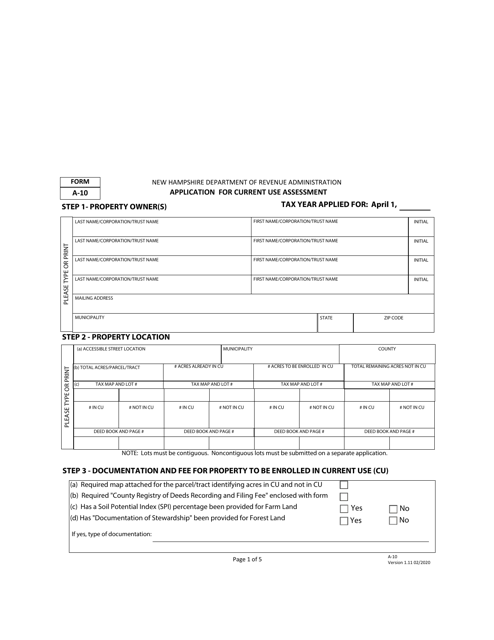

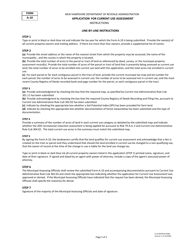

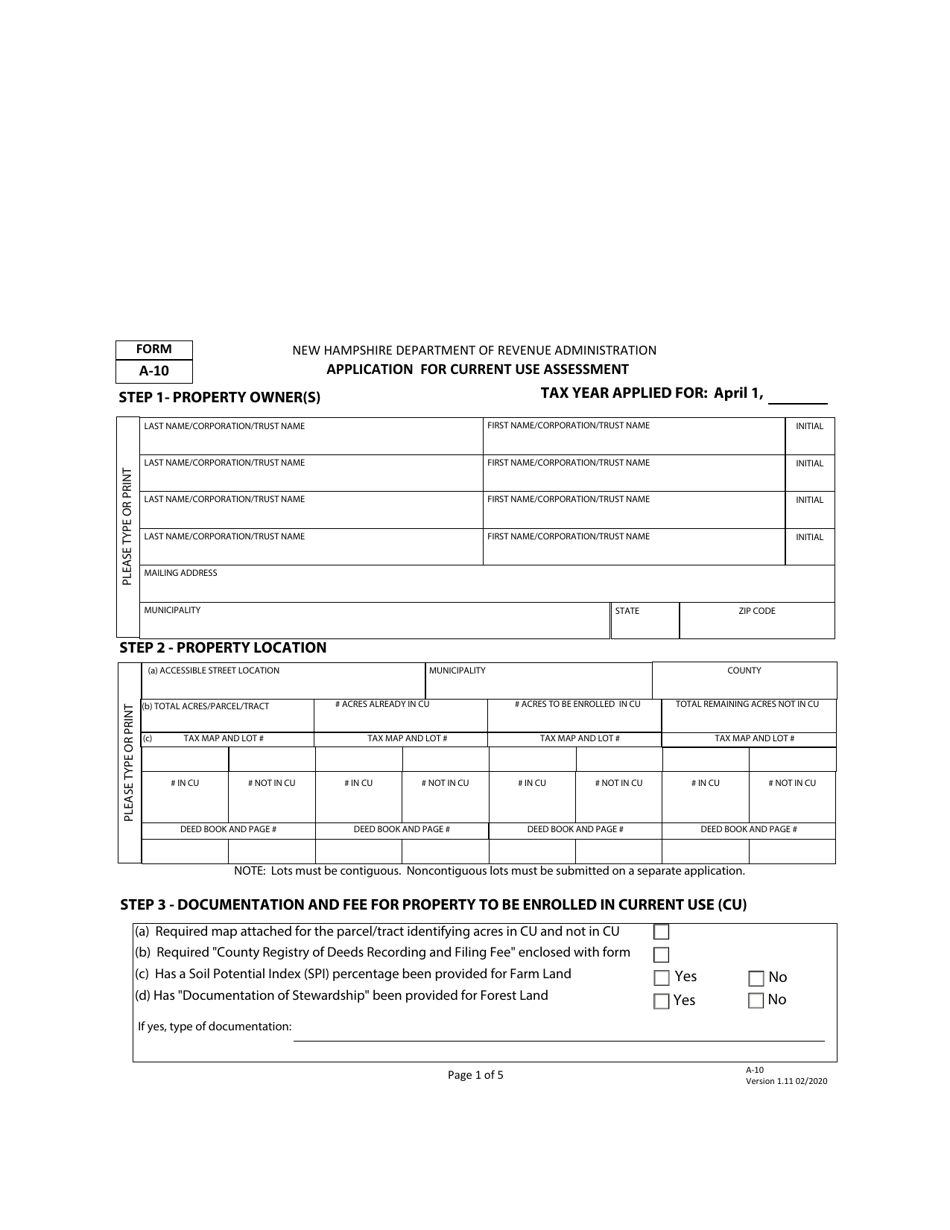

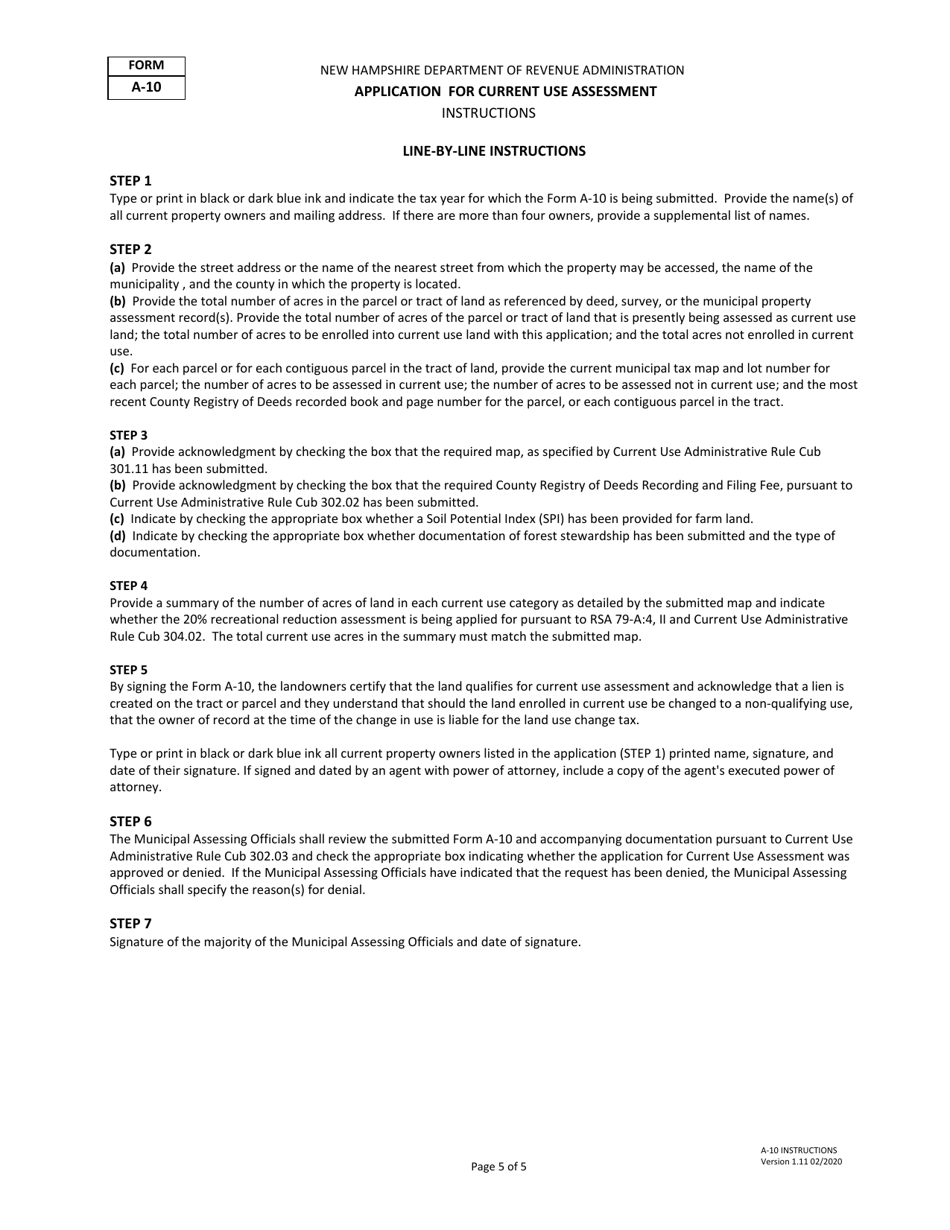

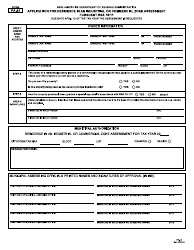

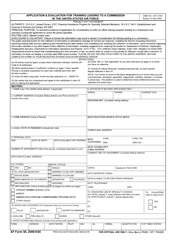

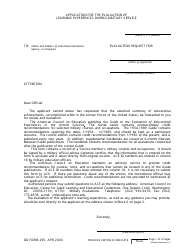

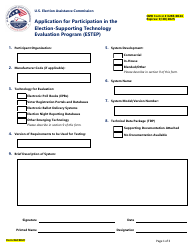

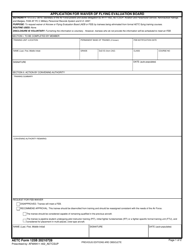

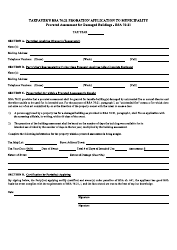

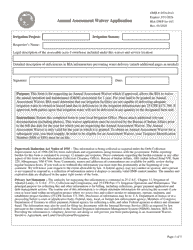

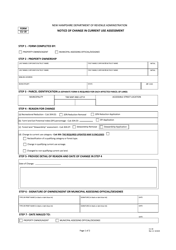

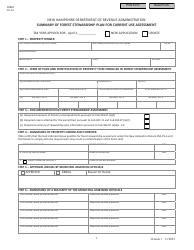

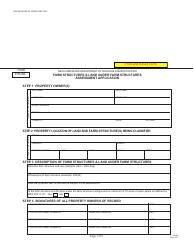

Form A-10 Application for Current Use Assessment - New Hampshire

What Is Form A-10?

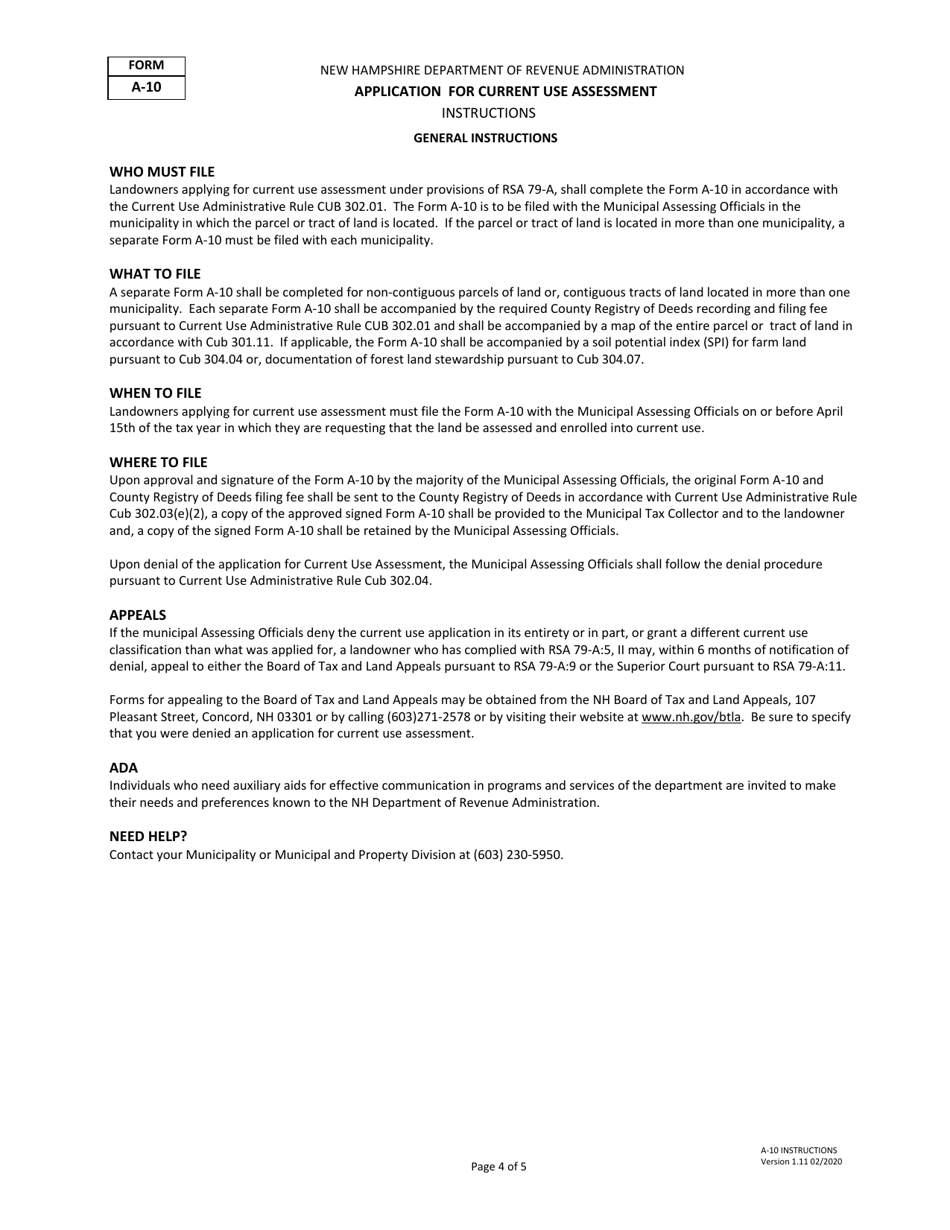

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A-10?

A: Form A-10 is the application for Current Use Assessment in New Hampshire.

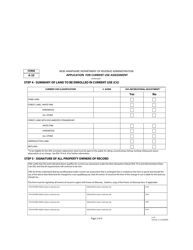

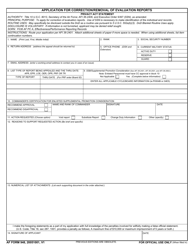

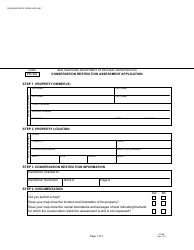

Q: What is Current Use Assessment?

A: Current Use Assessment is a tax program that provides property tax relief for qualifying landowners in New Hampshire.

Q: Who is eligible for Current Use Assessment?

A: Landowners who meet certain criteria are eligible for Current Use Assessment.

Q: What is the purpose of Form A-10?

A: Form A-10 is used to apply for Current Use Assessment and provide information about the property.

Q: When should I submit Form A-10?

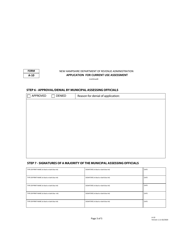

A: Form A-10 should be submitted to the assessing officials in the municipality where the property is located.

Q: What information is required on Form A-10?

A: Form A-10 requires information about the property, including owner's name, address, and parcel ID, as well as details about the land's current use.

Q: Are there any deadlines for submitting Form A-10?

A: Yes, the deadline for submitting Form A-10 is April 15th of each year.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-10 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.