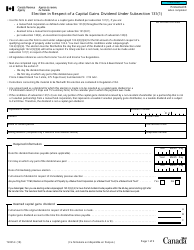

This version of the form is not currently in use and is provided for reference only. Download this version of

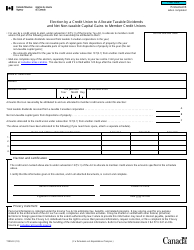

Form 5000-S3 Schedule 3

for the current year.

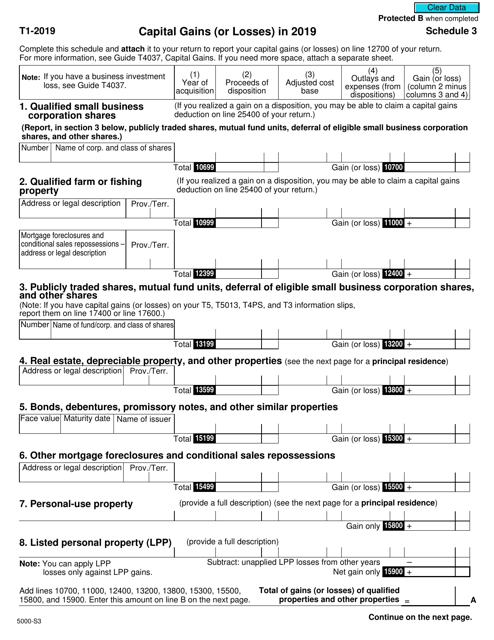

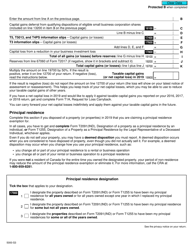

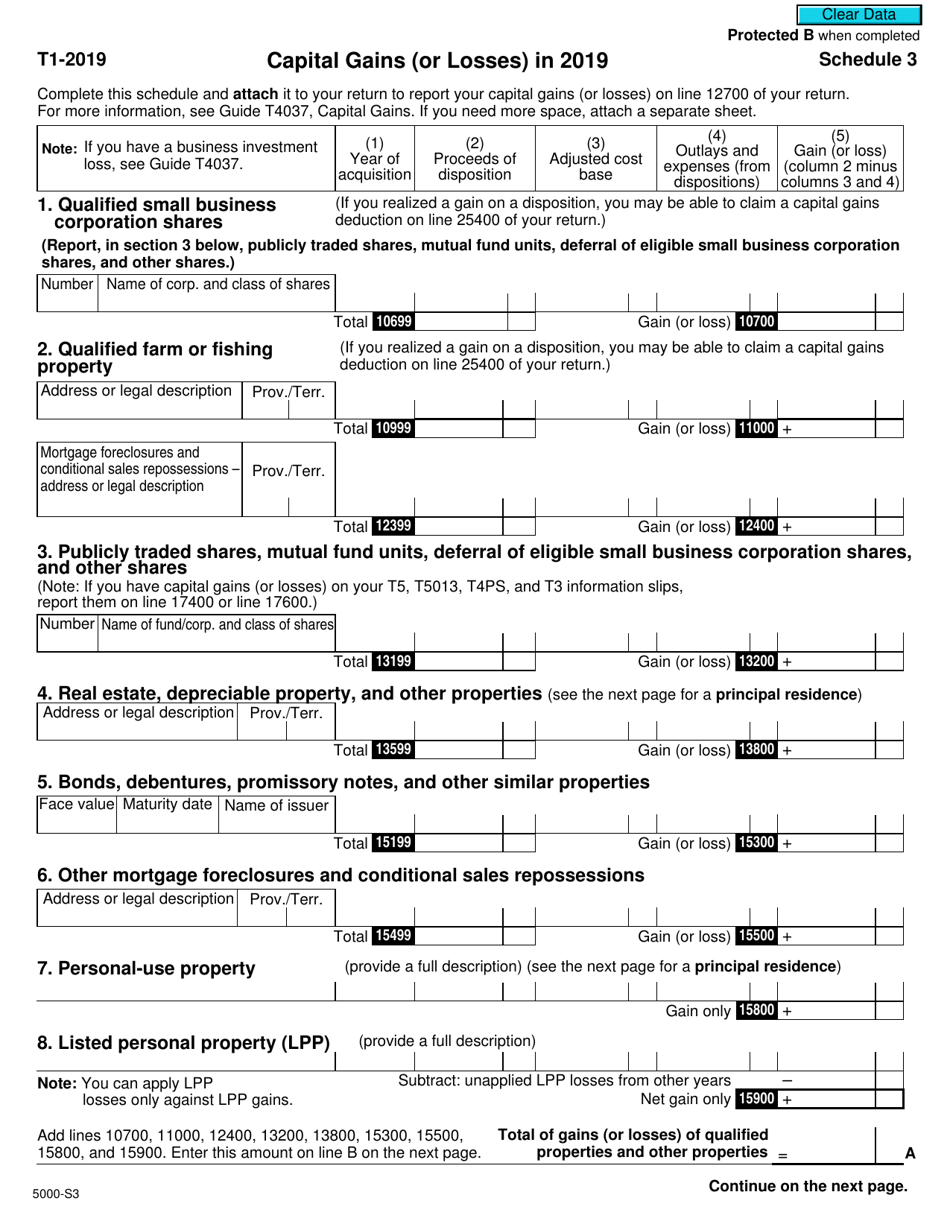

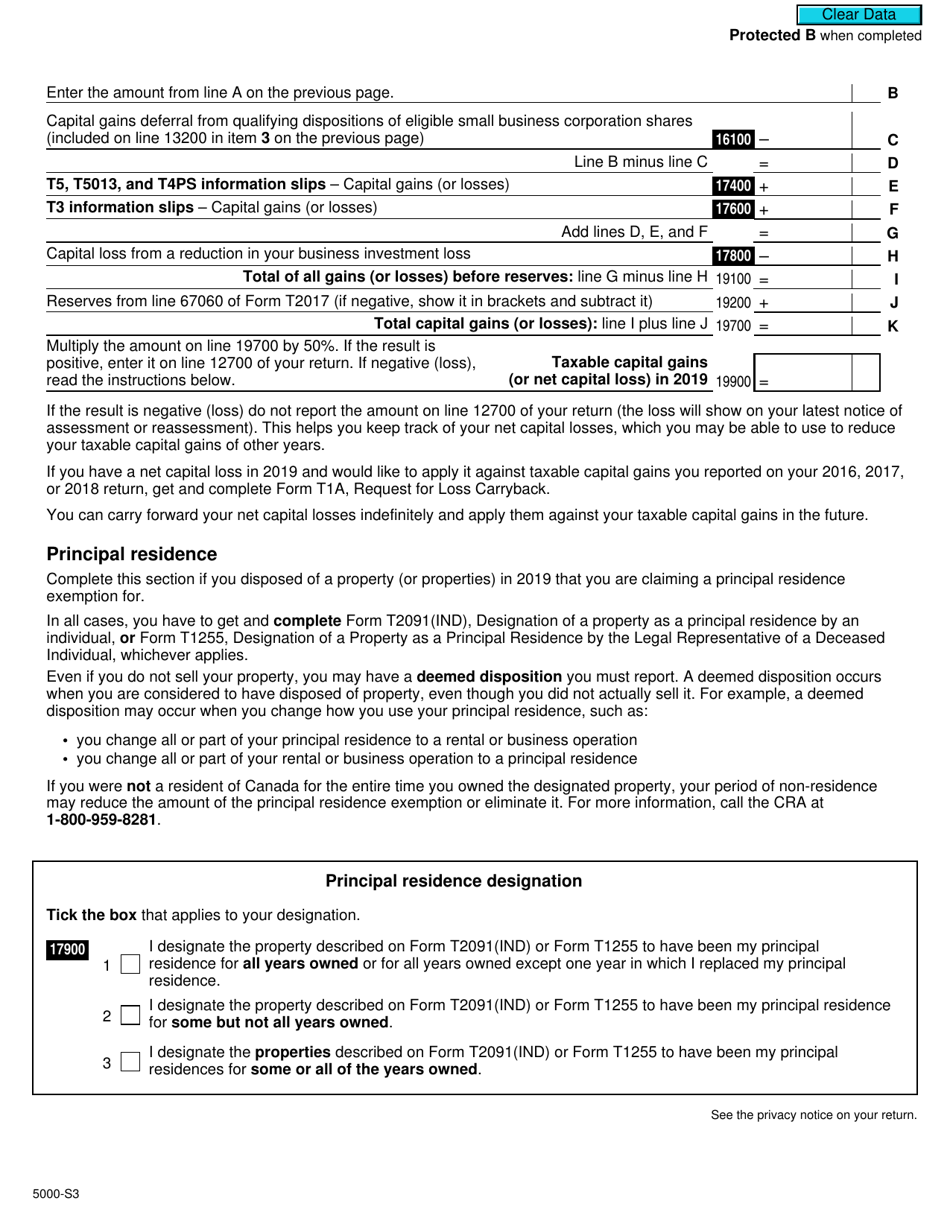

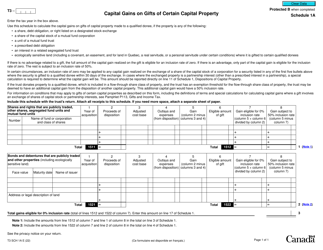

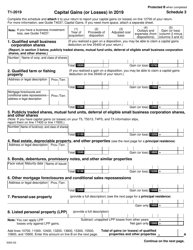

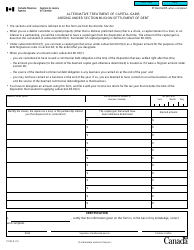

Form 5000-S3 Schedule 3 Capital Gains (Or Losses) - Canada

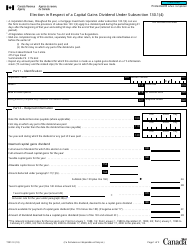

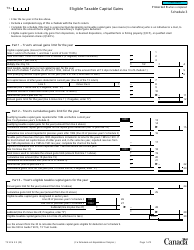

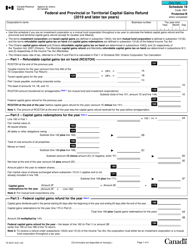

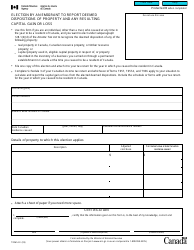

Form 5000-S3 Schedule 3 Capital Gains (Or Losses) in Canada is used to report any capital gains or losses that you may have made during the tax year. It is part of the Canadian income tax return and is used to calculate the taxable income from the sale of capital assets, such as stocks, real estate, or investments.

Individuals who have capital gains or losses in Canada file the Form 5000-S3 Schedule 3.

FAQ

Q: What is Form 5000-S3 Schedule 3?

A: Form 5000-S3 Schedule 3 is a tax form used in Canada to report capital gains or losses.

Q: Who needs to file Form 5000-S3 Schedule 3?

A: Individuals in Canada who have capital gains or losses during the tax year need to file Form 5000-S3 Schedule 3.

Q: What information is required on Form 5000-S3 Schedule 3?

A: Form 5000-S3 Schedule 3 requires information about the taxpayer, details of the capital gains or losses, and calculations.

Q: When is the deadline to file Form 5000-S3 Schedule 3?

A: The deadline to file Form 5000-S3 Schedule 3 in Canada is usually April 30th of the following year.

Q: What happens if I don't file Form 5000-S3 Schedule 3?

A: If you have capital gains or losses and fail to file Form 5000-S3 Schedule 3, you may face penalties or interest charges from the Canada Revenue Agency.

Q: Do I need to include supporting documents with Form 5000-S3 Schedule 3?

A: You should keep supporting documents, such as receipts or transaction records, but you don't need to submit them with the form. Keep them for possible audit.

Q: What if I have multiple capital gains or losses?

A: If you have multiple capital gains or losses, you need to provide separate calculations for each one on Form 5000-S3 Schedule 3.

Q: Can I get help with completing Form 5000-S3 Schedule 3?

A: Yes, you can seek assistance from professional tax preparers or use software programs specifically designed for tax filing in Canada.