This version of the form is not currently in use and is provided for reference only. Download this version of

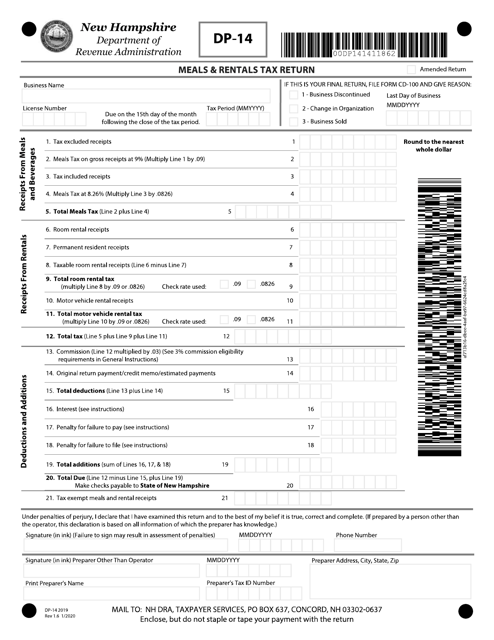

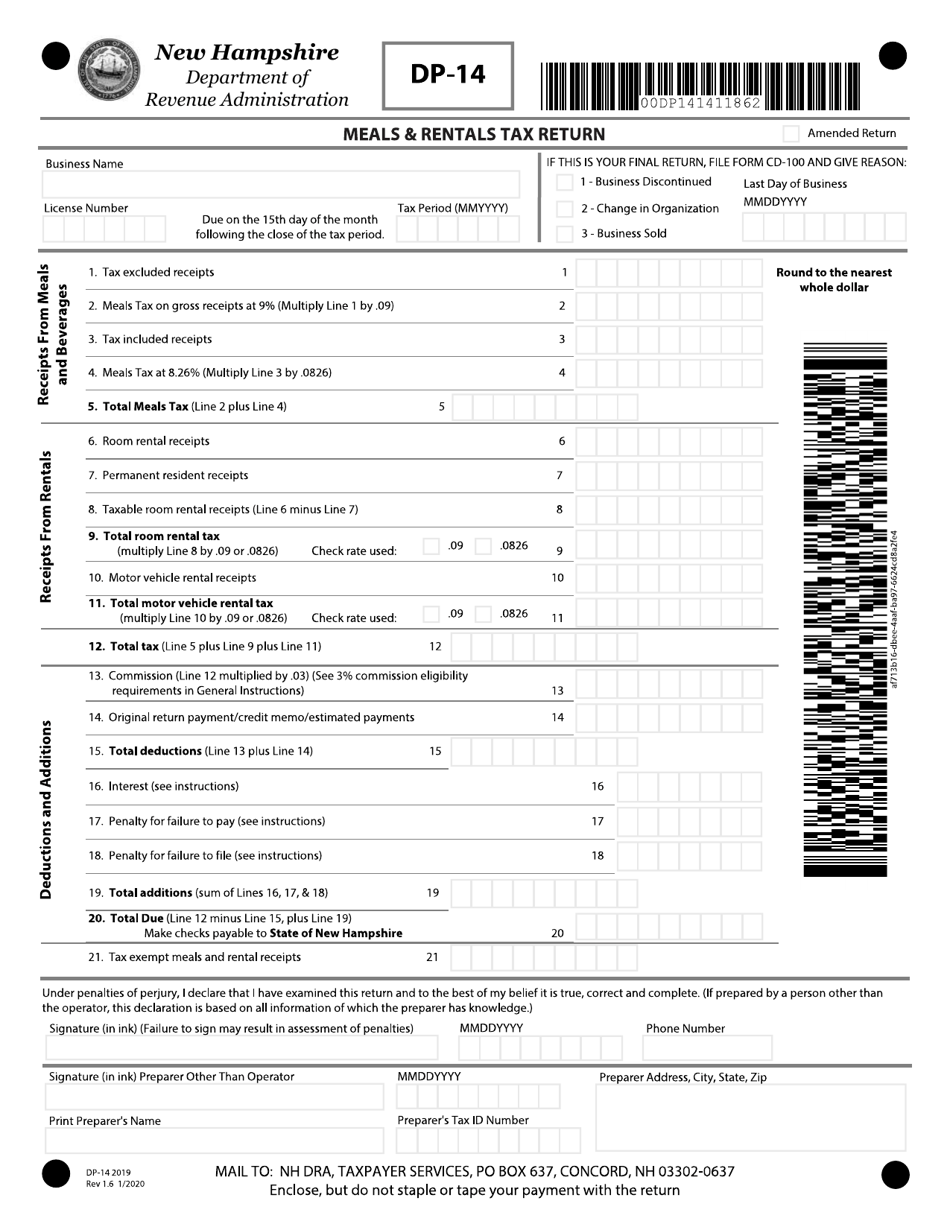

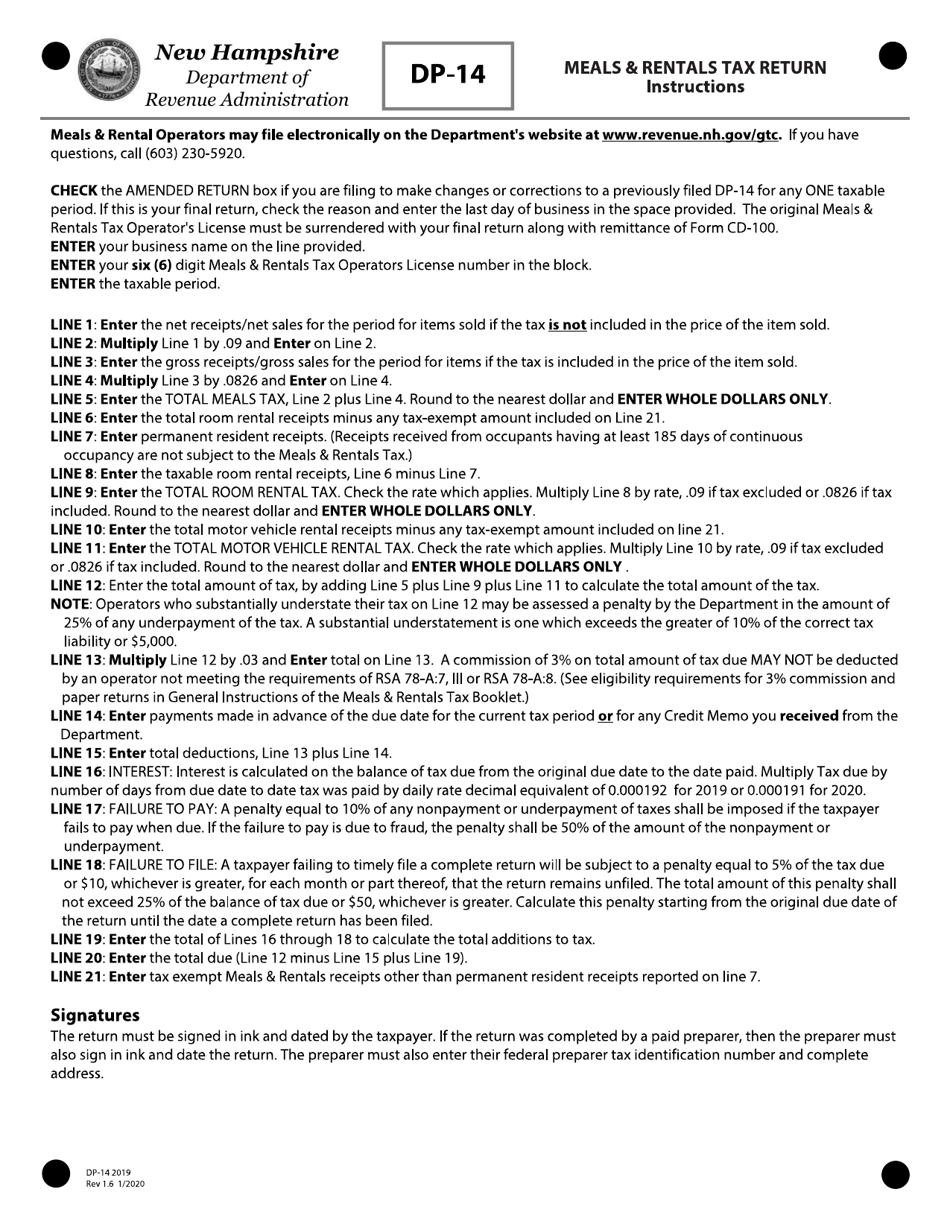

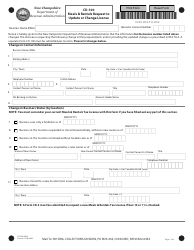

Form DP-14

for the current year.

Form DP-14 Meals and Rentals Tax Form - New Hampshire

What Is Form DP-14?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-14?

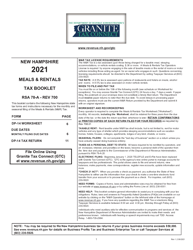

A: Form DP-14 is the Meals and Rentals Tax Form in New Hampshire.

Q: What is the purpose of Form DP-14?

A: The purpose of Form DP-14 is to report and remit meals and rentals tax owed by businesses in New Hampshire.

Q: Who needs to file Form DP-14?

A: Businesses in New Hampshire that sell meals or rent accommodations are required to file Form DP-14.

Q: How often should Form DP-14 be filed?

A: Form DP-14 should be filed monthly by businesses in New Hampshire.

Q: What information is required on Form DP-14?

A: Form DP-14 requires businesses to provide information about their sales, rentals, and tax owed.

Q: When is Form DP-14 due?

A: Form DP-14 is due on the 15th day of the month following the reporting period.

Q: What happens if I don't file Form DP-14?

A: Failure to file Form DP-14 or pay the required tax may result in penalties and interest being assessed by the New Hampshire Department of Revenue Administration.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-14 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.