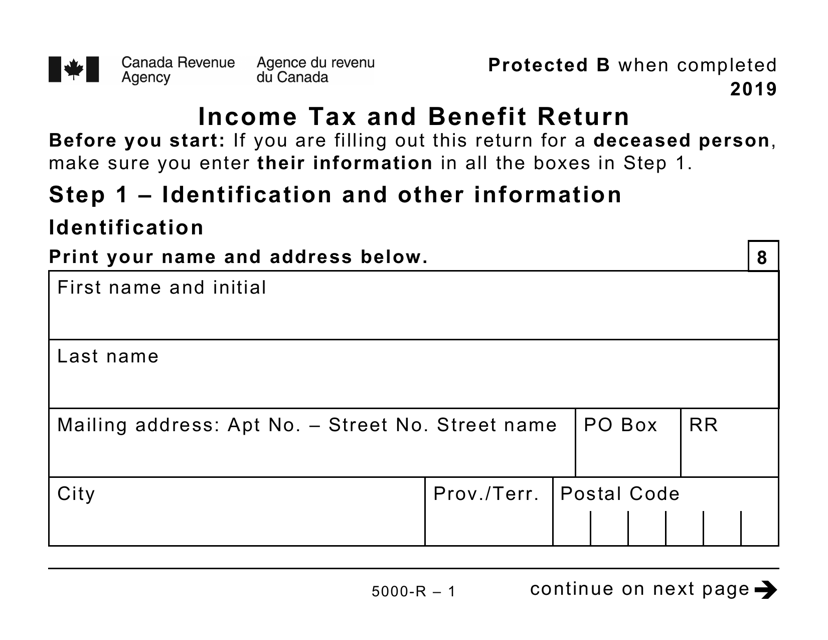

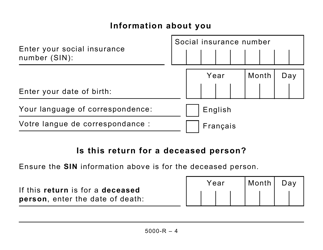

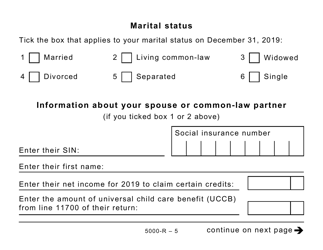

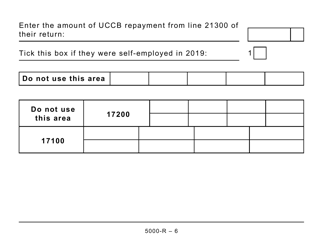

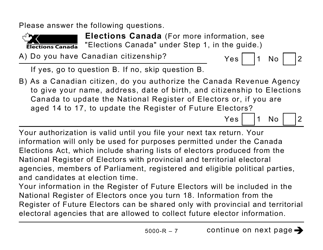

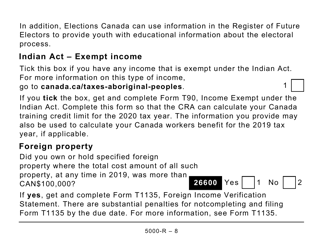

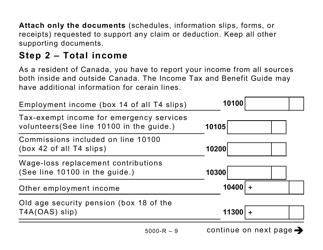

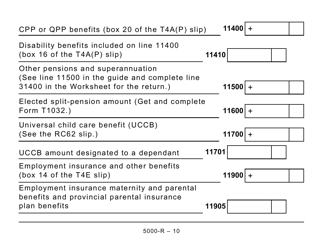

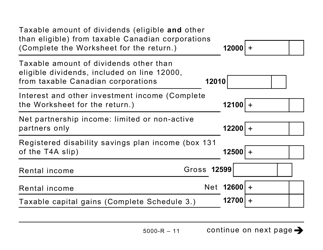

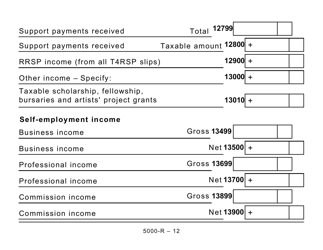

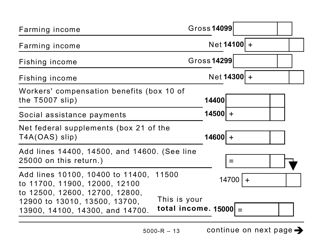

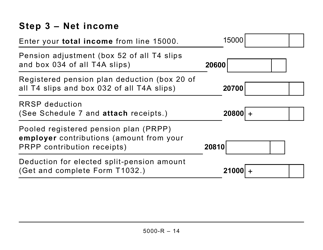

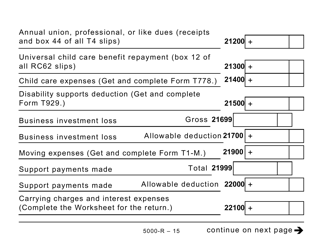

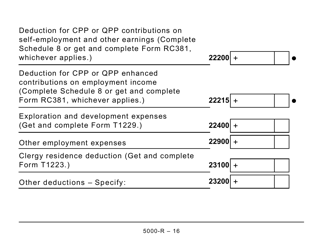

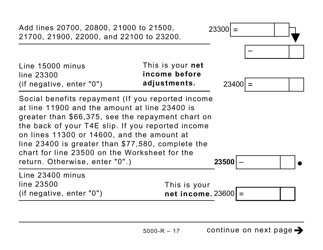

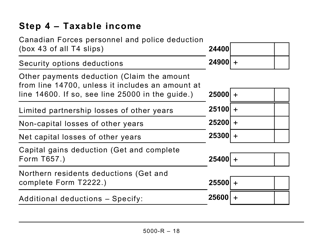

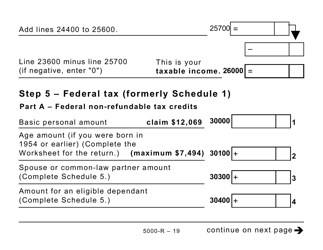

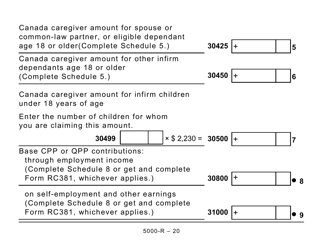

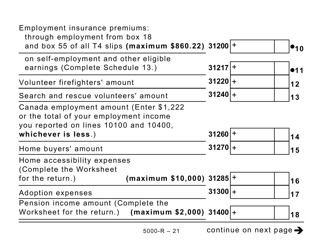

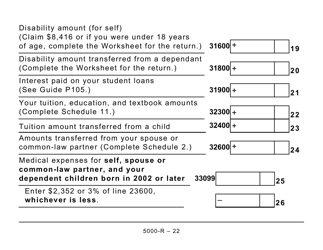

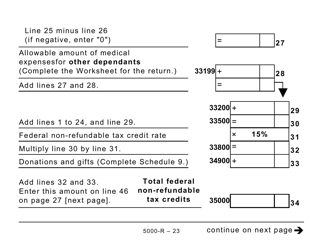

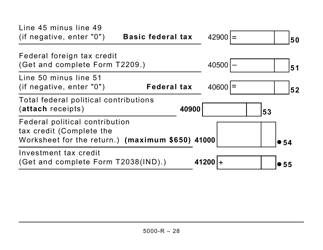

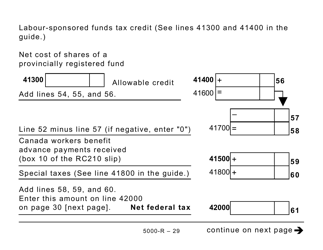

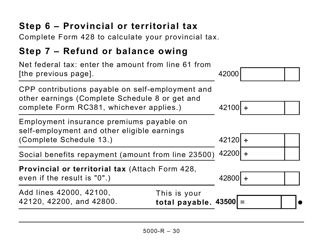

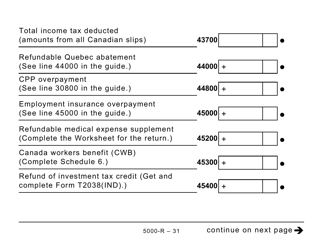

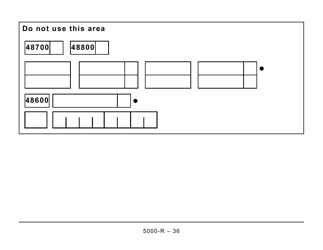

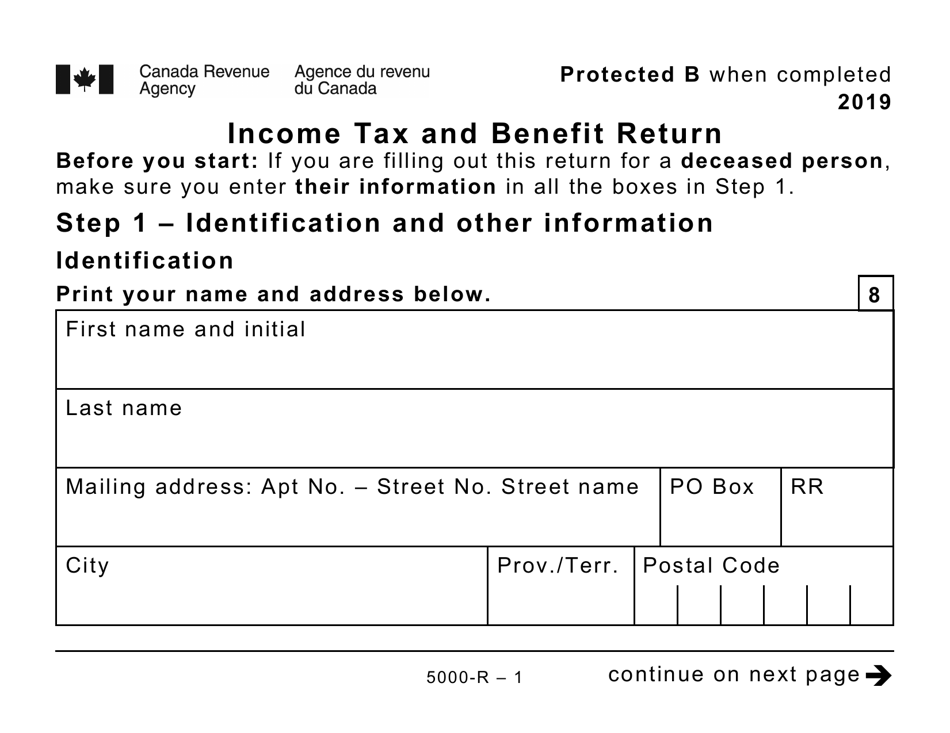

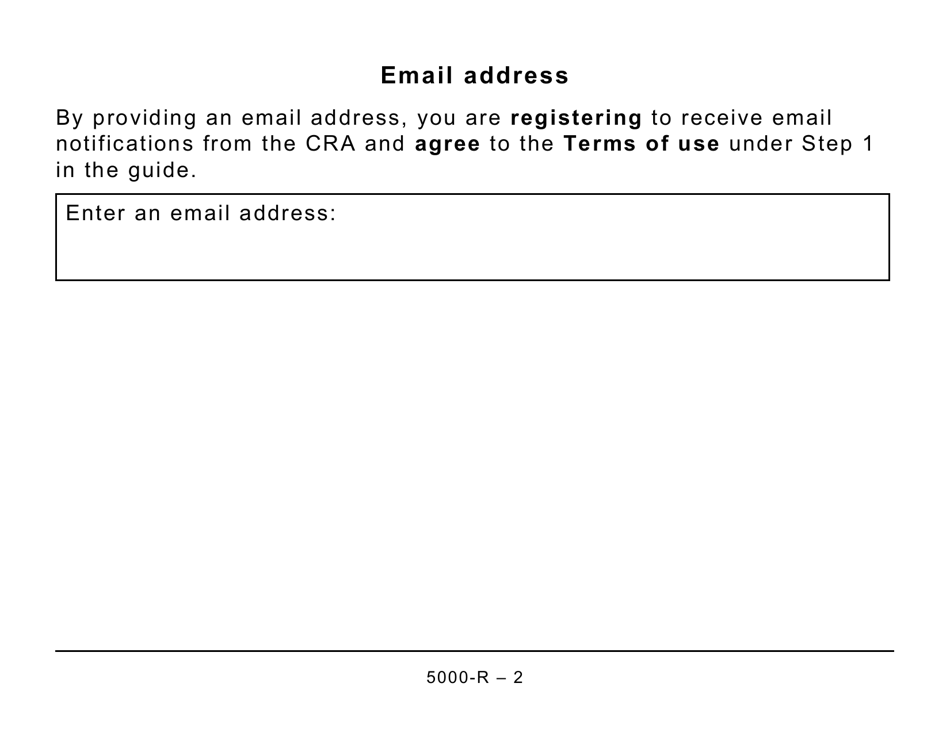

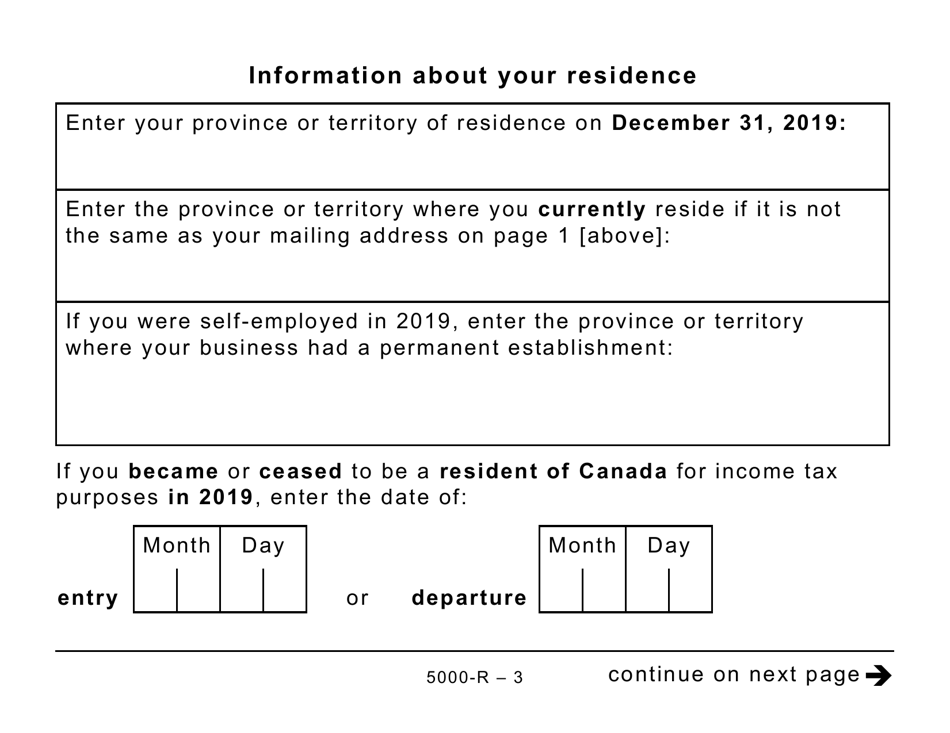

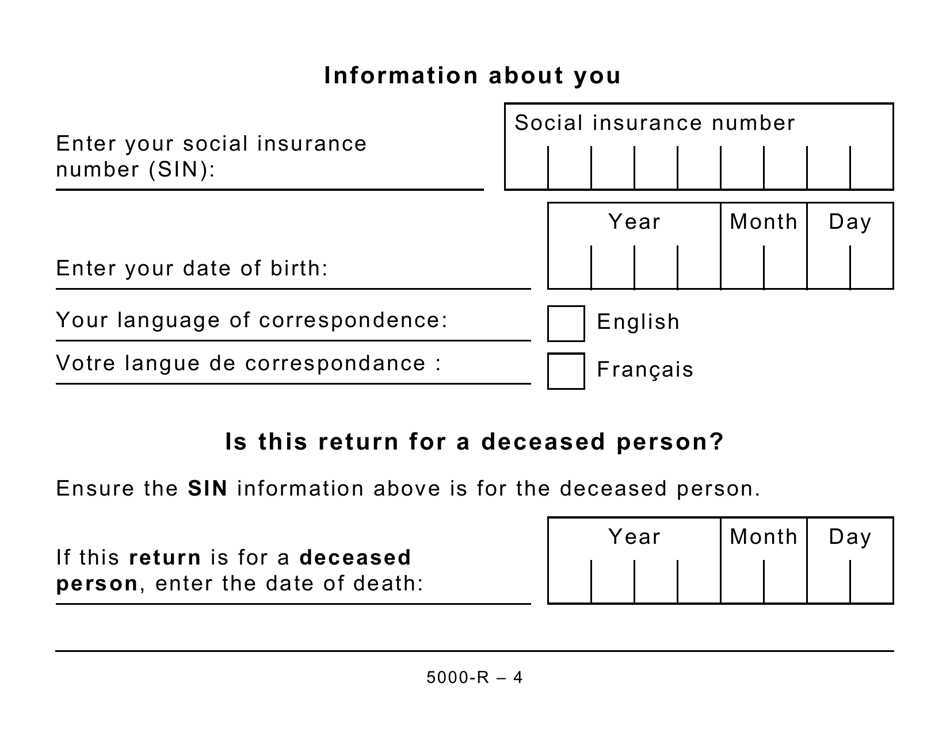

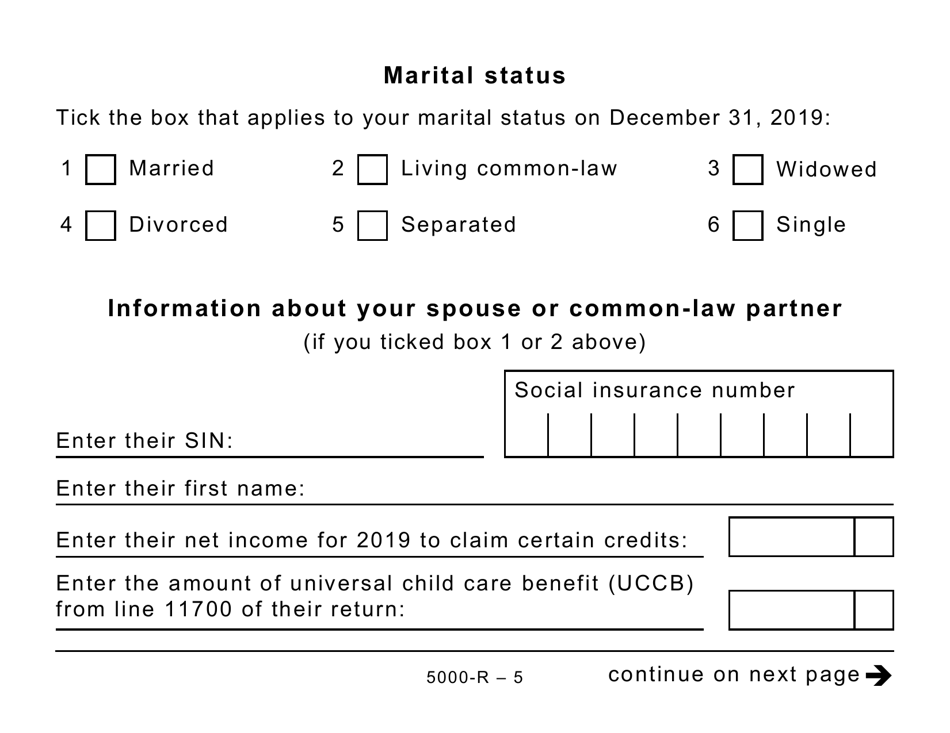

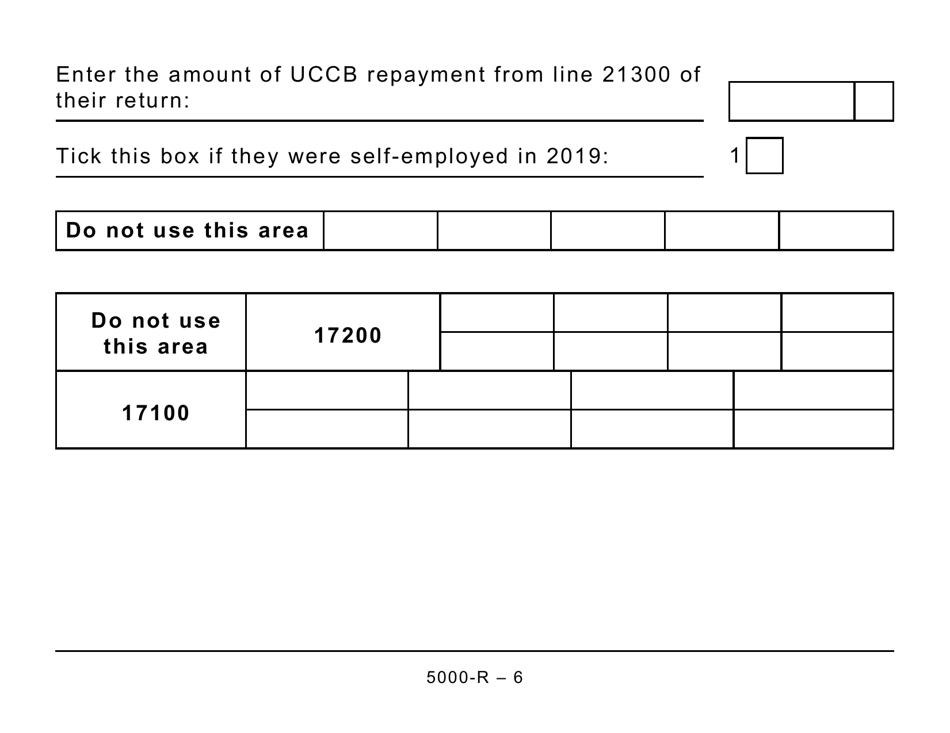

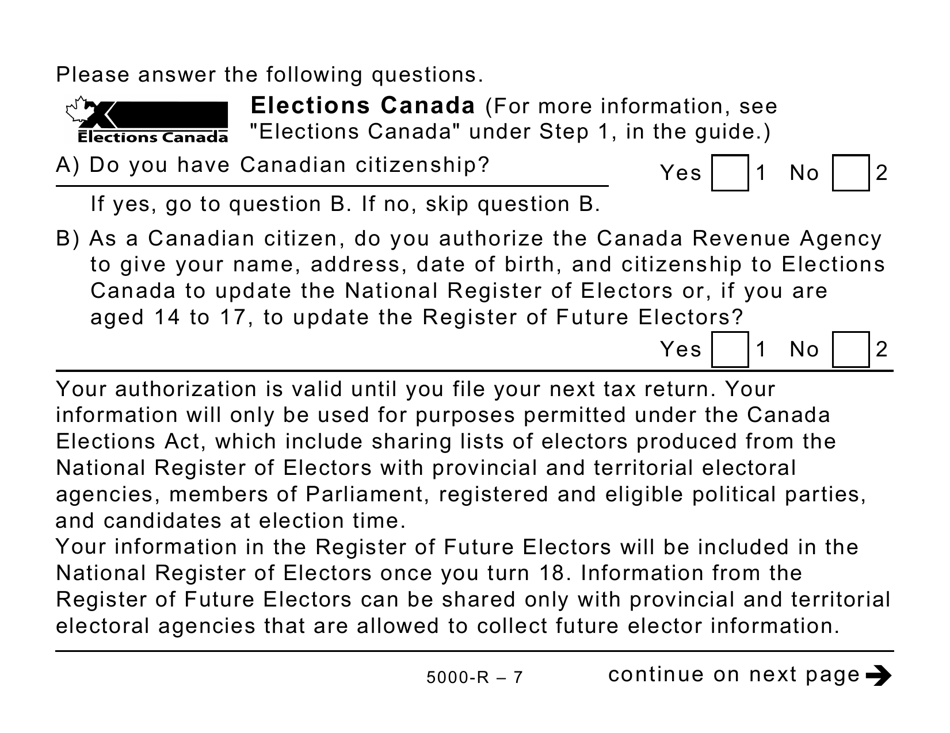

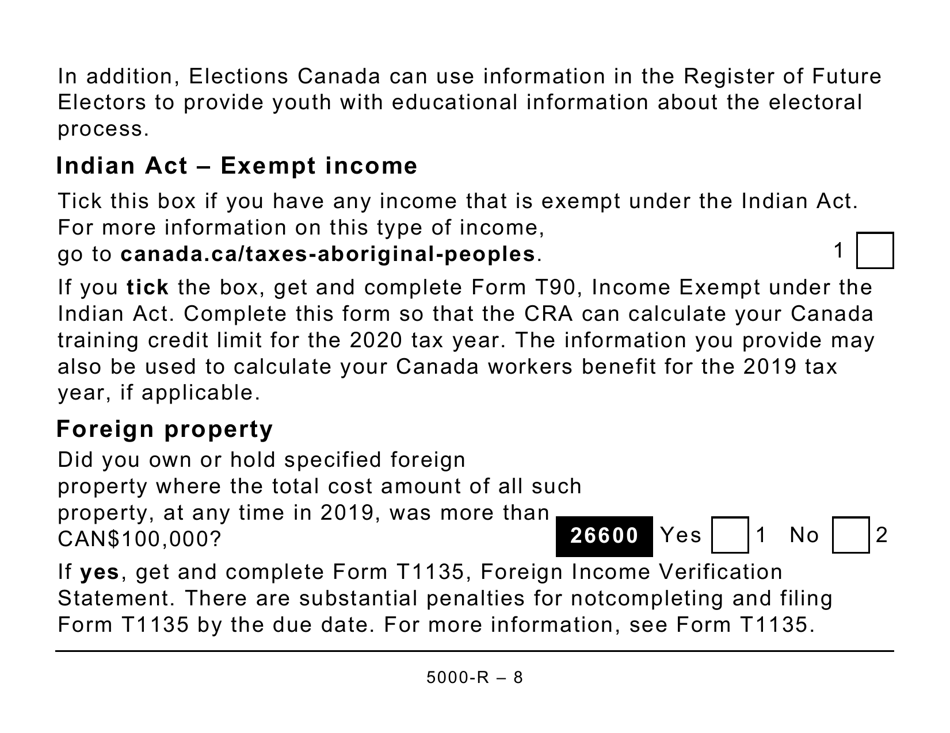

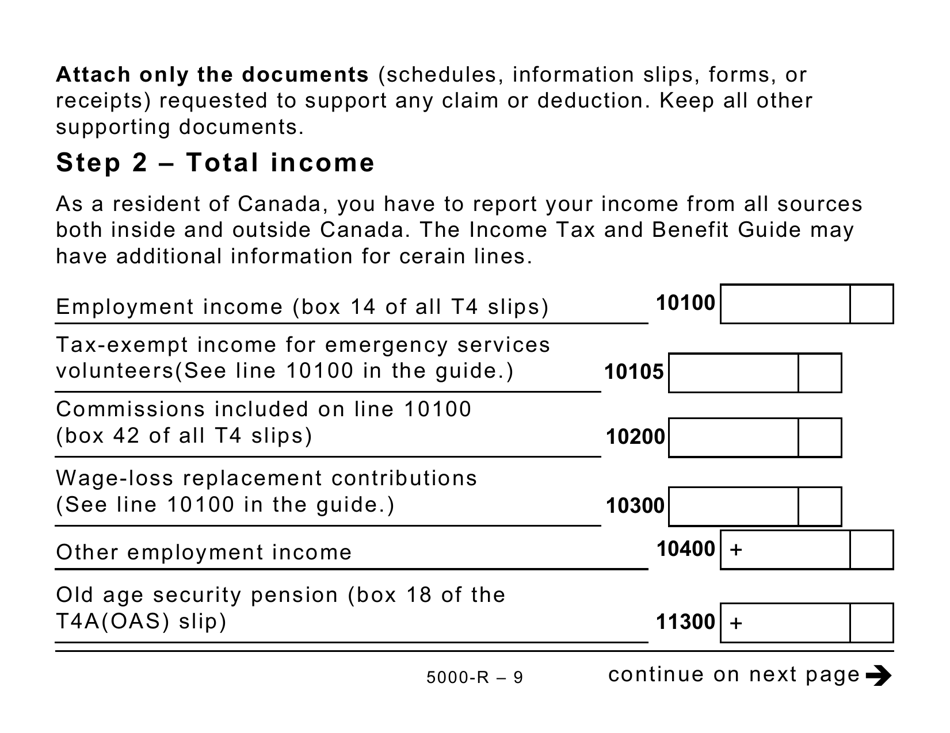

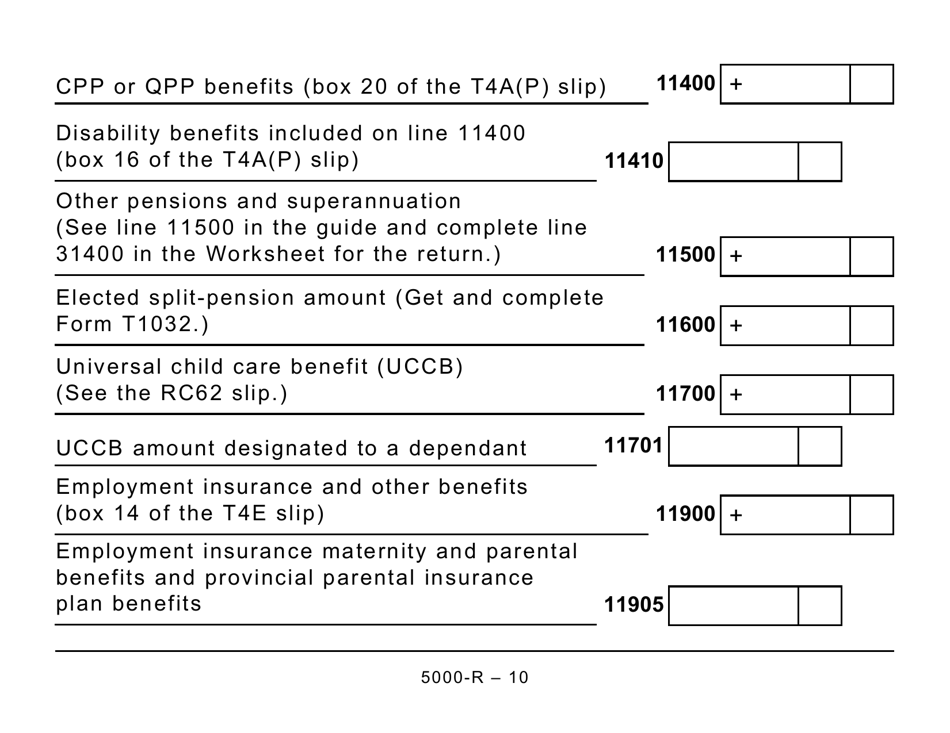

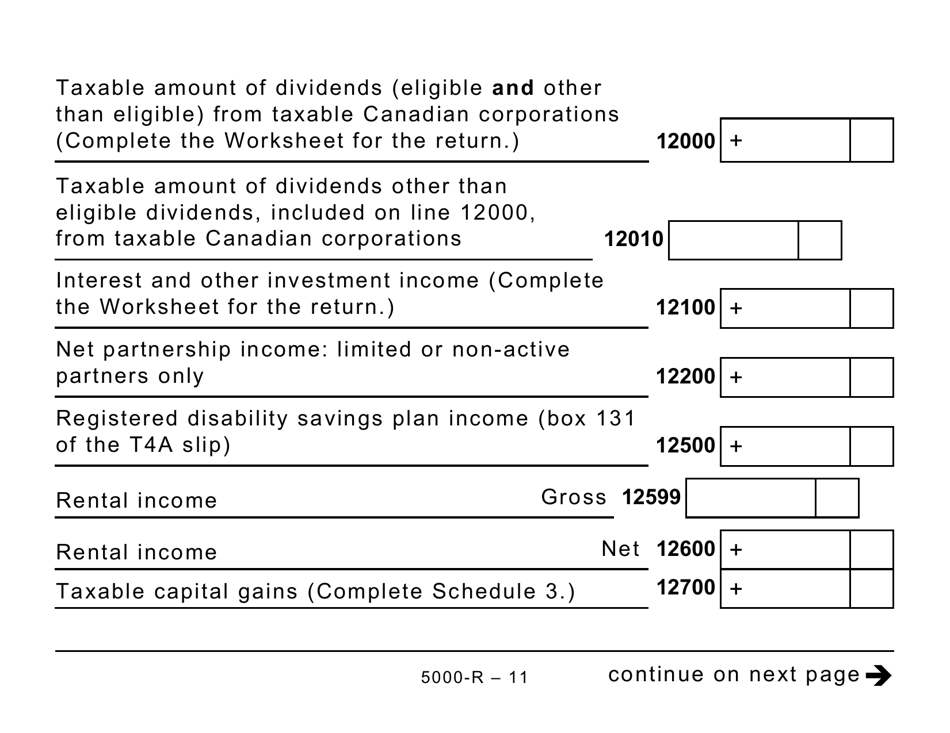

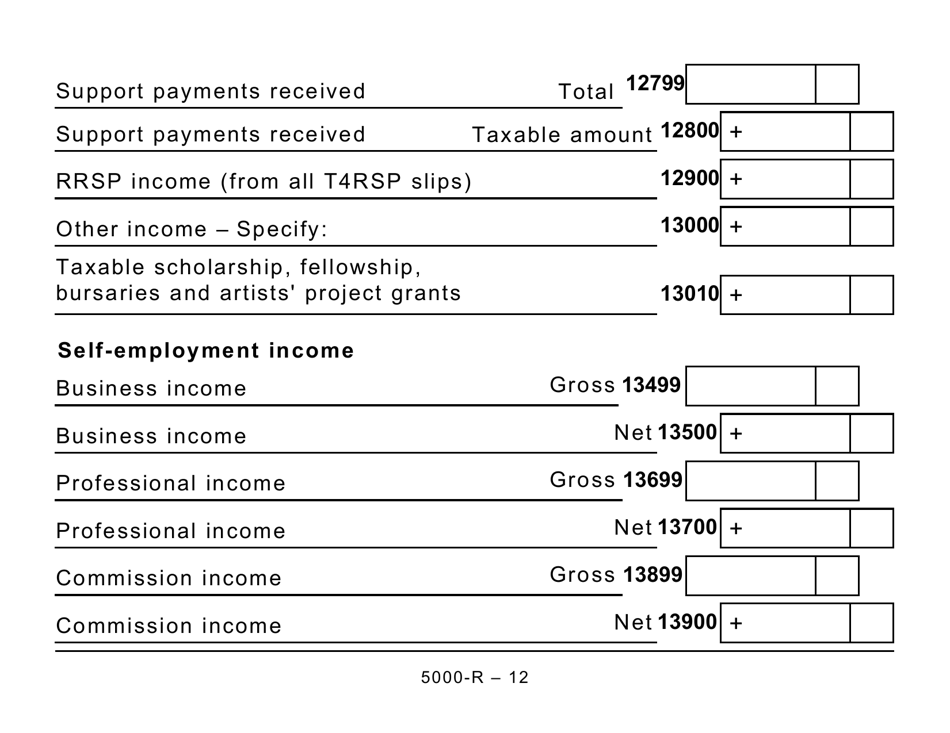

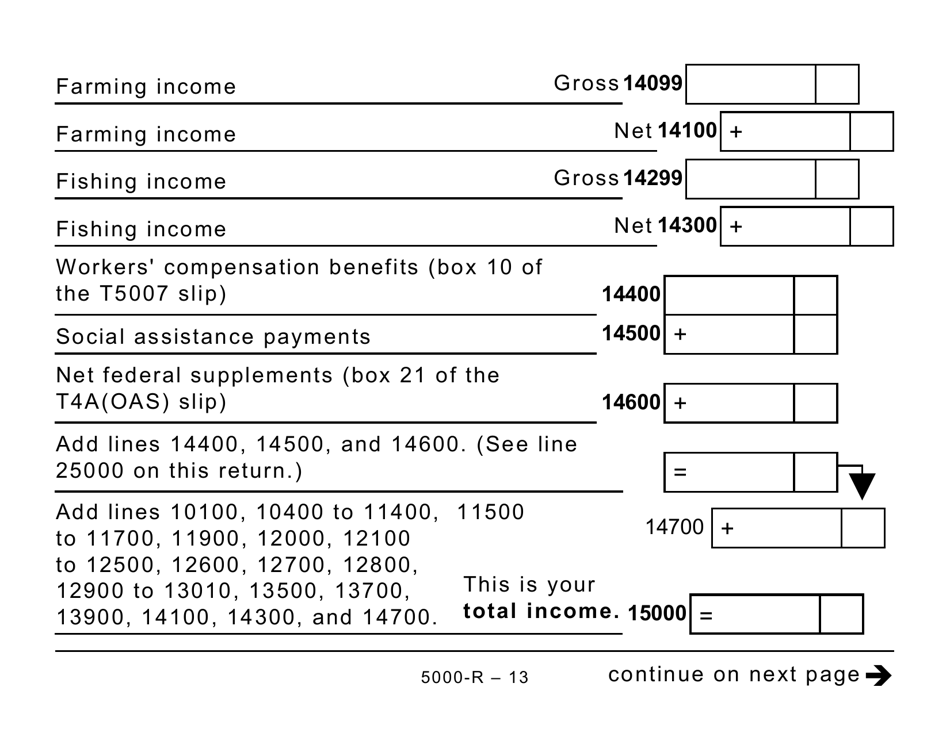

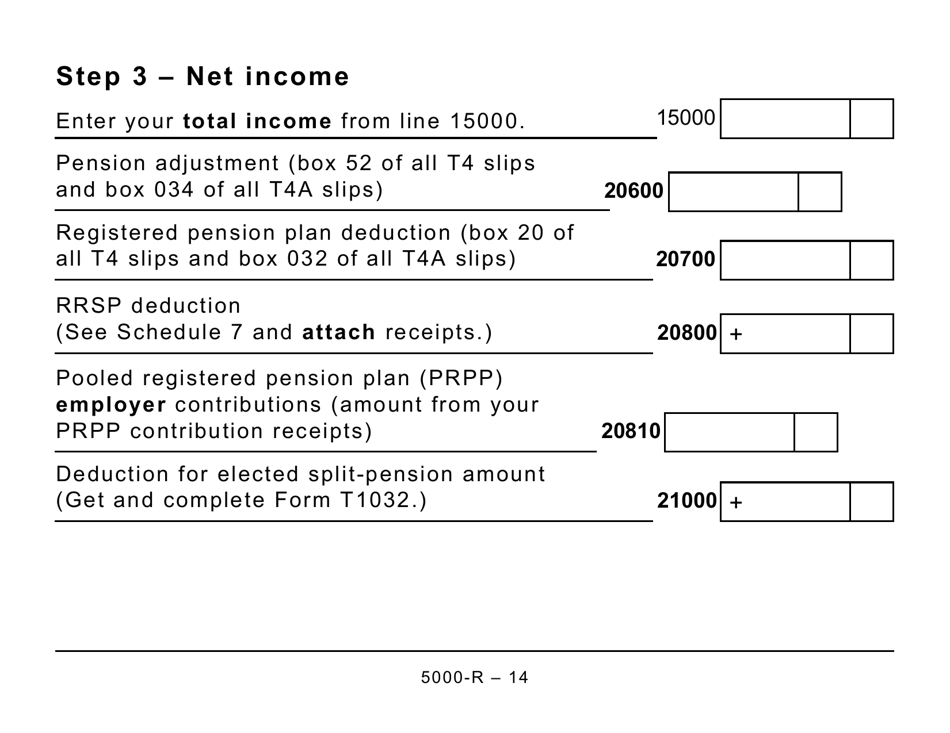

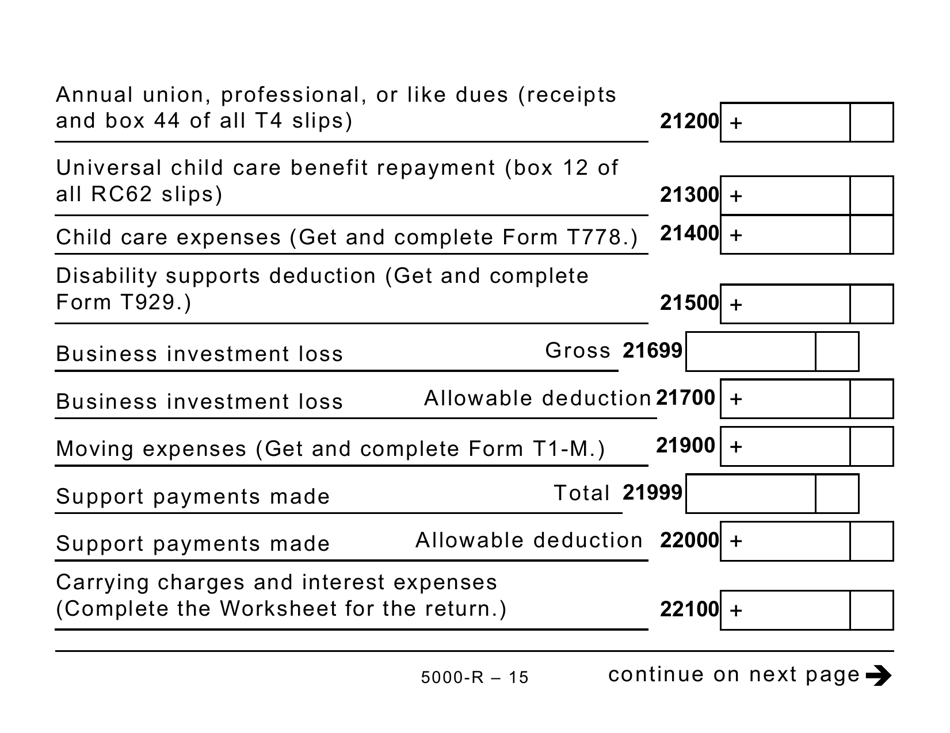

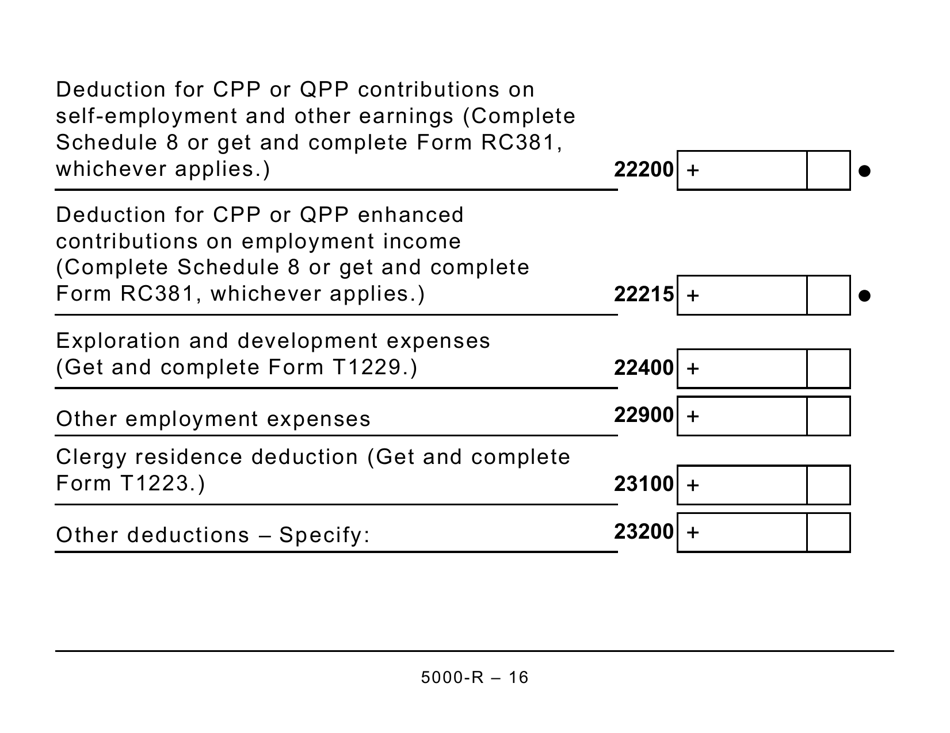

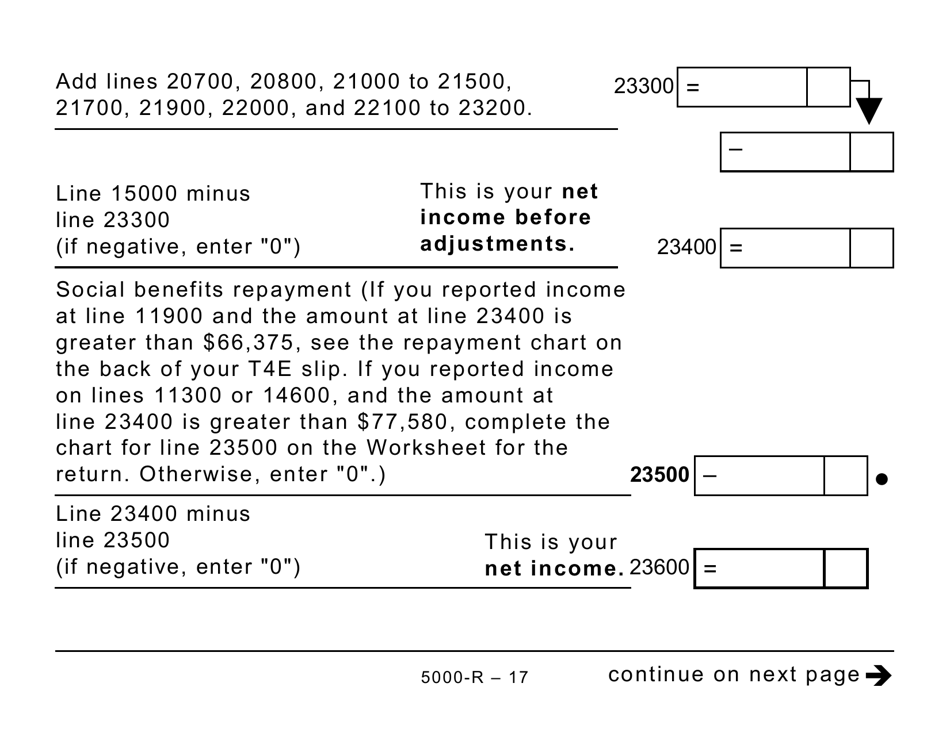

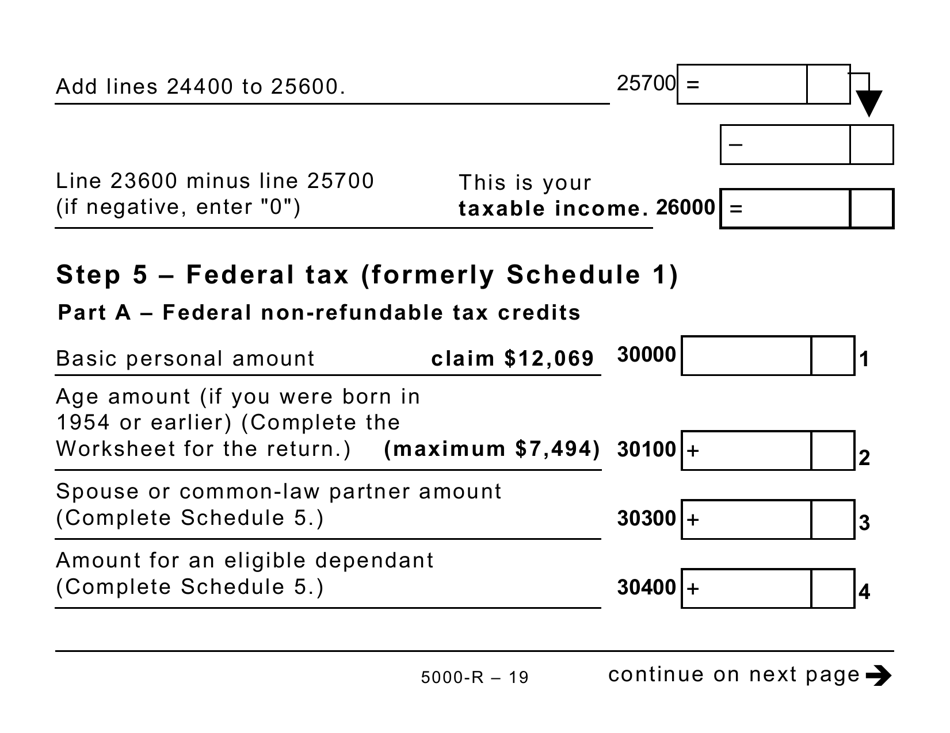

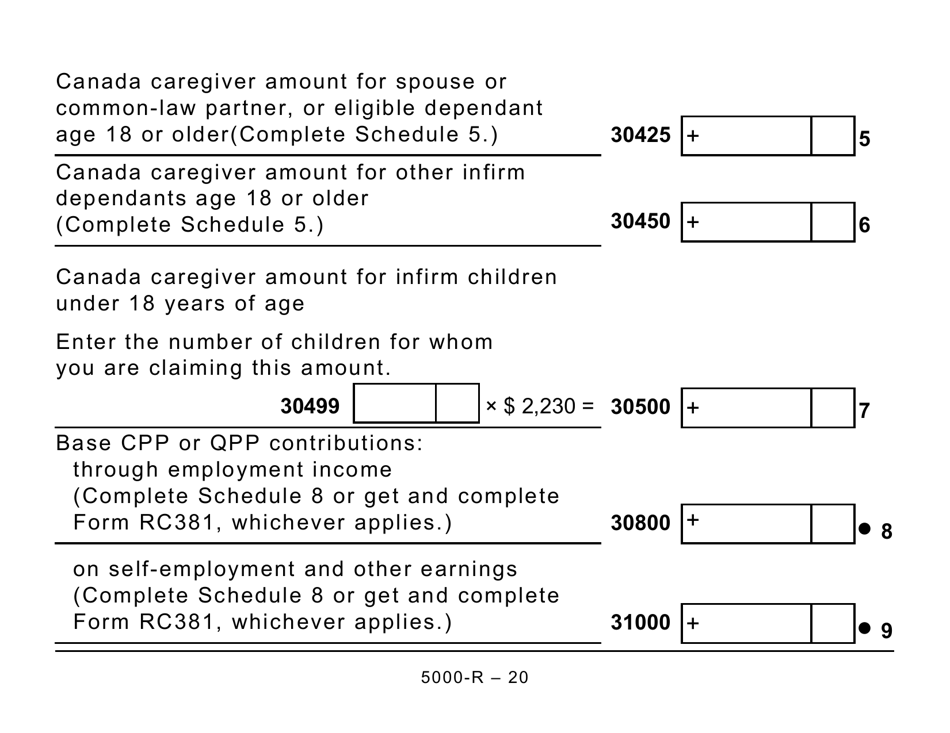

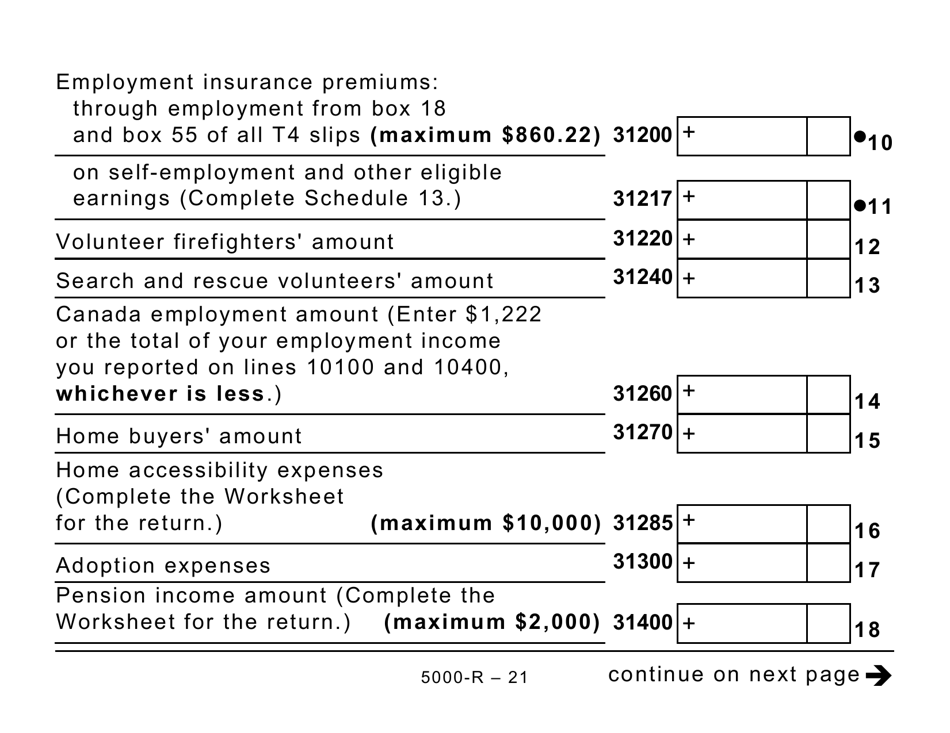

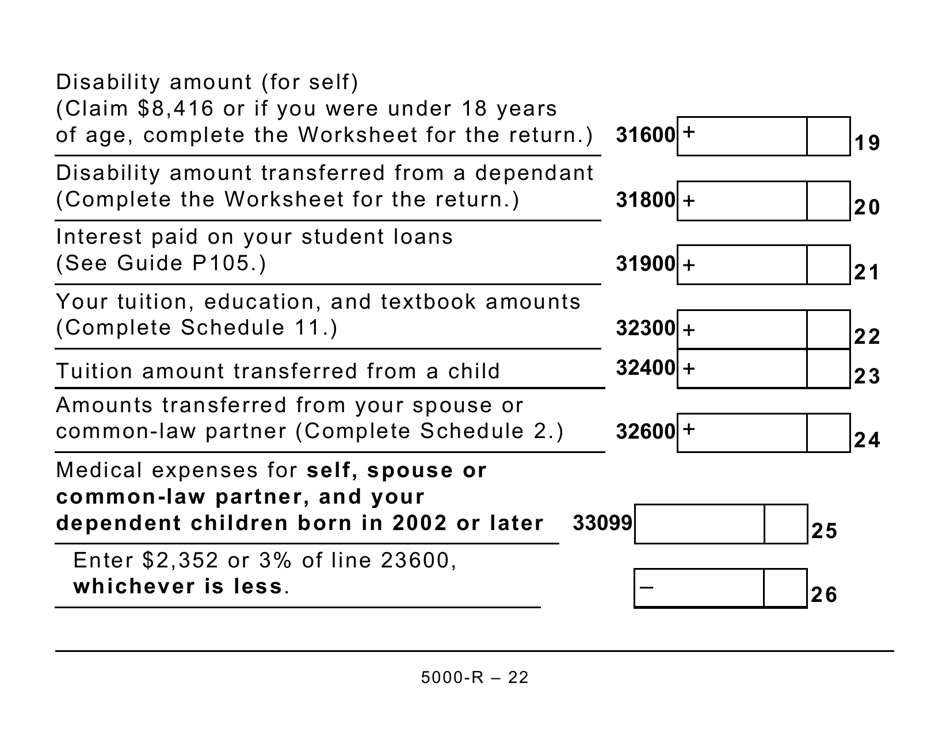

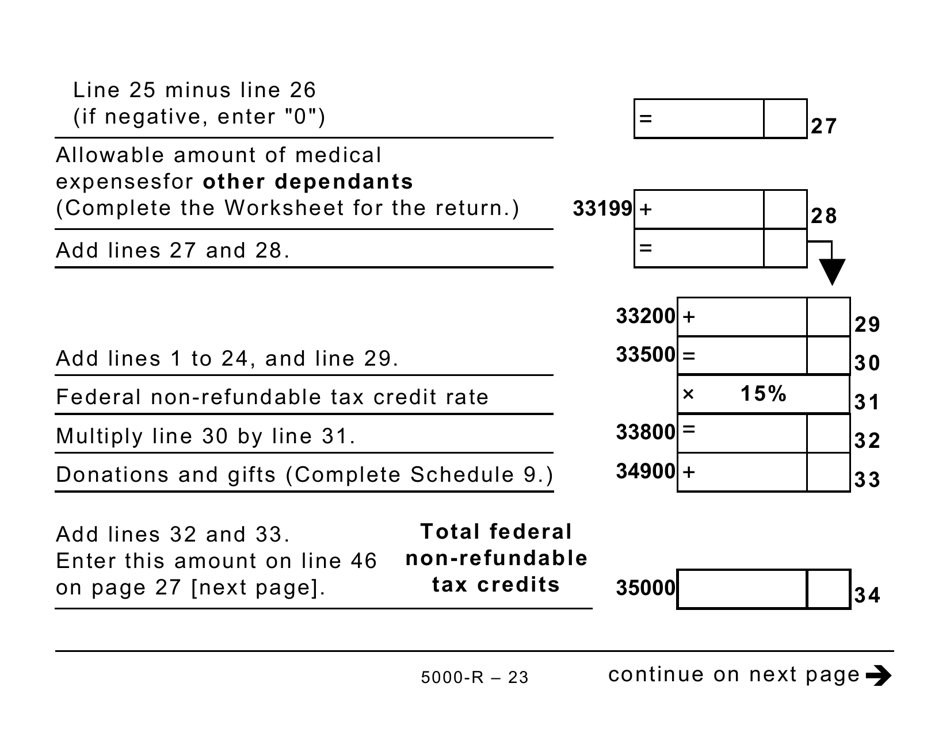

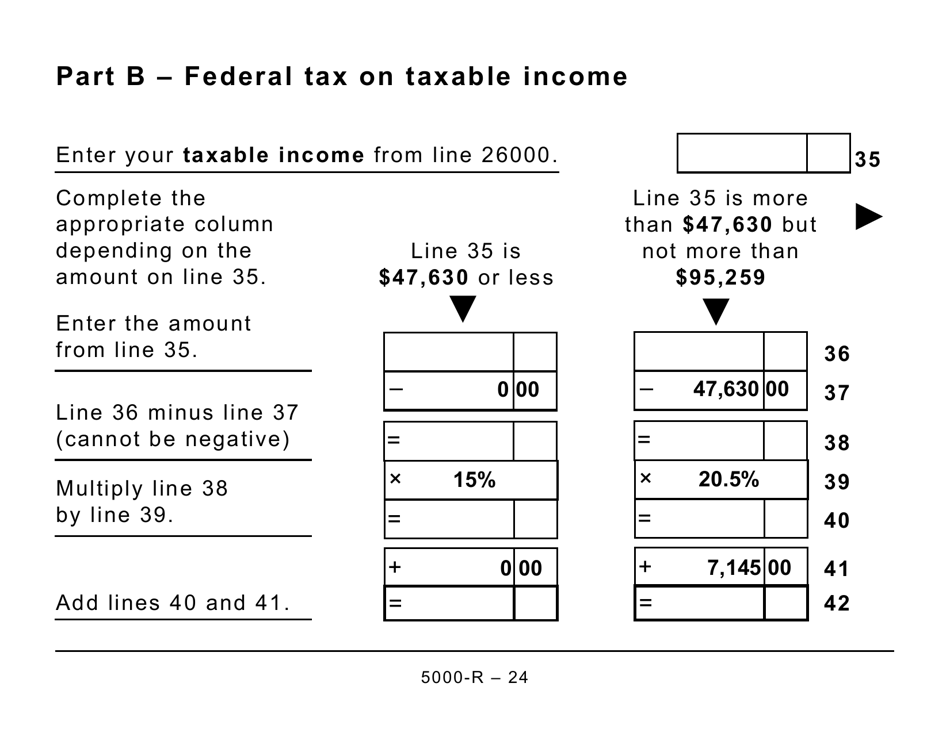

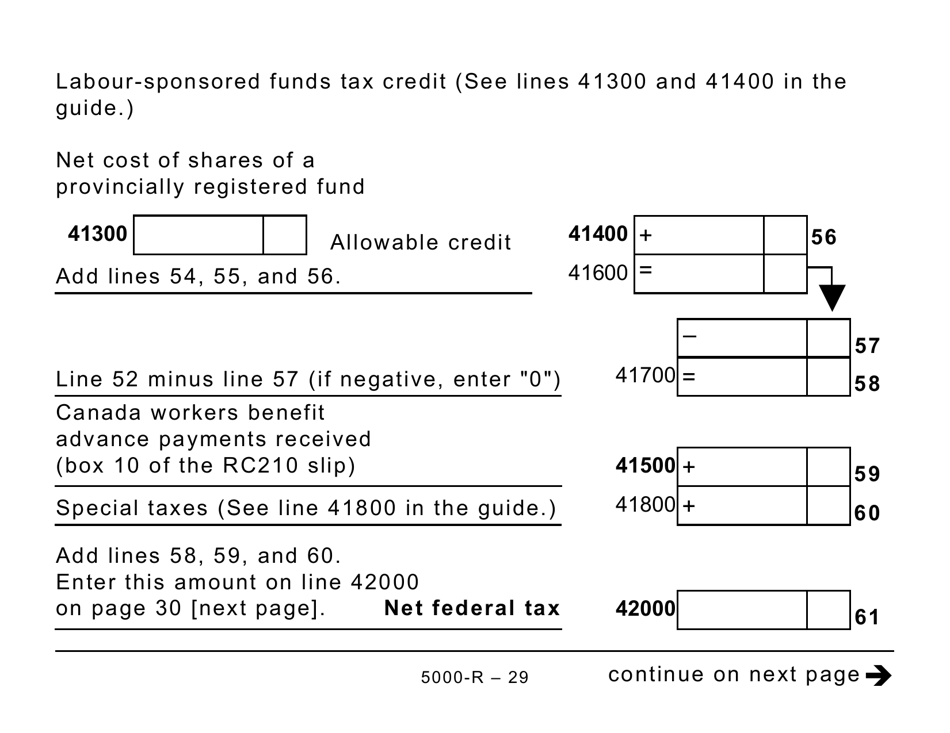

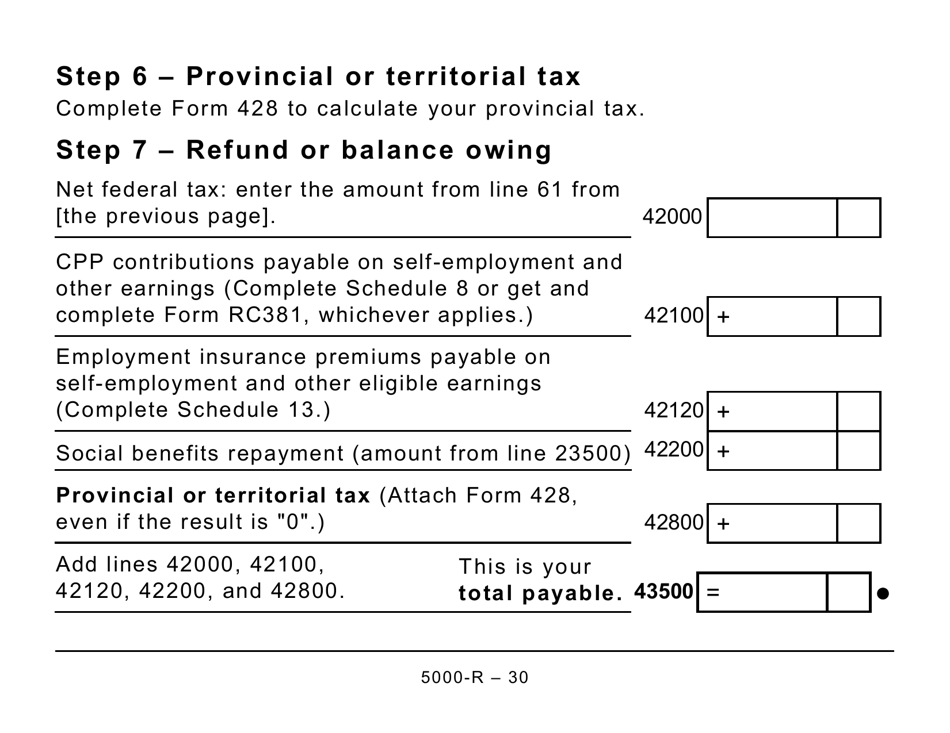

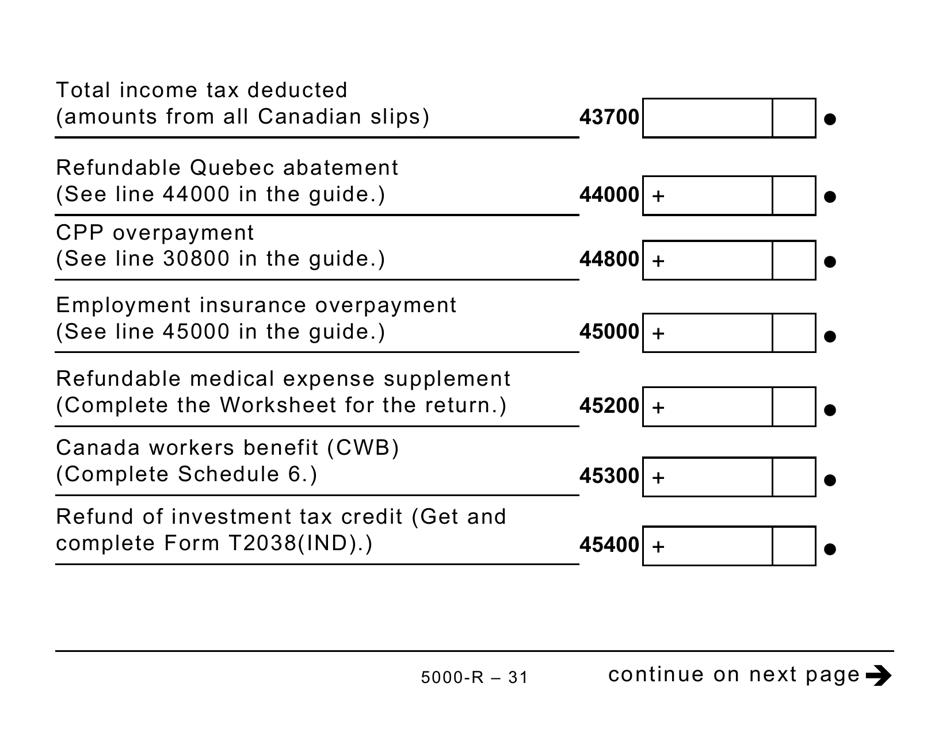

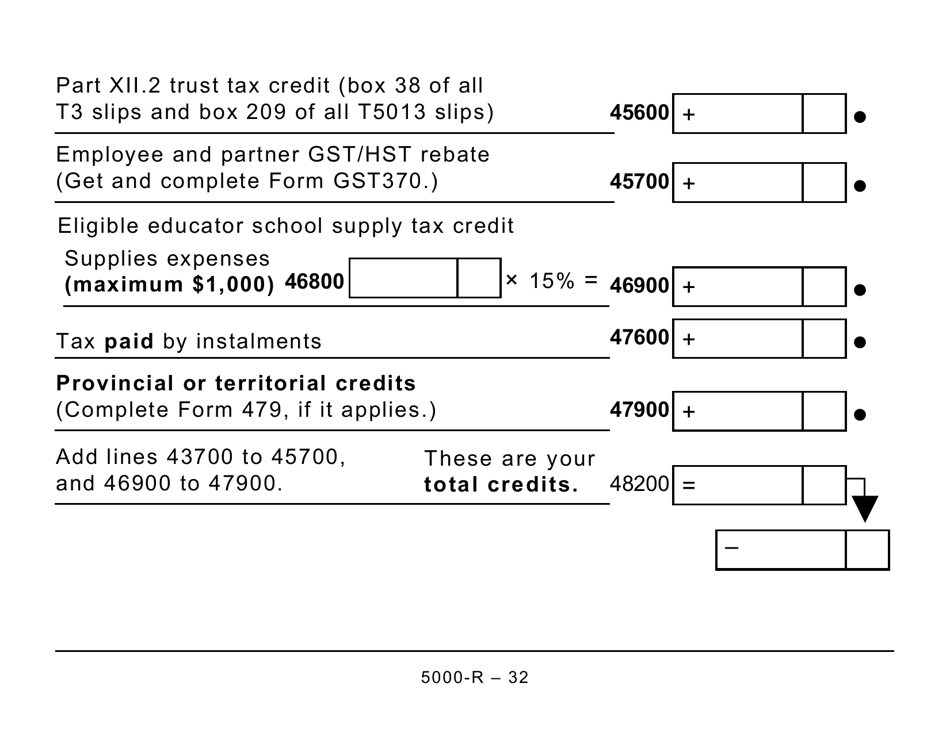

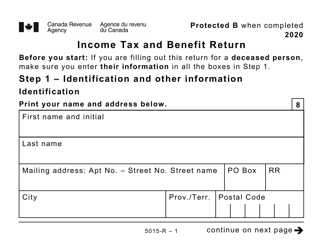

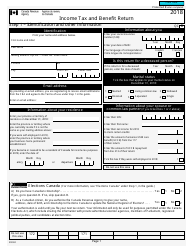

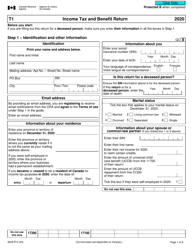

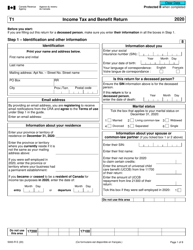

Form 5000-R Income Tax and Benefit Return (Large Print) - Canada

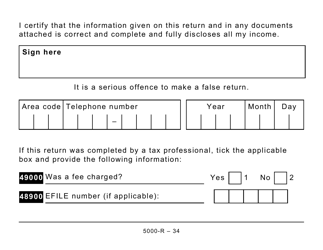

The Form 5000-R Income Tax and Benefit Return (Large Print) is used by Canadian individuals who have visual impairments and require a larger print format to complete their income tax return. It is a modified version of the standard income tax return form to accommodate the needs of visually impaired individuals.

The Form 5000-R Income Tax and Benefit Return (Large Print) in Canada is filed by individual taxpayers who require a large print version of the form.

FAQ

Q: What is Form 5000-R?

A: Form 5000-R is the Income Tax and Benefit Return form.

Q: Who should use Form 5000-R?

A: Form 5000-R is intended for individuals who require a large print format.

Q: What is the purpose of Form 5000-R?

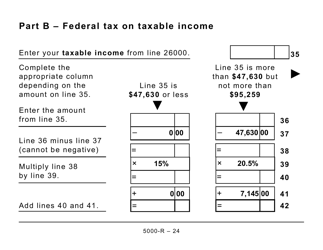

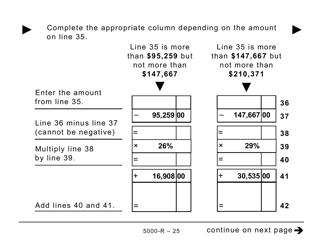

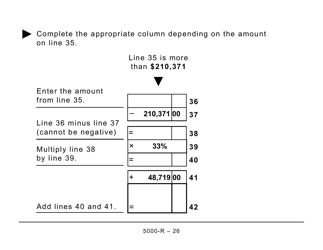

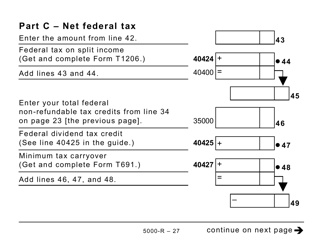

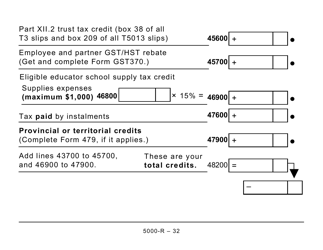

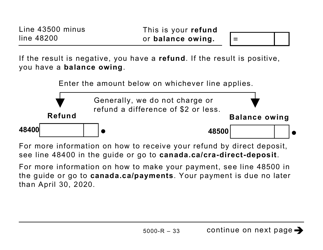

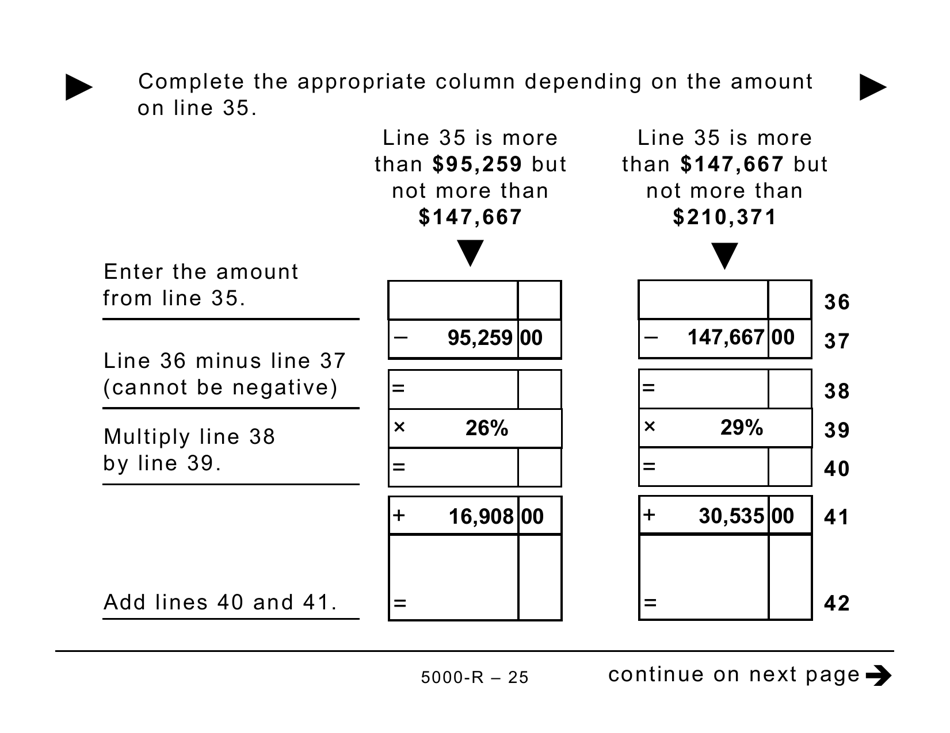

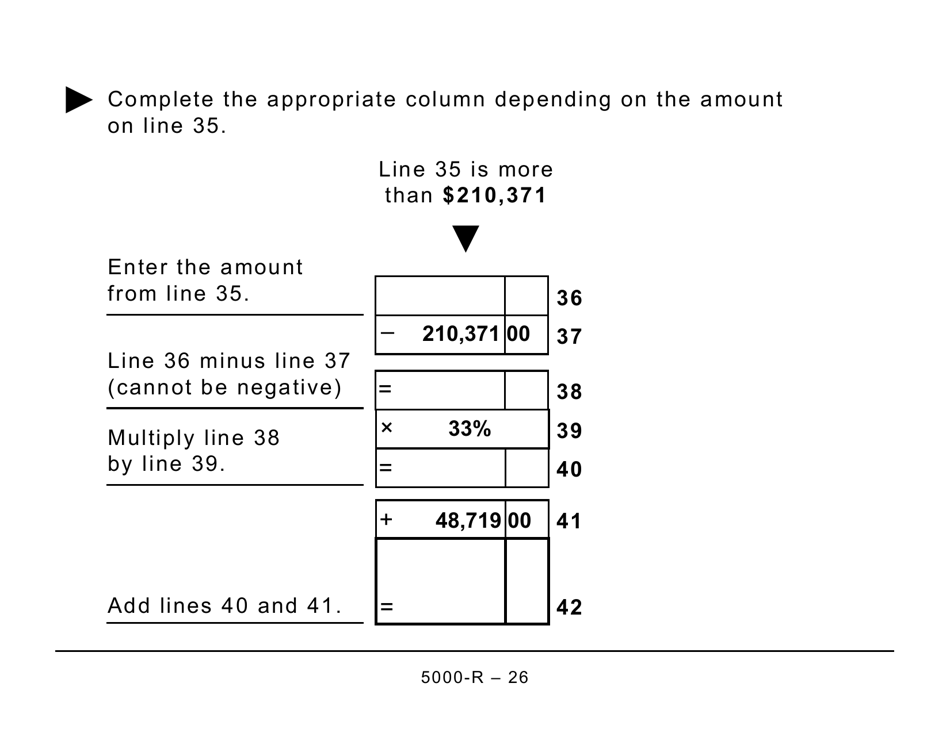

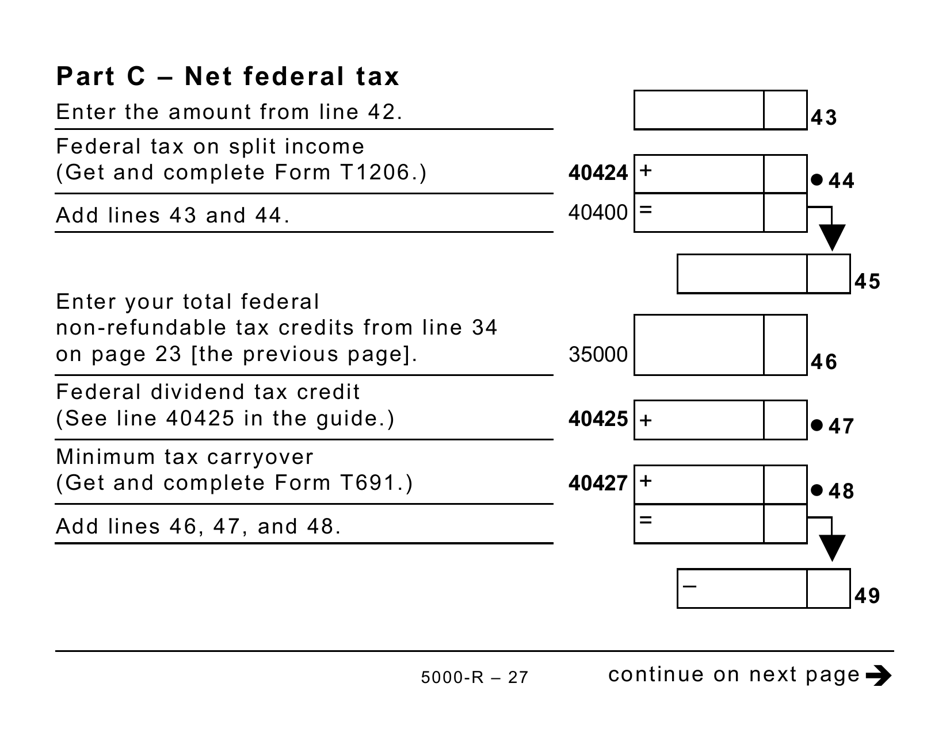

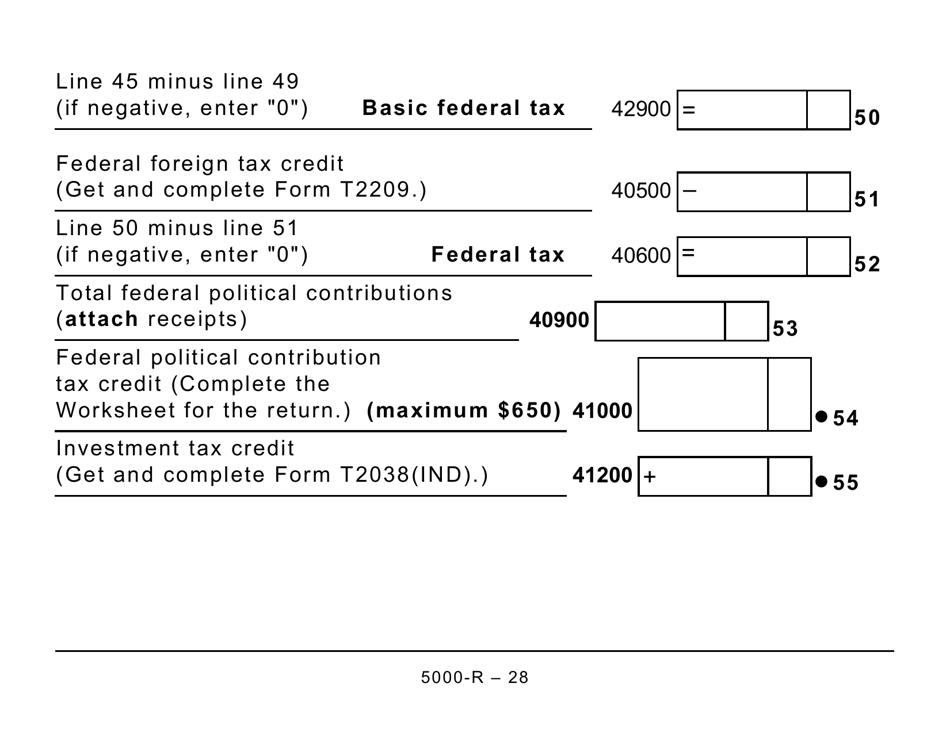

A: The purpose of Form 5000-R is to report income, claim deductions and credits, and calculate taxes owed or refund.

Q: Is there a deadline for filing Form 5000-R?

A: Yes, the deadline for filing Form 5000-R is generally April 30th of the following year.

Q: Can I file Form 5000-R electronically?

A: No, Form 5000-R is not available for electronic filing.

Q: Are there any other forms or schedules that need to be filed along with Form 5000-R?

A: Depending on your individual situation, you may need to include additional forms or schedules with Form 5000-R.

Q: Can I file Form 5000-R if I live in the United States?

A: No, Form 5000-R is for Canadian residents only. If you live in the United States, you will need to file the appropriate U.S. tax forms.

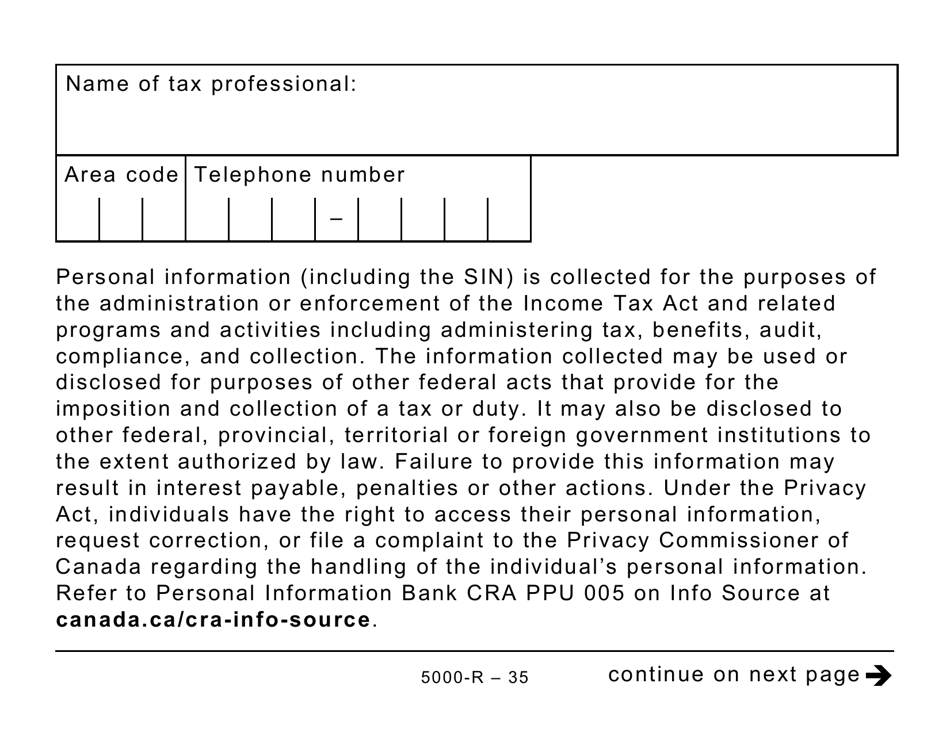

Q: What should I do if I need assistance with completing Form 5000-R?

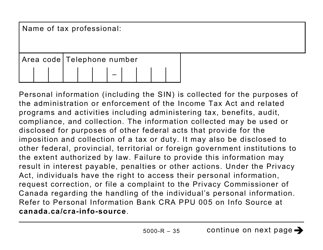

A: If you need assistance, you can contact the Canada Revenue Agency (CRA) or seek help from a tax professional.