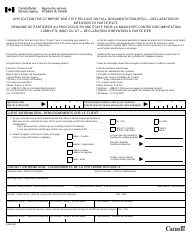

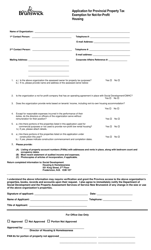

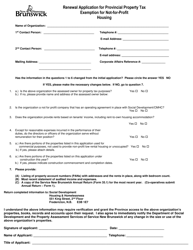

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

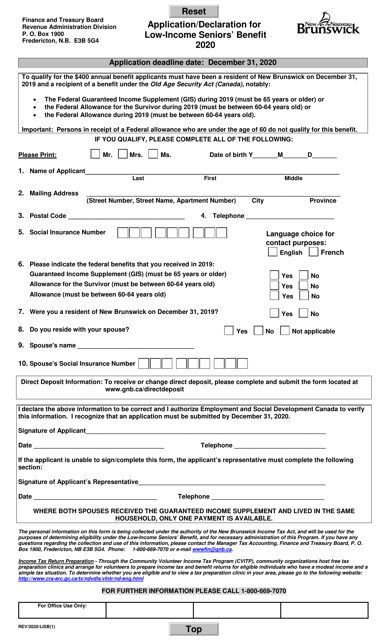

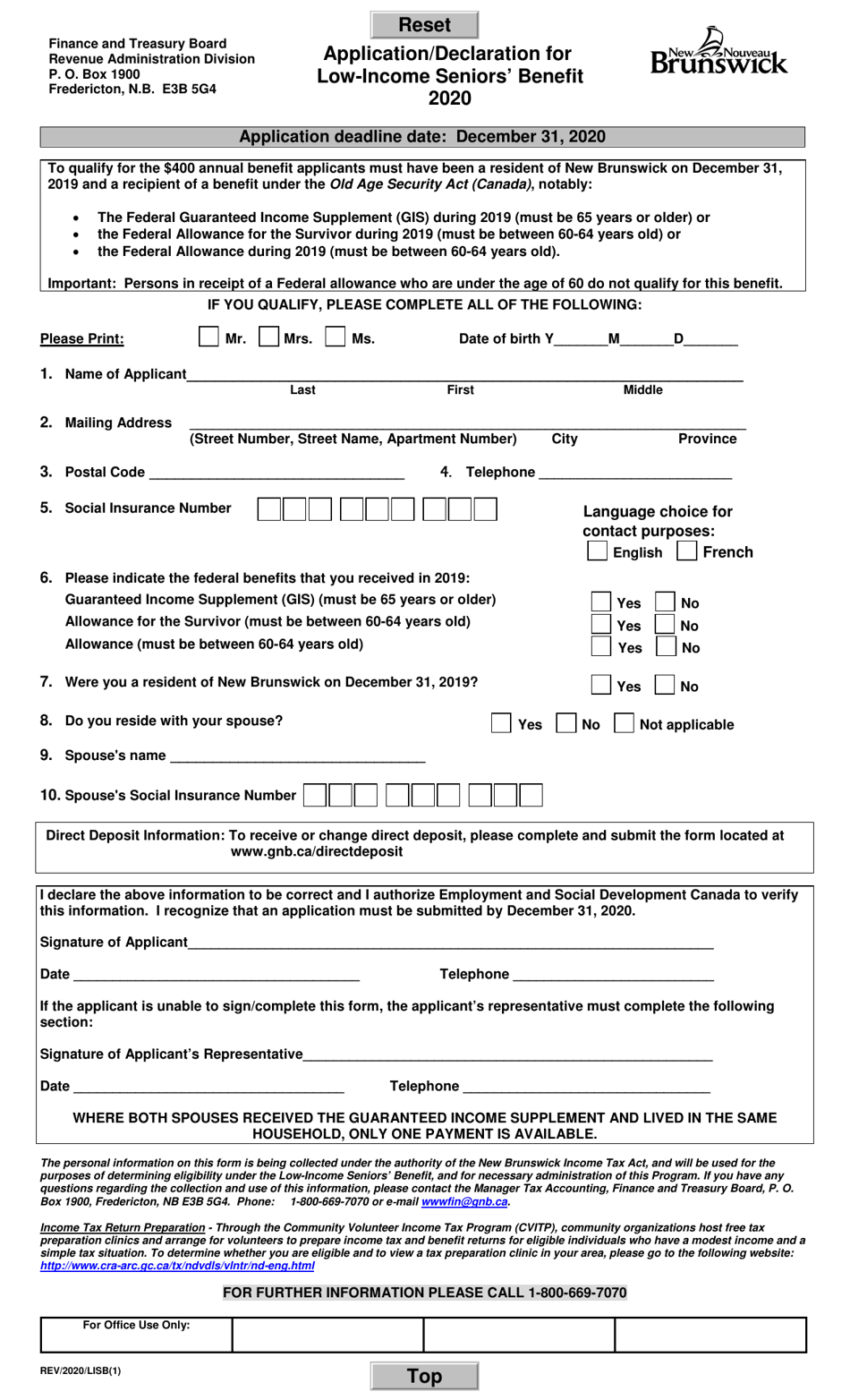

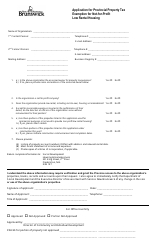

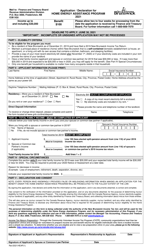

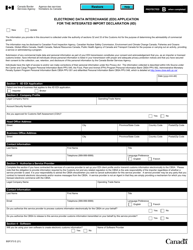

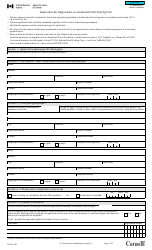

Application / Declaration for Low-Income Seniors' Benefit - New Brunswick, Canada

The Application/Declaration for Low-Income Seniors' Benefit in New Brunswick, Canada is a form that allows low-income seniors to apply for financial assistance from the government. It is designed to help eligible seniors cover living expenses and improve their quality of life.

The Low-Income Seniors' Benefit application in New Brunswick, Canada, is typically filed by the eligible seniors themselves.

FAQ

Q: What is the Low-Income Seniors' Benefit?

A: The Low-Income Seniors' Benefit is a program in New Brunswick, Canada that provides financial assistance to low-income seniors.

Q: Who is eligible for the Low-Income Seniors' Benefit?

A: To be eligible for the Low-Income Seniors' Benefit, you must be a resident of New Brunswick, Canada, and meet certain income and age requirements.

Q: How can I apply for the Low-Income Seniors' Benefit?

A: You can apply for the Low-Income Seniors' Benefit by completing the application form and submitting it to the Department of Finance in New Brunswick.

Q: What documents do I need to include with my application?

A: You may need to include documents such as proof of income, proof of age, and proof of residency with your application for the Low-Income Seniors' Benefit.

Q: How much financial assistance does the Low-Income Seniors' Benefit provide?

A: The amount of financial assistance provided by the Low-Income Seniors' Benefit varies depending on your income and age. It is paid out annually.

Q: When will I receive the Low-Income Seniors' Benefit payment?

A: The payment for the Low-Income Seniors' Benefit is usually made in July of each year.

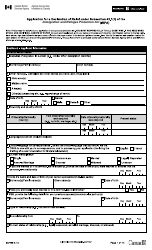

Q: Can I receive the Low-Income Seniors' Benefit if I already receive other government benefits?

A: Yes, you may still be eligible for the Low-Income Seniors' Benefit even if you receive other government benefits. However, the amount you receive may be affected.

Q: Is the Low-Income Seniors' Benefit taxable?

A: No, the Low-Income Seniors' Benefit is non-taxable.

Q: Is the Low-Income Seniors' Benefit available in other provinces?

A: No, the Low-Income Seniors' Benefit is specific to New Brunswick and is not available in other provinces of Canada.