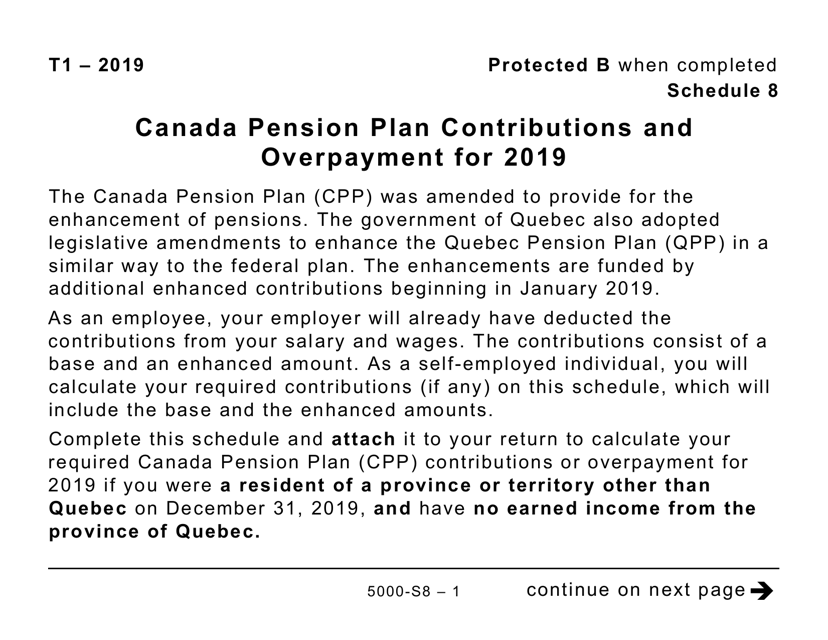

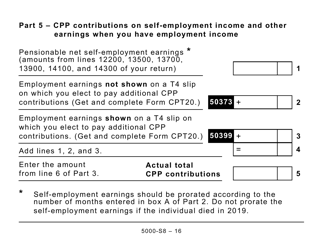

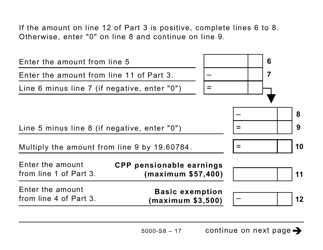

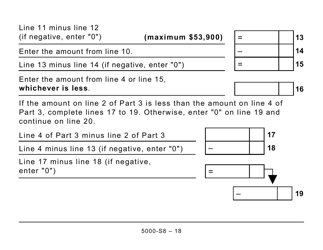

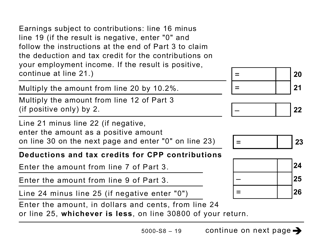

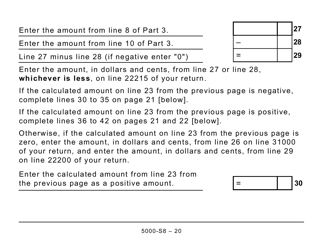

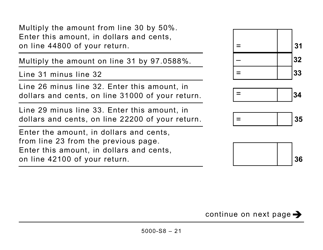

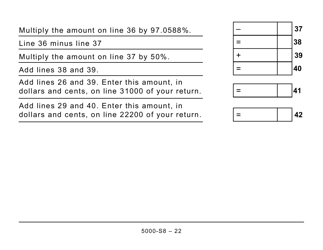

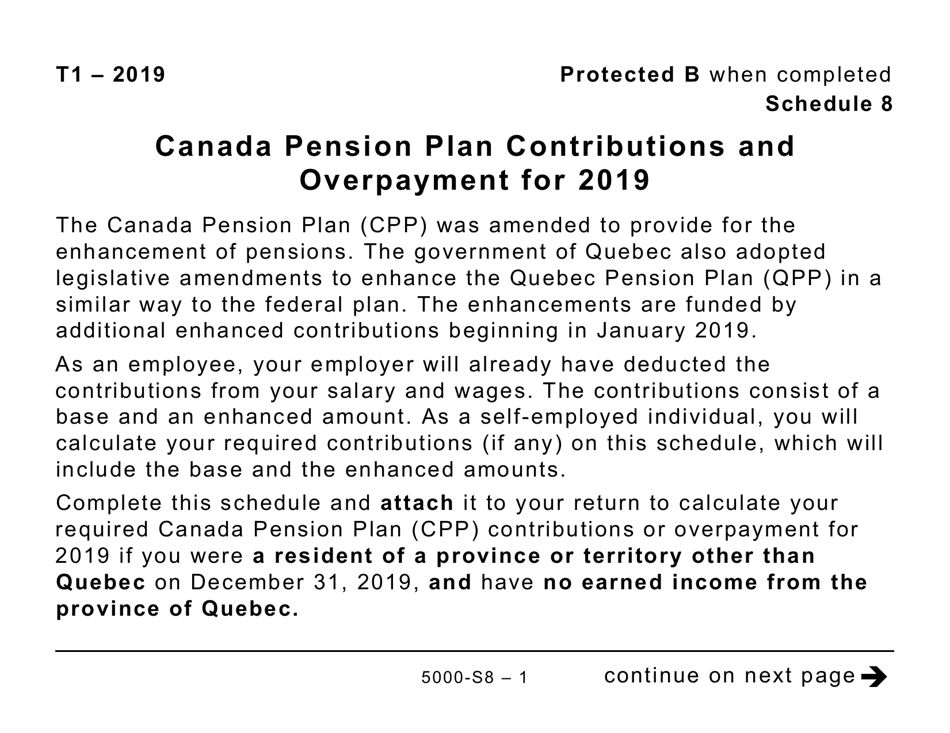

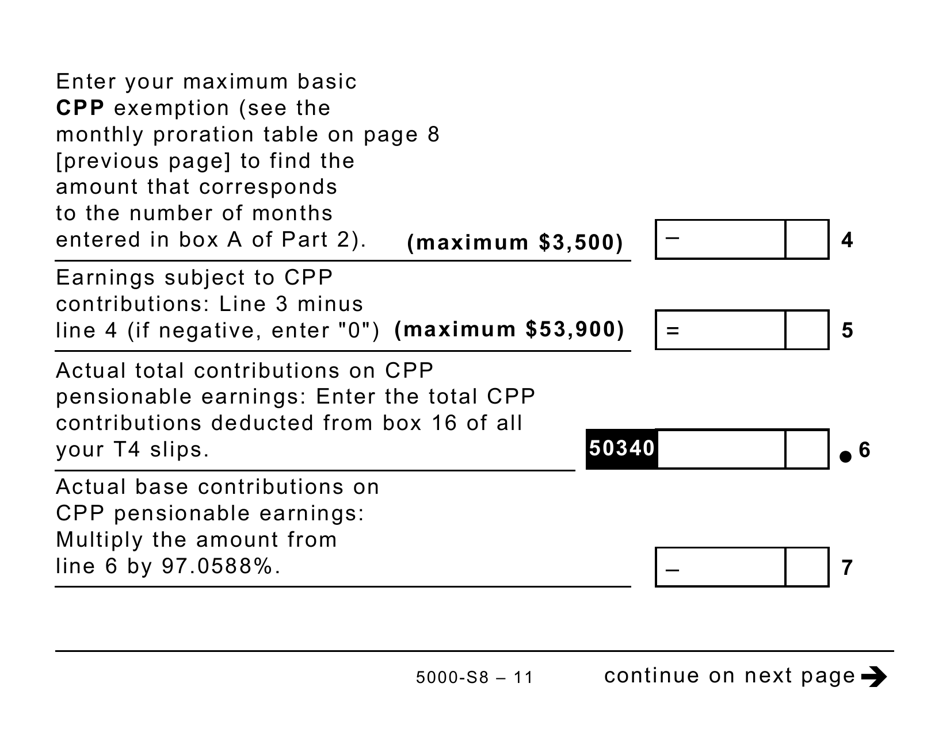

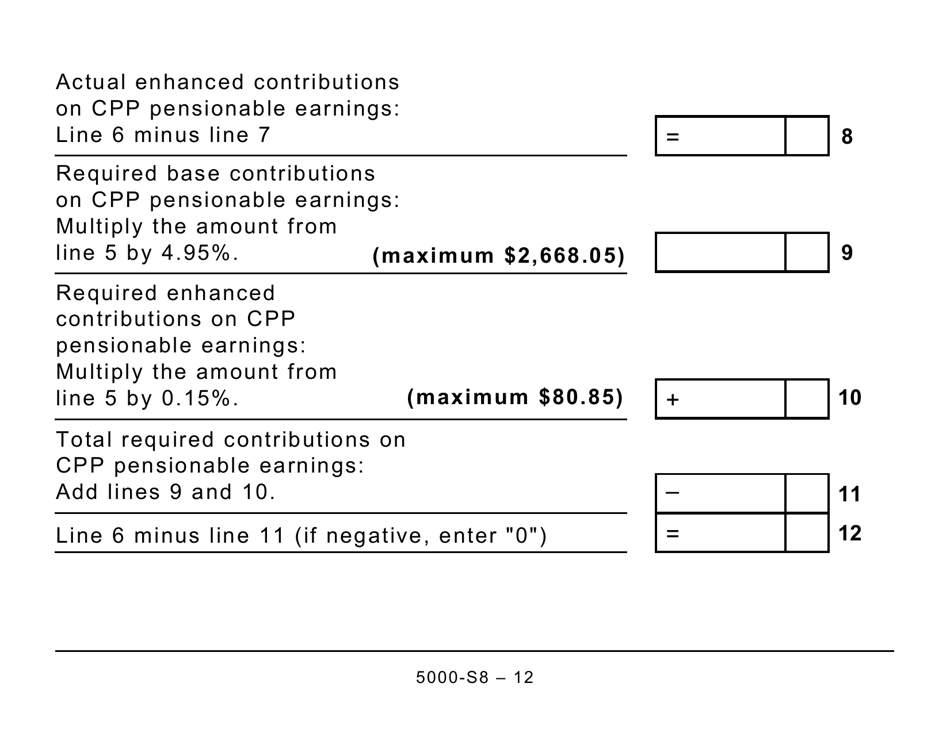

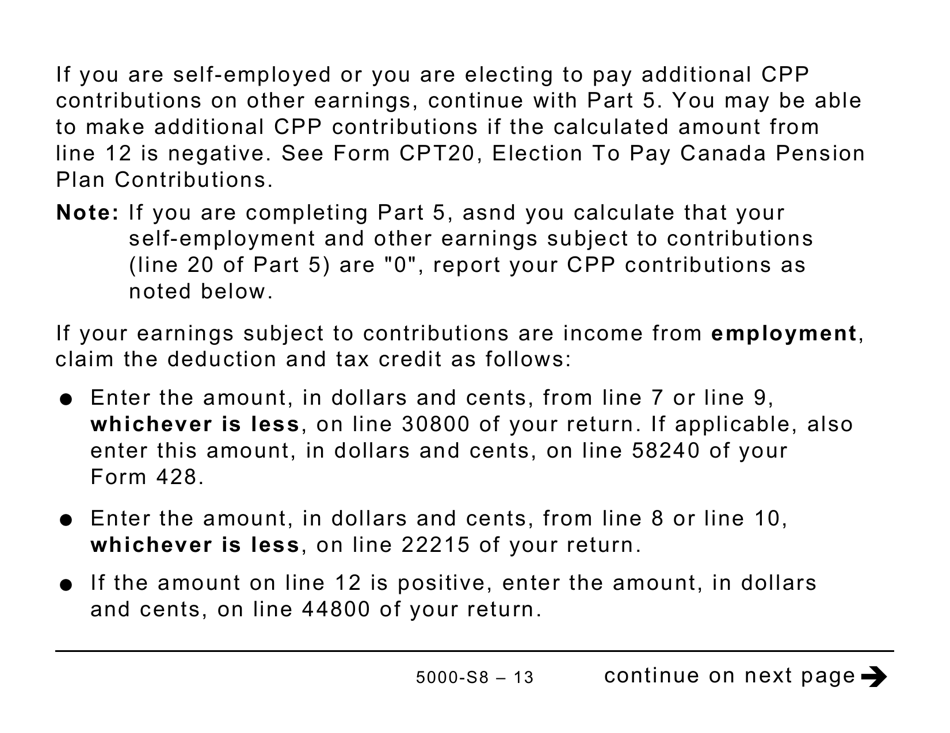

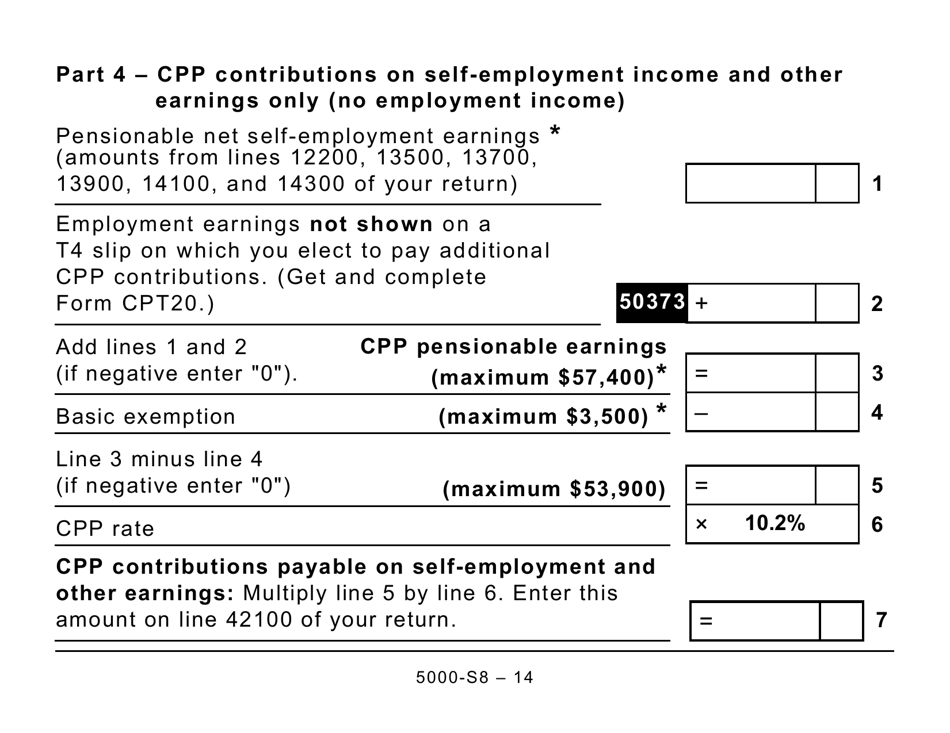

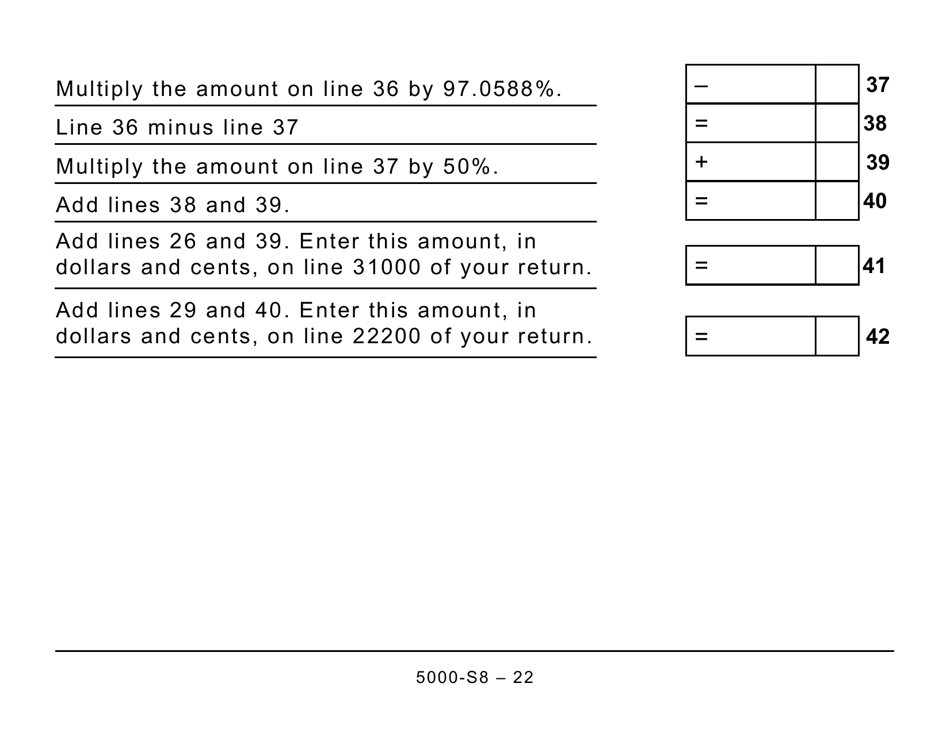

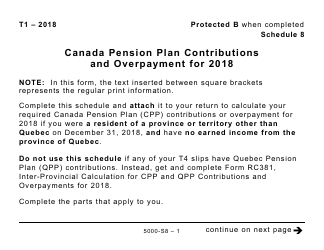

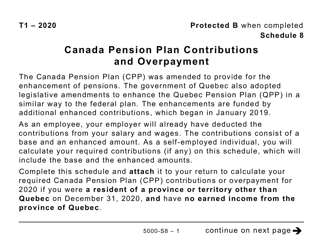

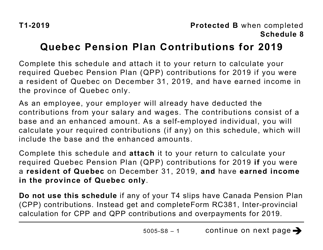

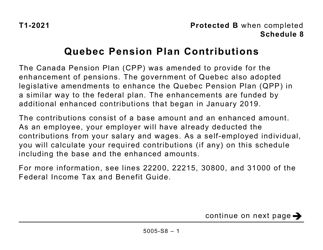

Form 5000-S8 Schedule 8 Canada Pension Plan Contributions and Overpayment (Large Print) - Canada

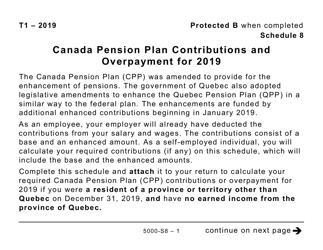

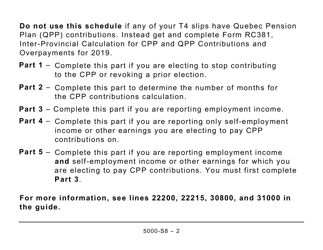

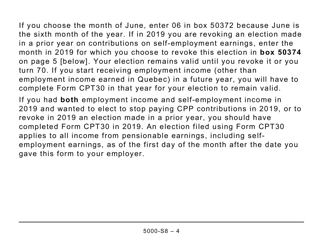

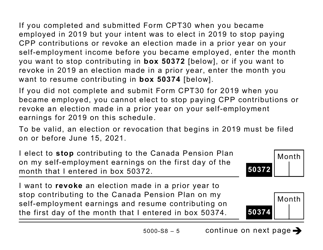

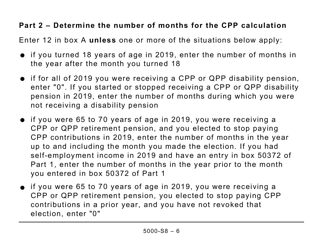

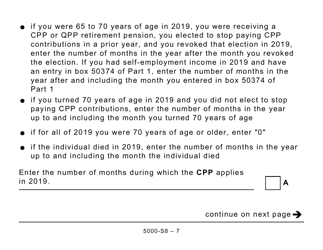

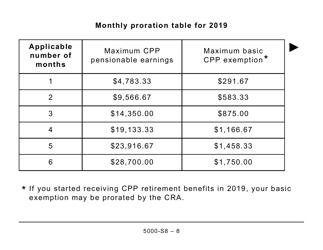

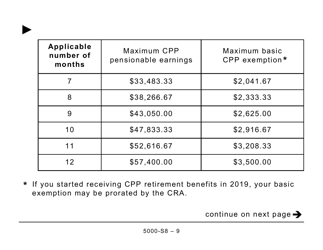

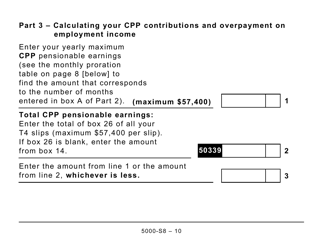

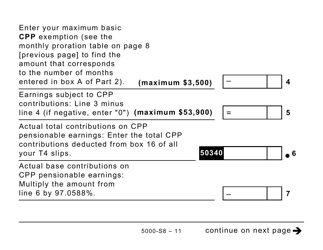

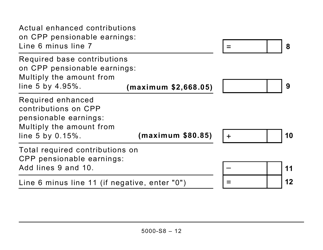

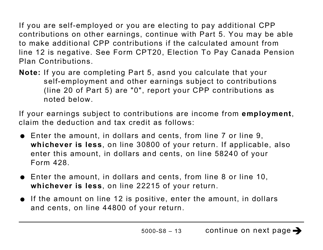

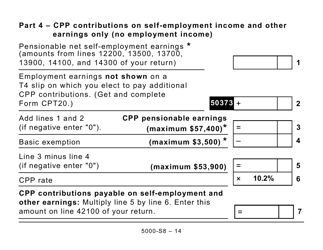

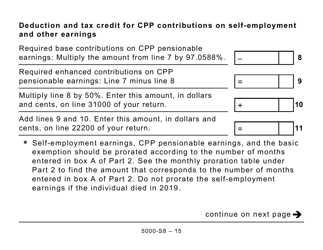

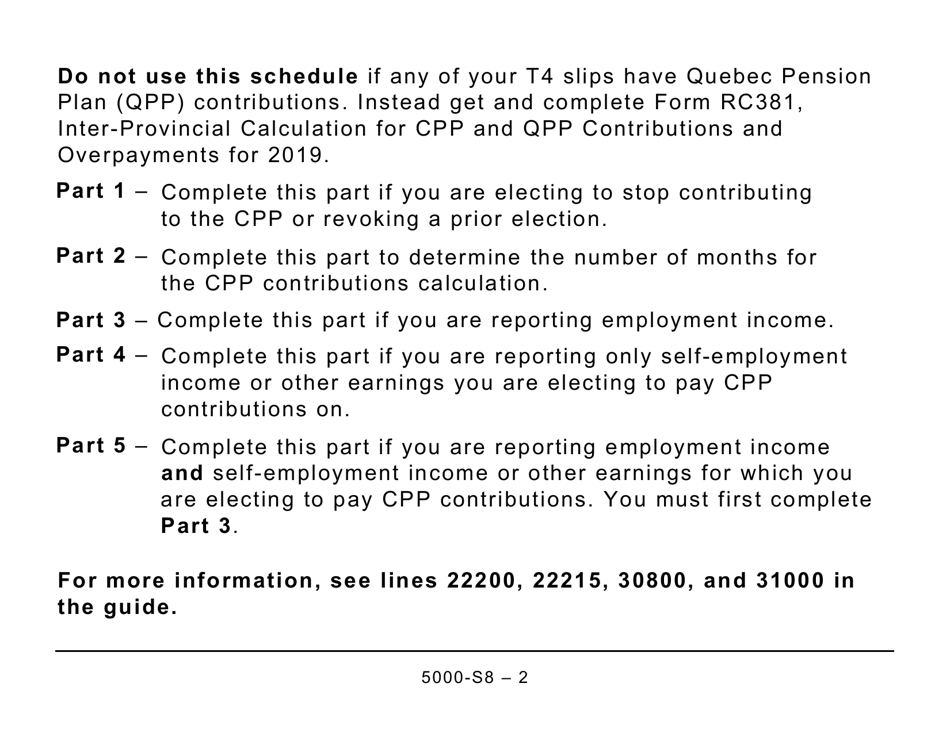

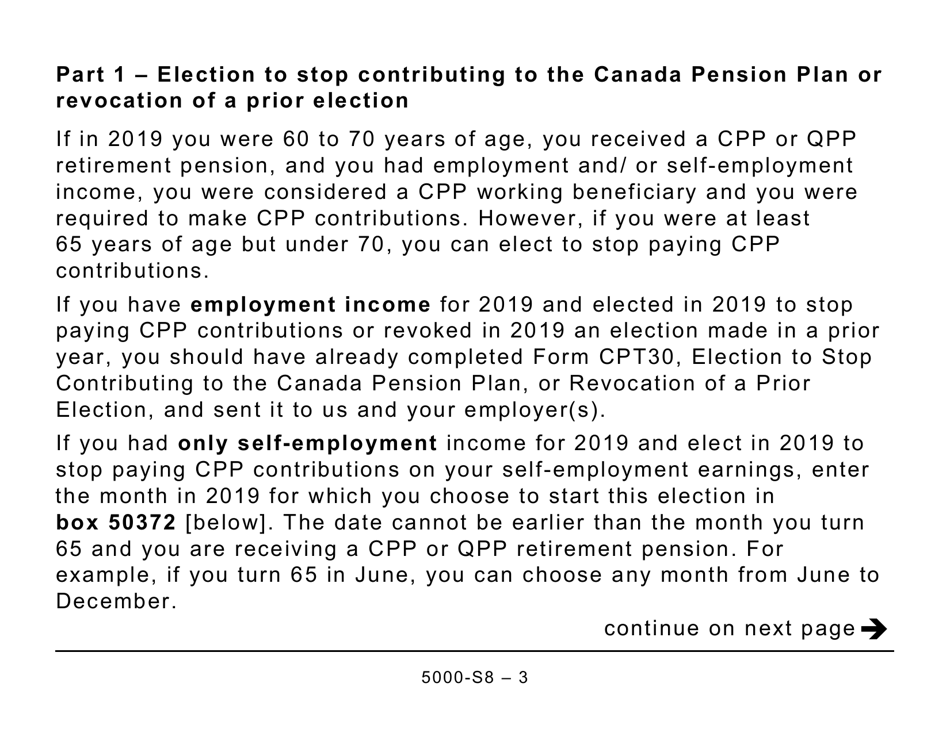

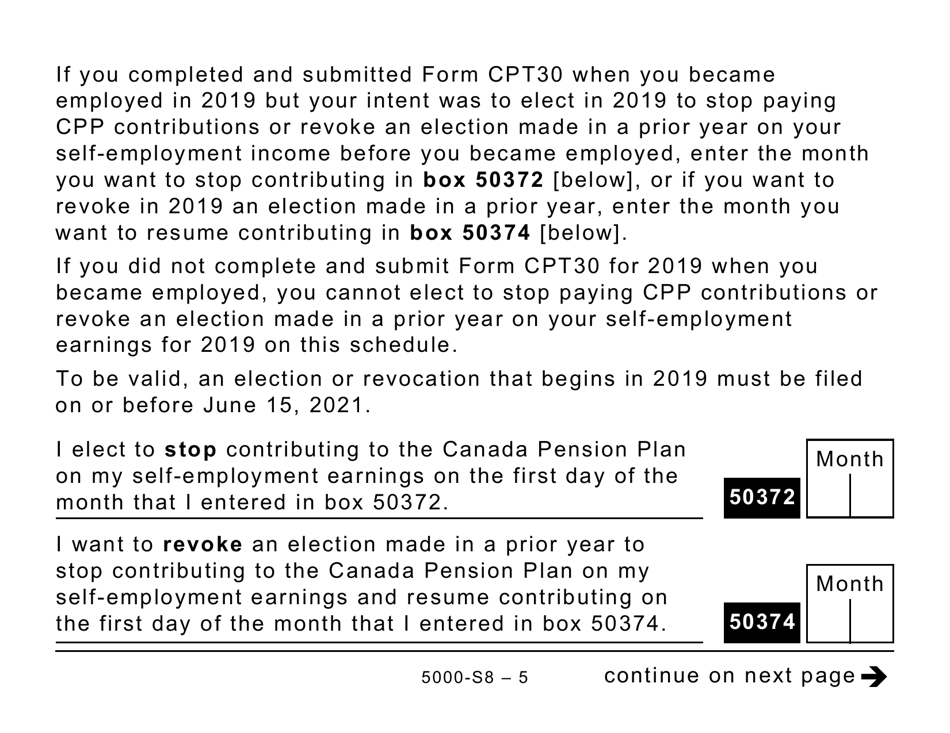

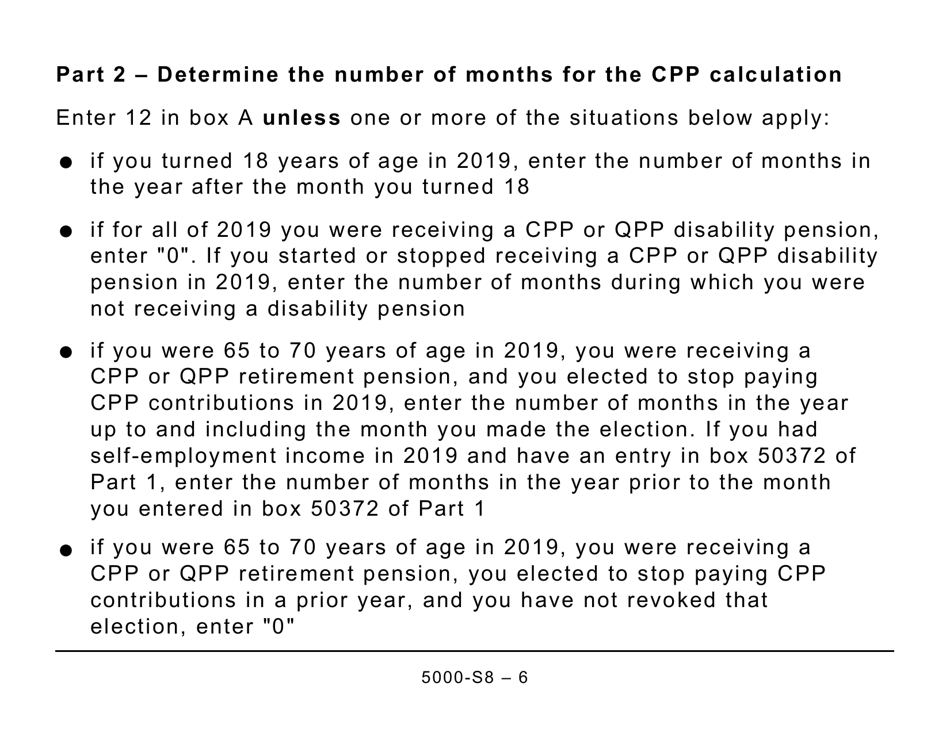

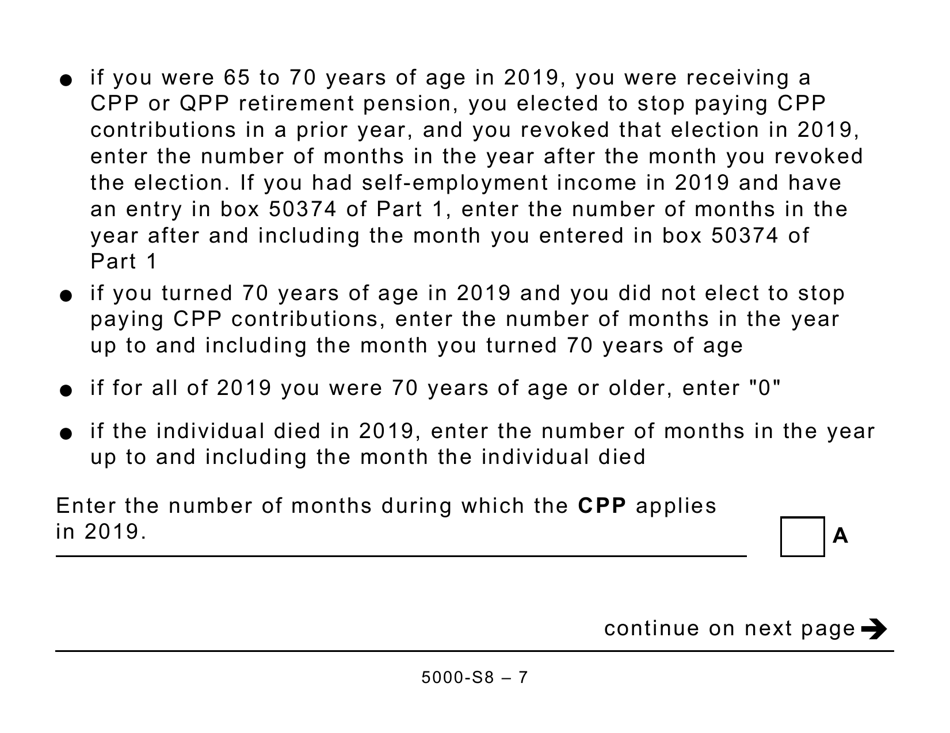

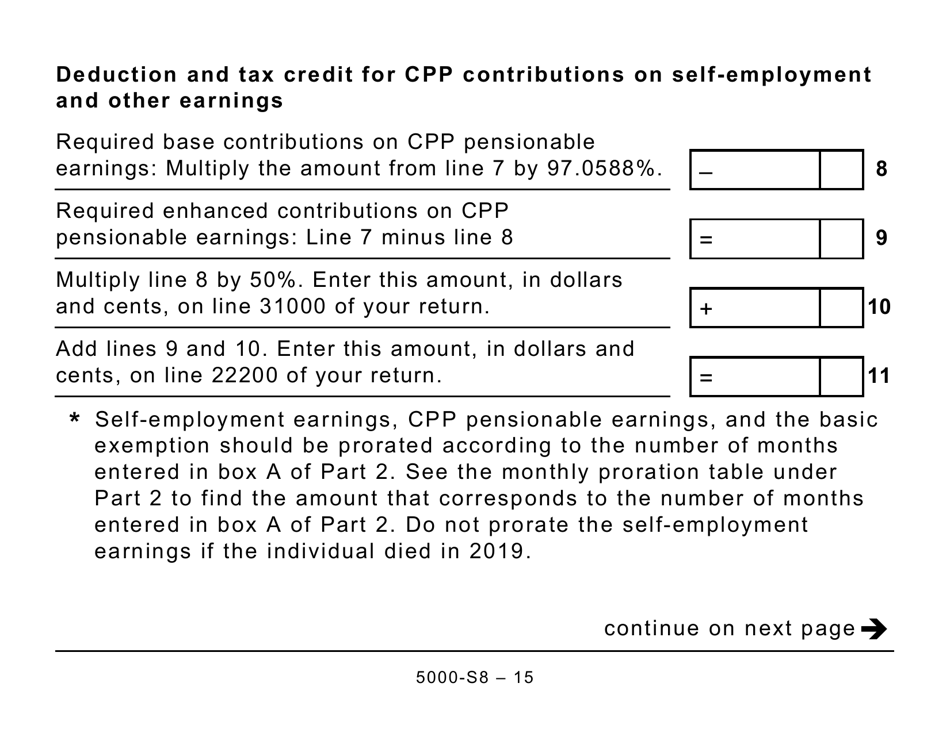

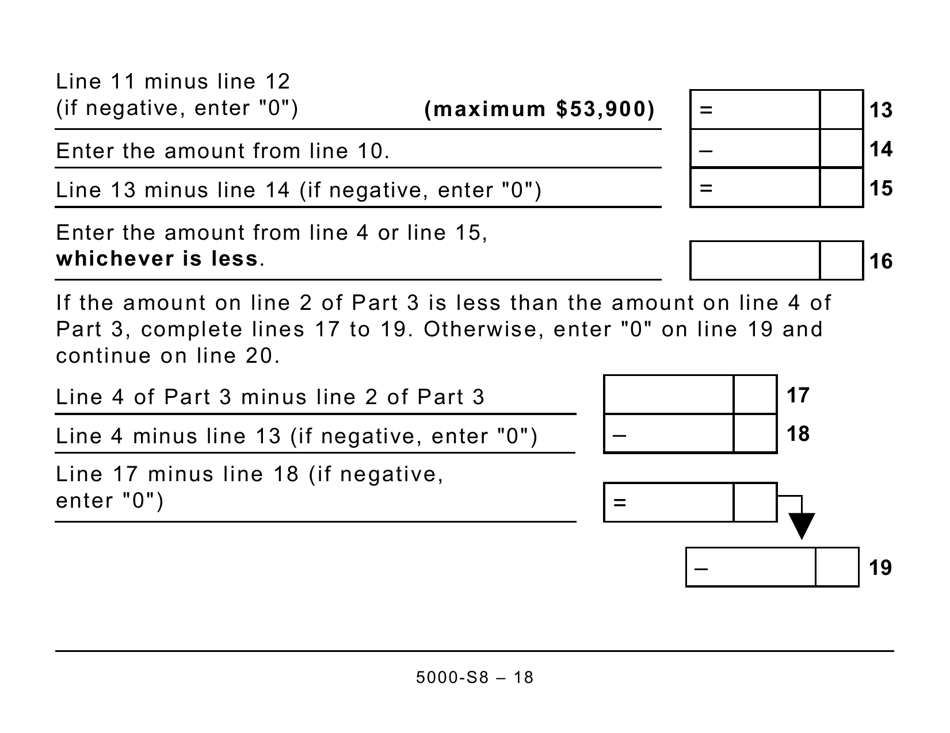

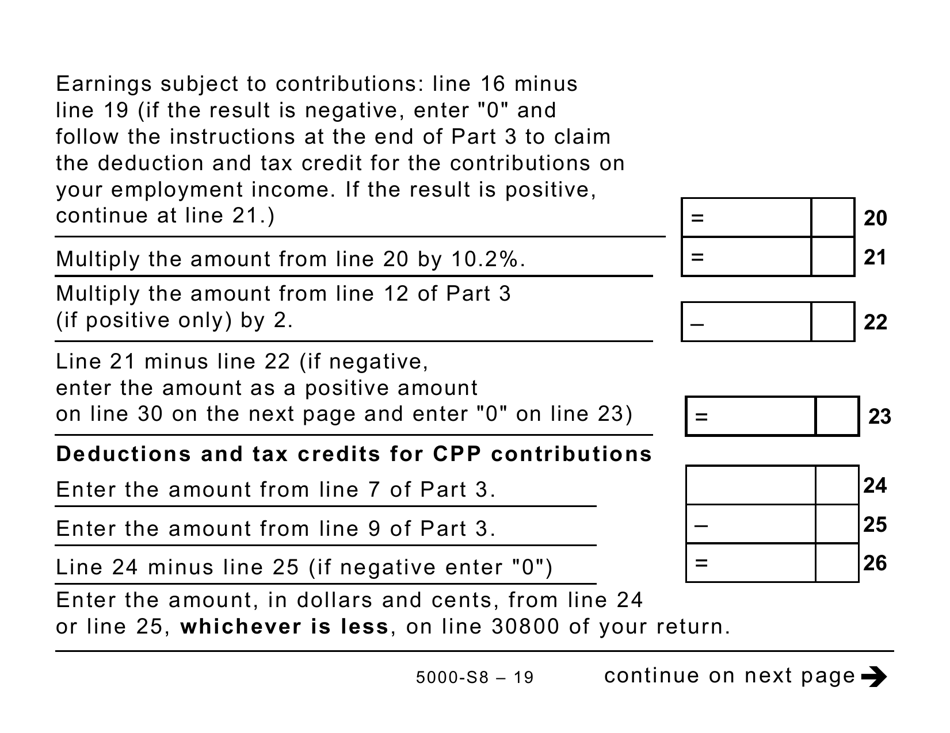

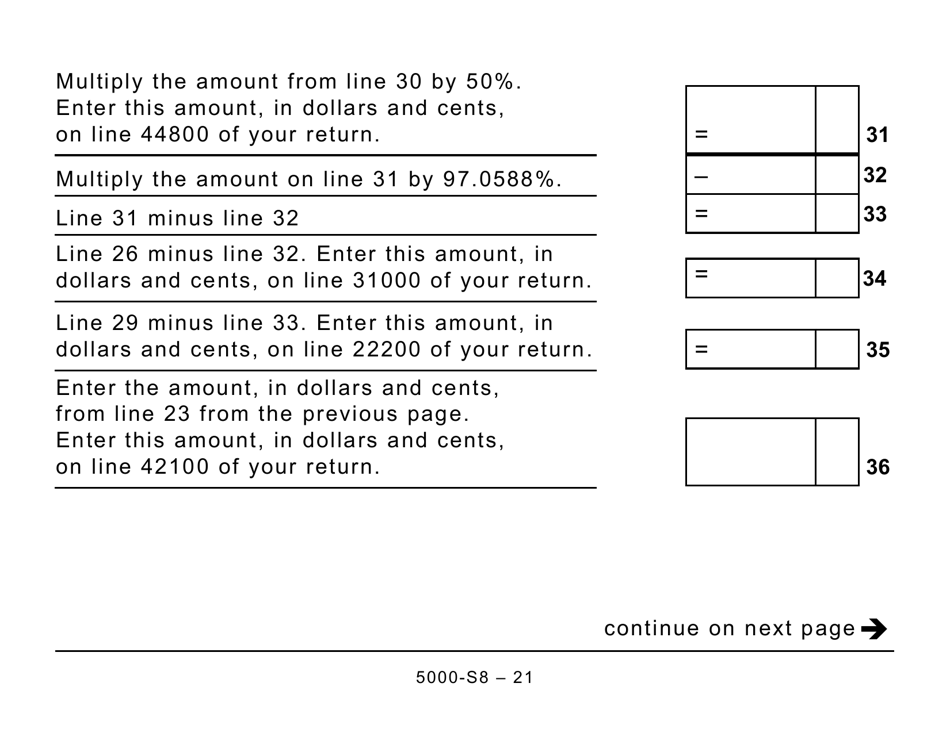

Form 5000-S8 Schedule 8 is used for reporting contributions and overpayments to the Canada Pension Plan. It is specifically designed for individuals who require a large print format.

Individuals who have made contributions to the Canada Pension Plan (CPP) and have overpaid are required to file the Form 5000-S8 Schedule 8.

FAQ

Q: What is Form 5000-S8?

A: Form 5000-S8 is a schedule used for reporting Canada Pension Plan (CPP) contributions and overpayments.

Q: Who should use Form 5000-S8?

A: This form is used by individuals who need to report their CPP contributions and any overpayments they may have made.

Q: What is the purpose of Form 5000-S8?

A: The purpose of this form is to report CPP contributions and any overpayments made by individuals.

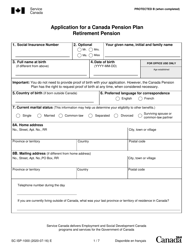

Q: What information is required on Form 5000-S8?

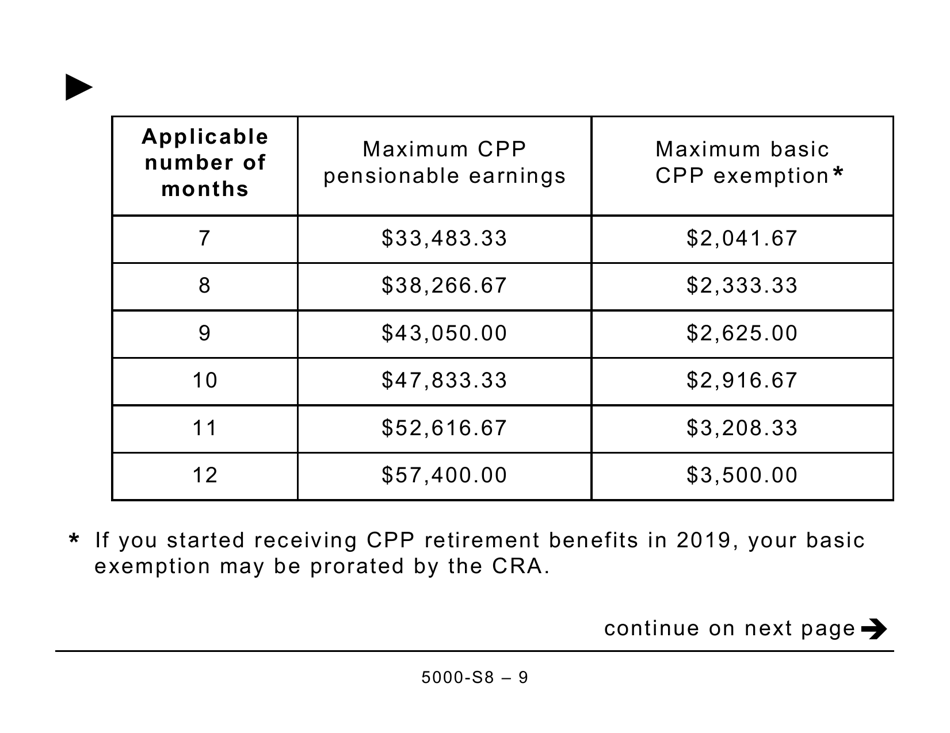

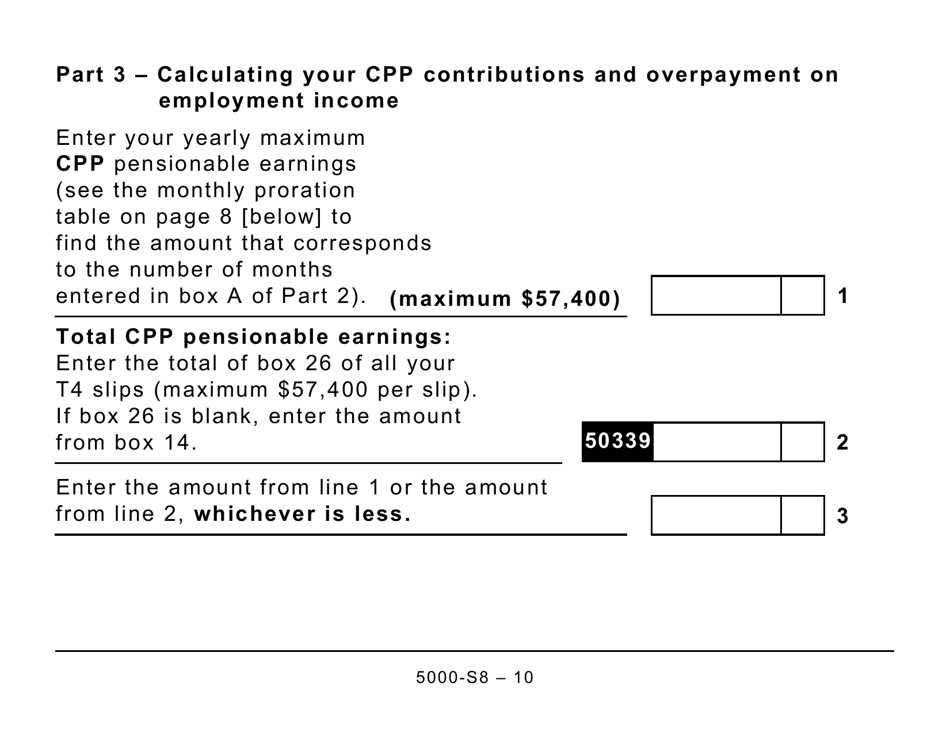

A: On this form, you will need to provide information about your CPP contributions and any overpayments, including the relevant amounts and dates.

Q: Is Form 5000-S8 available in large print?

A: Yes, Form 5000-S8 is available in a large print format for individuals who may have difficulty reading the standard form.

Q: When should I submit Form 5000-S8?

A: Form 5000-S8 should be submitted to the CRA along with your personal income tax return.

Q: Do I need to keep a copy of Form 5000-S8 for my records?

A: Yes, it is recommended to keep a copy of all forms and documents related to your tax filings for your records.