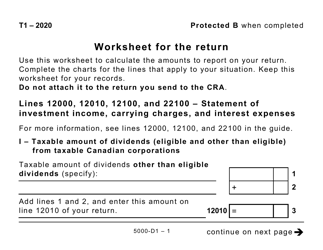

This version of the form is not currently in use and is provided for reference only. Download this version of

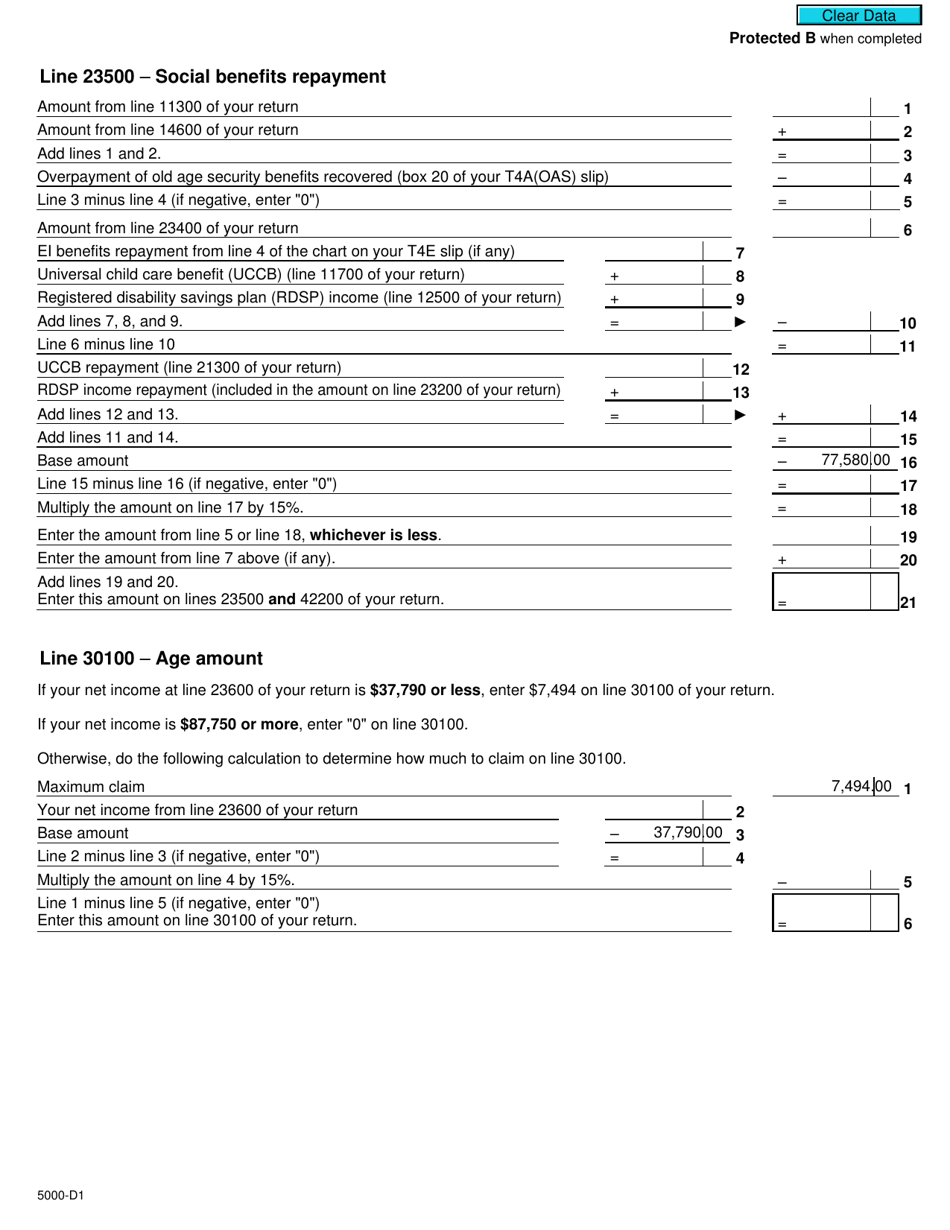

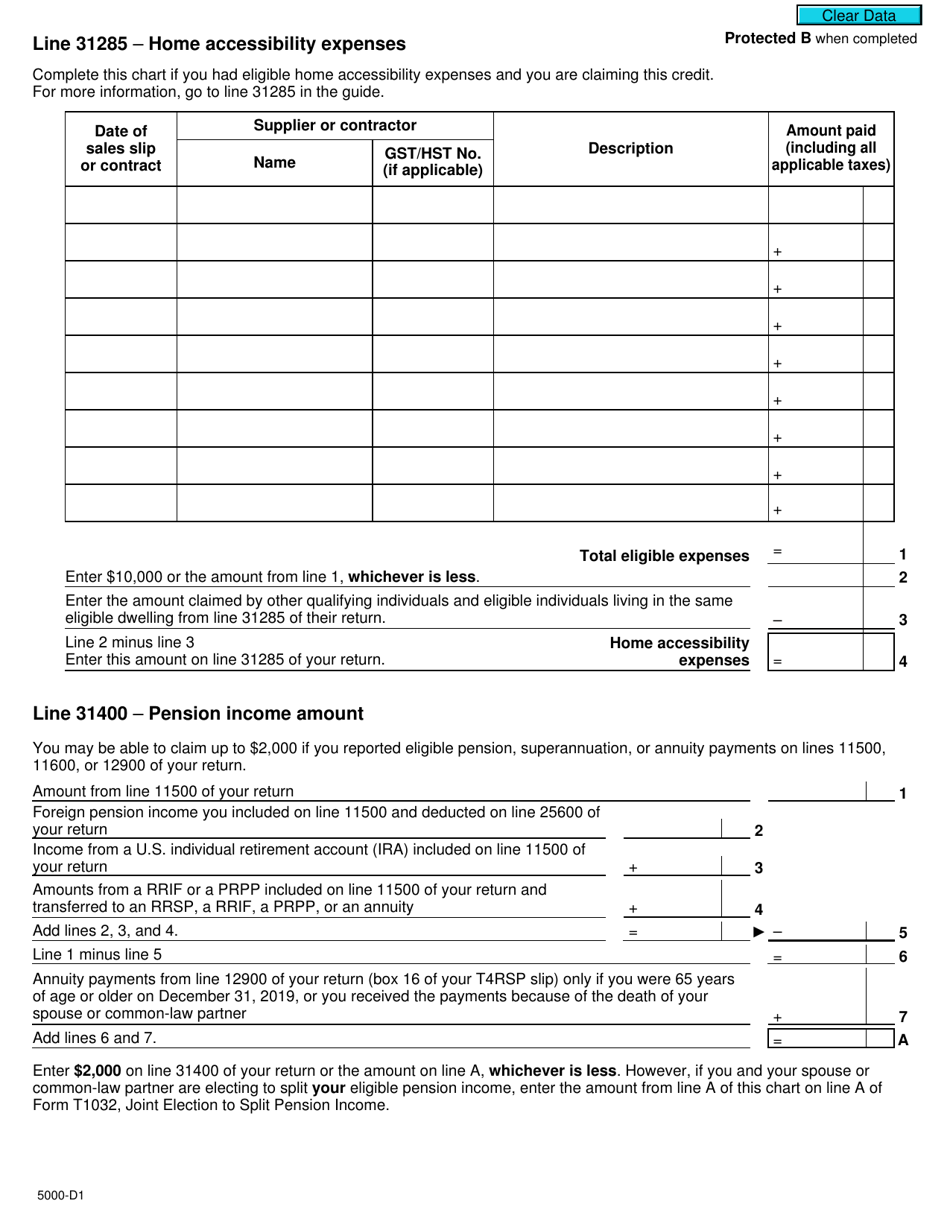

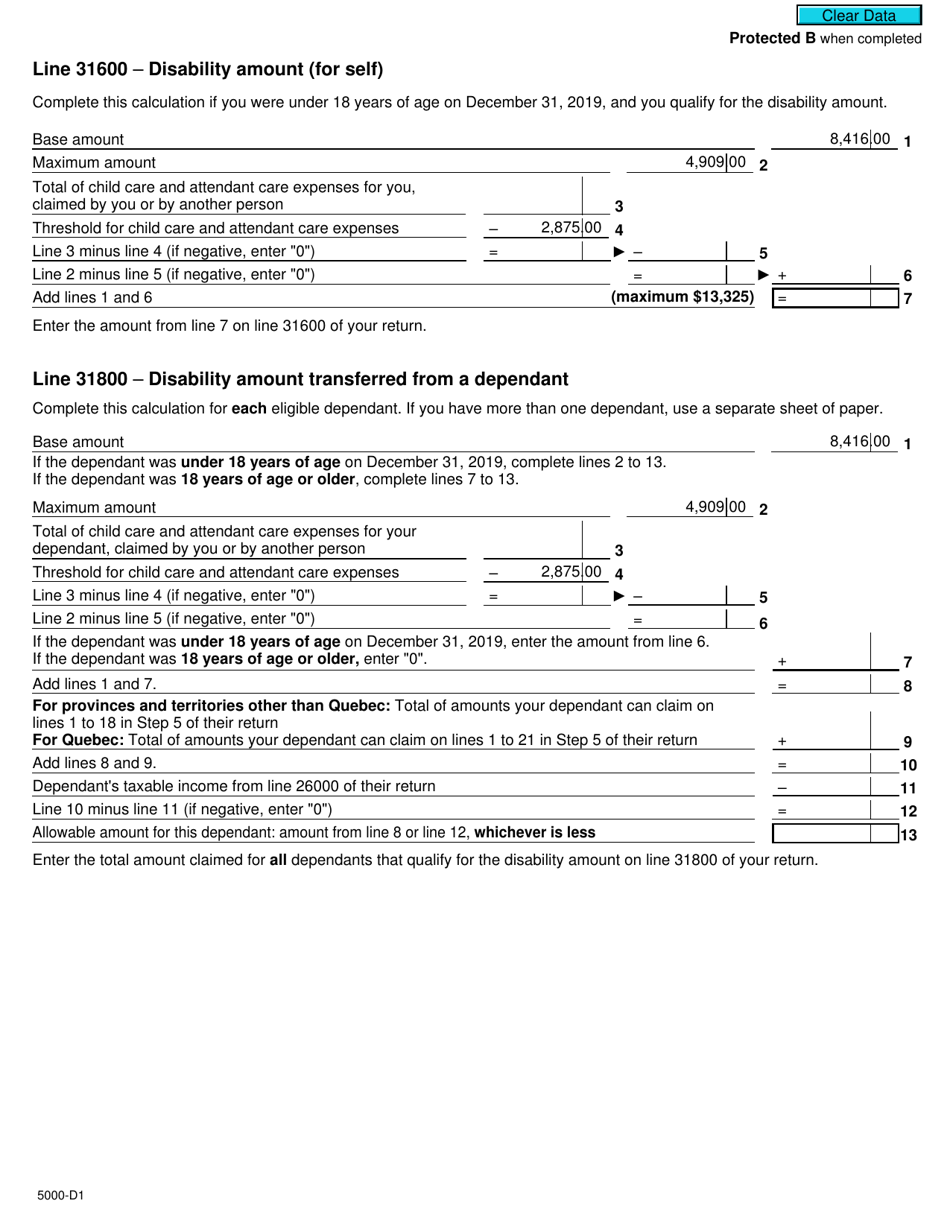

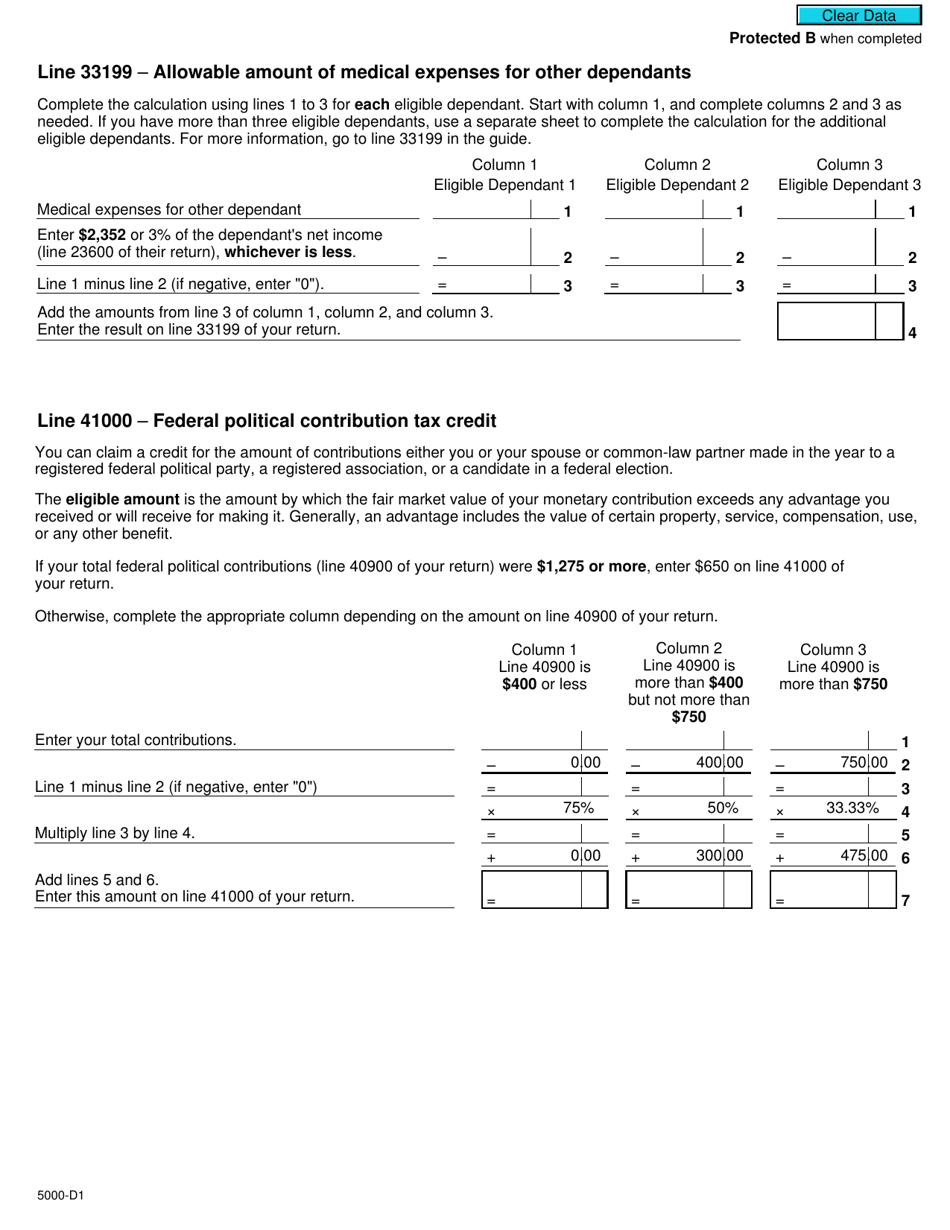

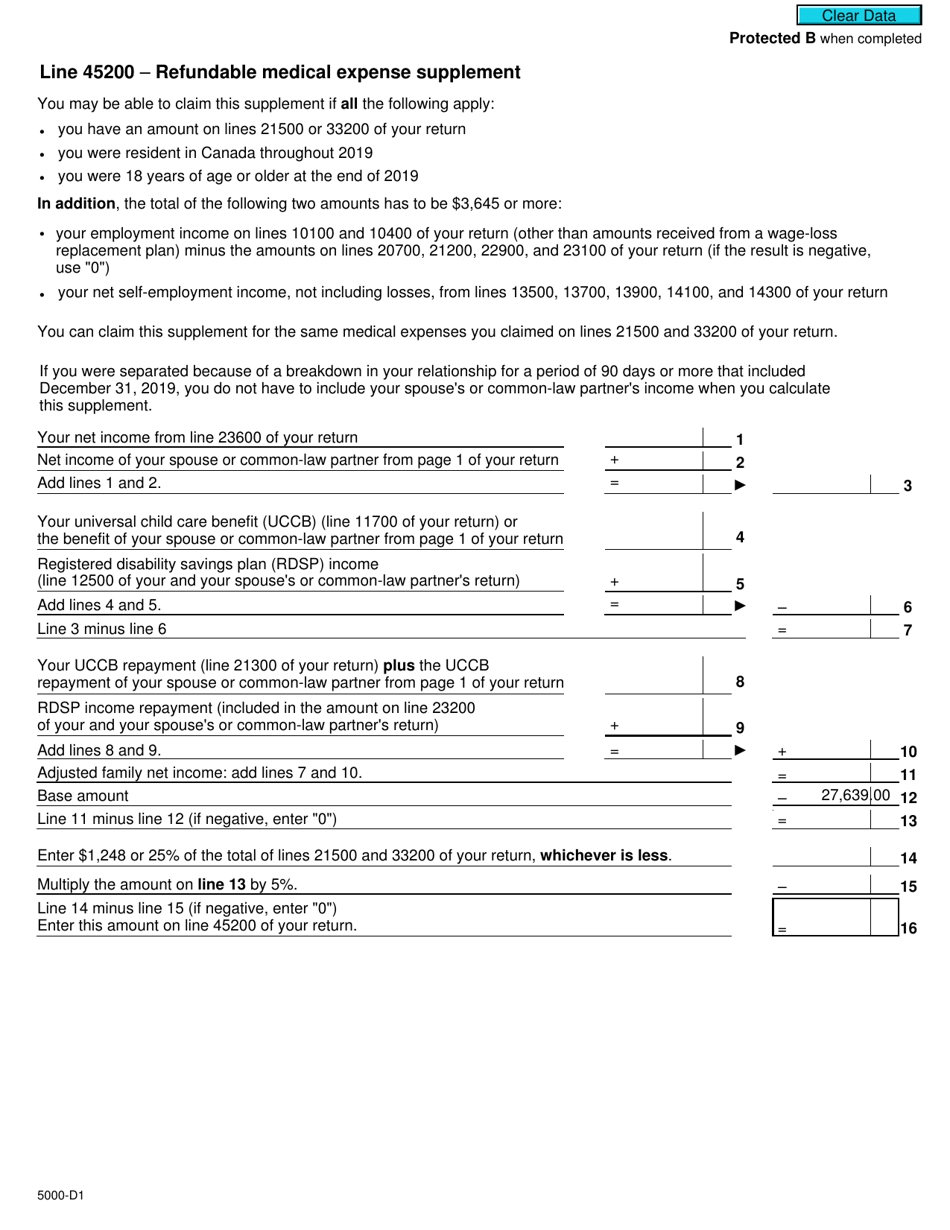

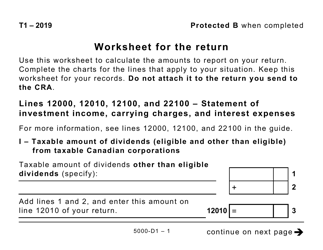

Form 5000-D1

for the current year.

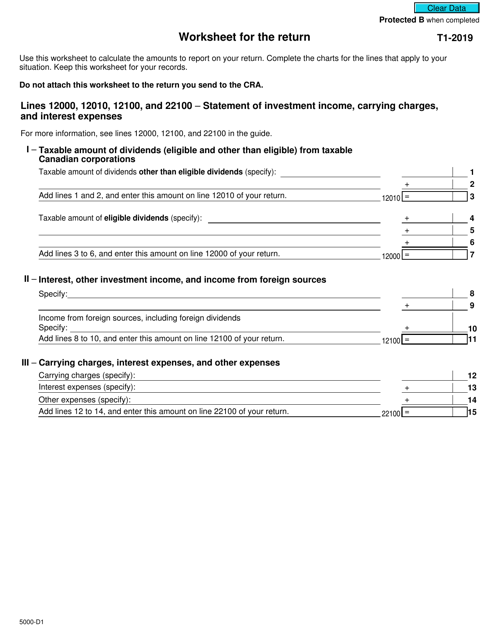

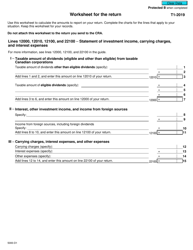

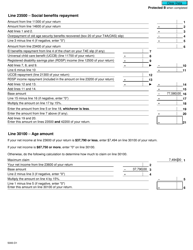

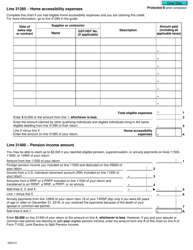

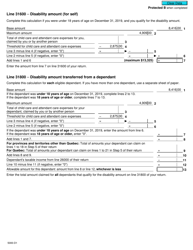

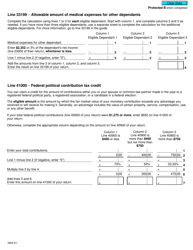

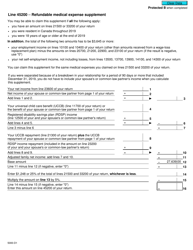

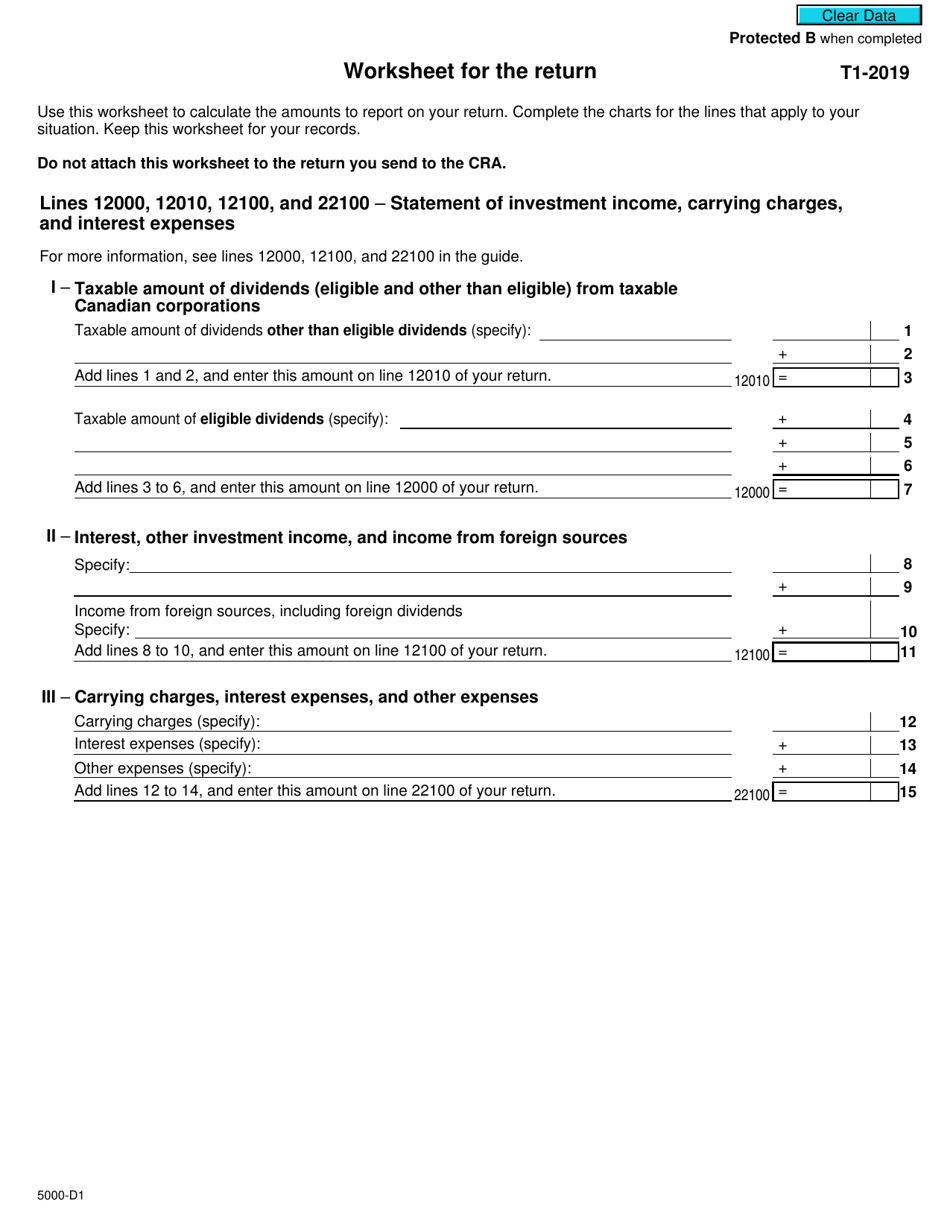

Form 5000-D1 Worksheet for the Return - Canada

The Form 5000-D1 Worksheet for the Return in Canada is a document used to calculate and report your income, deductions, and credits for the purpose of filing your Canadian tax return.

FAQ

Q: What is Form 5000-D1?

A: Form 5000-D1 is a worksheet for the return in Canada.

Q: What is the purpose of Form 5000-D1?

A: The purpose of Form 5000-D1 is to help taxpayers calculate their tax liability.

Q: Who needs to fill out Form 5000-D1?

A: If you are a resident of Canada and need to file a tax return, you may need to fill out Form 5000-D1.

Q: What information is required on Form 5000-D1?

A: Form 5000-D1 requires you to provide details about your income, deductions, and tax credits.

Q: When is Form 5000-D1 due?

A: Form 5000-D1 is due on or before April 30th of the following year, for most taxpayers.

Q: Can I e-file Form 5000-D1?

A: Yes, you can e-file Form 5000-D1 using certified tax software or a tax professional.

Q: What should I do if I can't complete Form 5000-D1 on time?

A: If you can't complete Form 5000-D1 on time, you should apply for an extension with the CRA.

Q: Do I need to keep a copy of Form 5000-D1?

A: Yes, it is recommended to keep a copy of Form 5000-D1 for your records.

Q: What happens if I make a mistake on Form 5000-D1?

A: If you make a mistake on Form 5000-D1, you should correct it and notify the CRA as soon as possible.