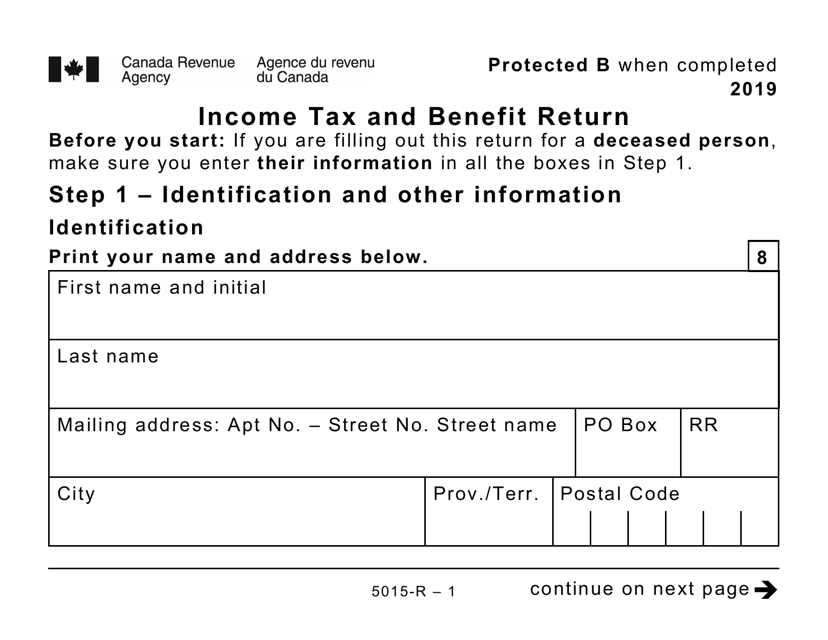

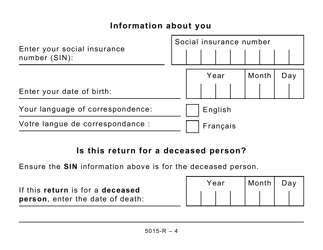

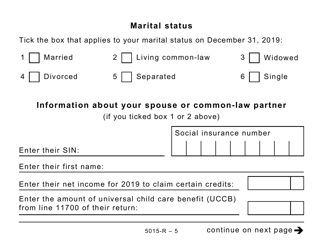

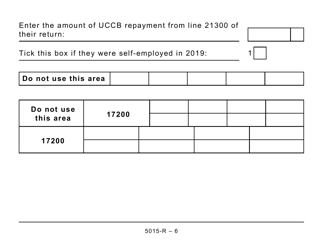

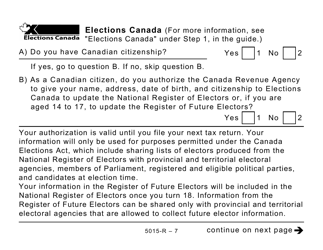

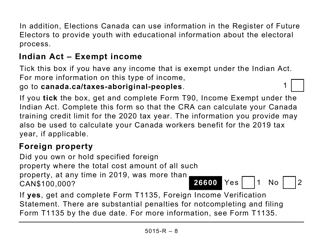

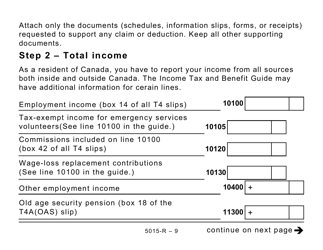

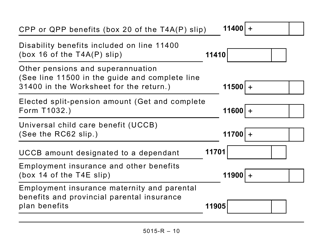

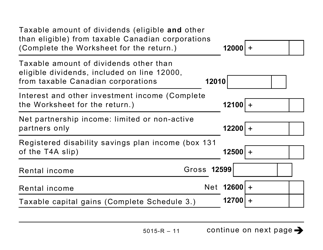

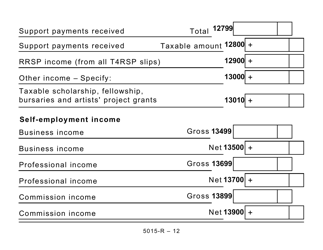

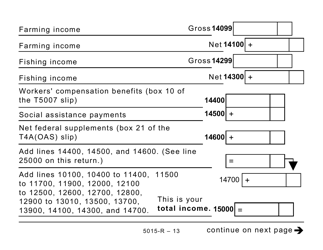

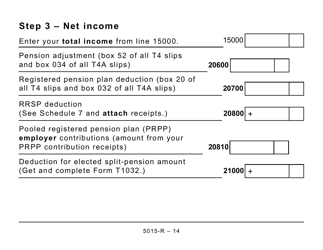

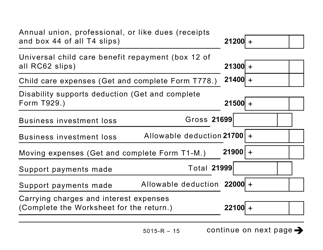

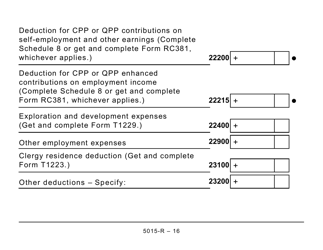

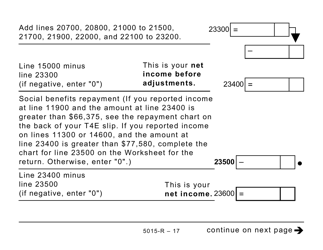

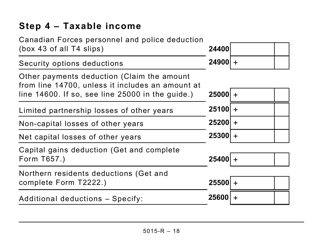

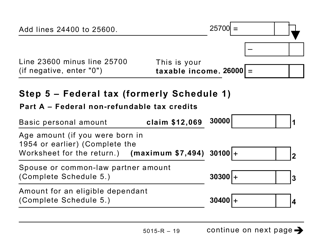

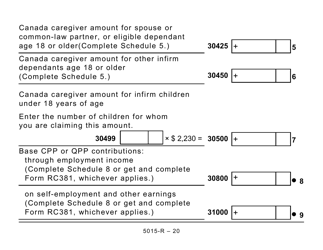

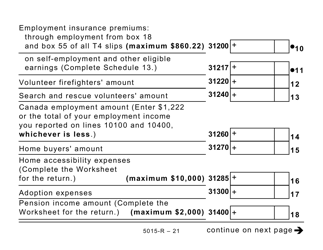

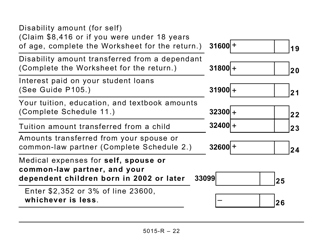

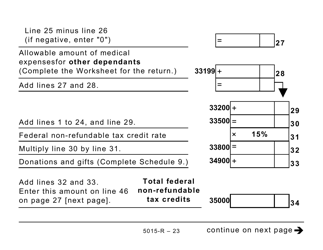

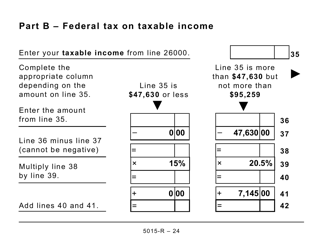

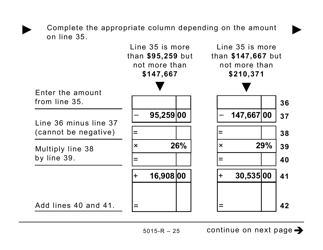

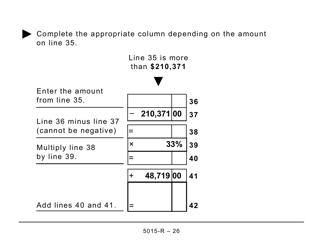

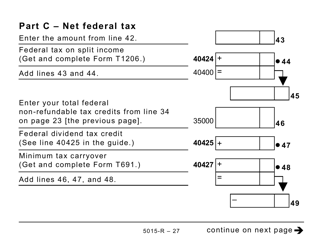

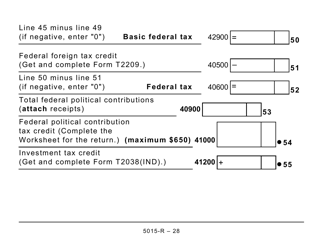

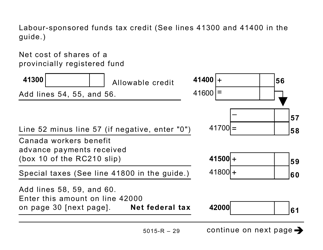

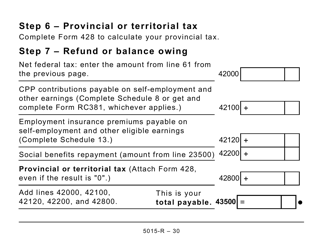

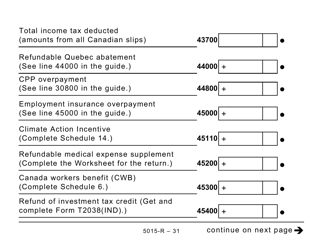

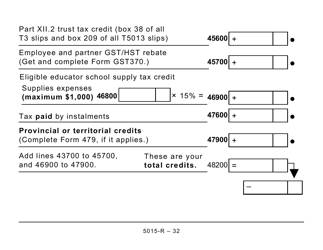

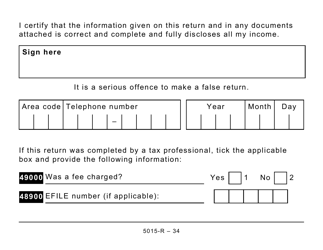

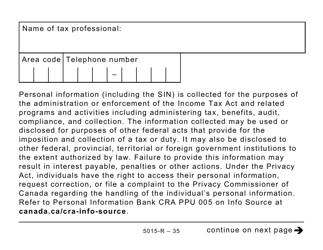

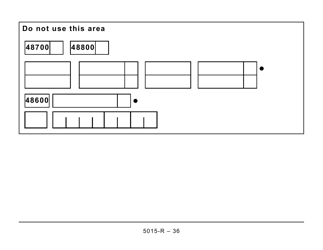

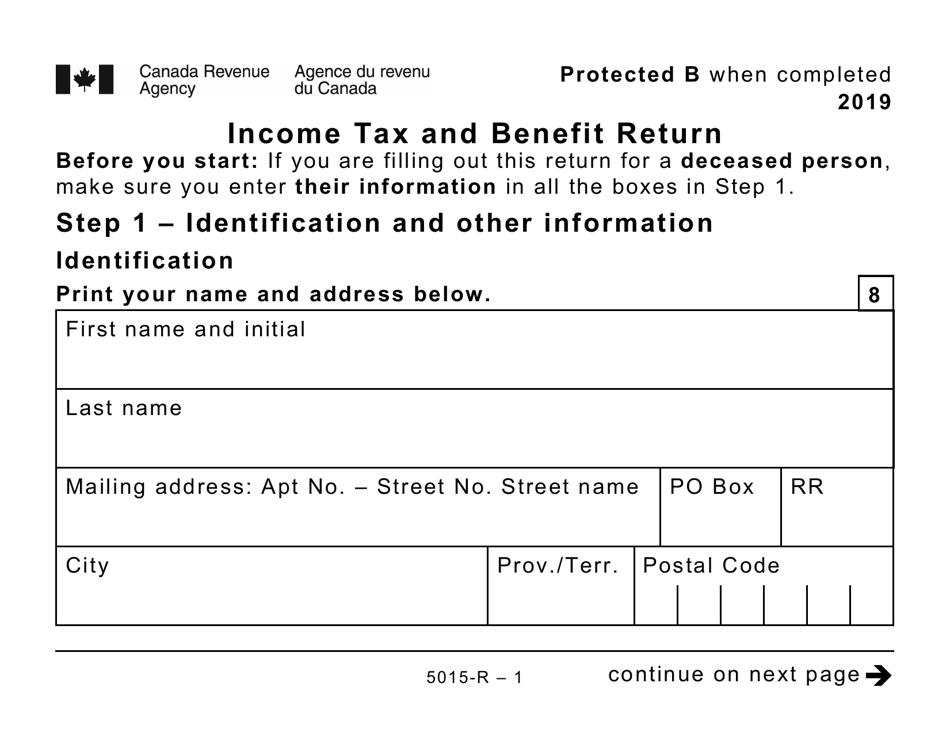

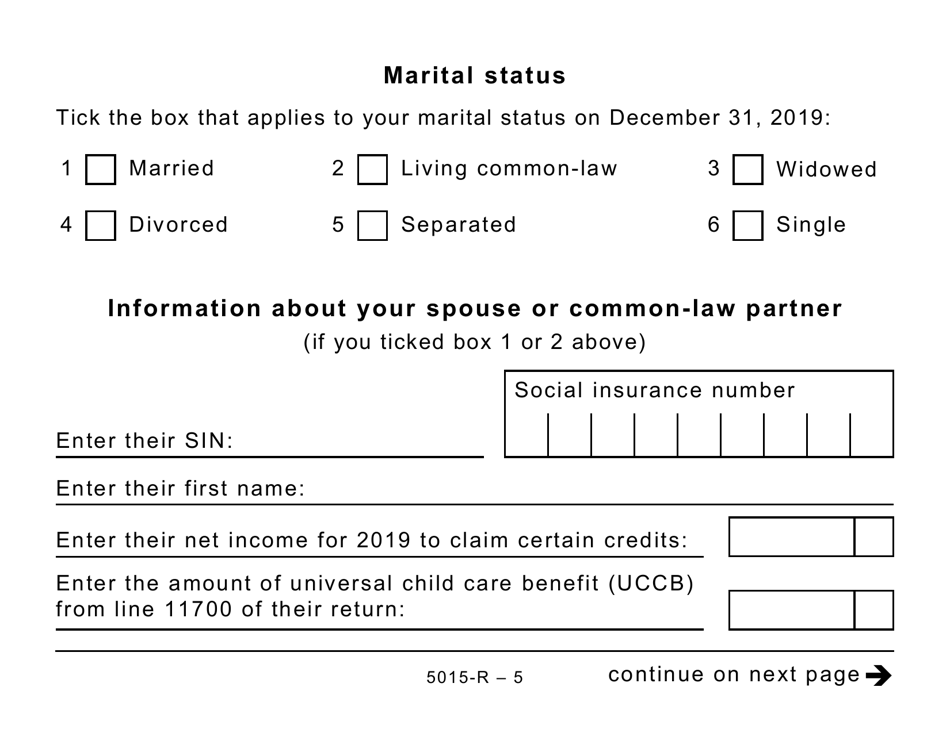

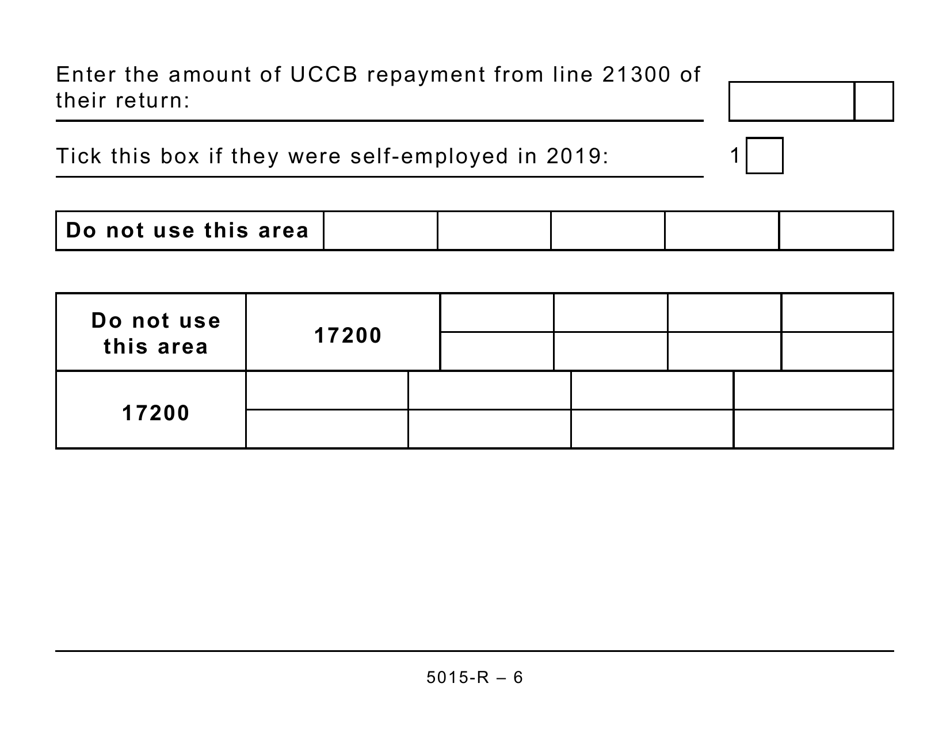

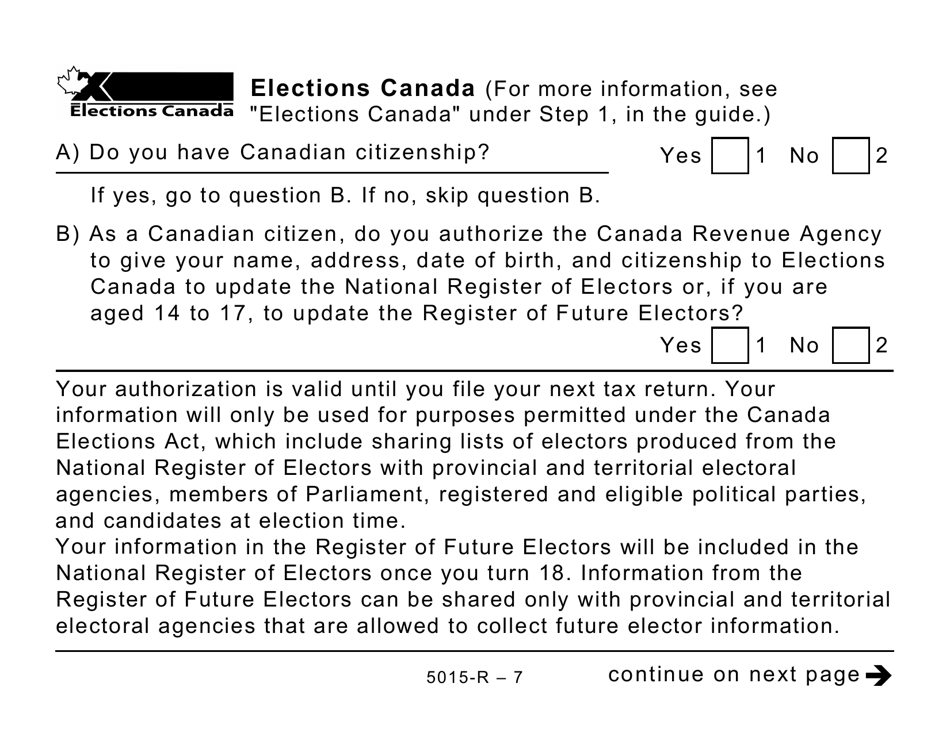

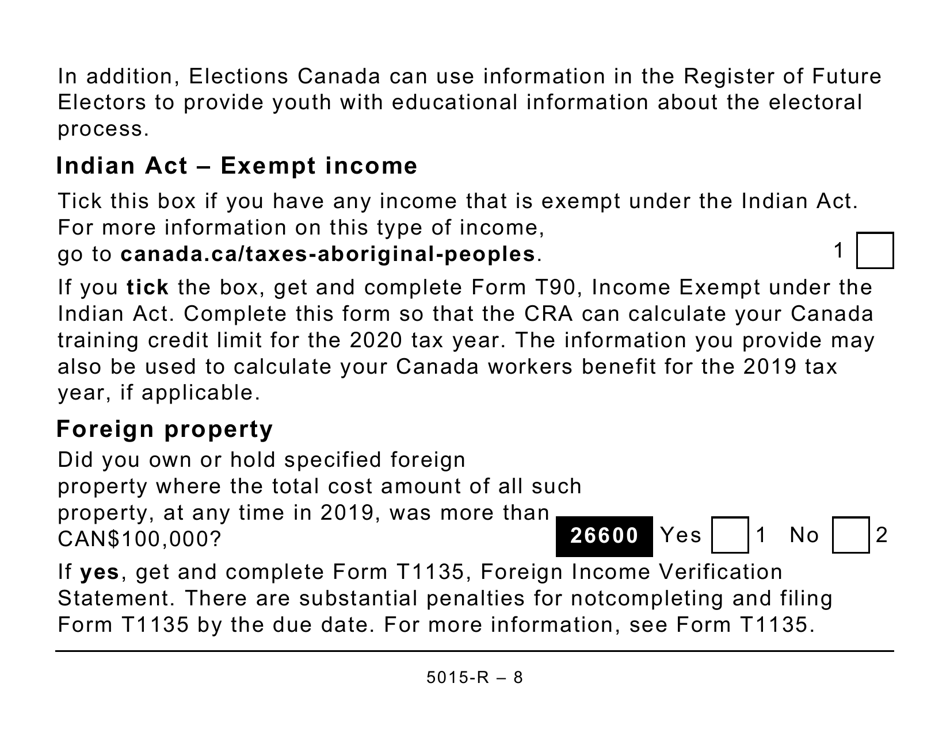

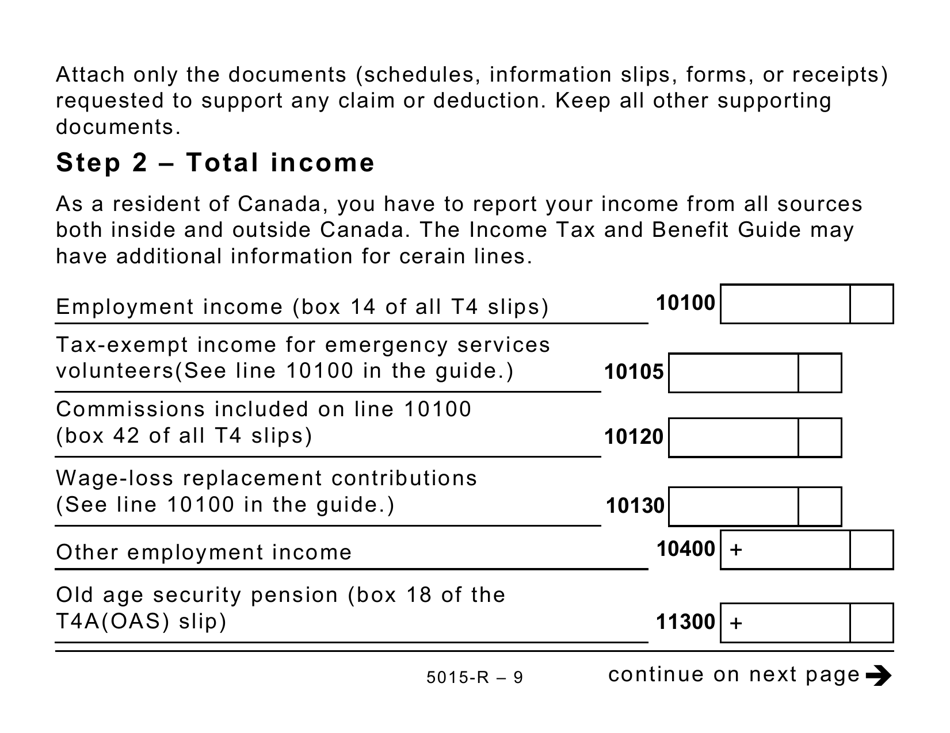

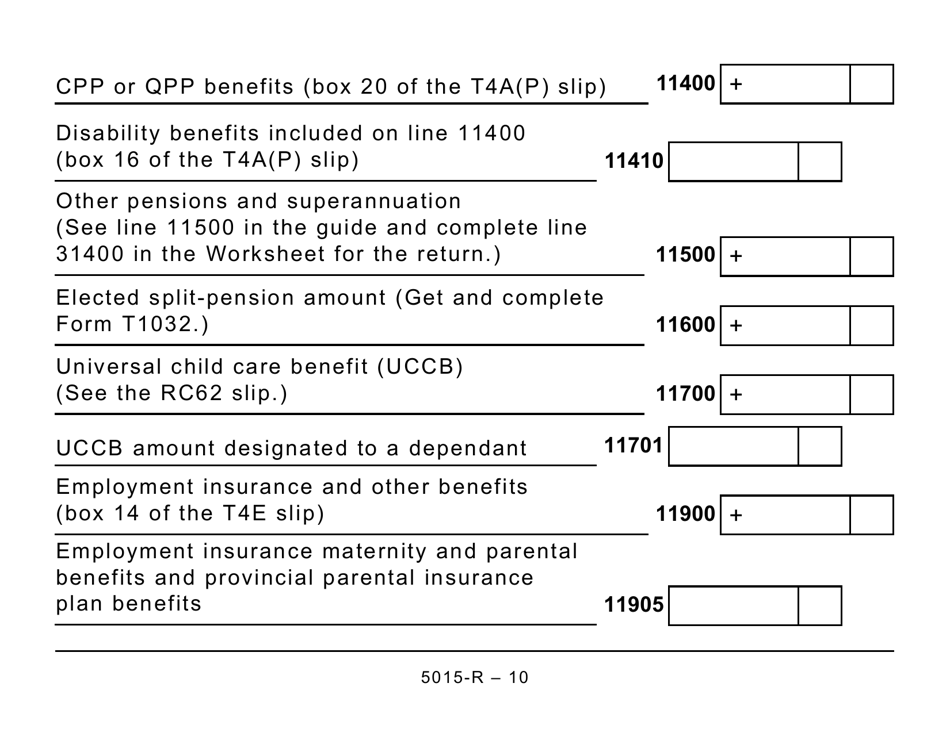

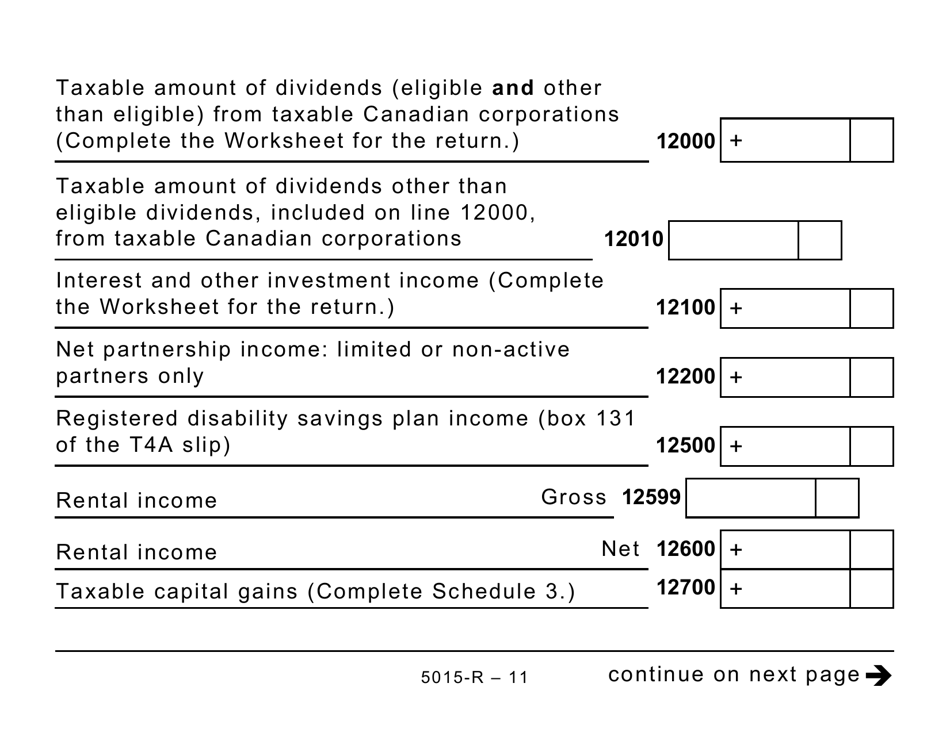

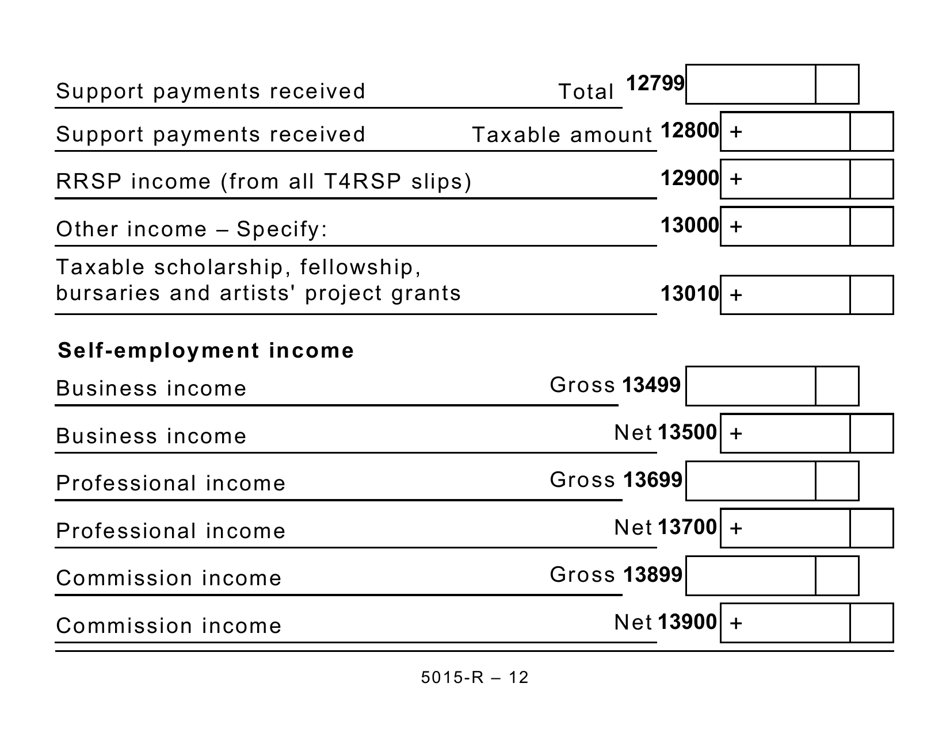

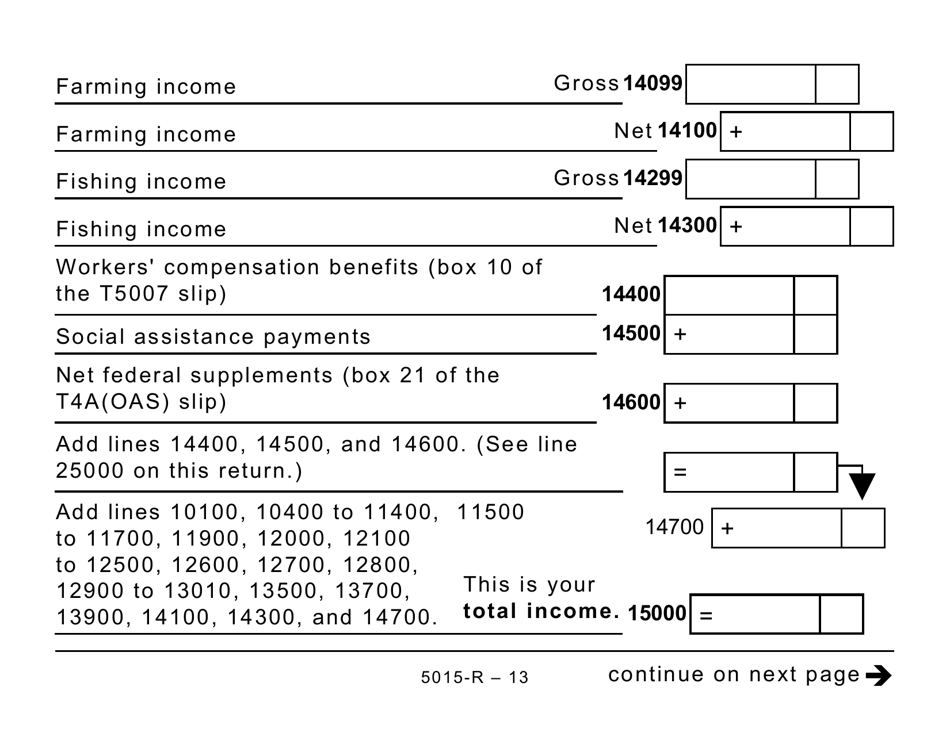

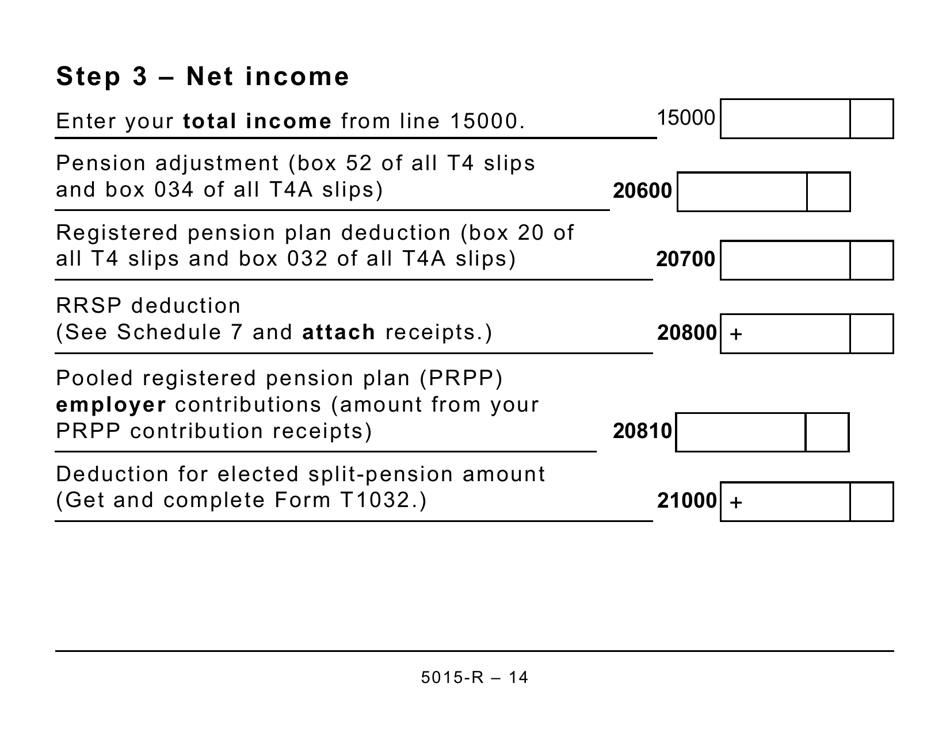

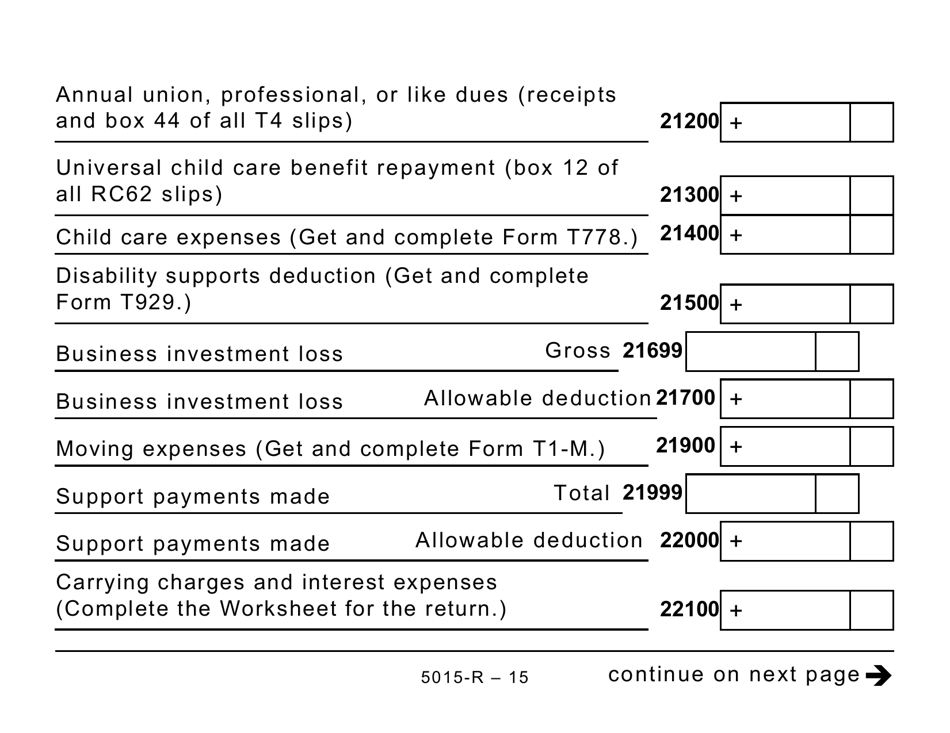

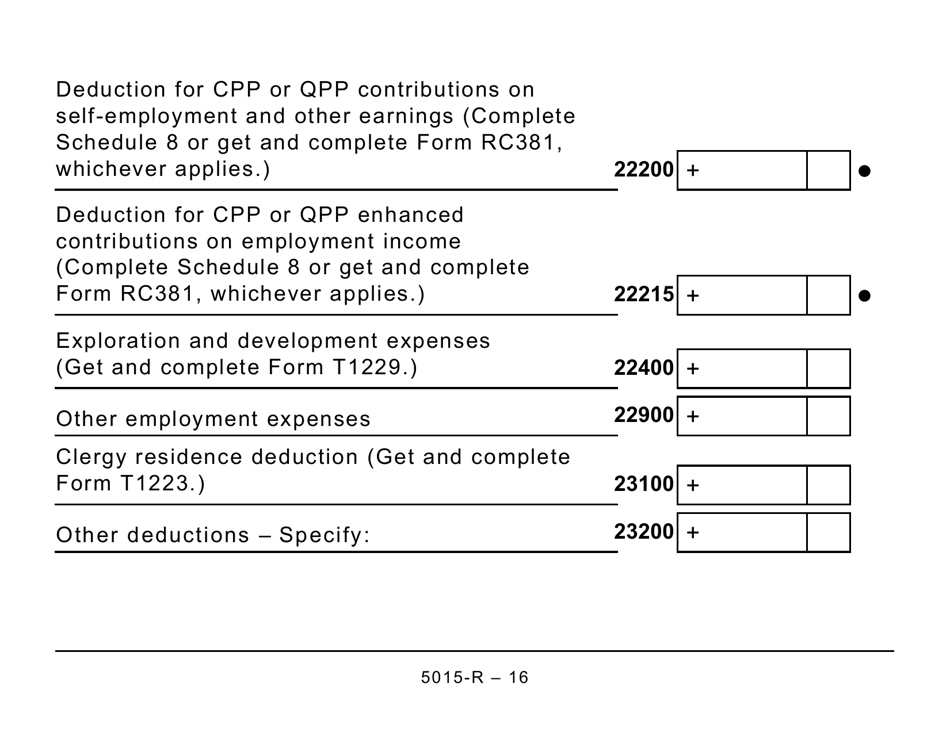

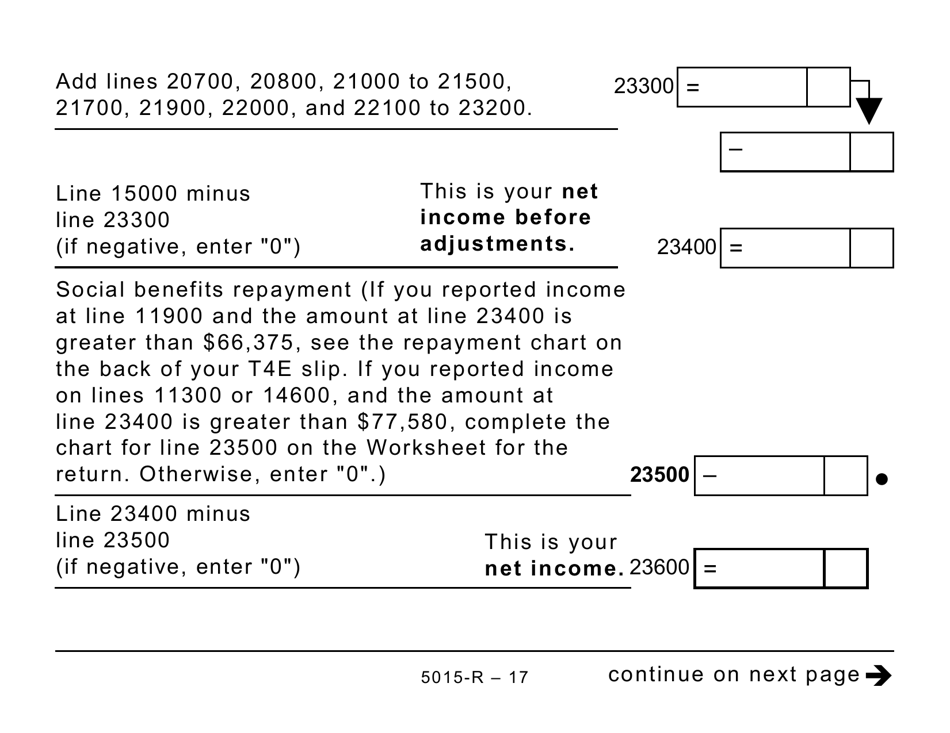

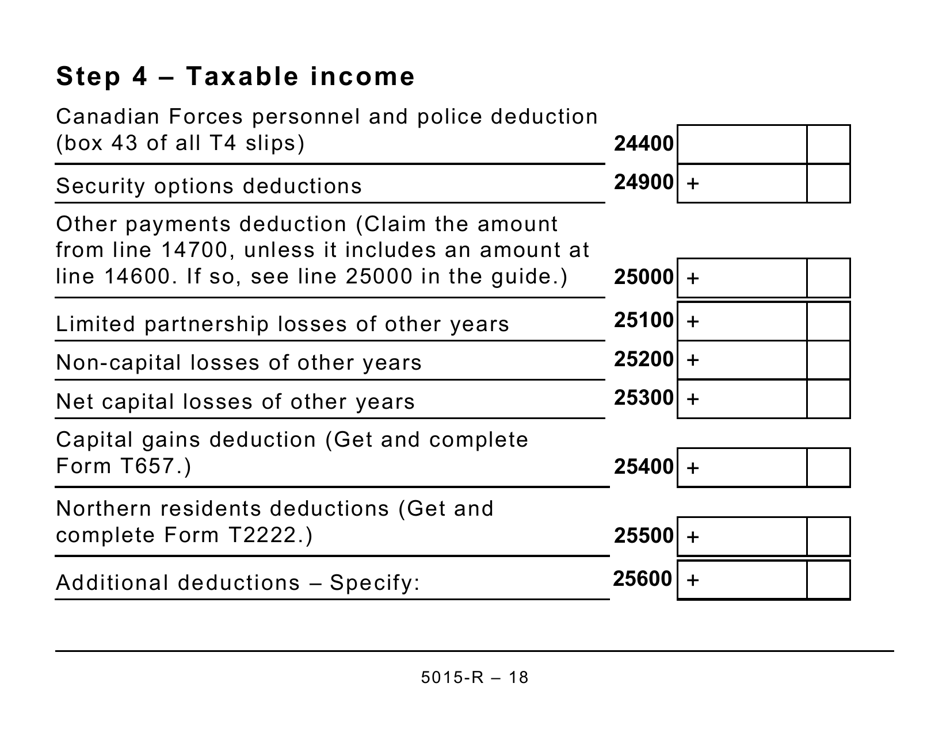

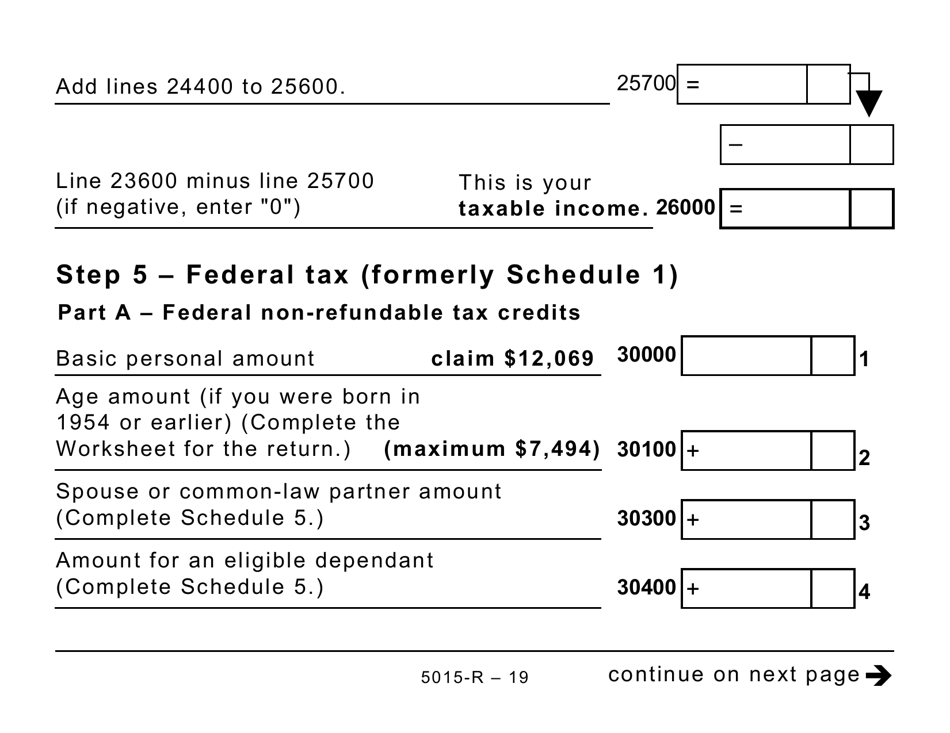

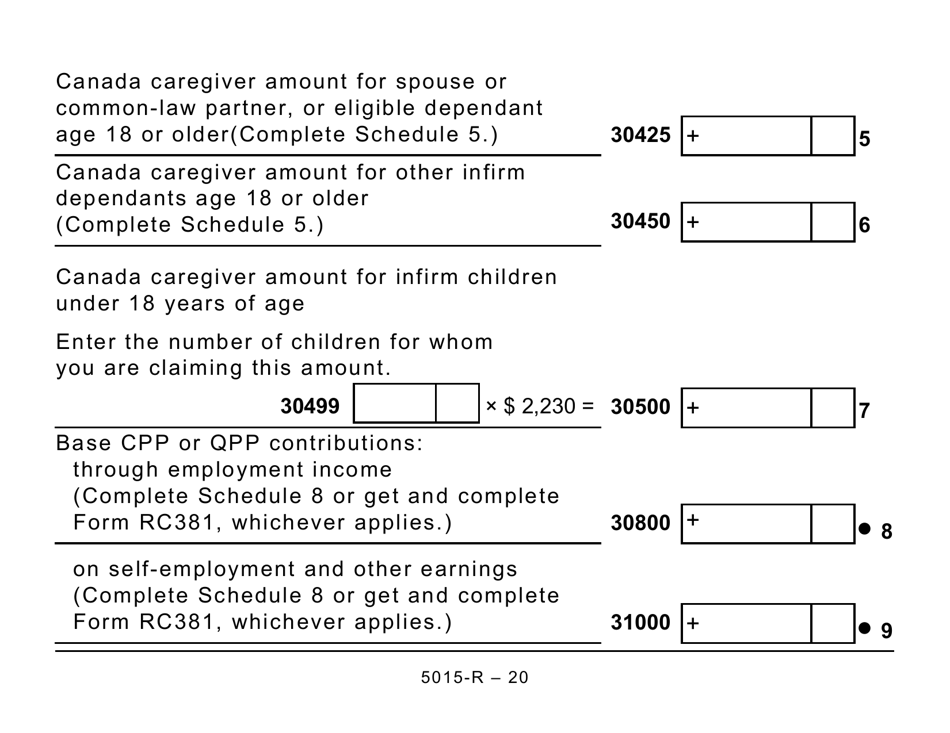

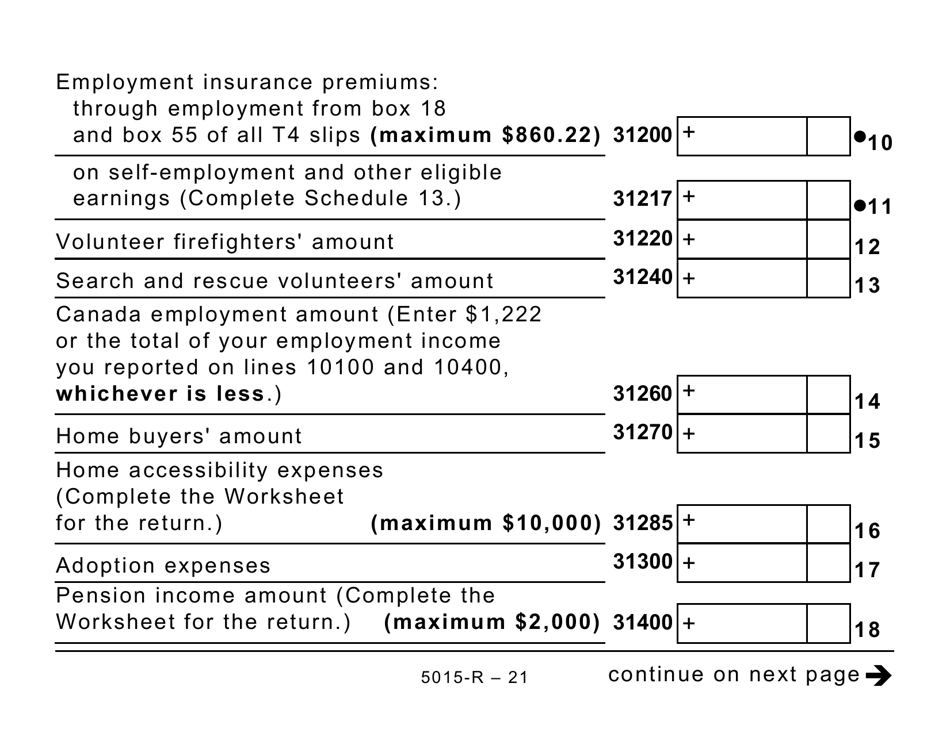

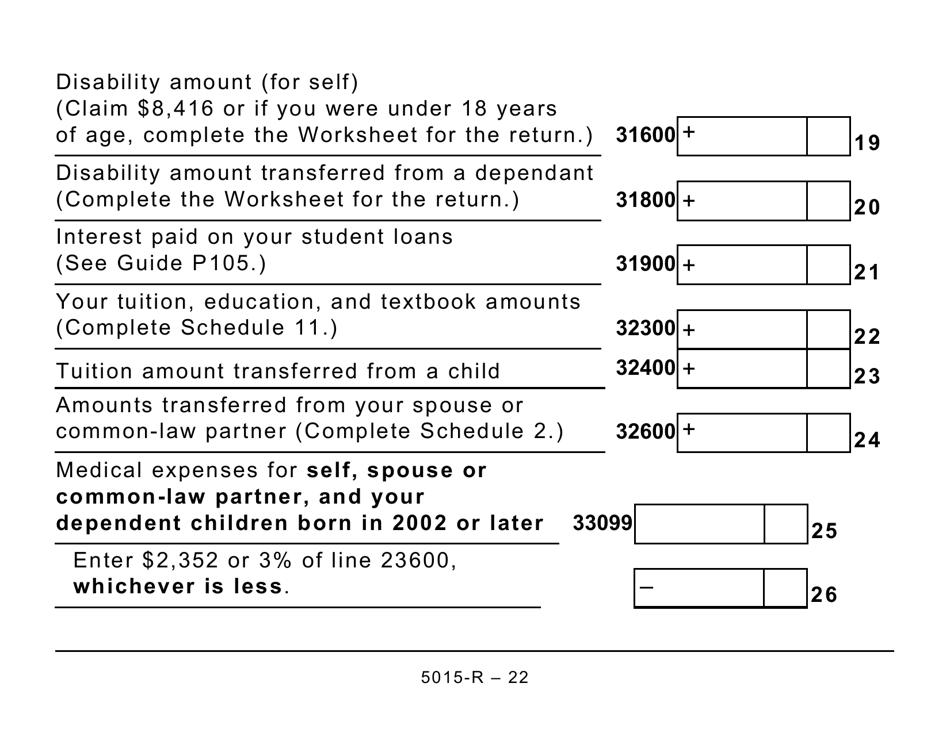

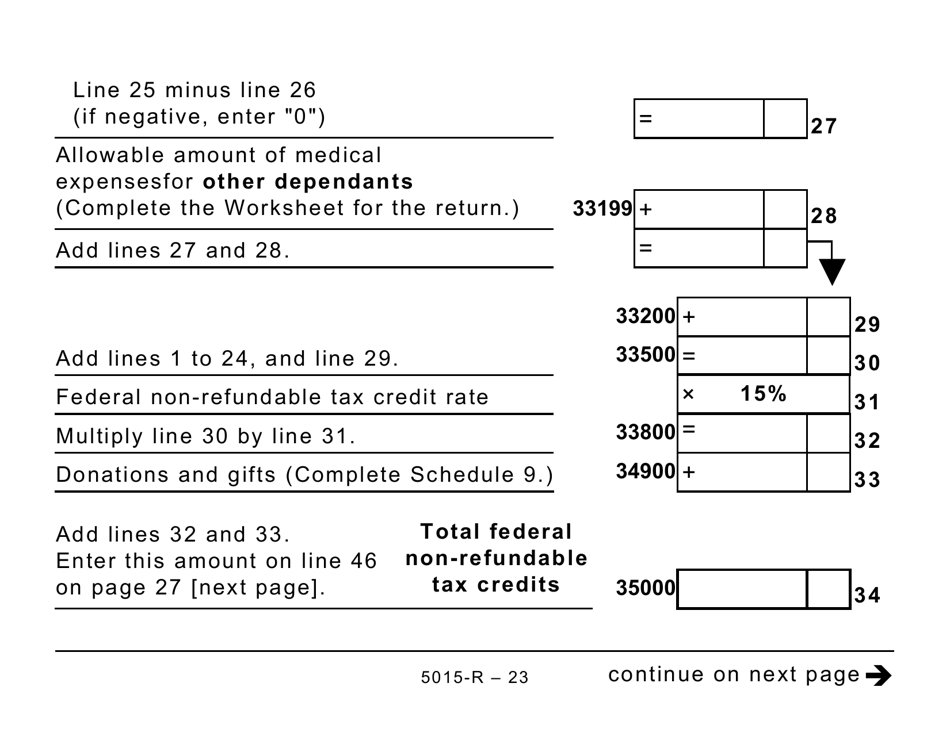

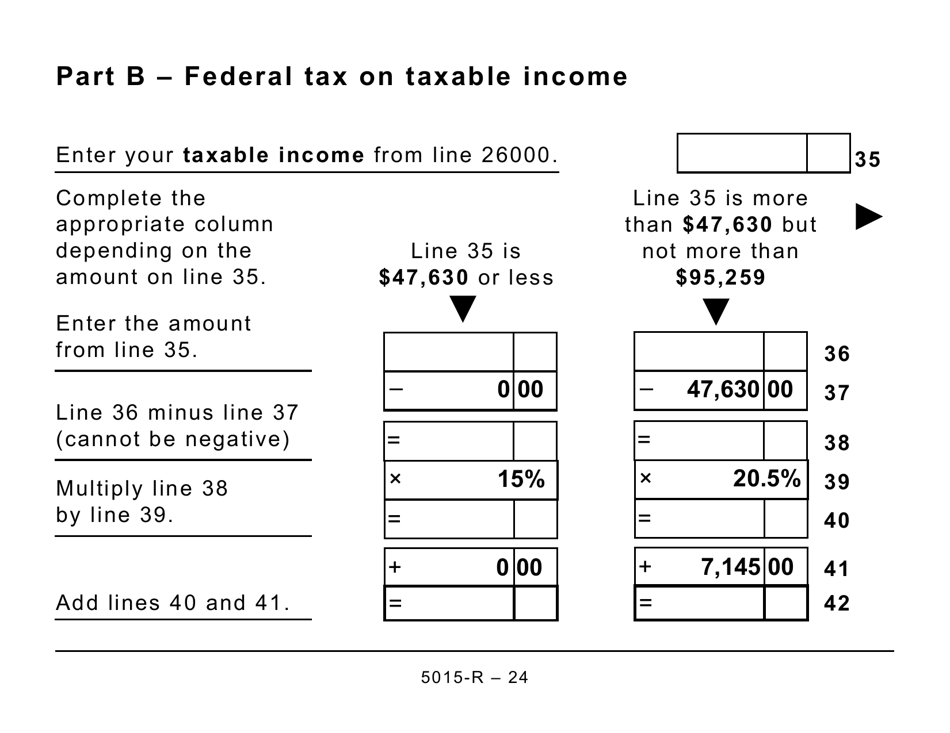

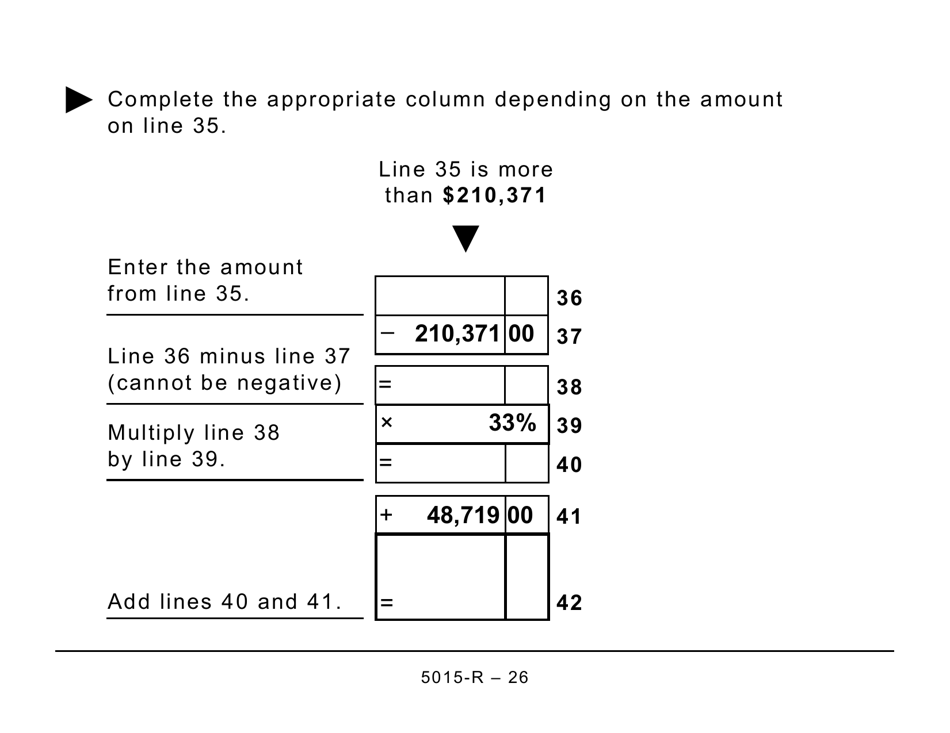

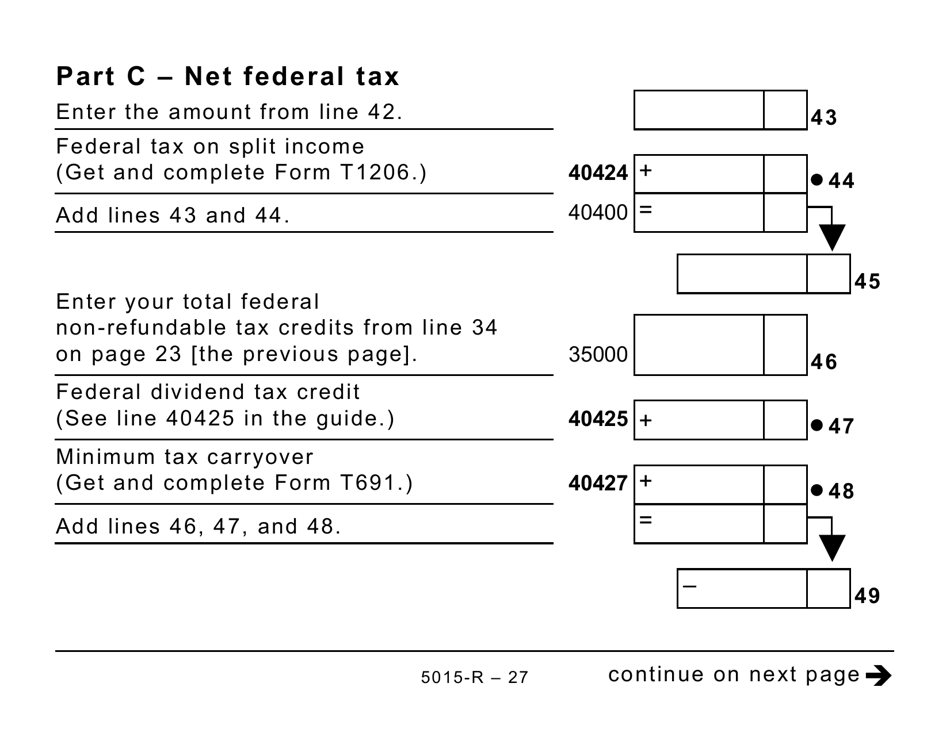

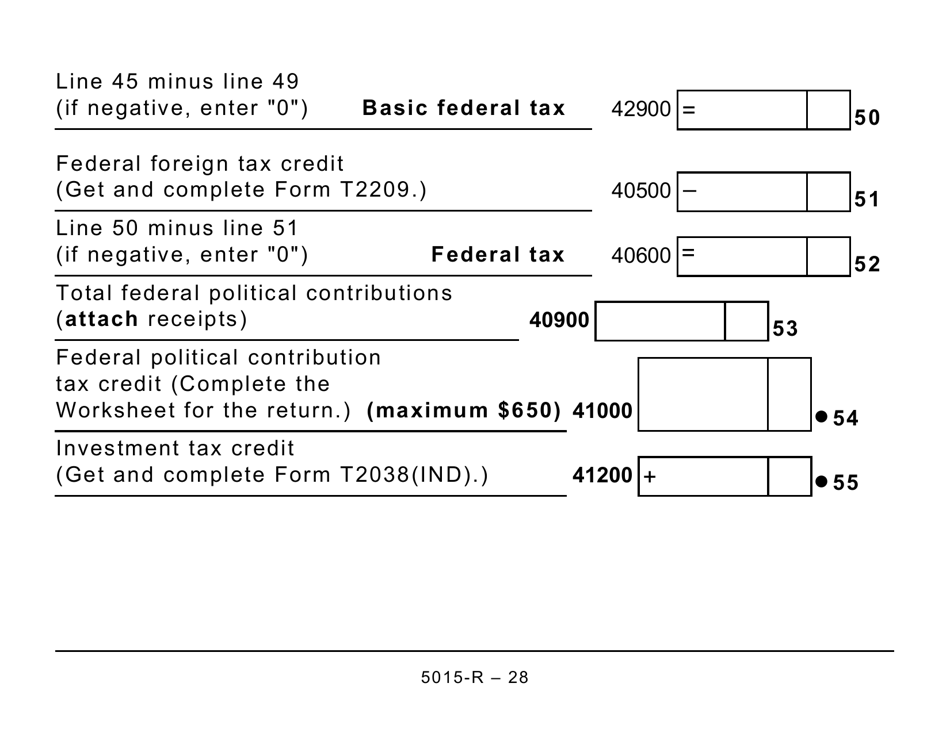

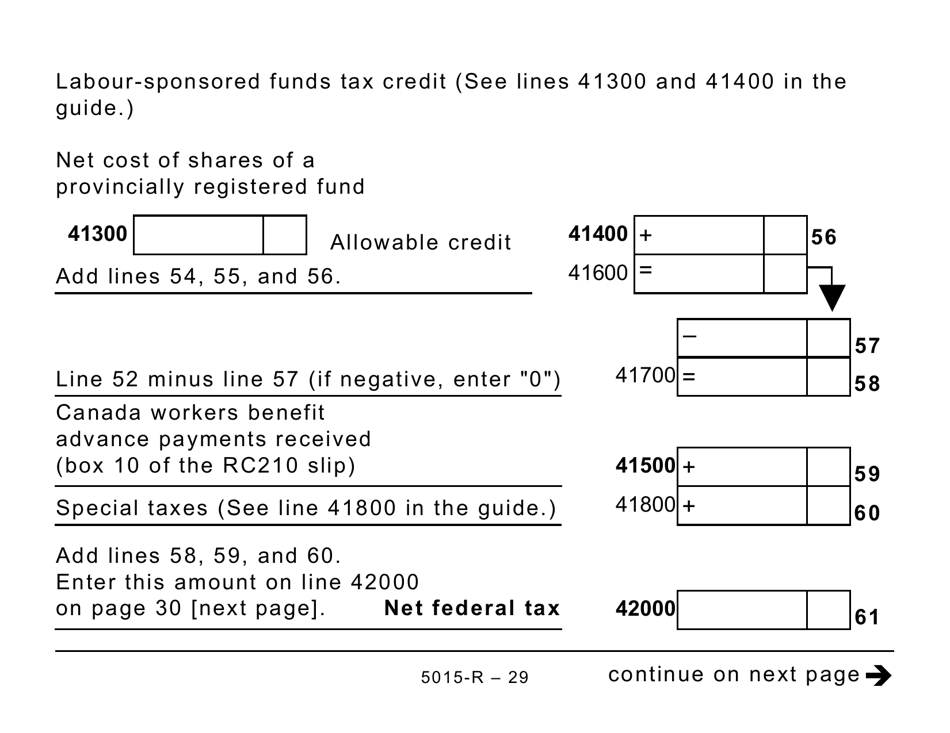

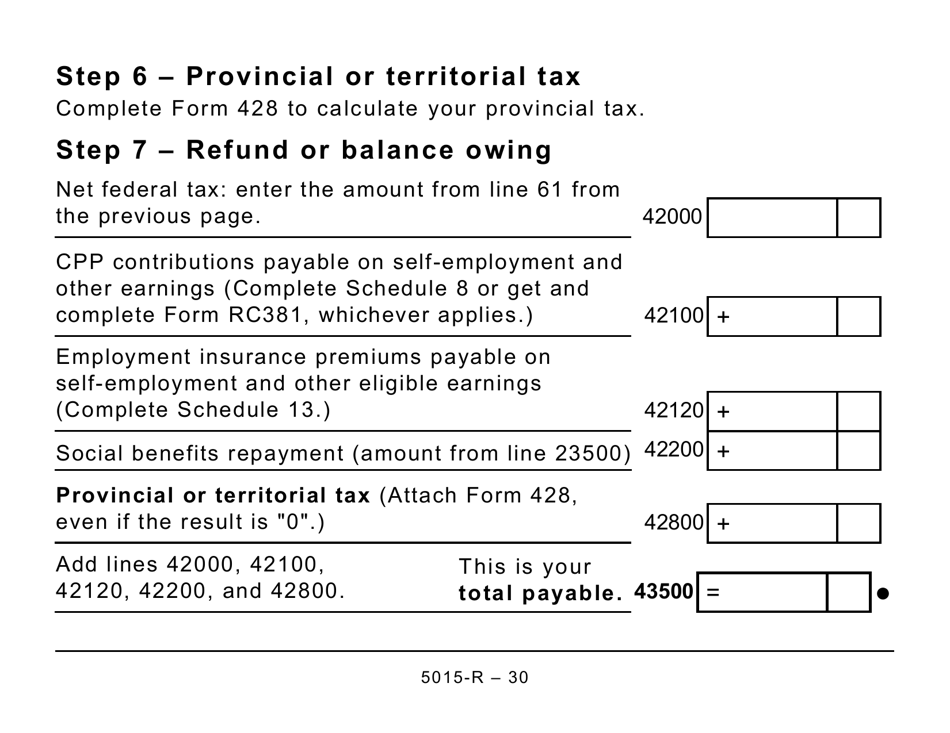

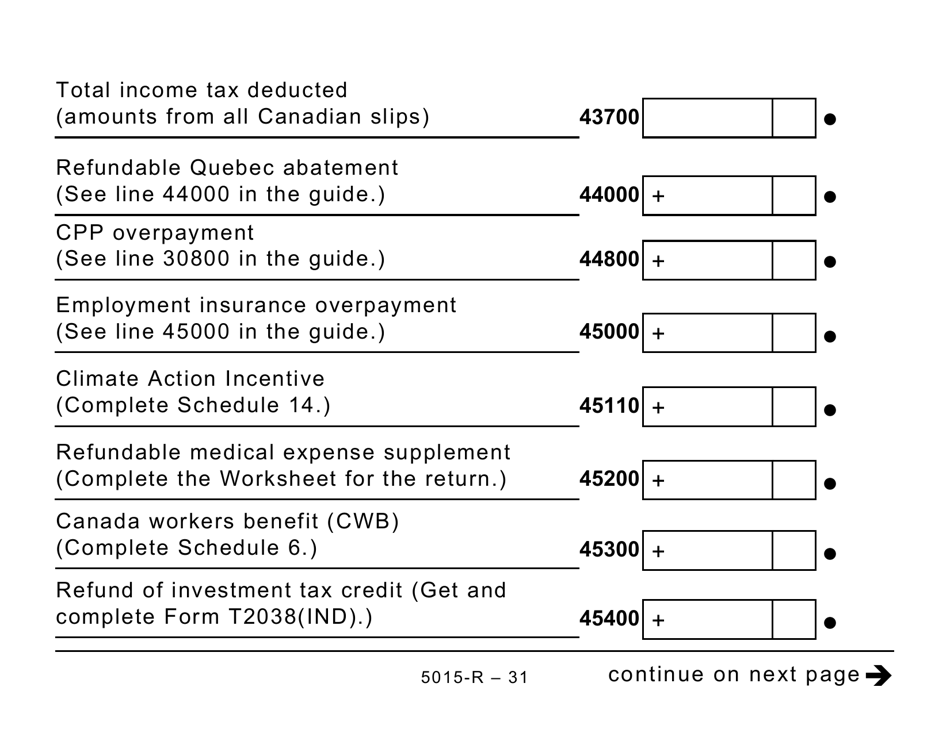

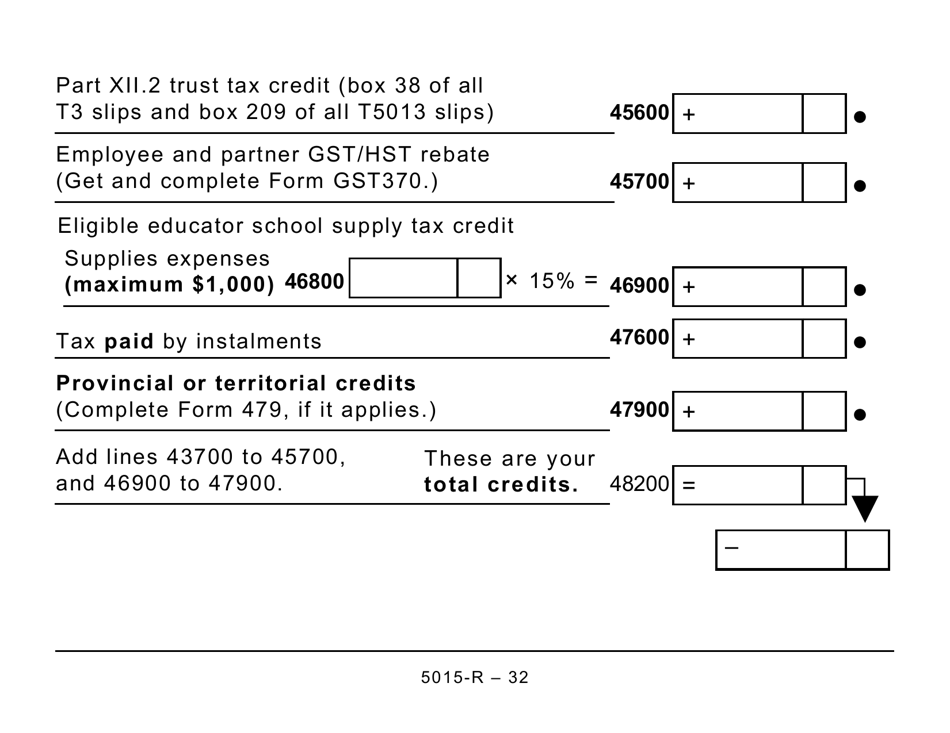

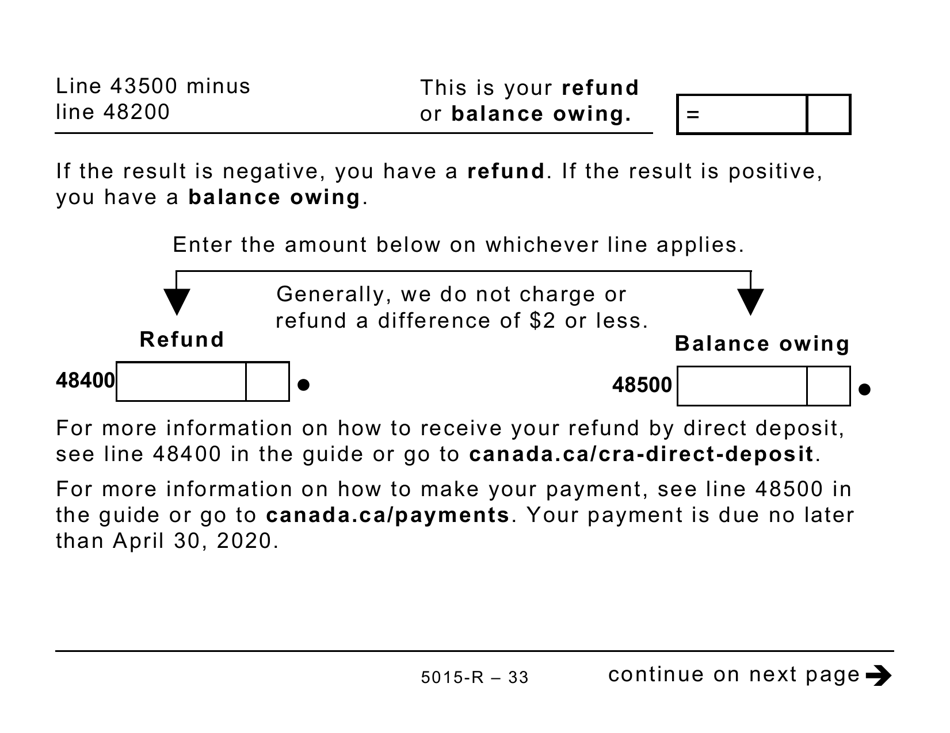

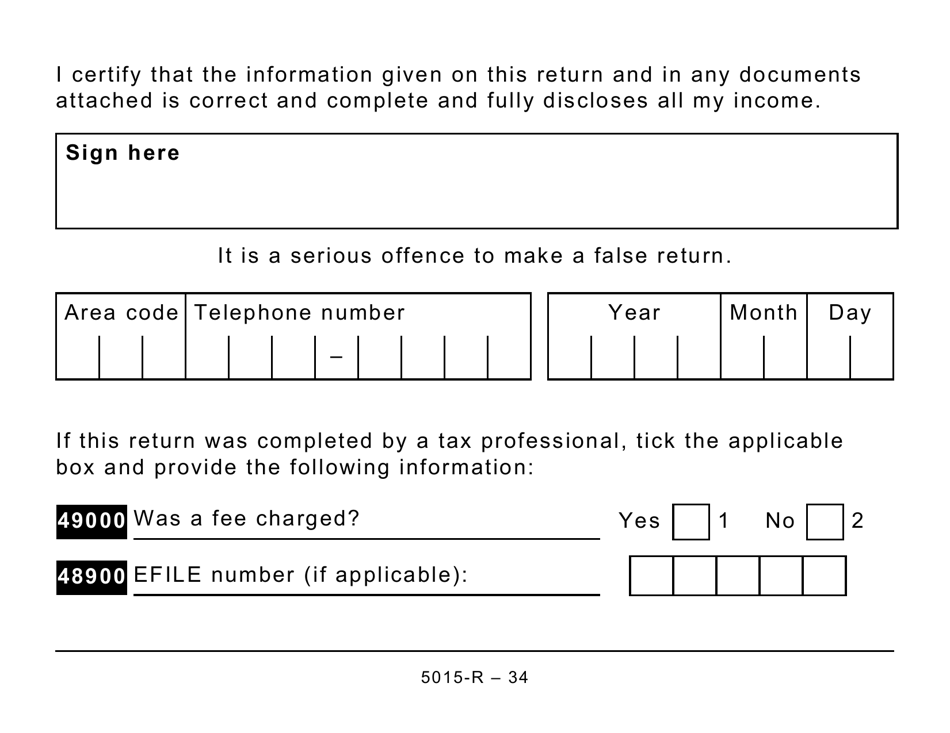

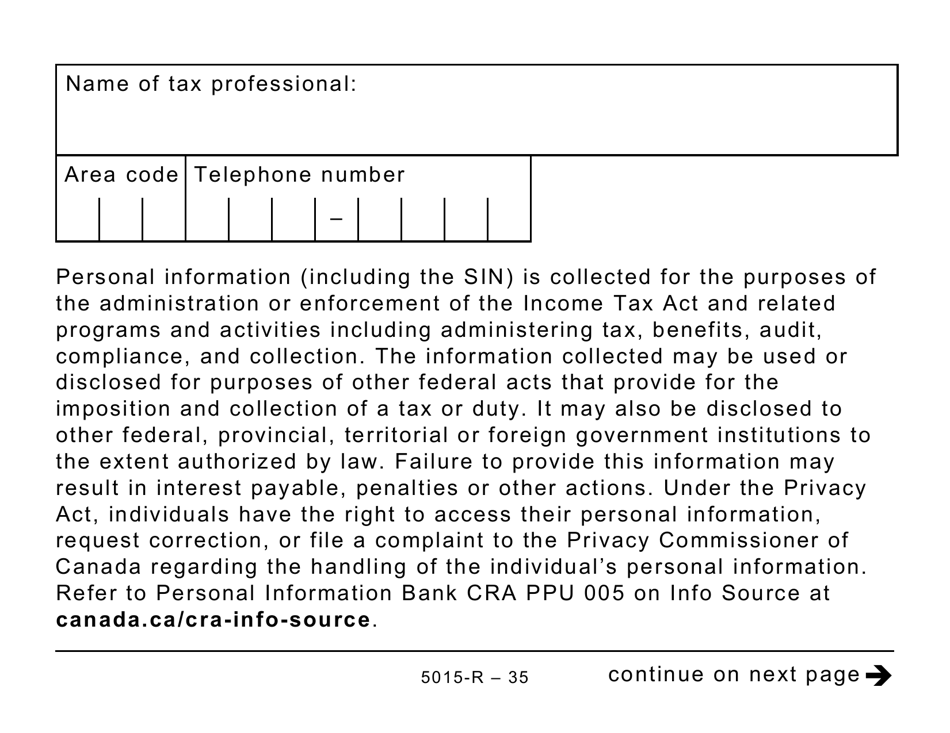

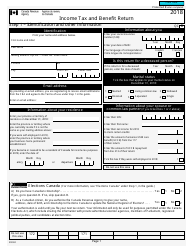

Form 5015-R Income Tax and Benefit Return - Alberta, Manitoba, Saskatchewan (Large Print) - Canada

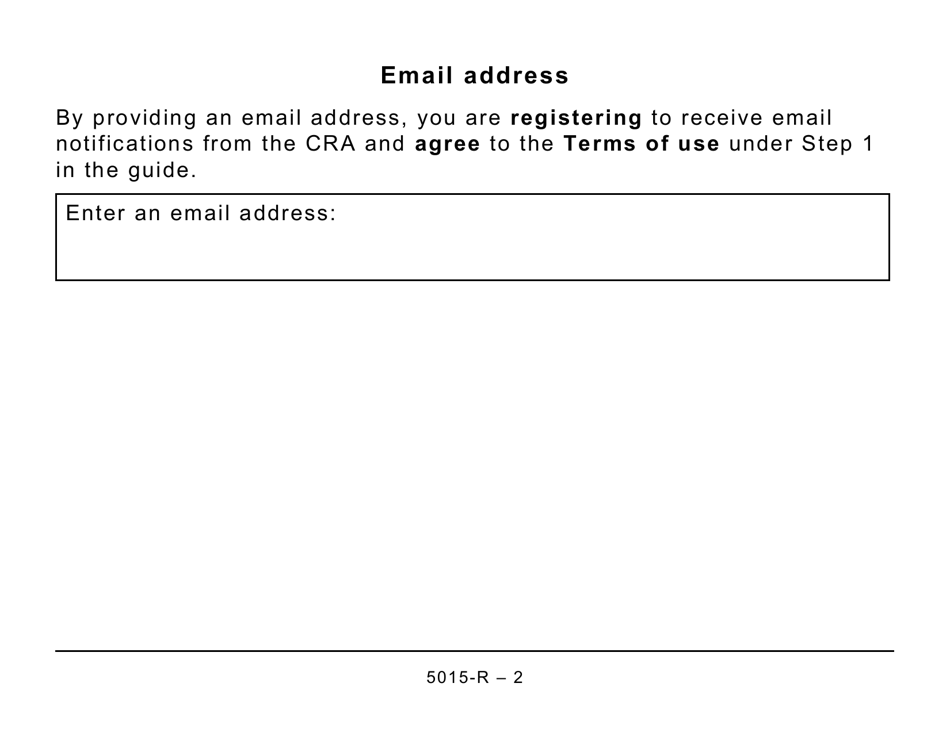

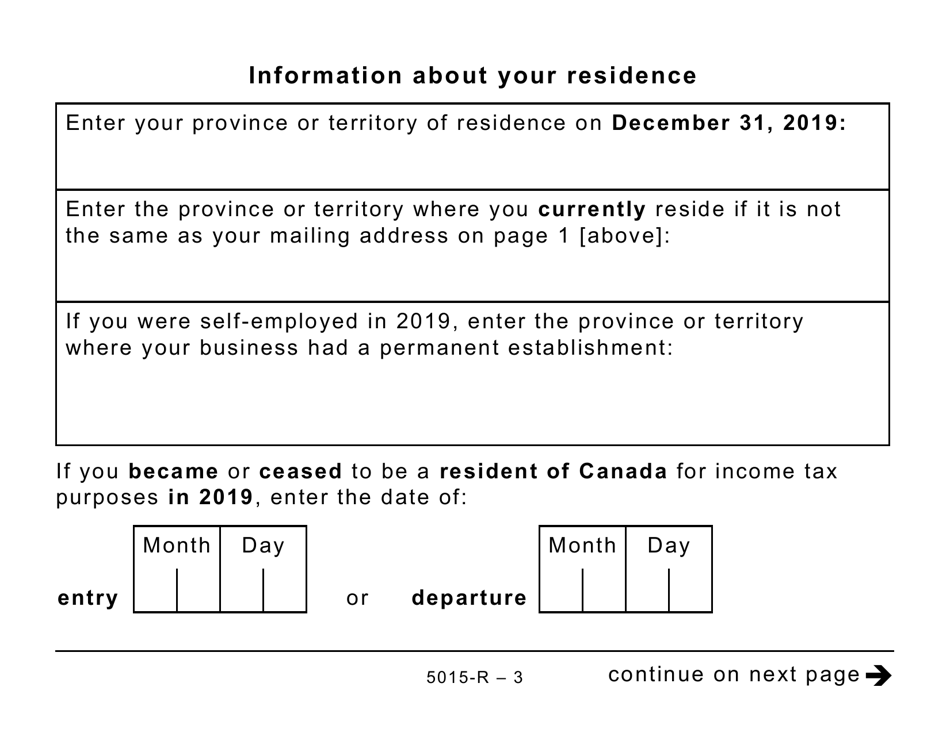

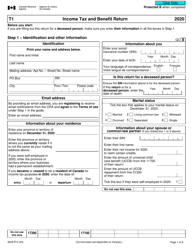

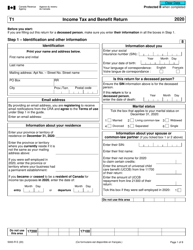

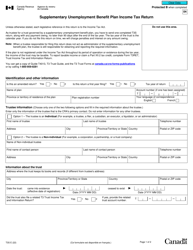

Form 5015-R Income Tax and Benefit Return - Alberta, Manitoba, Saskatchewan (Large Print) - Canada is used for reporting income and claiming tax benefits in these specific provinces. It is a tax return form for individuals.

In Canada, individuals who are residents of Alberta, Manitoba, and Saskatchewan file the Form 5015-R Income Tax and Benefit Return.

FAQ

Q: What is Form 5015-R?

A: Form 5015-R is the Income Tax and Benefit Return for residents of Alberta, Manitoba, and Saskatchewan in Canada.

Q: Who is required to file Form 5015-R?

A: Residents of Alberta, Manitoba, and Saskatchewan in Canada are required to file Form 5015-R if they have income to report or if they are eligible for certain tax credits or benefits.

Q: What is the purpose of Form 5015-R?

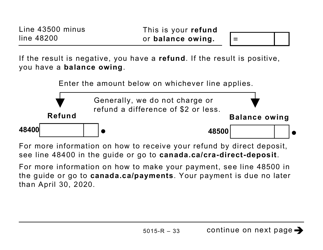

A: The purpose of Form 5015-R is to report your income, claim tax deductions and credits, and determine if you owe taxes or are eligible for a refund.

Q: What is the deadline to file Form 5015-R?

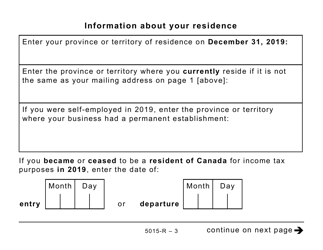

A: The deadline to file Form 5015-R is usually April 30th, but it may vary depending on certain circumstances such as self-employment income or being a deceased person.

Q: Is Form 5015-R available in large print?

A: Yes, Form 5015-R is available in large print for individuals who have visual impairments.