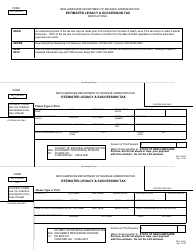

This version of the form is not currently in use and is provided for reference only. Download this version of

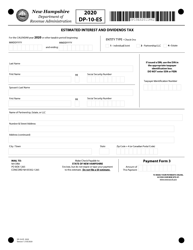

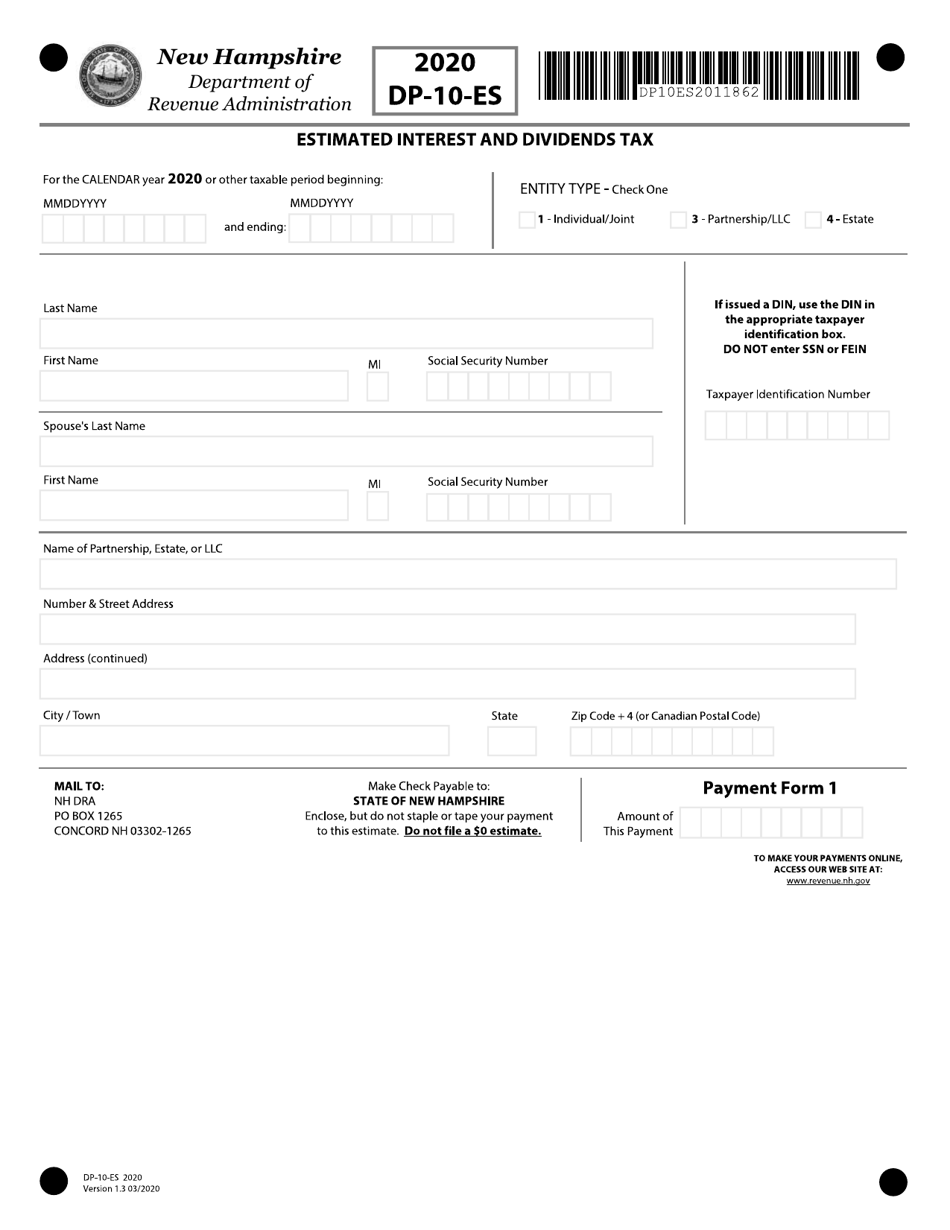

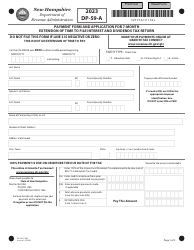

Form DP-10-ES

for the current year.

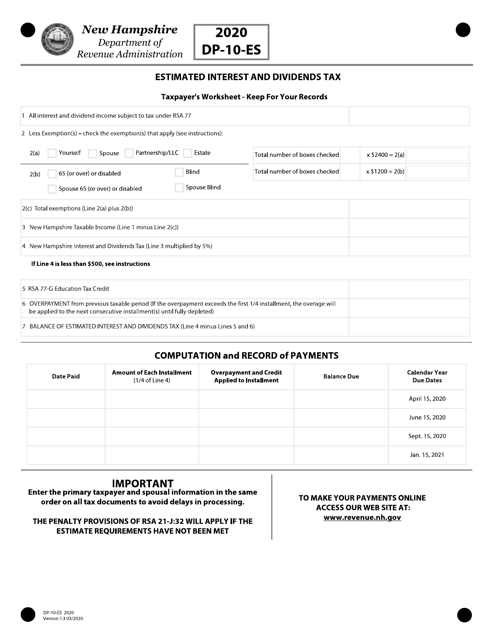

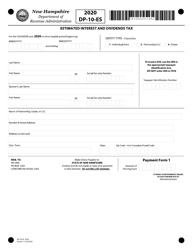

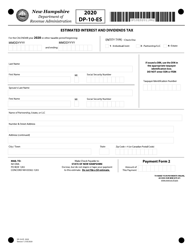

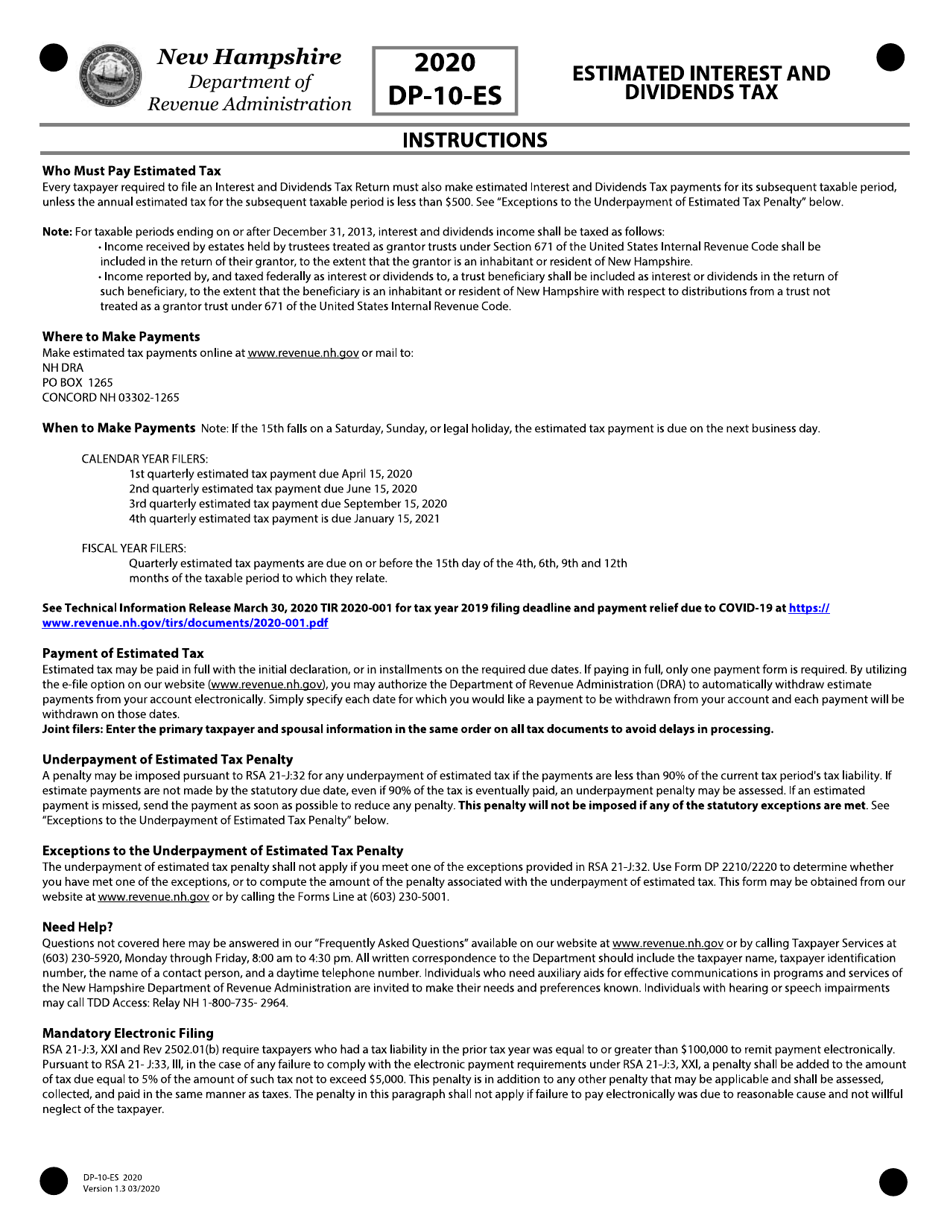

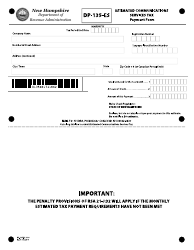

Form DP-10-ES Estimated Interest and Dividends Tax - New Hampshire

What Is Form DP-10-ES?

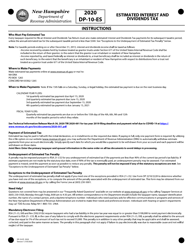

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-10-ES?

A: Form DP-10-ES is the Estimated Interest and Dividends Tax form for residents of New Hampshire.

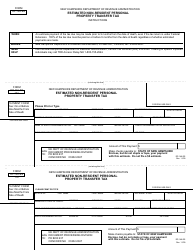

Q: Who needs to file Form DP-10-ES?

A: Residents of New Hampshire who expect to owe more than $10 in interest and dividends tax are required to file Form DP-10-ES.

Q: What is the purpose of Form DP-10-ES?

A: The purpose of Form DP-10-ES is to help residents of New Hampshire estimate and pay their interest and dividends tax throughout the year.

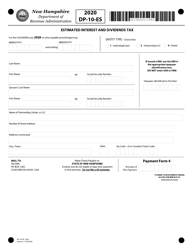

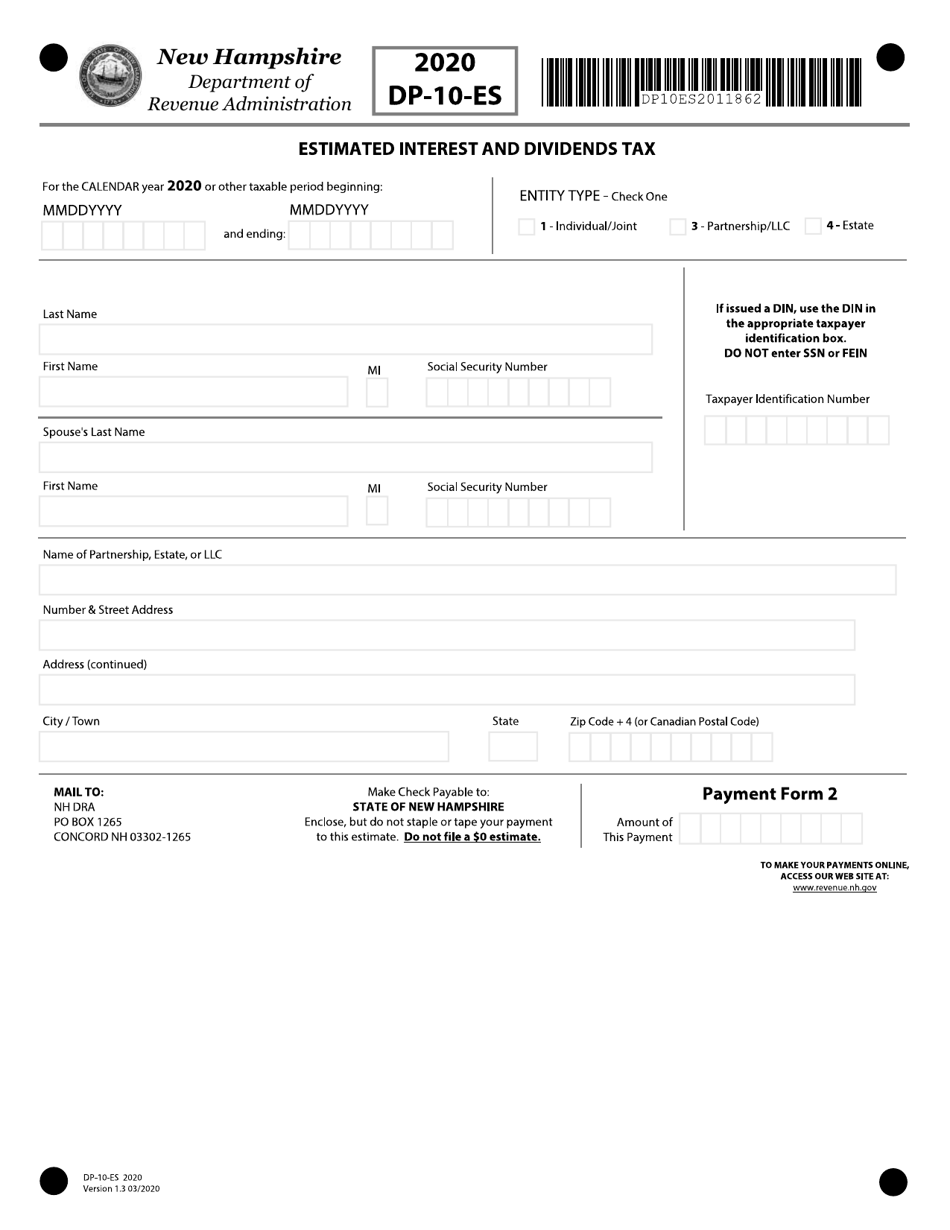

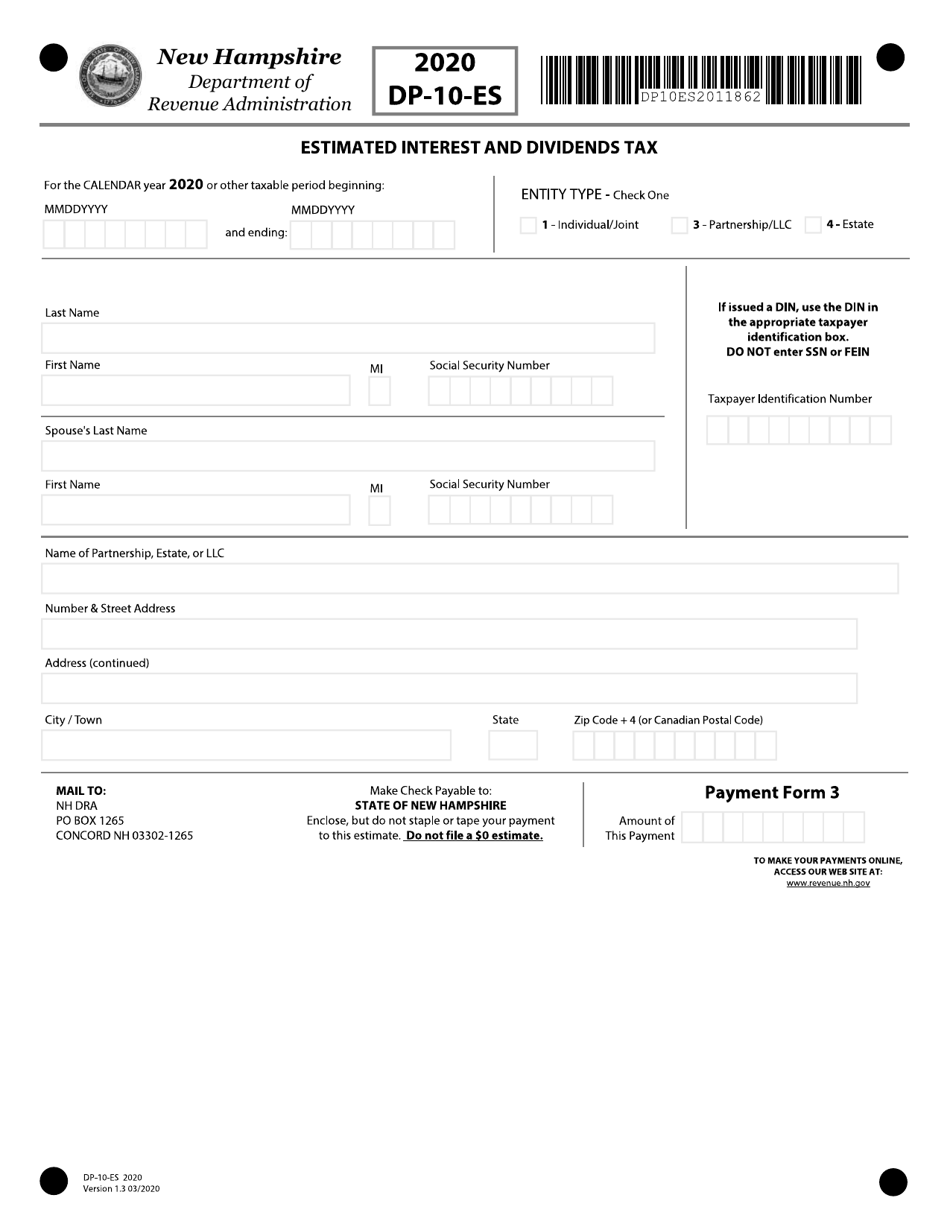

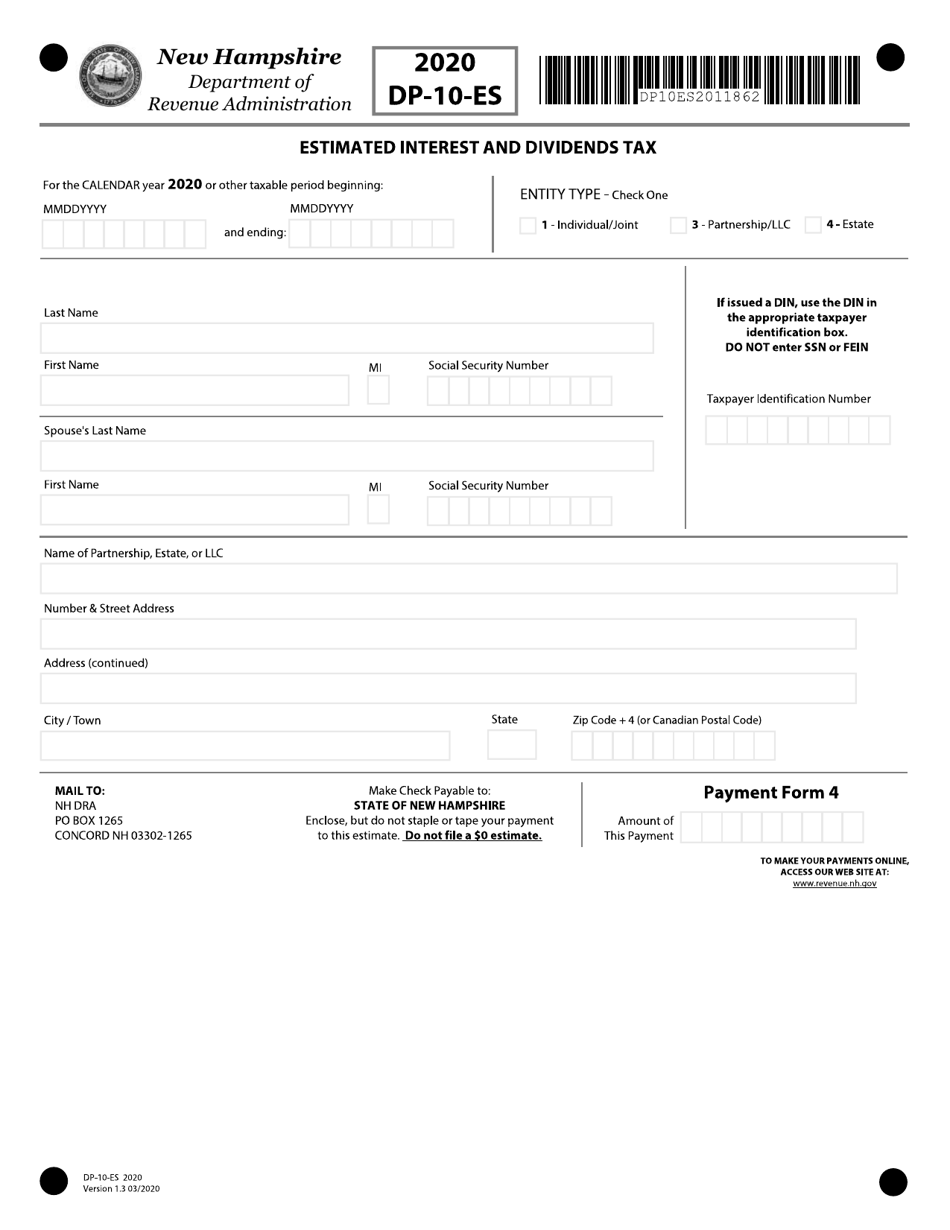

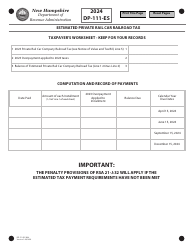

Q: How often do I need to file Form DP-10-ES?

A: Form DP-10-ES is filed on a quarterly basis. The filing due dates are April 15th, June 15th, September 15th, and December 15th.

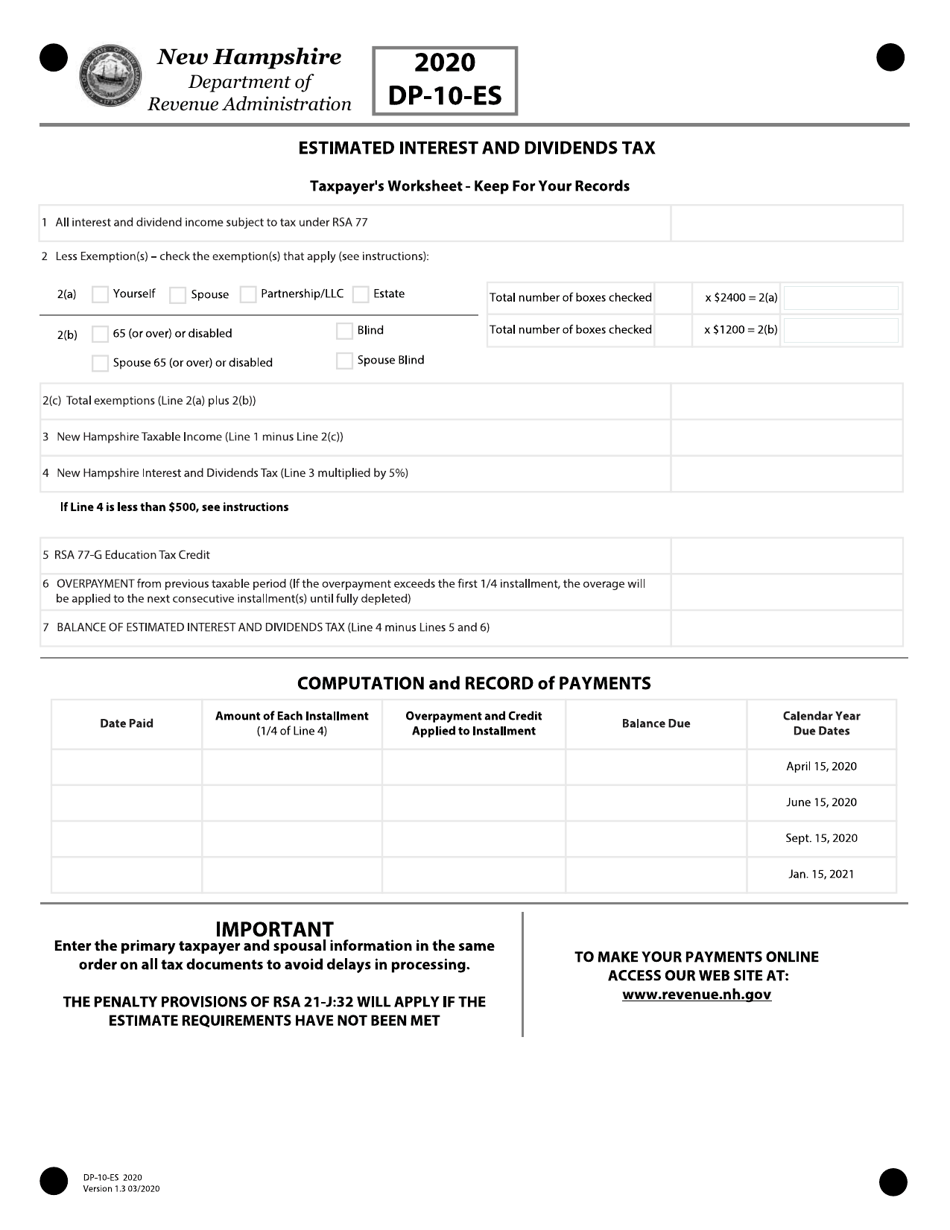

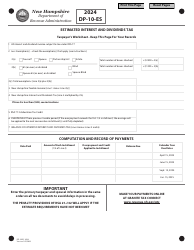

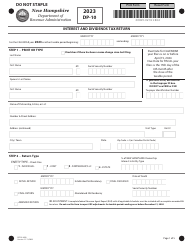

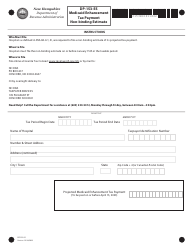

Q: What information do I need to complete Form DP-10-ES?

A: To complete Form DP-10-ES, you will need to know your estimated interest and dividends income, as well as any estimated tax payments you have made.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-10-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.