This version of the form is not currently in use and is provided for reference only. Download this version of

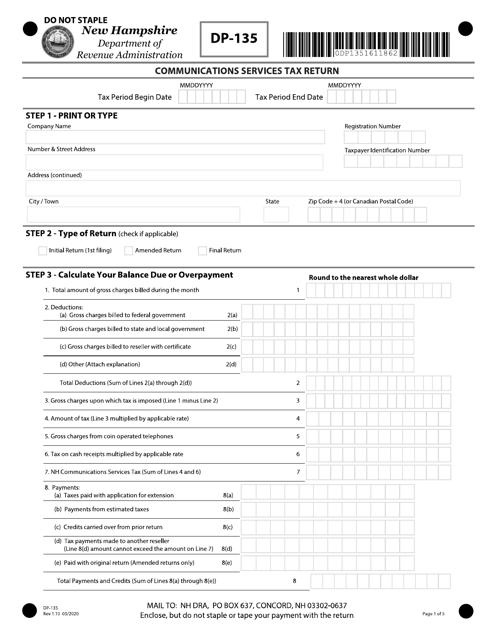

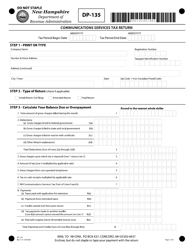

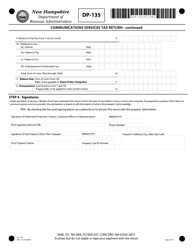

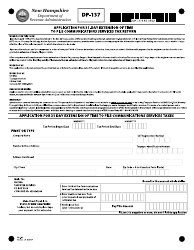

Form DP-135

for the current year.

Form DP-135 Communications Services Tax Return - New Hampshire

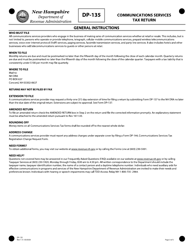

What Is Form DP-135?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

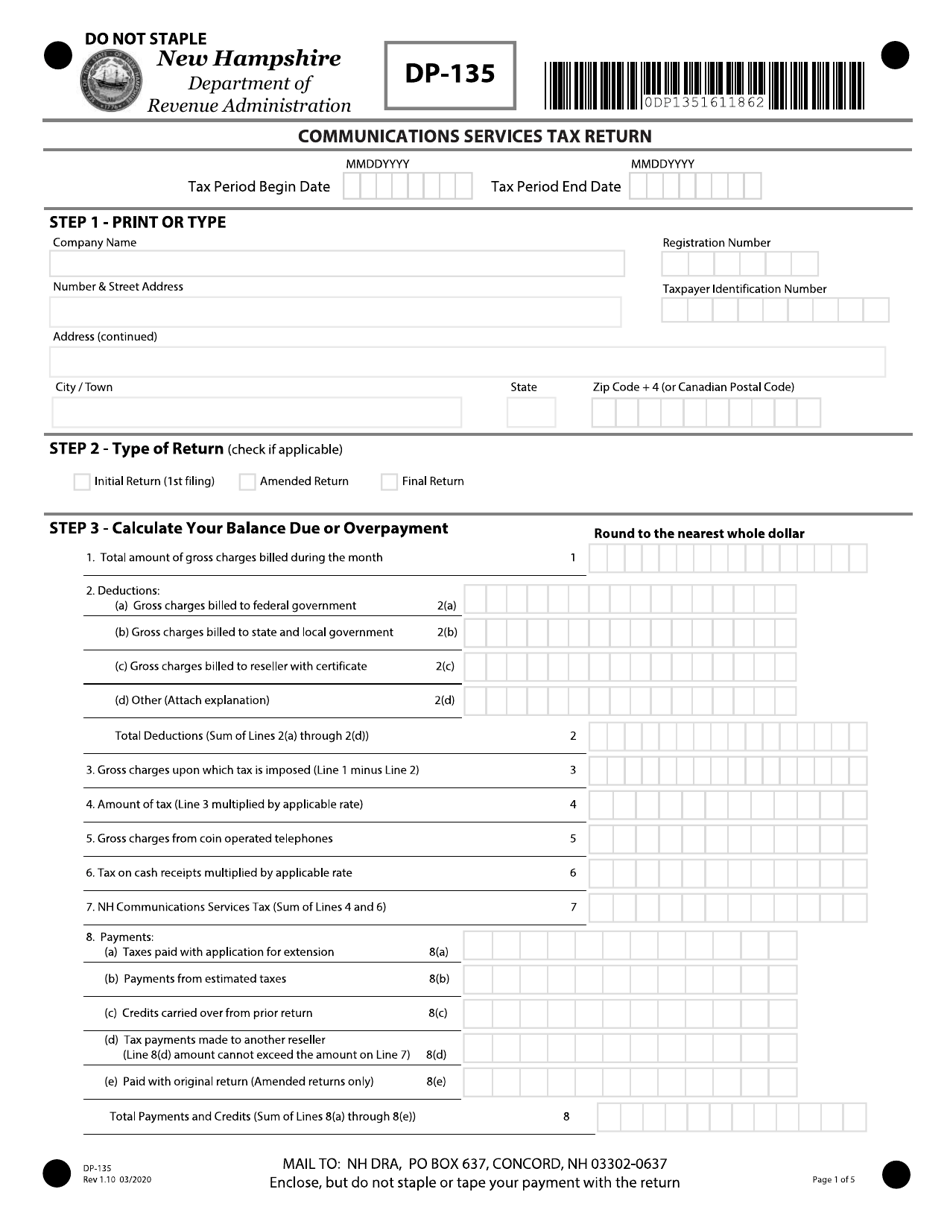

Q: What is Form DP-135?

A: Form DP-135 is the Communications Services Tax Return for the state of New Hampshire.

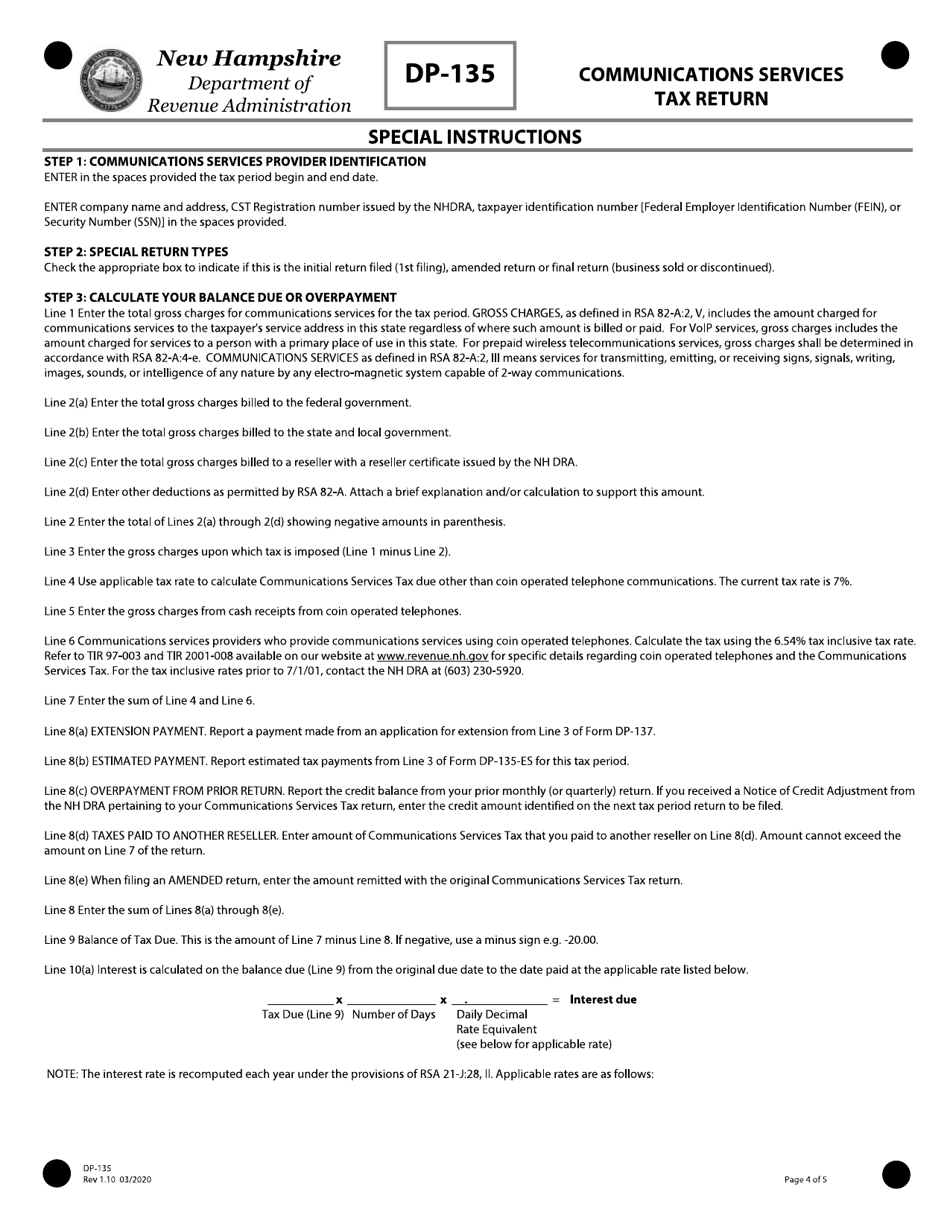

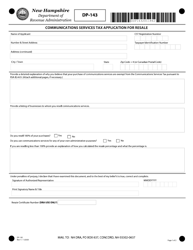

Q: Who needs to file Form DP-135?

A: Any person or business who provides taxable communication services in New Hampshire needs to file Form DP-135.

Q: What are taxable communication services?

A: Taxable communication services include telecommunications, cable television, and certain Voice over Internet Protocol (VoIP) services.

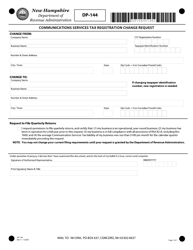

Q: When is Form DP-135 due?

A: Form DP-135 is due on a quarterly basis. The due dates are April 30th, July 31st, October 31st, and January 31st.

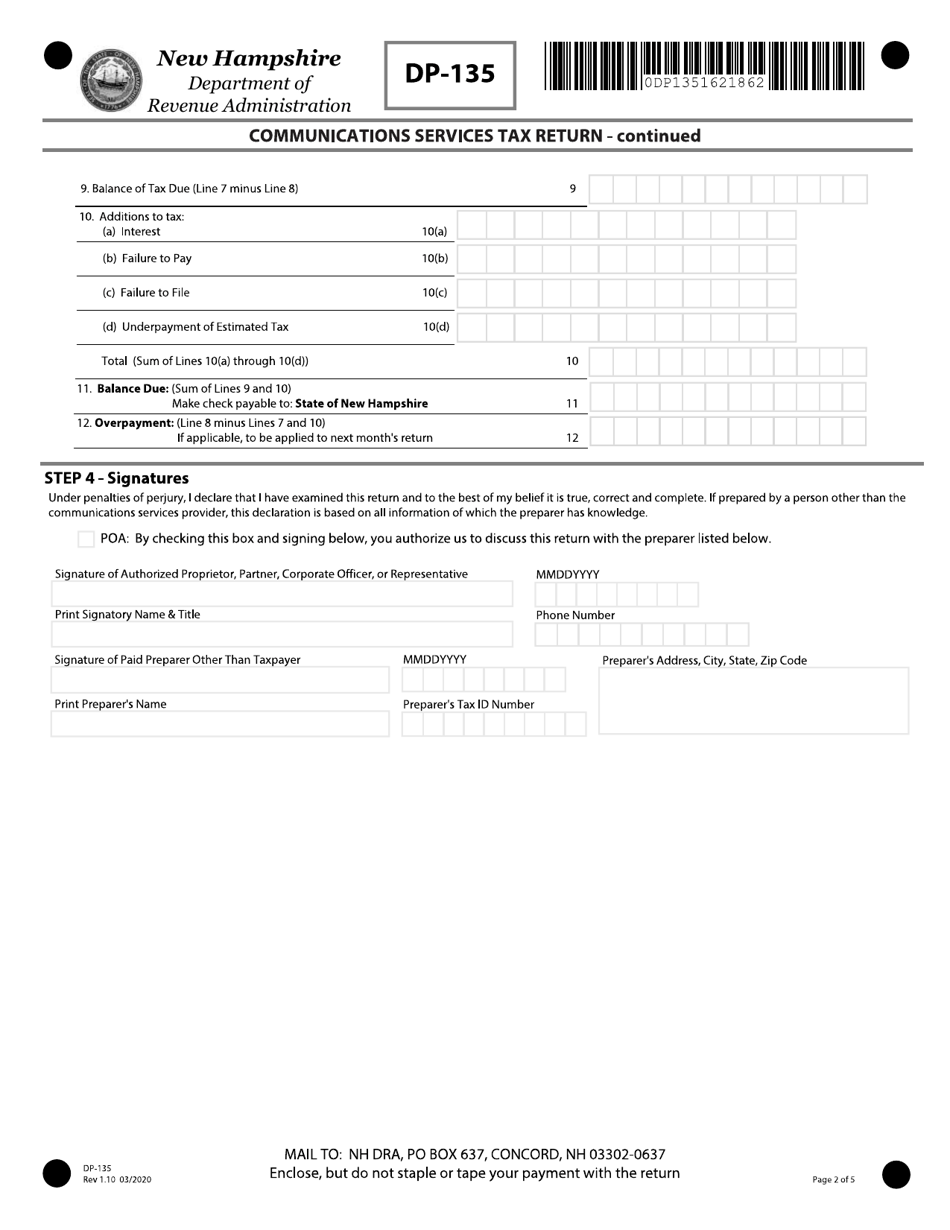

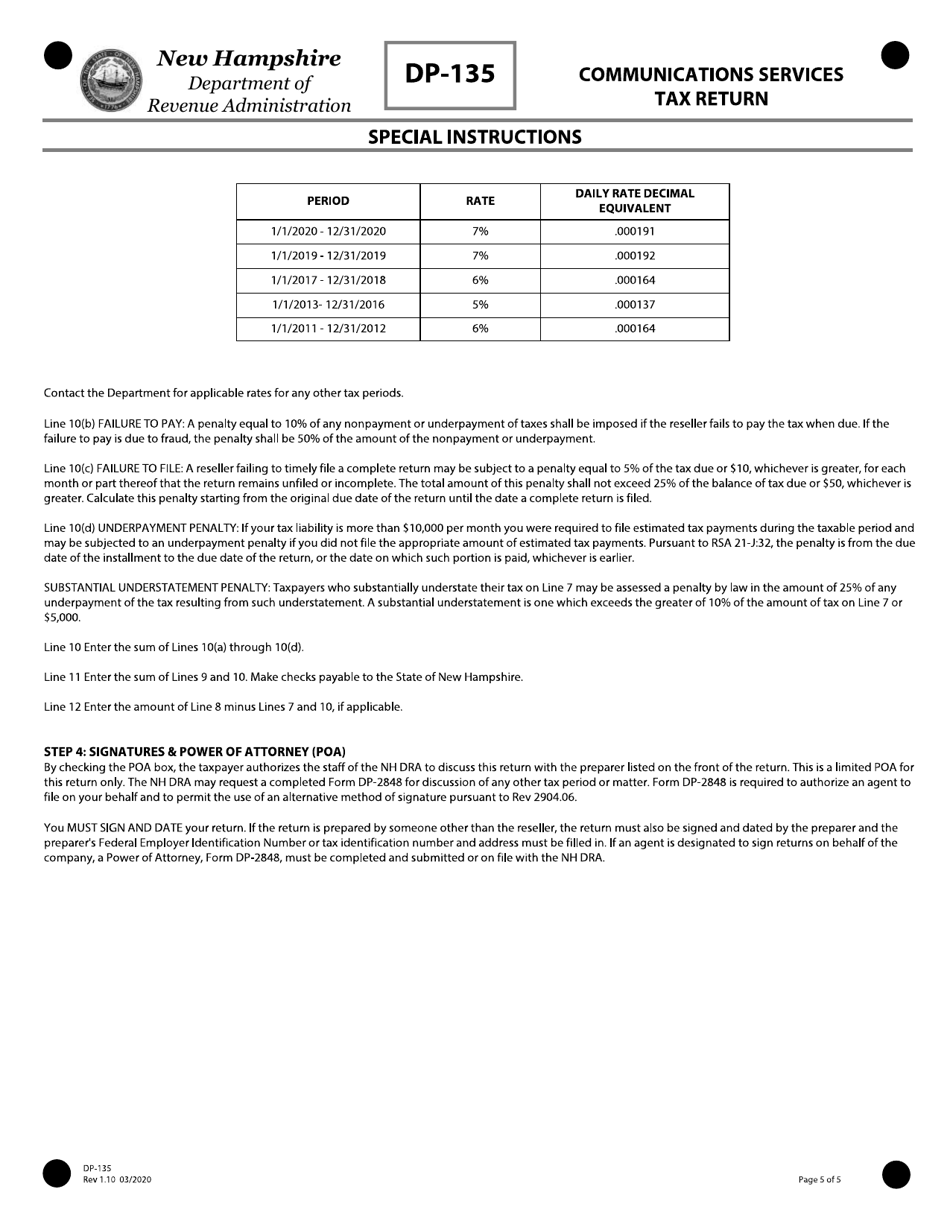

Q: Are there any penalties for late filing or payment?

A: Yes, there are penalties for late filing or payment. The penalties can include interest charges and late payment penalties.

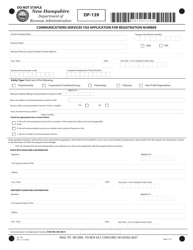

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-135 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.