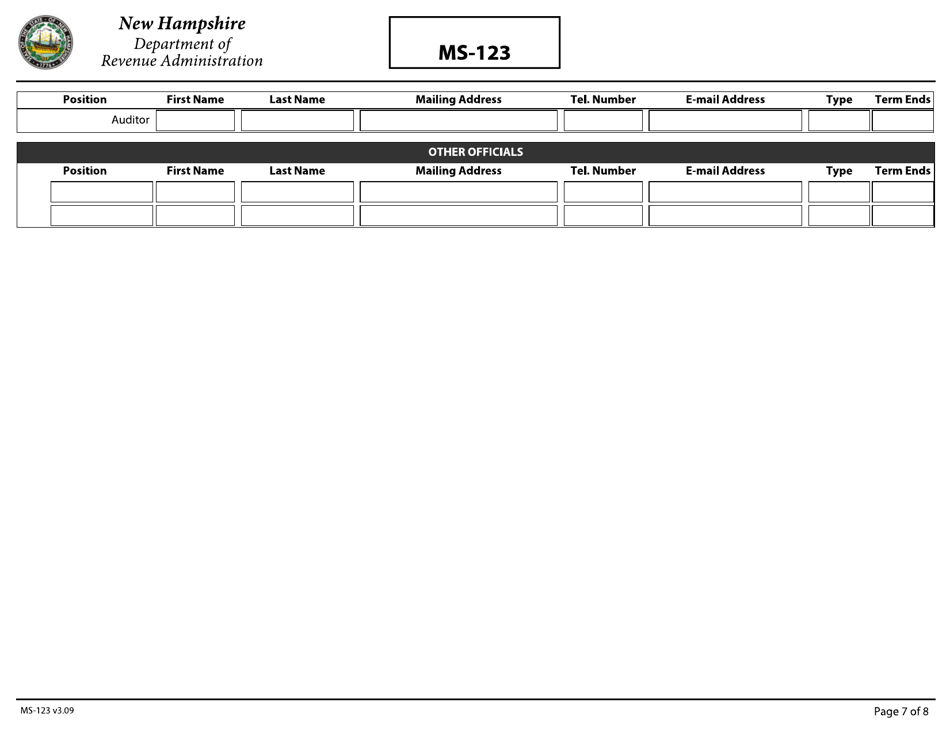

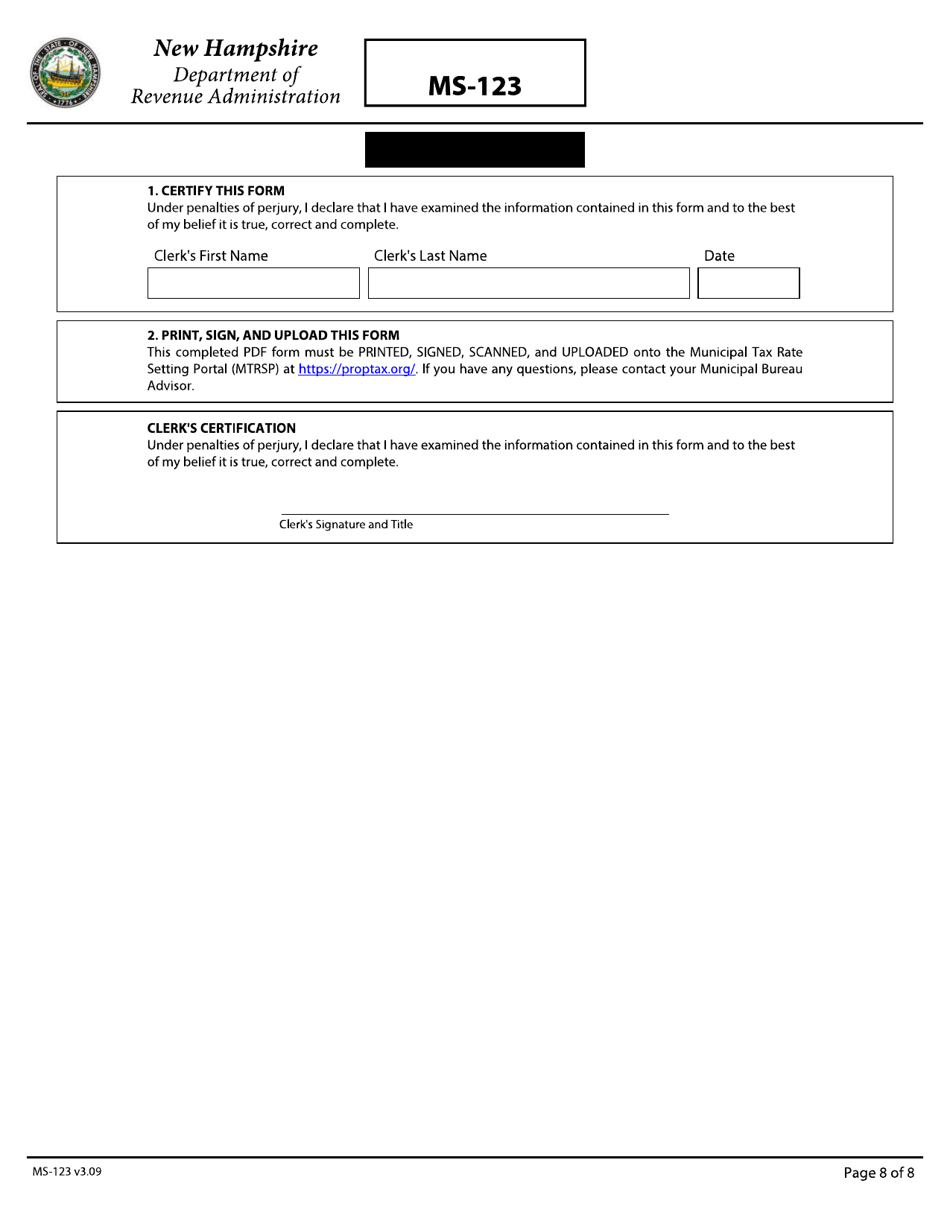

Form MS-123 Report of Town / City / Village Officials - New Hampshire

What Is Form MS-123?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MS-123?

A: Form MS-123 is the Report of Town/City/Village Officials in New Hampshire.

Q: Who needs to file Form MS-123?

A: Town/City/Village Officials in New Hampshire need to file Form MS-123.

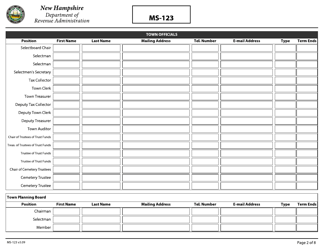

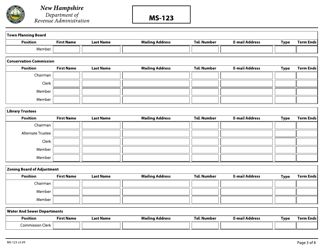

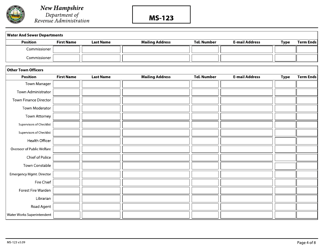

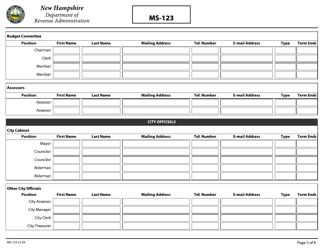

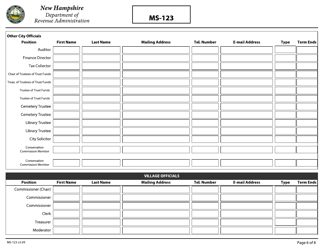

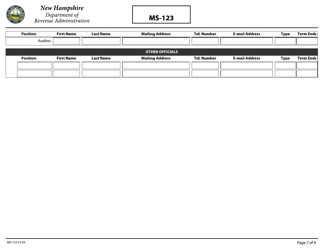

Q: What information is required on Form MS-123?

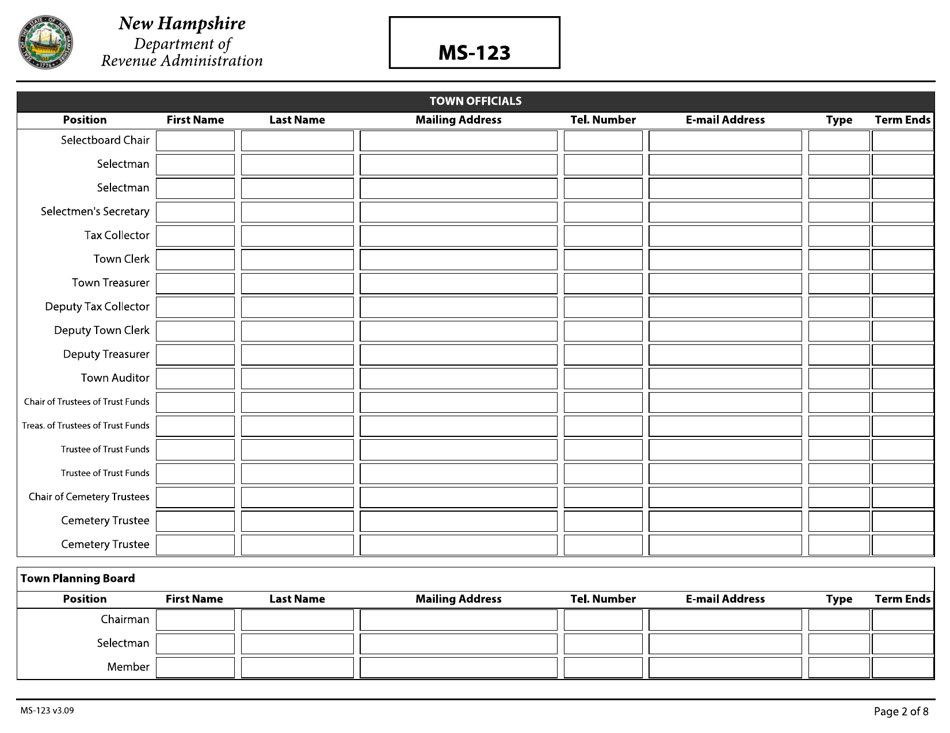

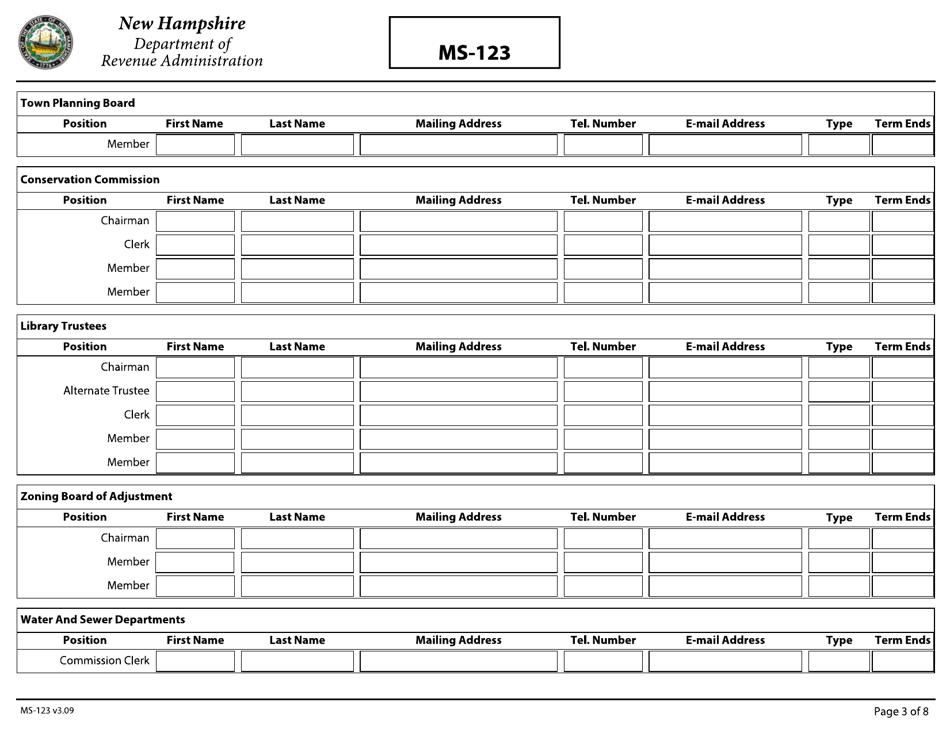

A: Form MS-123 requires information about the officials serving in the town/city/village, including their names, positions, terms, and other relevant details.

Q: When is Form MS-123 due?

A: Form MS-123 is typically due on a specific date determined by the town/city/village in New Hampshire. It is recommended to check with the local government for the exact deadline.

Q: Is Form MS-123 mandatory?

A: Yes, Form MS-123 is mandatory for town/city/village officials in New Hampshire to report their information.

Q: Are there any penalties for not filing Form MS-123?

A: Penalties for not filing Form MS-123 may vary depending on the local government's regulations and policies. It is best to comply with the reporting requirements to avoid any potential penalties.

Q: Are there any fees associated with filing Form MS-123?

A: Fees, if any, associated with filing Form MS-123 may vary depending on the town/city/village. It is best to inquire with the local government about any applicable fees.

Q: What should I do if I have questions about Form MS-123?

A: If you have questions about Form MS-123, it is recommended to contact the local town/city/village office in New Hampshire for assistance.

Form Details:

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MS-123 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.