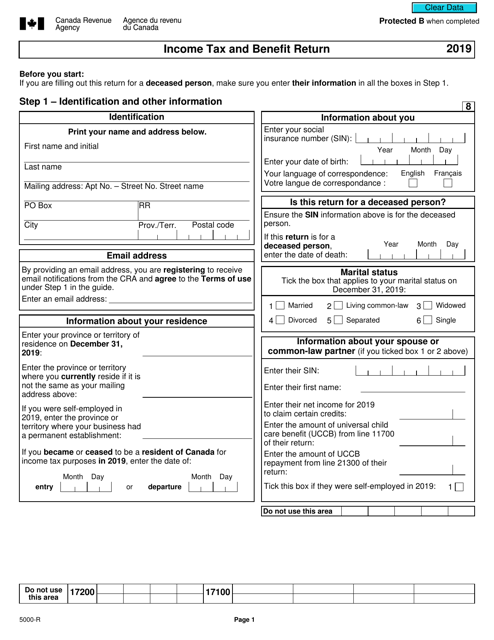

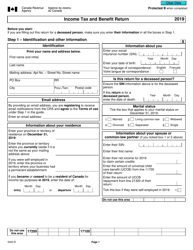

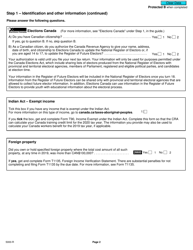

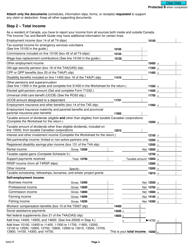

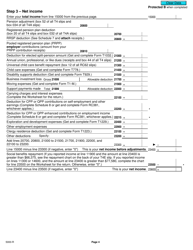

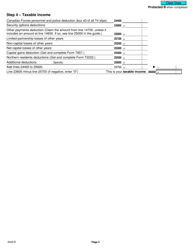

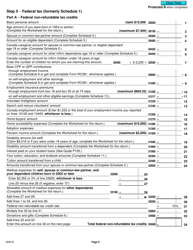

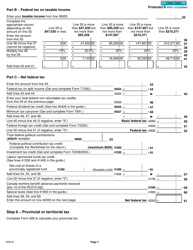

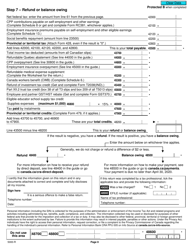

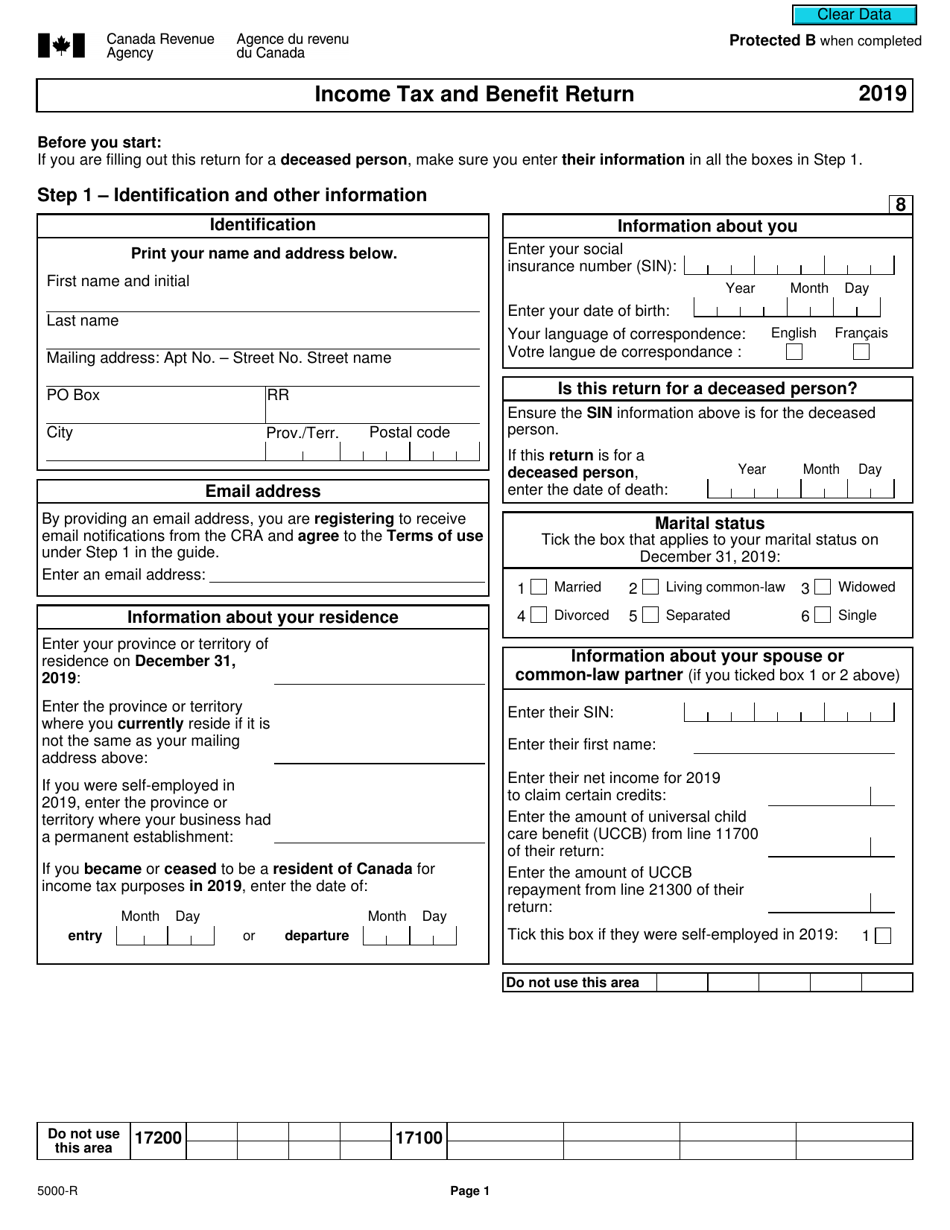

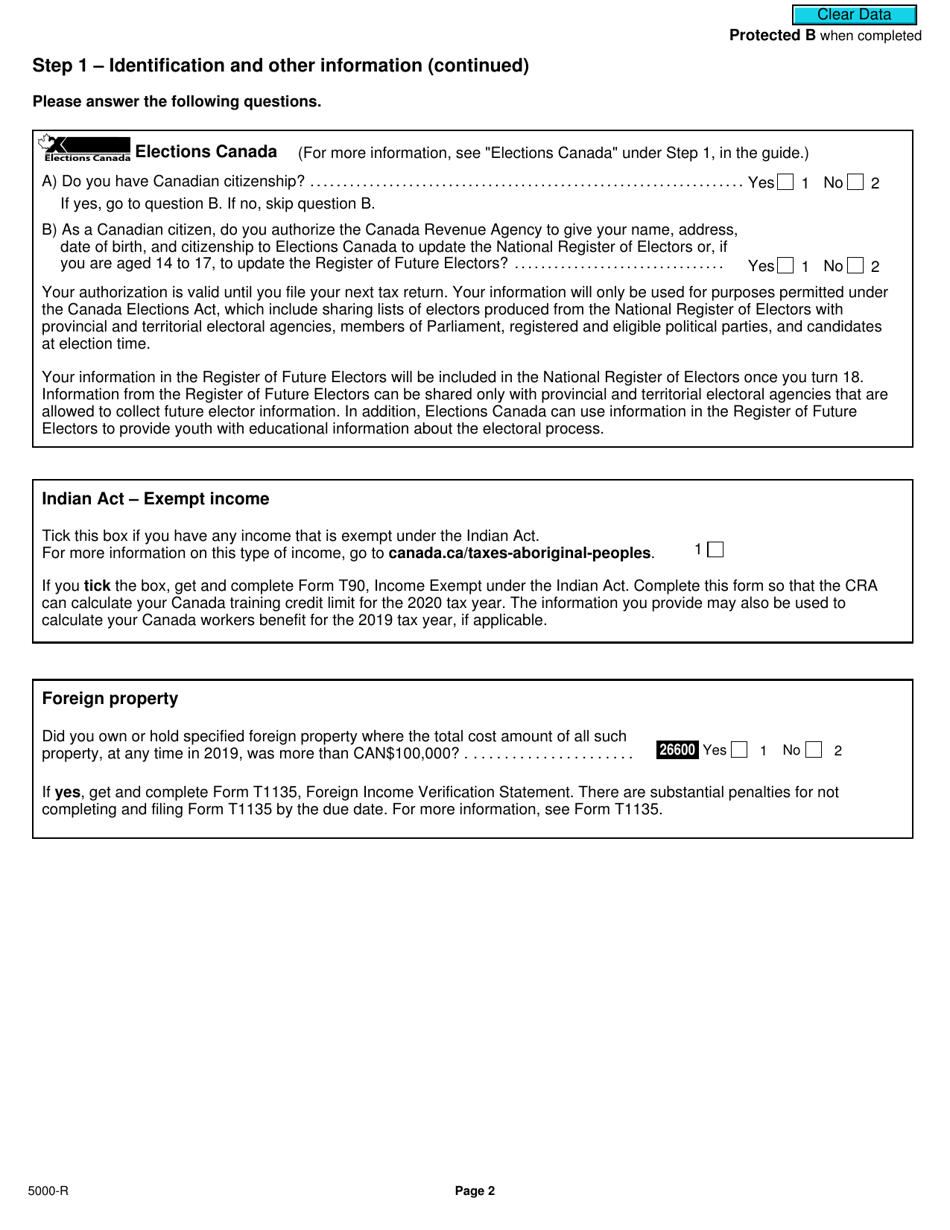

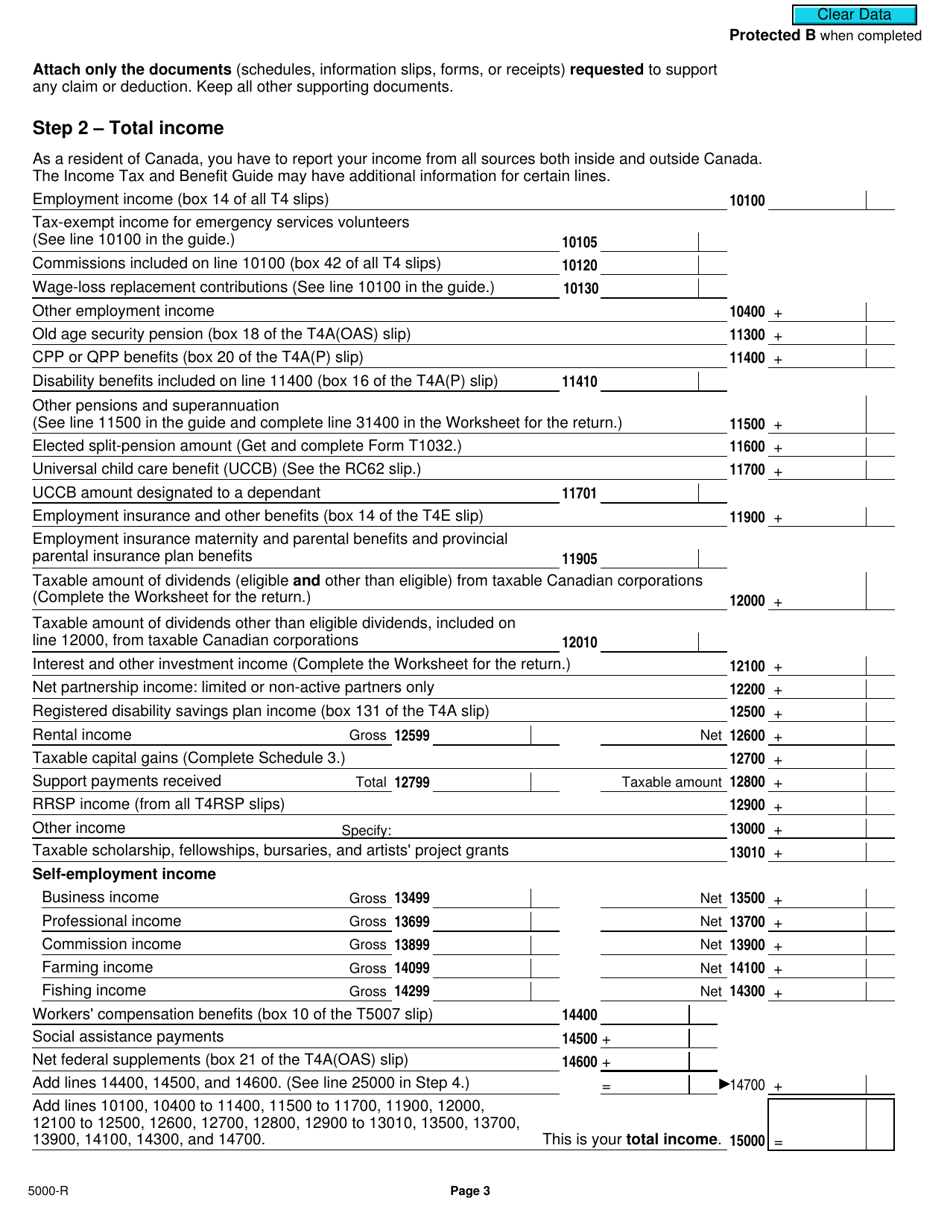

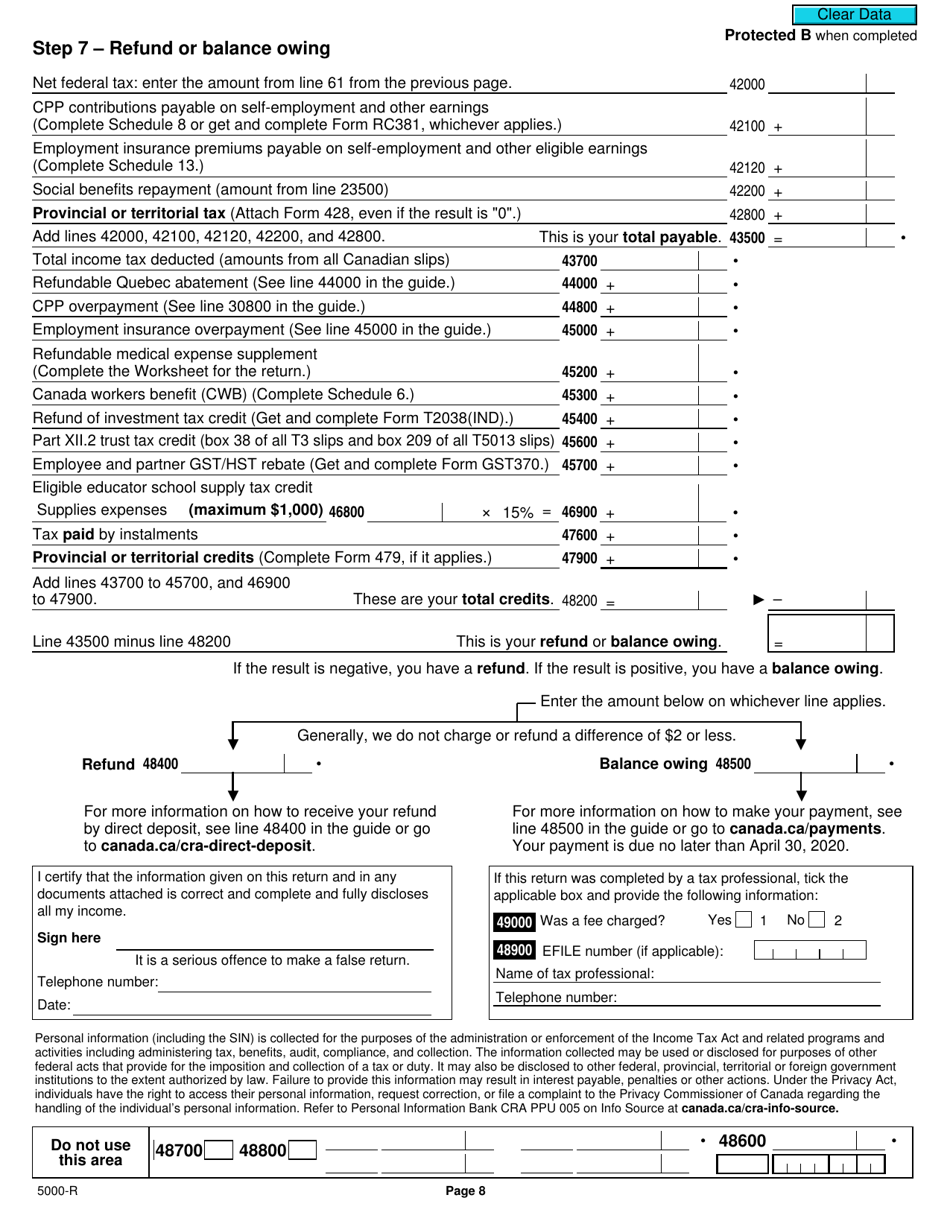

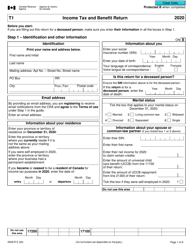

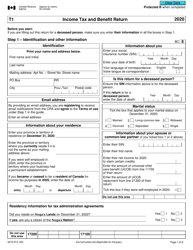

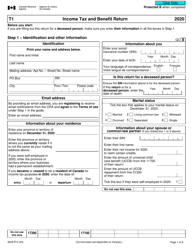

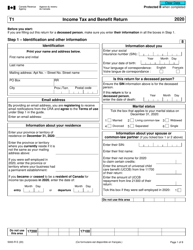

Form 5000-R Income Tax and Benefit Return - Canada

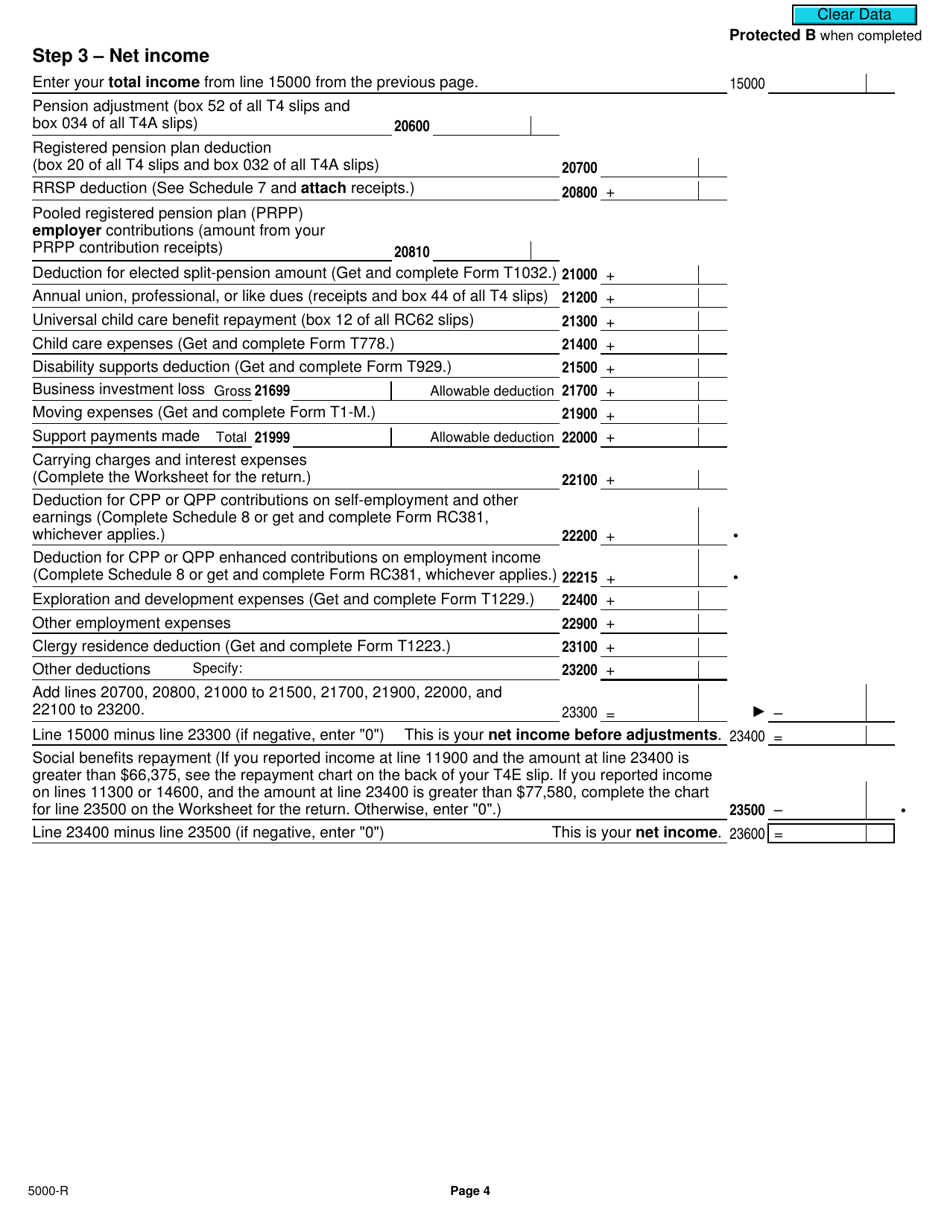

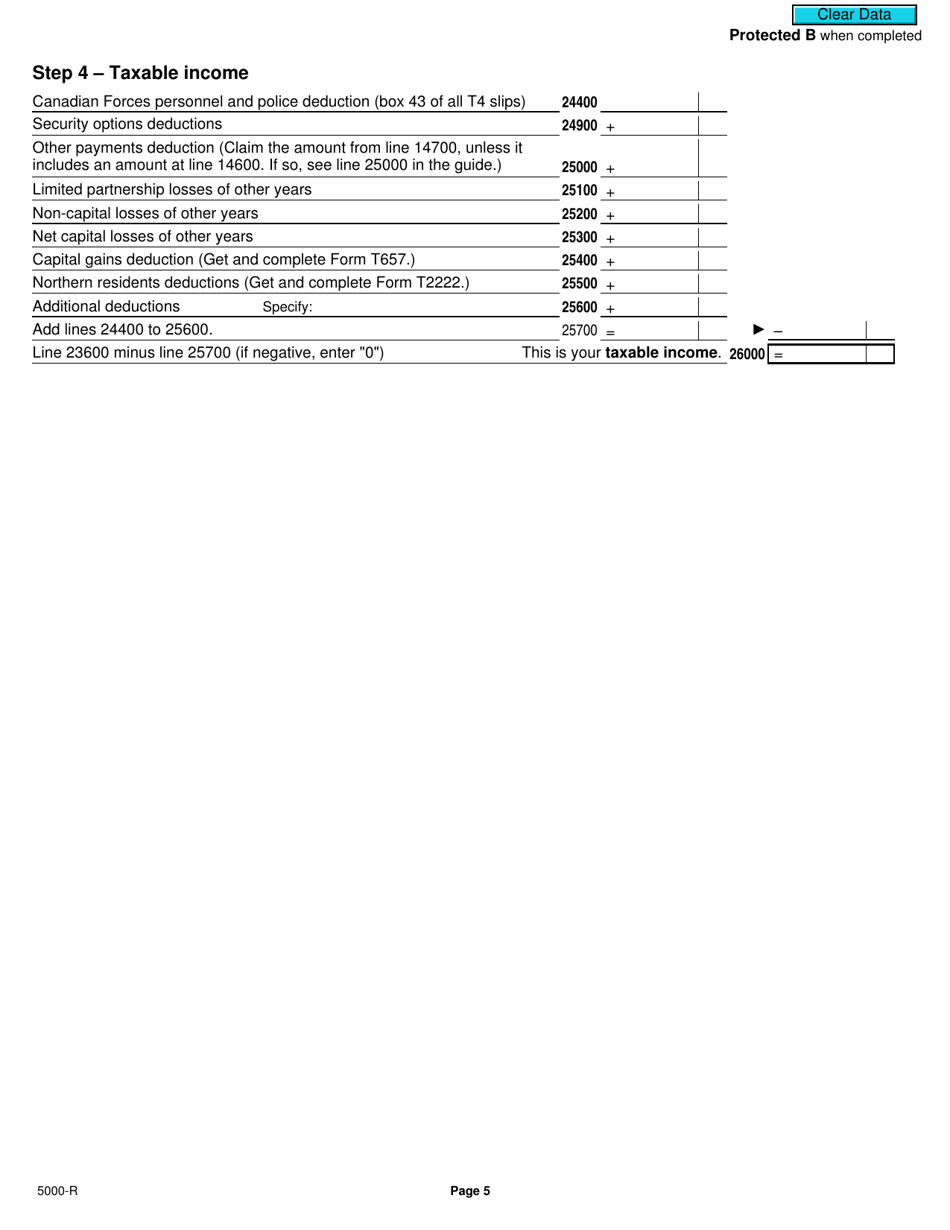

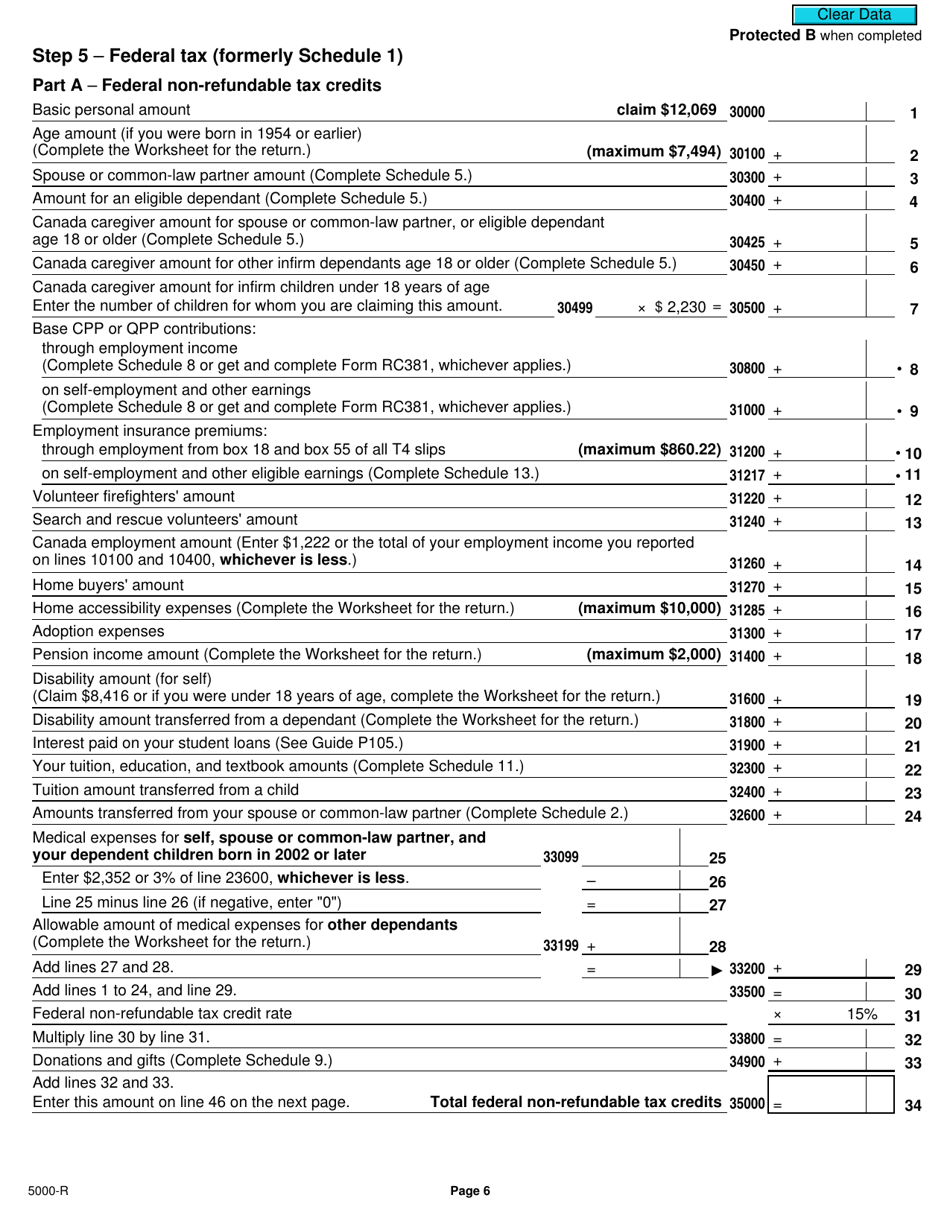

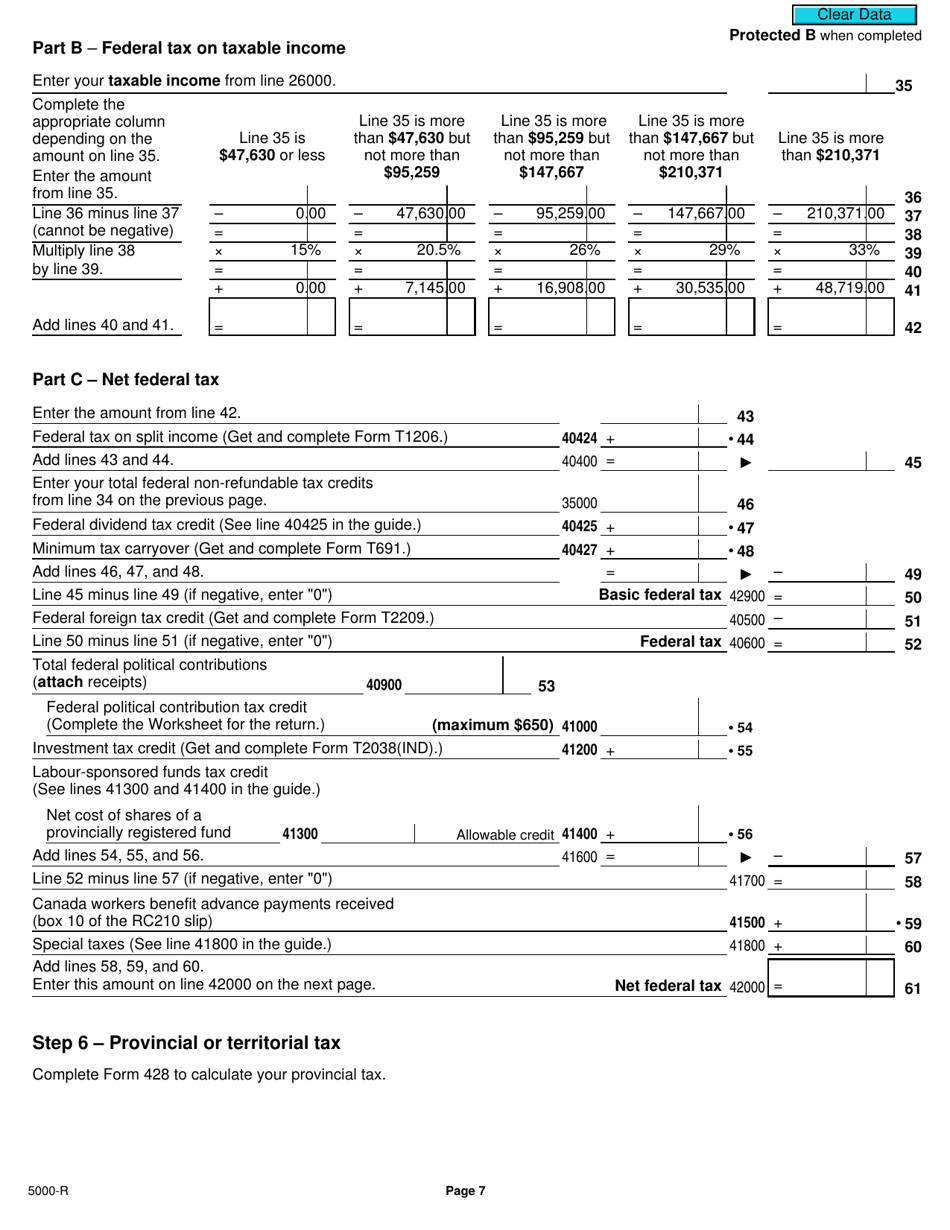

Form 5000-R Income Tax and Benefit Return - Canada is used for filing your annual income tax return in Canada. It is a document that helps you report your income, deductions, and credits to calculate the tax you owe or the refund you may be entitled to.

The Form 5000-R Income Tax and Benefit Return in Canada is filed by individual taxpayers to report their income and claim various tax deductions and benefits.

FAQ

Q: What is Form 5000-R?

A: Form 5000-R is the Income Tax and Benefit Return form used in Canada.

Q: Who needs to file Form 5000-R?

A: Any individual who has to pay income tax in Canada needs to file Form 5000-R.

Q: What is the purpose of Form 5000-R?

A: Form 5000-R is used to report your income, deductions, and credits to the Canada Revenue Agency (CRA).

Q: What information is required on Form 5000-R?

A: Form 5000-R requires you to provide personal information, income details, deductions, and credits.

Q: When is the deadline to file Form 5000-R?

A: The deadline to file Form 5000-R is April 30th, unless you or your spouse are self-employed, in which case the deadline is June 15th.

Q: What happens if I don't file Form 5000-R?

A: If you don't file Form 5000-R, you may face penalties and interest charges from the CRA.

Q: Can I claim deductions and credits on Form 5000-R?

A: Yes, Form 5000-R allows you to claim various deductions and credits, such as medical expenses, charitable donations, and tuition fees.