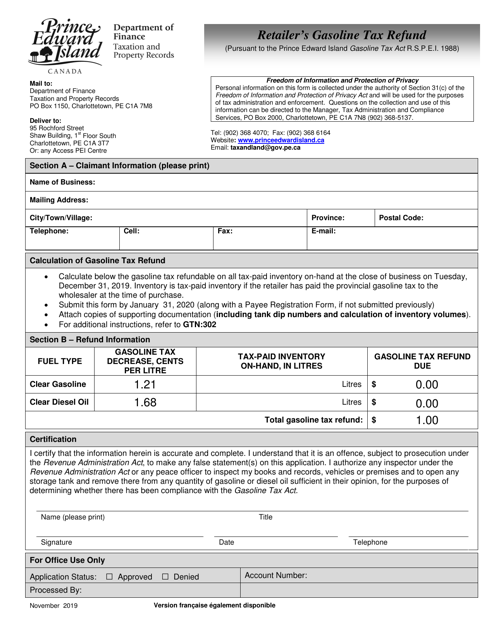

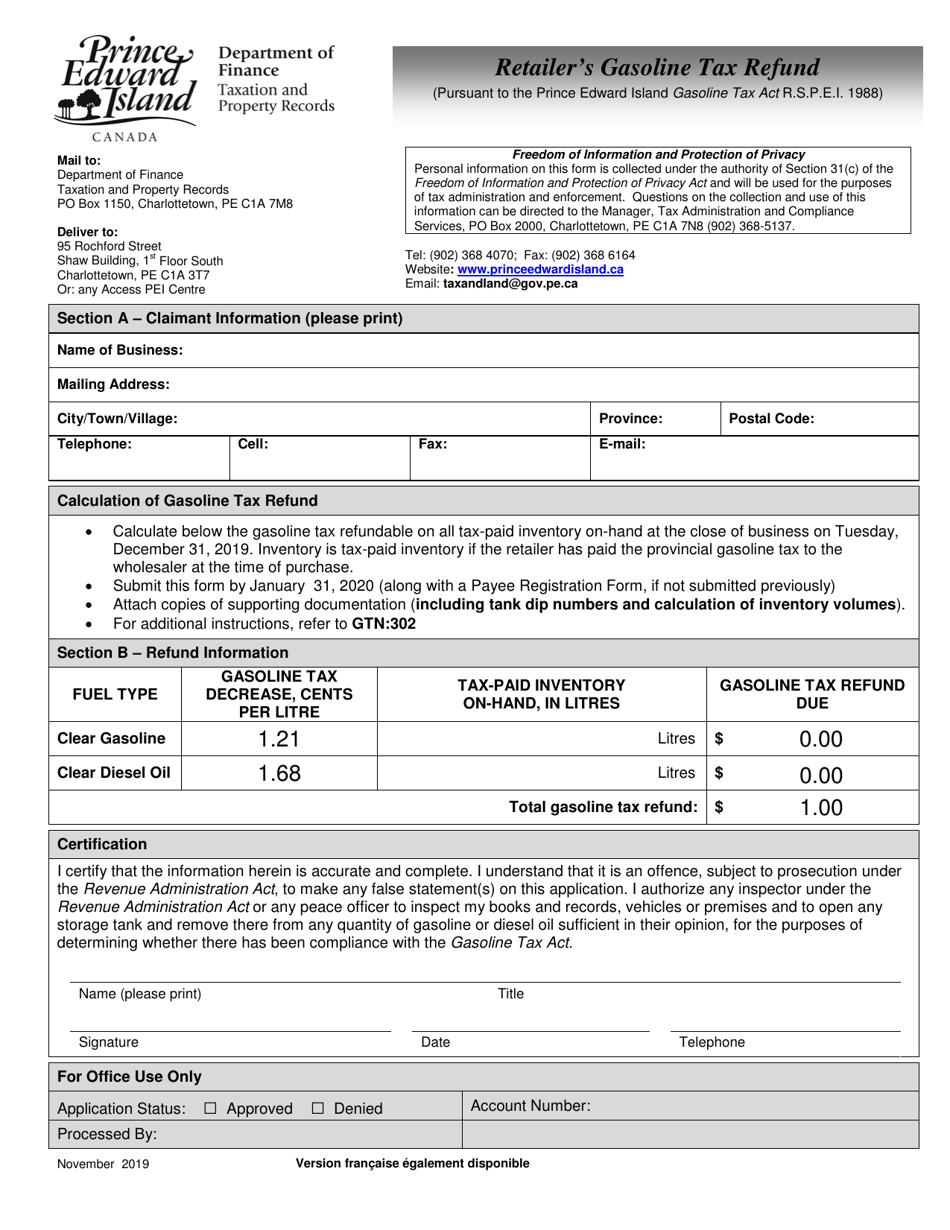

Retailer's Gasoline Tax Refund - Prince Edward Island, Canada

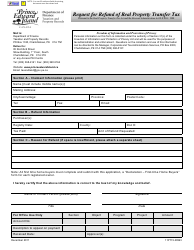

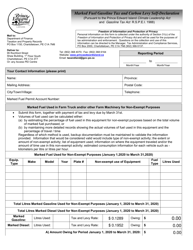

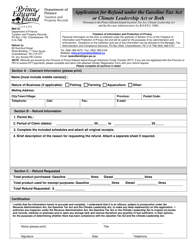

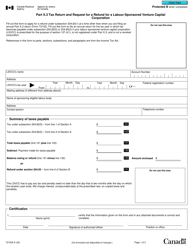

The Retailer's Gasoline Tax Refund in Prince Edward Island, Canada is a program that allows retailers to claim a refund on the gasoline tax they have paid. This program is intended to support and benefit retailers by reducing their costs.

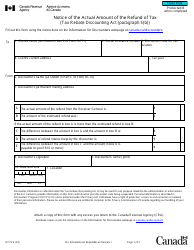

The retailer files the gasoline tax refund in Prince Edward Island, Canada.

FAQ

Q: What is the retailer's gasoline tax refund in Prince Edward Island?

A: The retailer's gasoline tax refund is a program in Prince Edward Island, Canada that allows retailers to claim a refund on the gasoline taxes they have paid.

Q: Who is eligible for the retailer's gasoline tax refund in Prince Edward Island?

A: Retailers in Prince Edward Island who sell gasoline are eligible for the refund.

Q: How does the retailer's gasoline tax refund work?

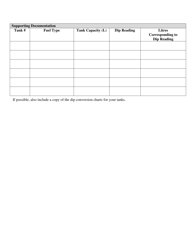

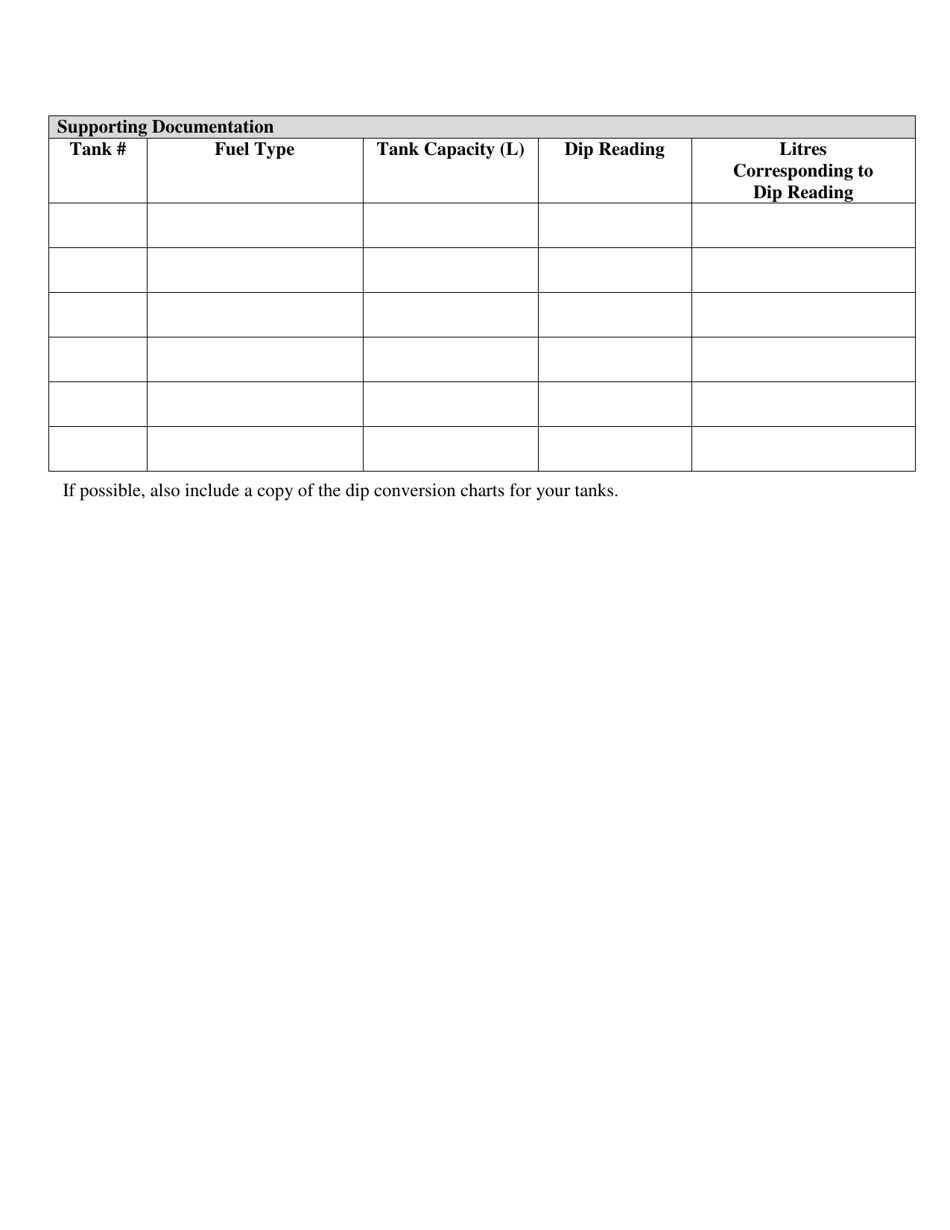

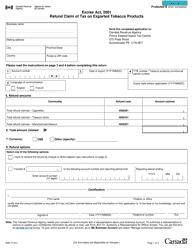

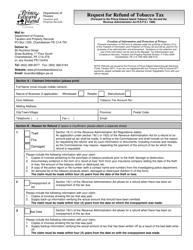

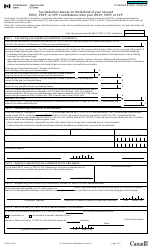

A: Retailers can apply for a refund of the gasoline taxes they have paid by following the guidelines and submitting the necessary documentation.

Q: What is the purpose of the retailer's gasoline tax refund?

A: The purpose of the refund is to provide financial relief to retailers who sell gasoline by allowing them to recover some of the taxes they have paid.

Q: Are there any restrictions or limitations on the retailer's gasoline tax refund in Prince Edward Island?

A: Yes, there are certain restrictions and limitations on the refund, such as the requirement to submit the application within a specific timeframe and providing accurate documentation.