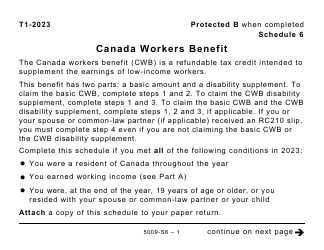

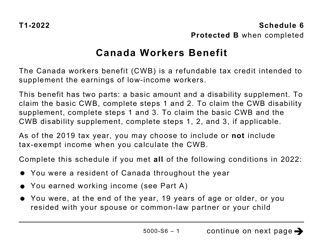

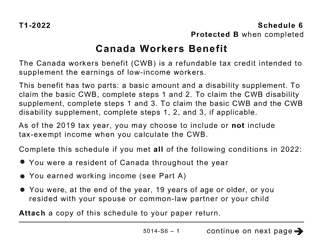

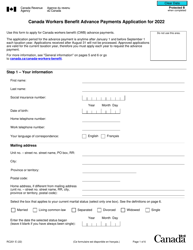

Form 5000-S6 Schedule 6 Canada Workers Benefit (Large Print) - Canada

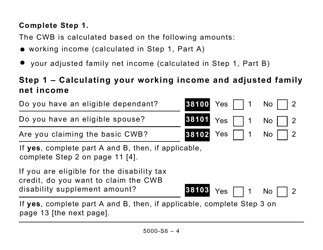

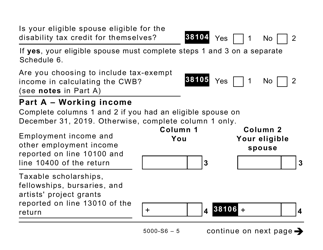

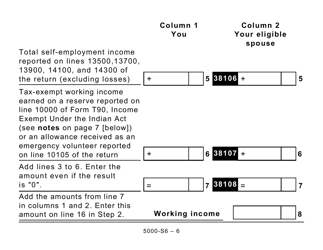

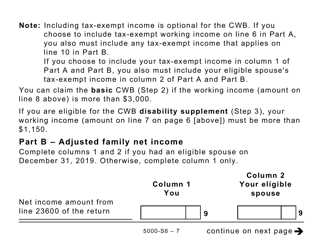

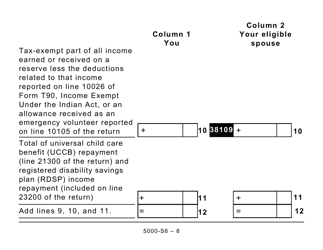

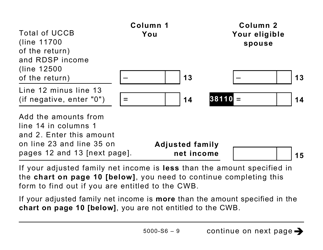

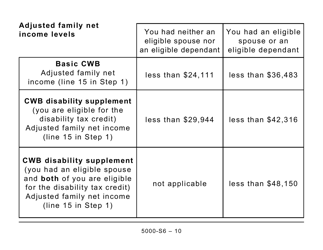

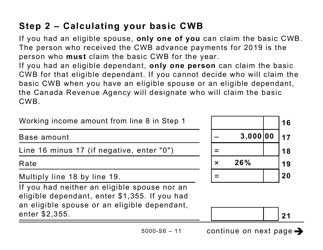

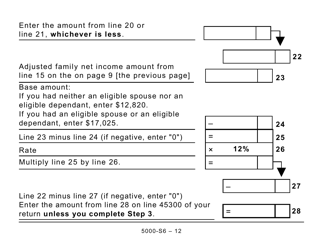

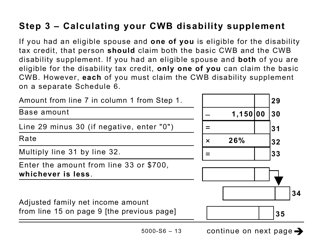

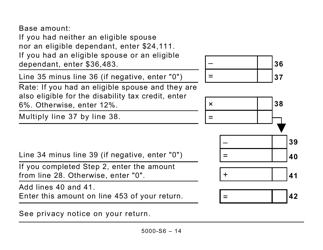

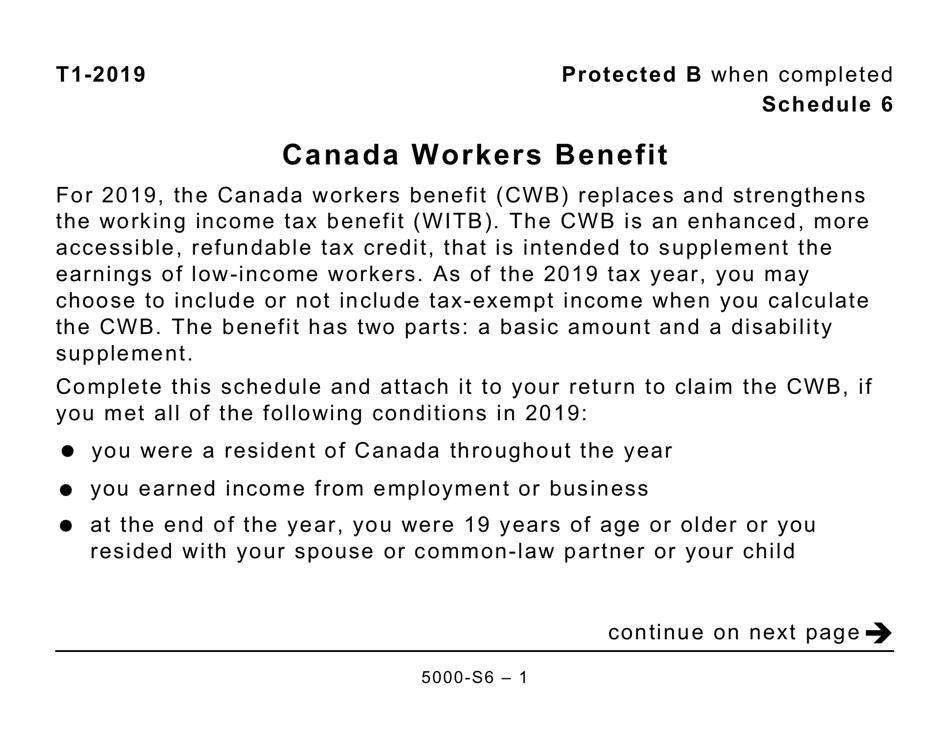

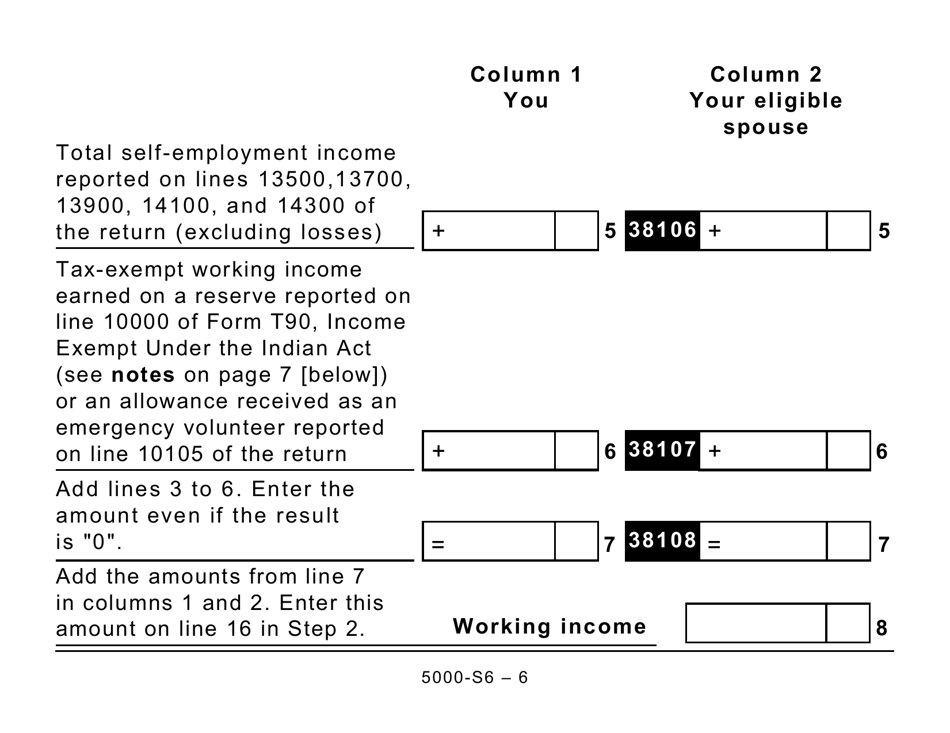

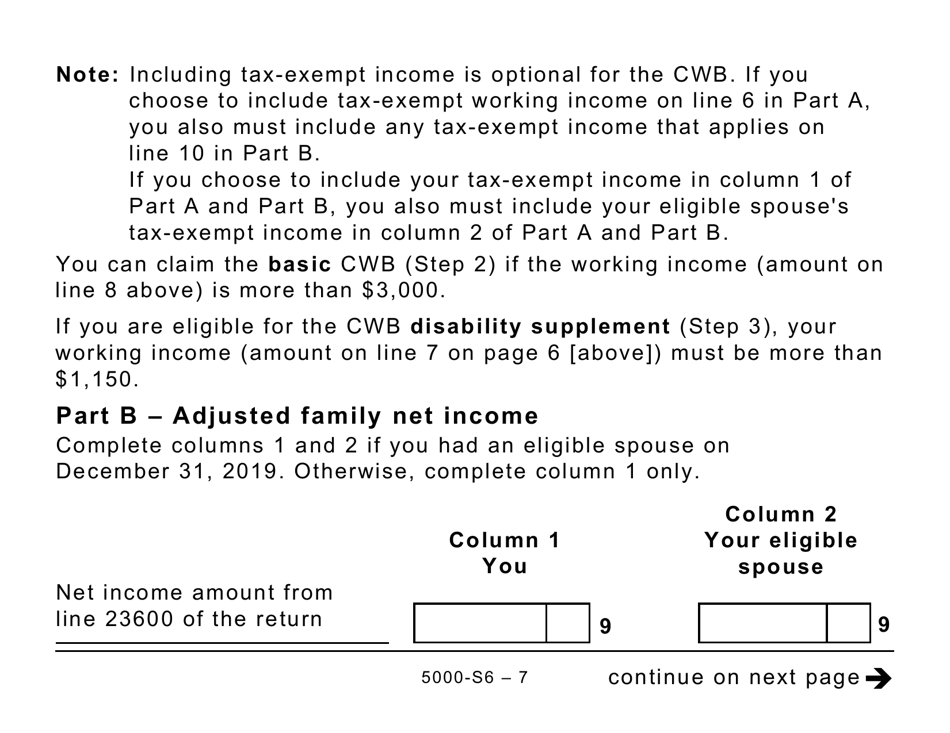

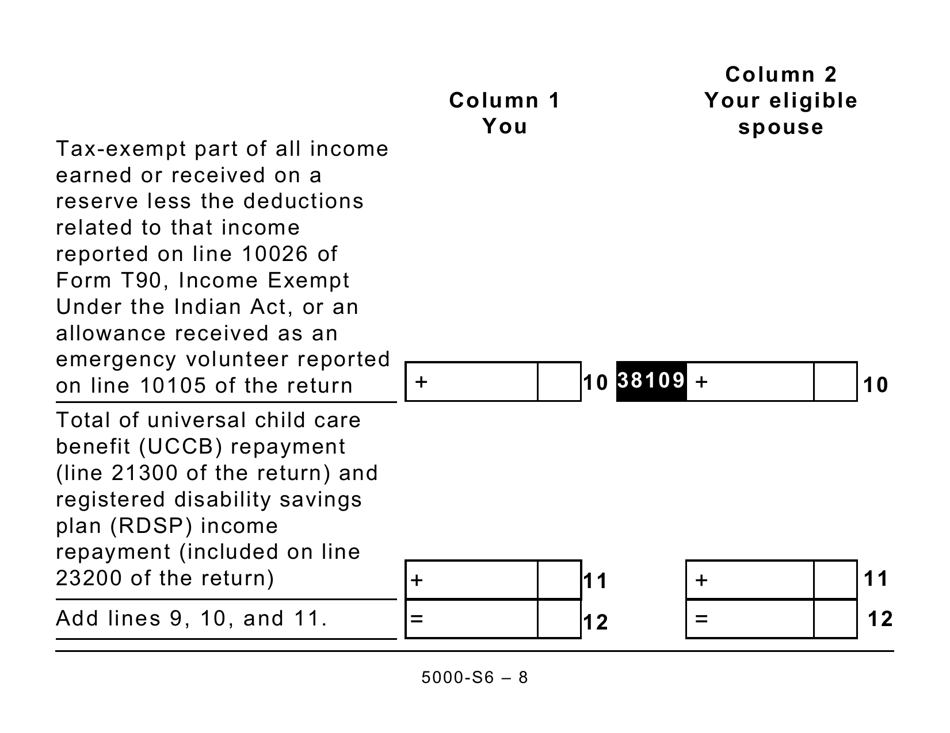

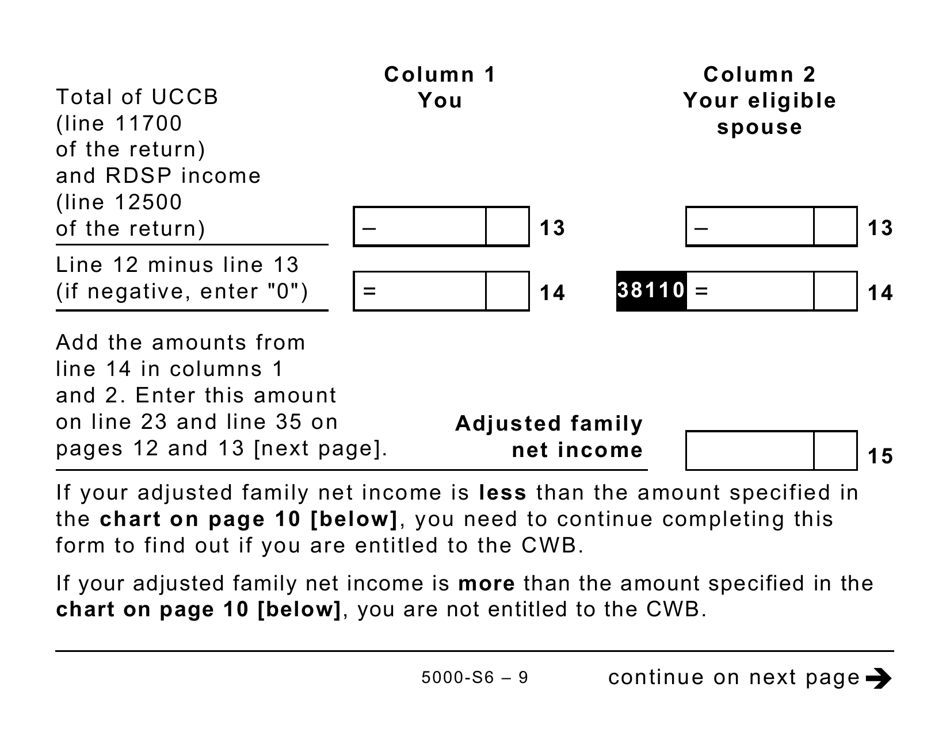

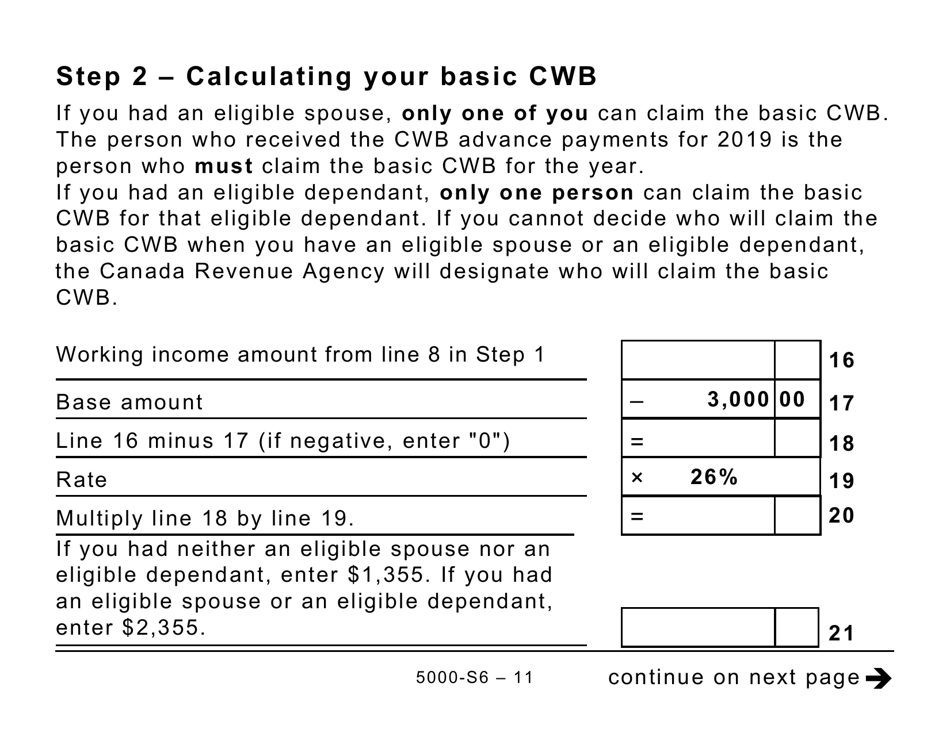

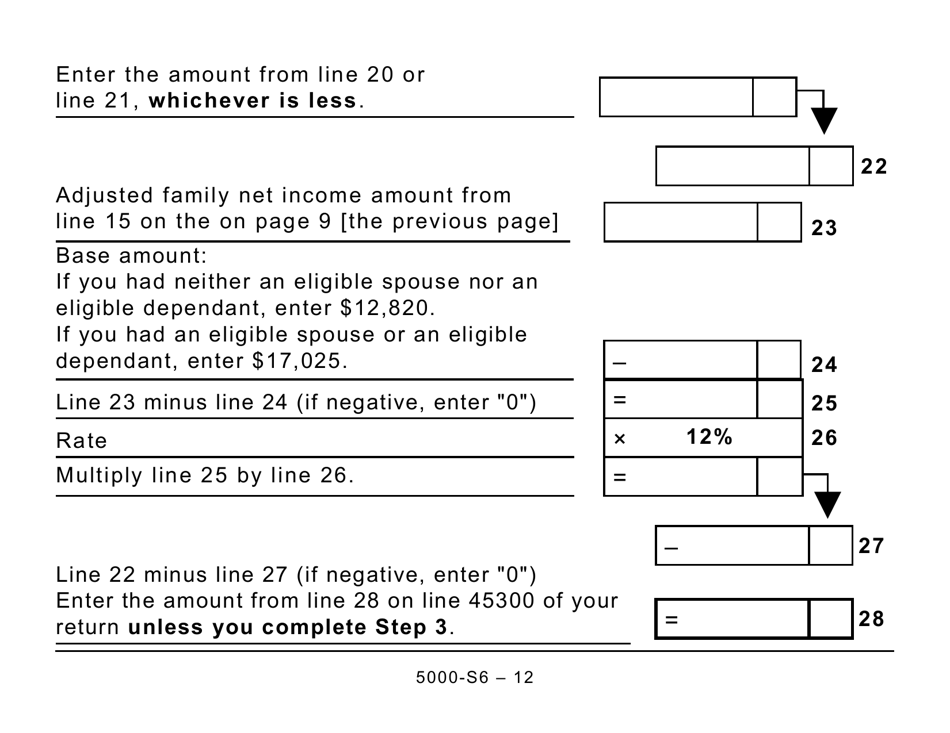

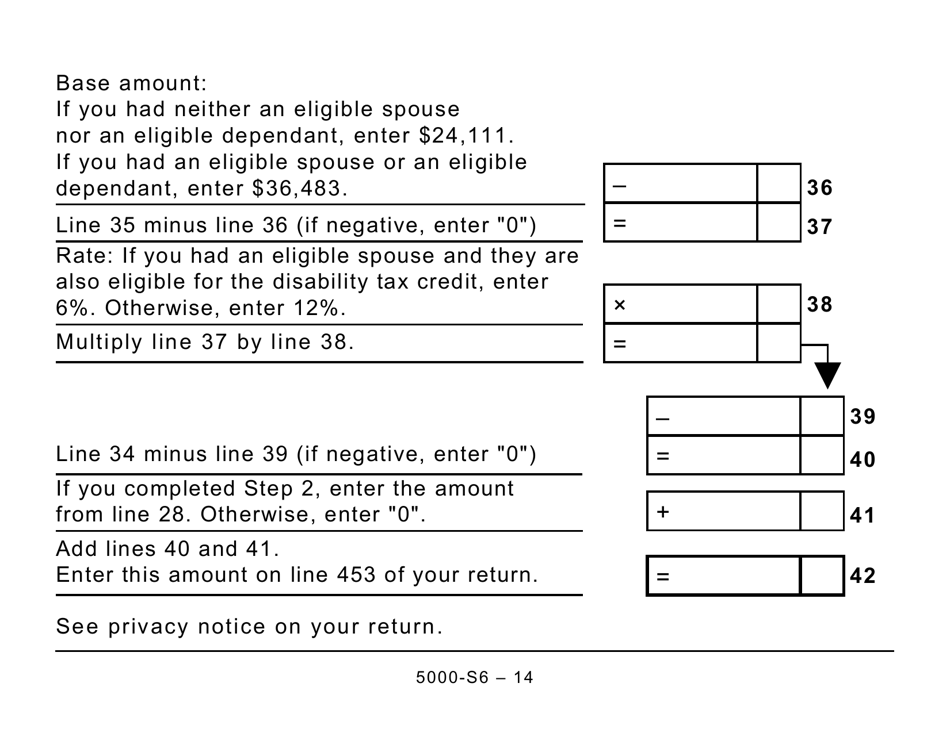

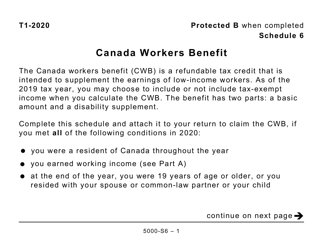

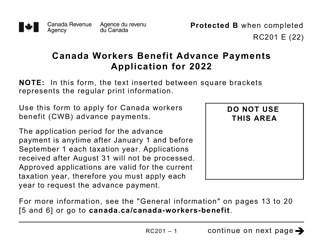

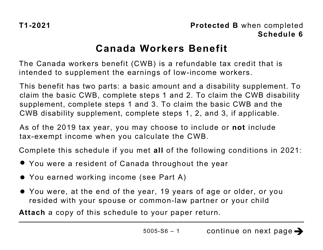

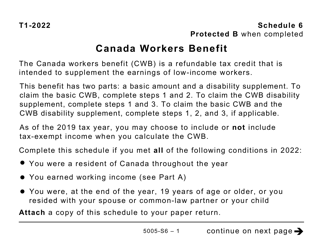

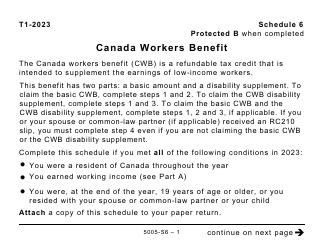

Form 5000-S6 Schedule 6 Canada Workers Benefit (Large Print) is used in Canada to calculate the Canada Workers Benefit, which is a refundable tax credit for low-income individuals and families who are working and earning income. It helps to supplement their income and improve their financial situation.

The Form 5000-S6 Schedule 6 is filed by individuals and families in Canada who are eligible for the Canada Workers Benefit.

FAQ

Q: What is Form 5000-S6 Schedule 6?

A: Form 5000-S6 Schedule 6 is a Canada Workers Benefit form.

Q: What is the Canada Workers Benefit?

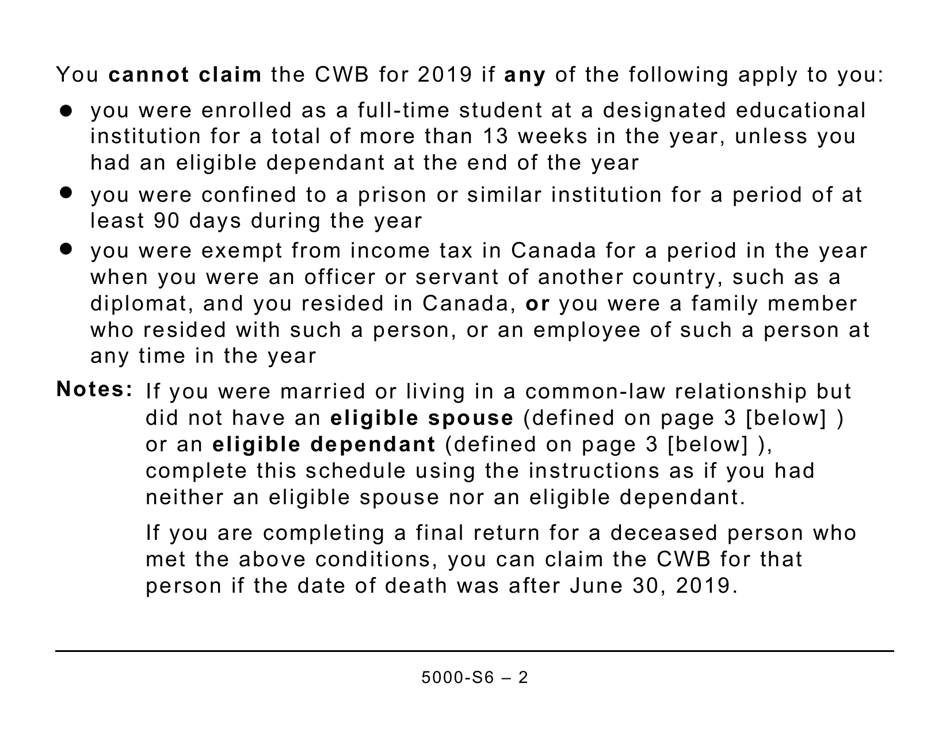

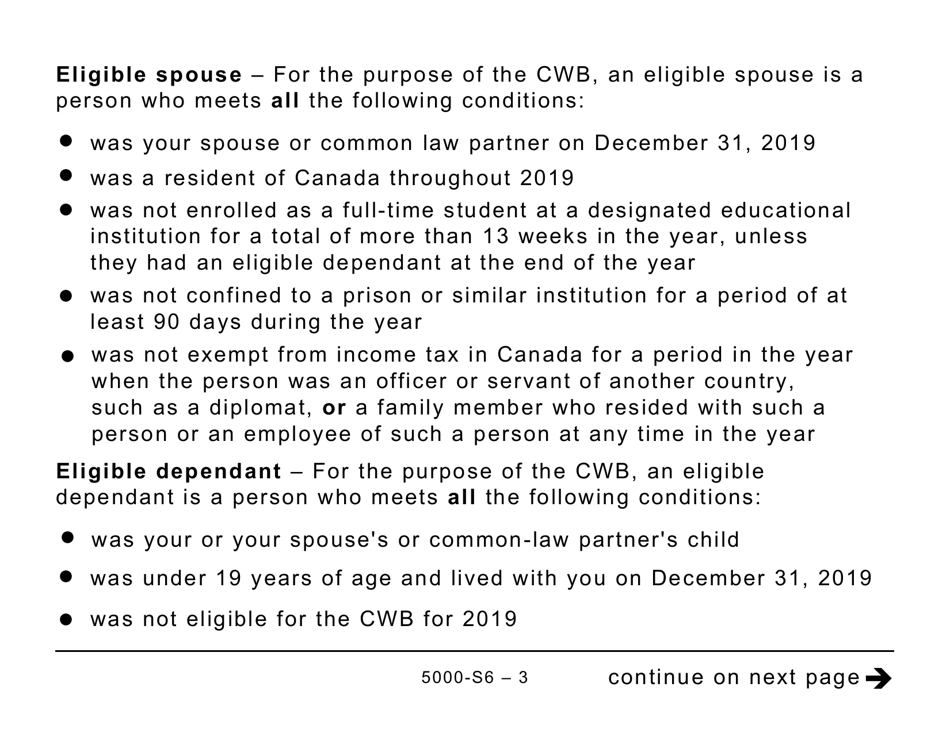

A: The Canada Workers Benefit (CWB) is a tax credit program to help low-income individuals and families who are in the workforce.

Q: What does this form do?

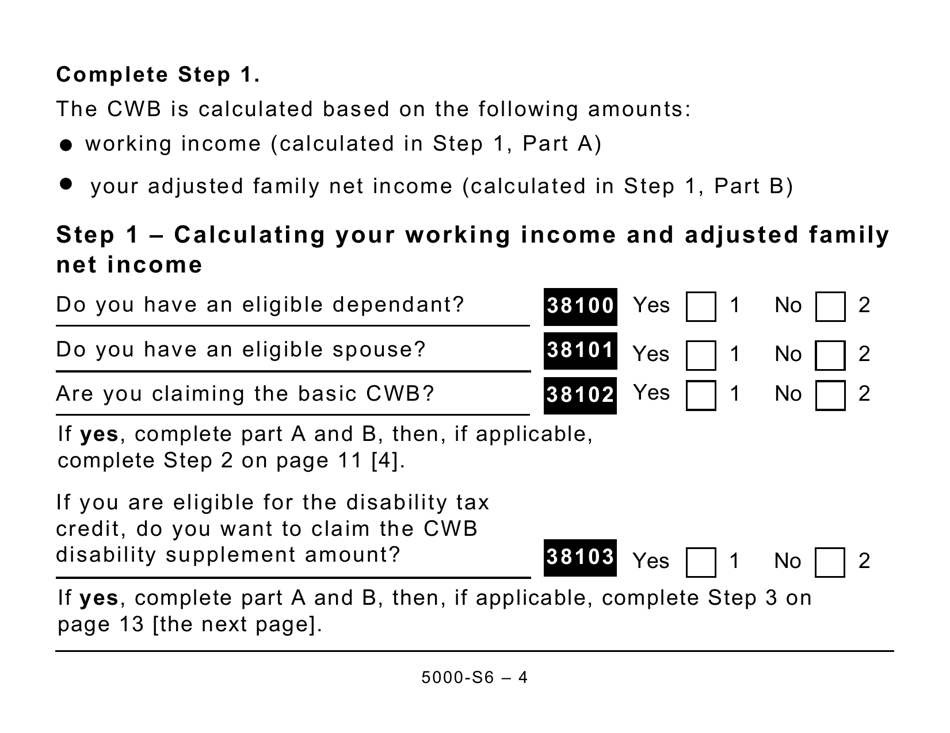

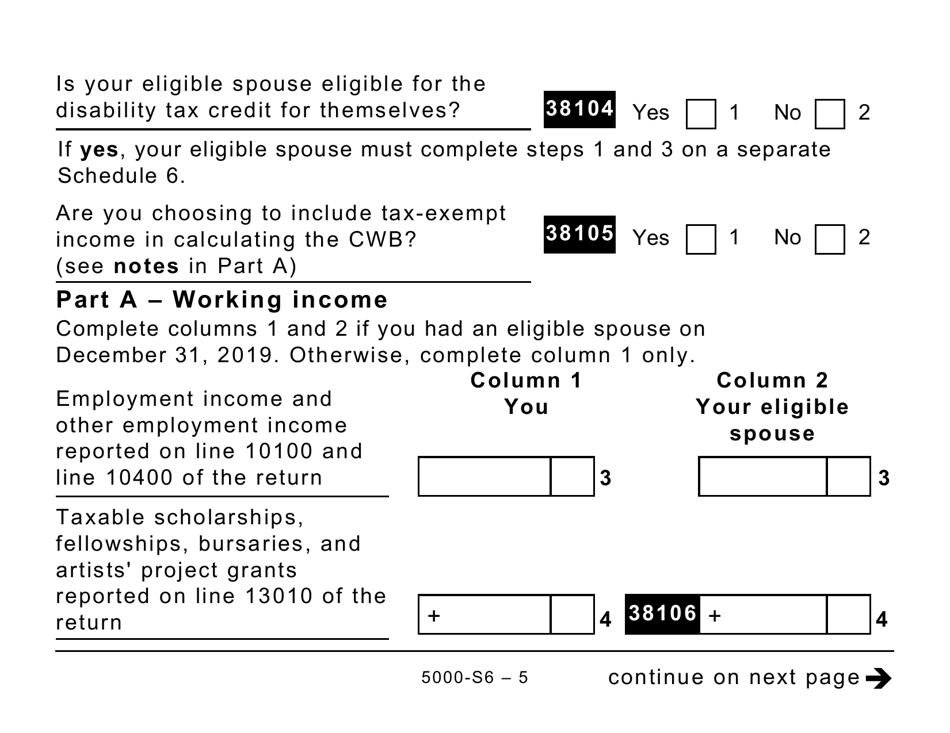

A: This form is used to calculate and claim the Canada Workers Benefit.

Q: Who is eligible for the Canada Workers Benefit?

A: Individuals and families with working income and whose net income falls below the maximum threshold are eligible for the CWB.

Q: How can I claim the Canada Workers Benefit?

A: You can claim the CWB by completing and filing Form 5000-S6 Schedule 6 along with your income tax return.

Q: Is this a large print version of the form?

A: Yes, Form 5000-S6 Schedule 6 is a large print version of the Canada Workers Benefit form.

Q: Is the Canada Workers Benefit available in the United States?

A: No, the Canada Workers Benefit is only available to residents of Canada.

Q: What is the deadline to file Form 5000-S6 Schedule 6?

A: The deadline to file Form 5000-S6 Schedule 6 is the same as the deadline for filing your income tax return, which is usually April 30th.

Q: Can I claim the Canada Workers Benefit retroactively?

A: Yes, you can claim the CWB for previous years by filing the appropriate forms and providing the necessary documentation.