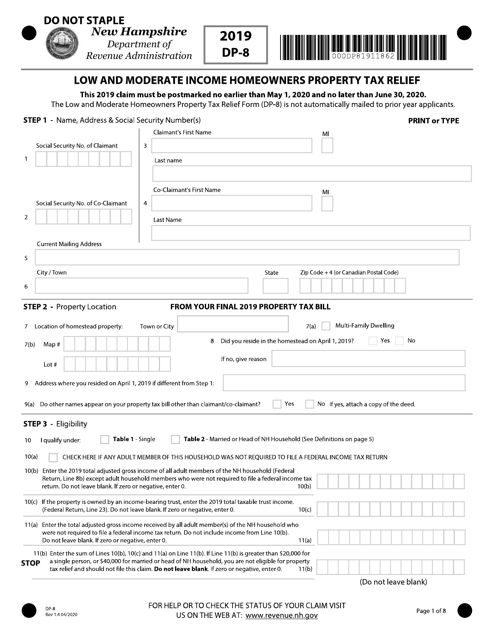

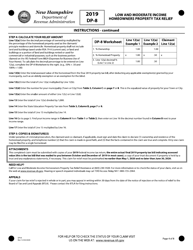

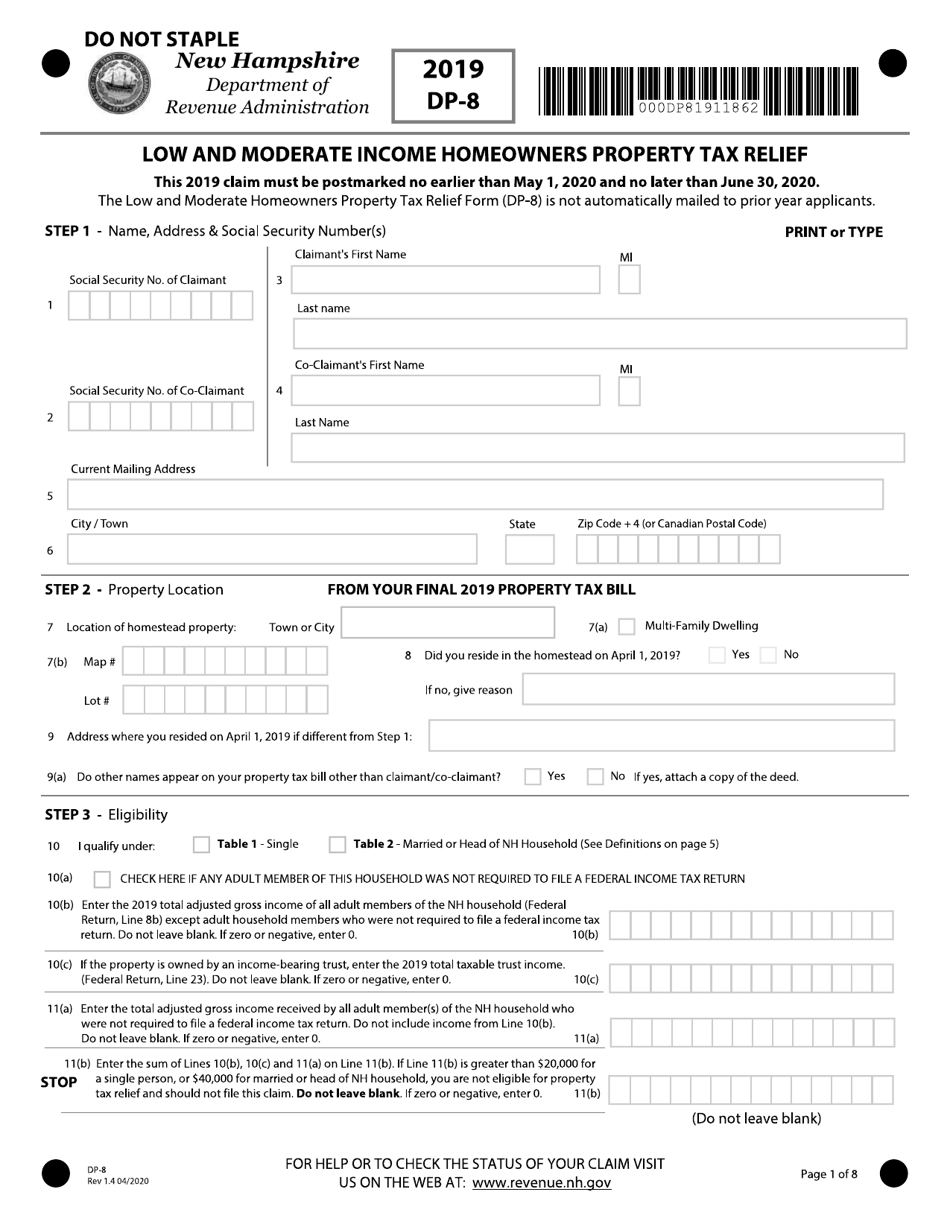

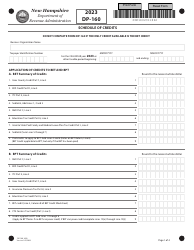

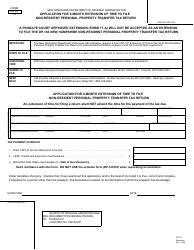

Form DP-8 Low and Moderate Income Homeowners Property Tax Relief - New Hampshire

What Is Form DP-8?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-8?

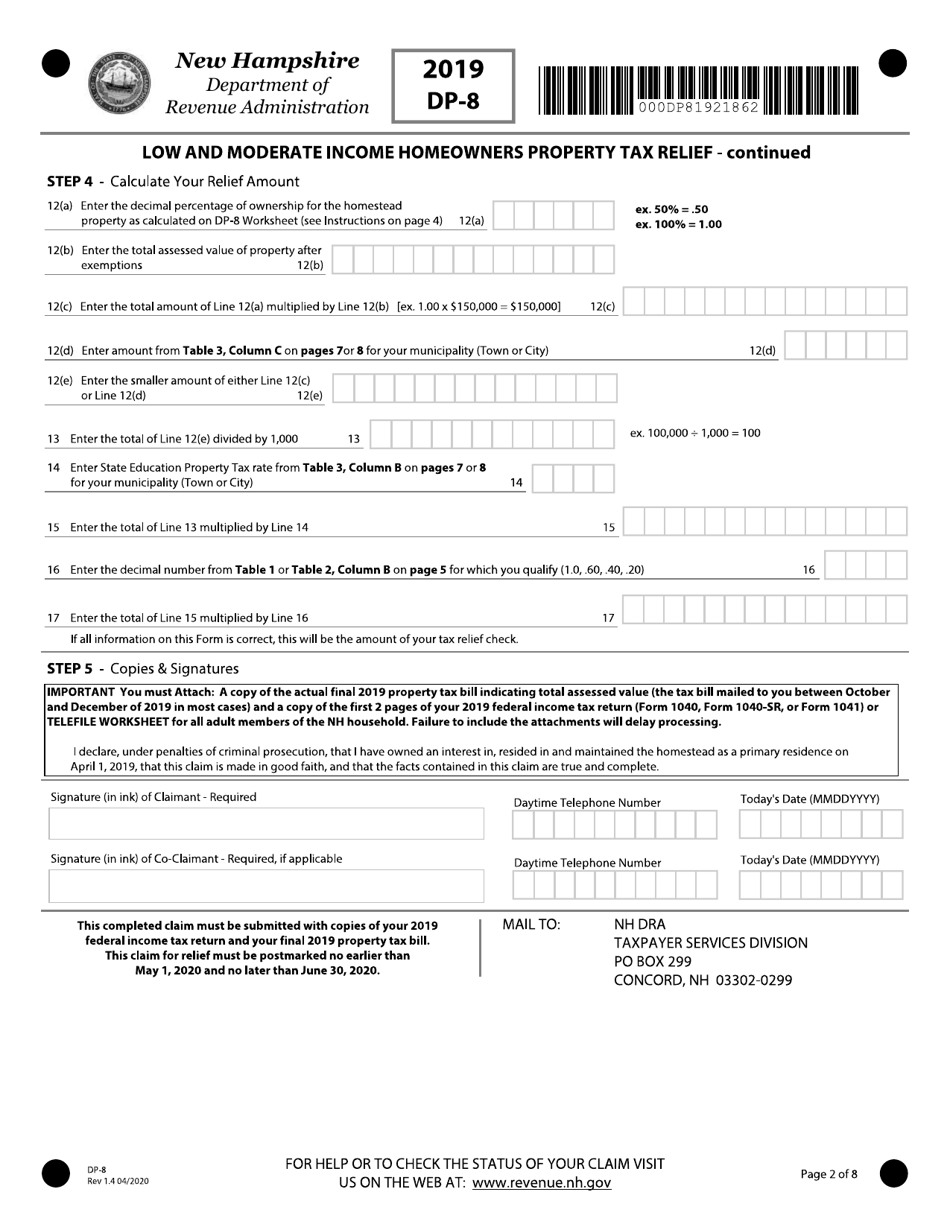

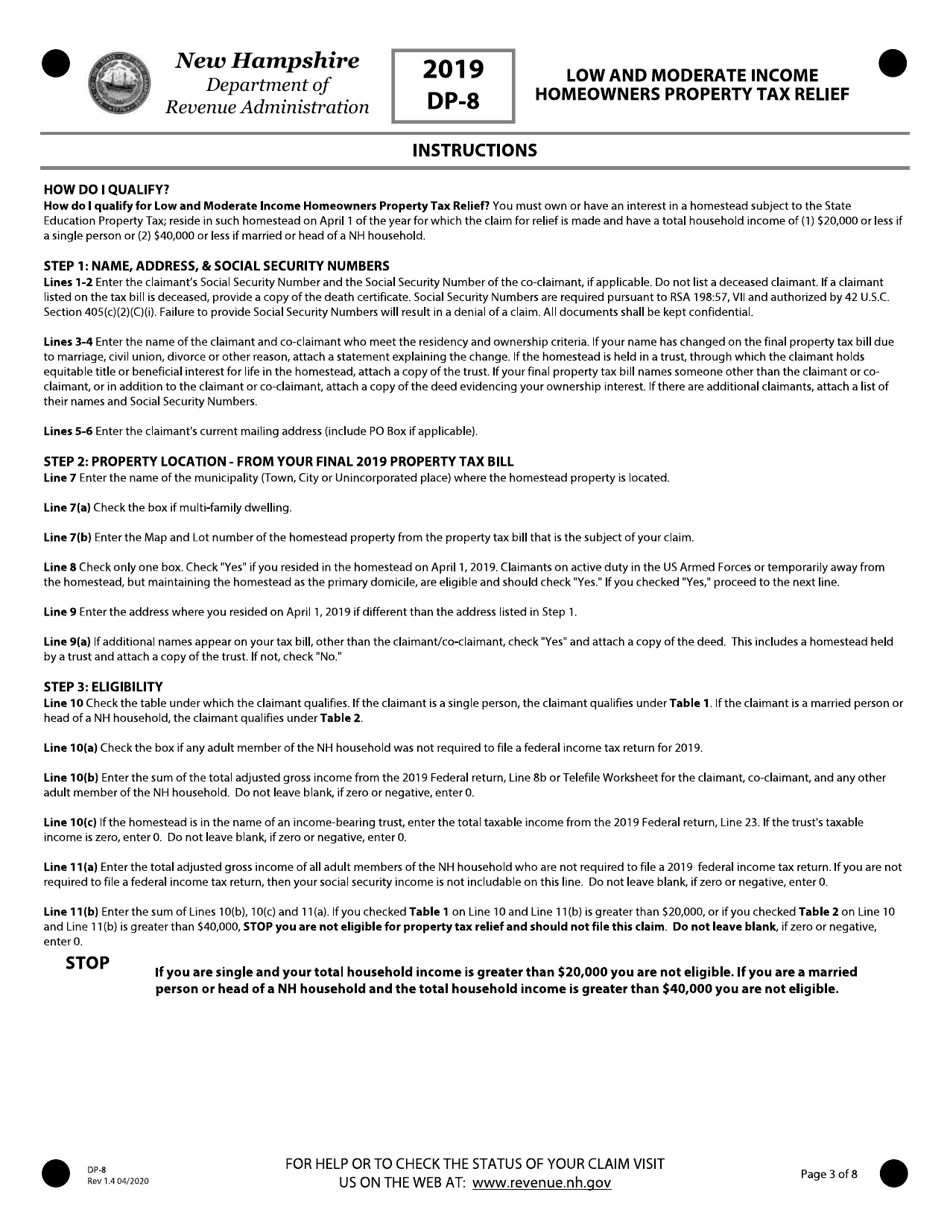

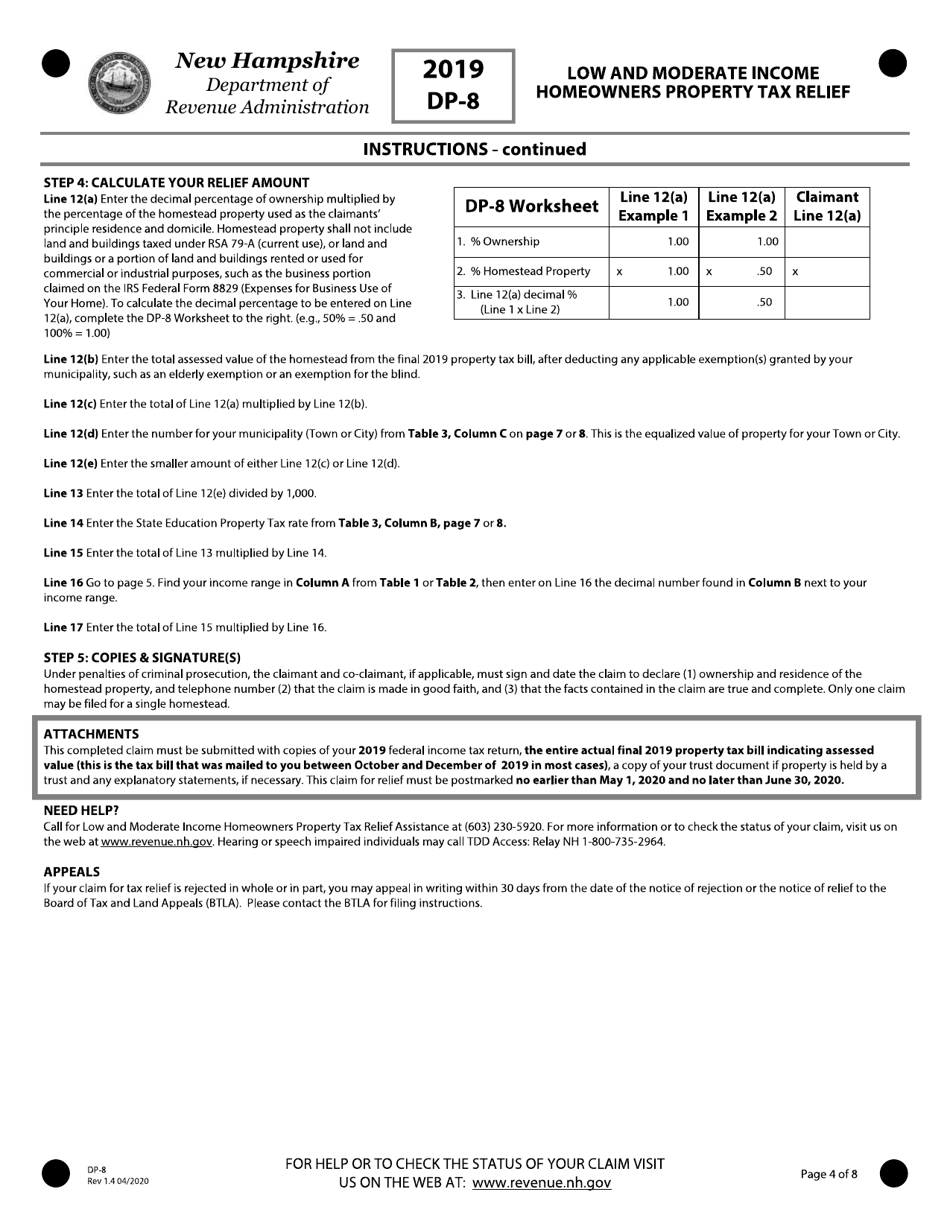

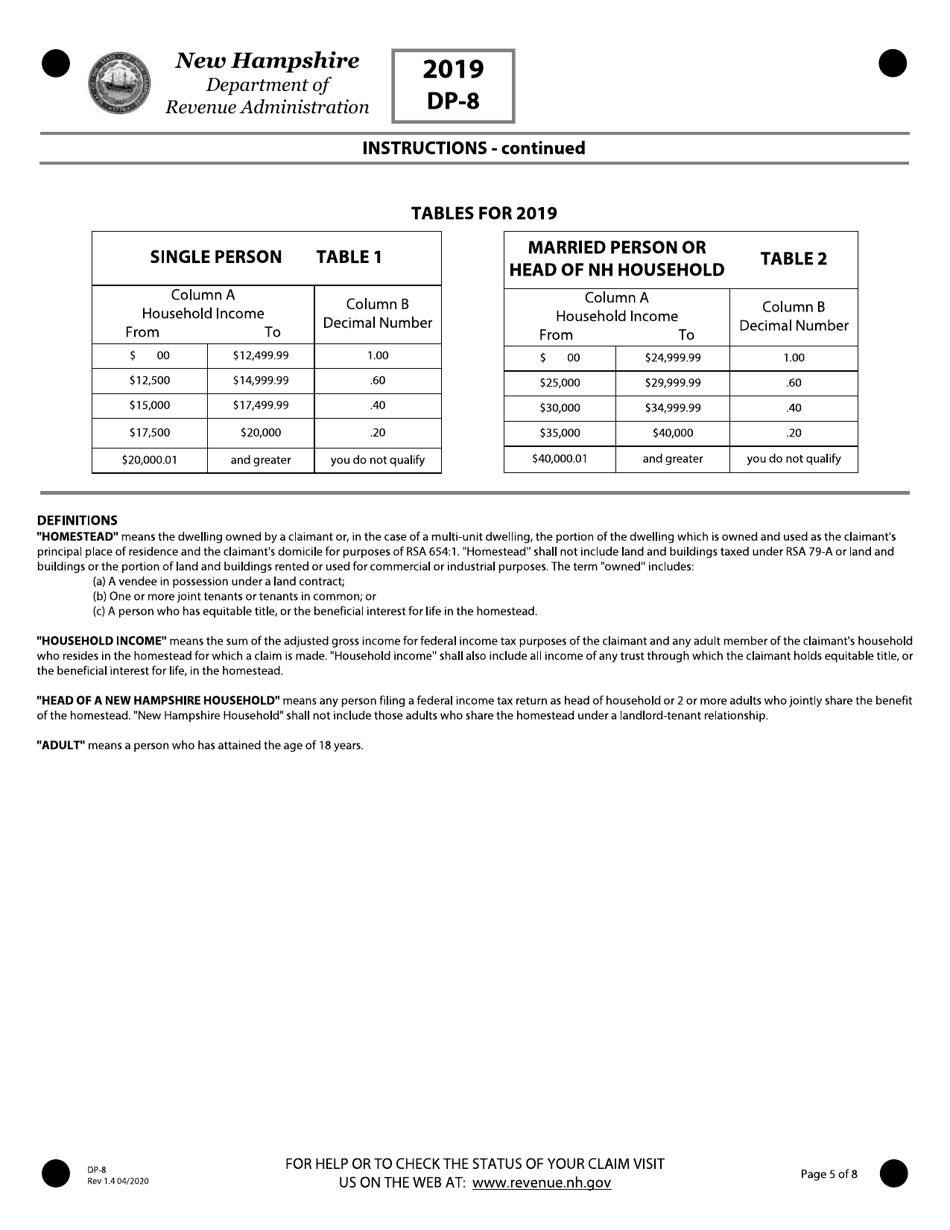

A: Form DP-8 is a form used in New Hampshire to apply for low and moderate income homeowners property tax relief.

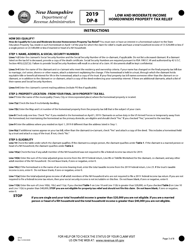

Q: Who is eligible for low and moderate income homeowners property tax relief in New Hampshire?

A: In New Hampshire, homeowners with low to moderate income may be eligible for property tax relief.

Q: How can I apply for low and moderate income homeowners property tax relief in New Hampshire?

A: You can apply for low and moderate income homeowners property tax relief in New Hampshire by completing and submitting Form DP-8.

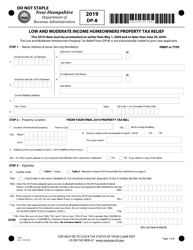

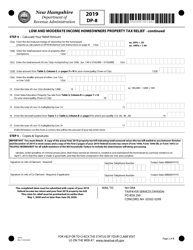

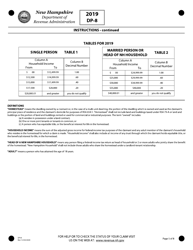

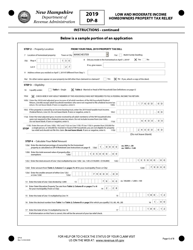

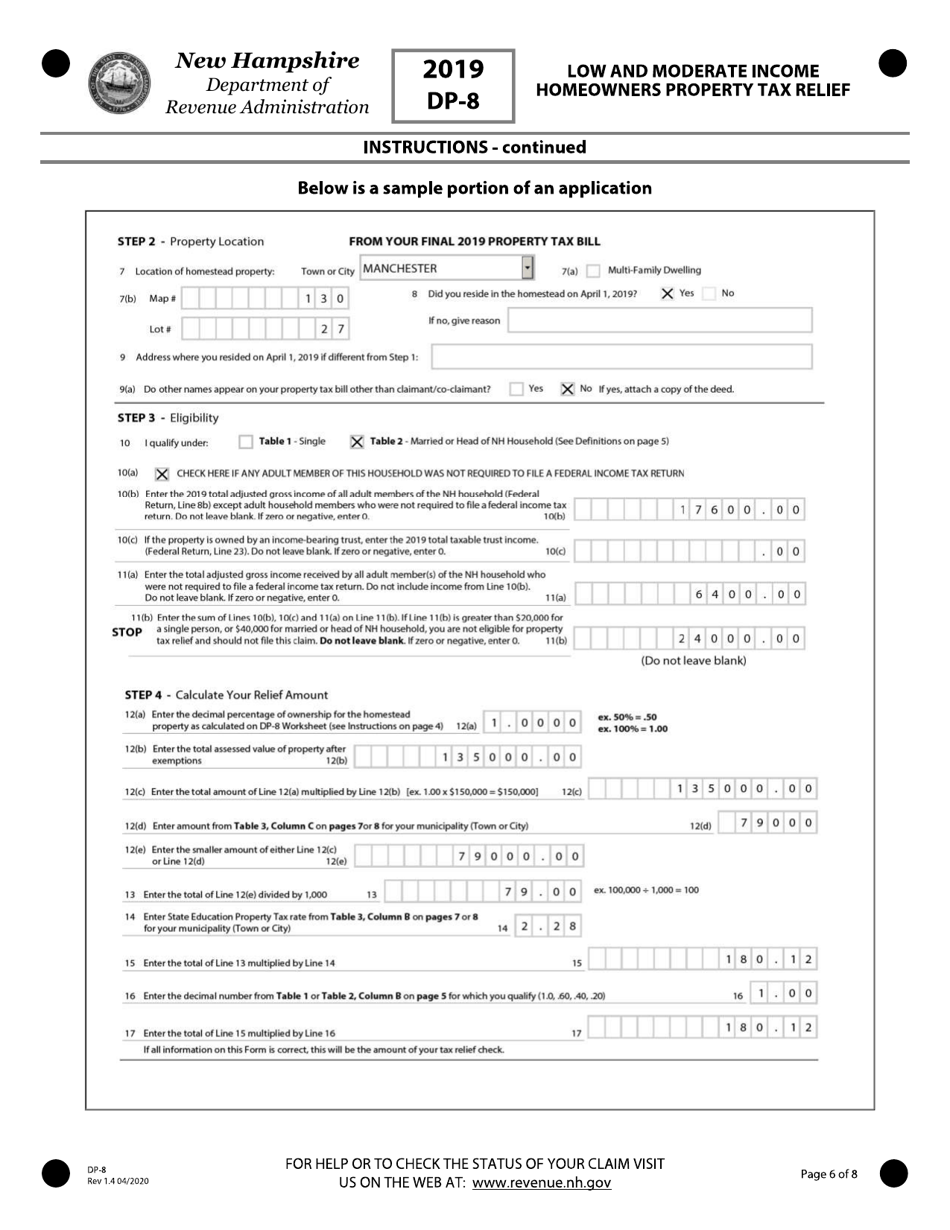

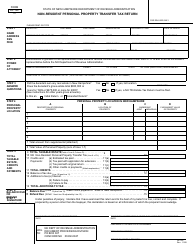

Q: What information do I need to provide on Form DP-8?

A: On Form DP-8, you will need to provide information such as your household income, property tax assessment, and the number of dependents in your household.

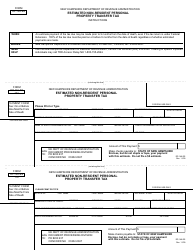

Q: Is there a deadline to submit Form DP-8 for low and moderate income homeowners property tax relief in New Hampshire?

A: Yes, the deadline to submit Form DP-8 for low and moderate income homeowners property tax relief in New Hampshire is typically in April.

Q: What happens after I submit Form DP-8 for low and moderate income homeowners property tax relief in New Hampshire?

A: After you submit Form DP-8, the New Hampshire Department of Revenue Administration will review your application and determine if you are eligible for property tax relief.

Q: How will I receive the property tax relief if I am approved?

A: If you are approved for property tax relief, you will receive a credit or refund on your property tax bill.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-8 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.