This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5000-S6 Schedule 6

for the current year.

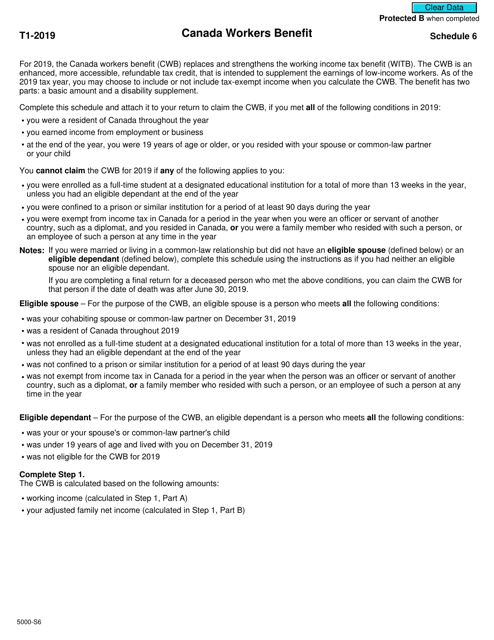

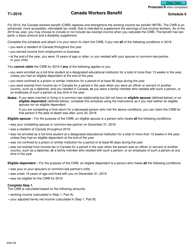

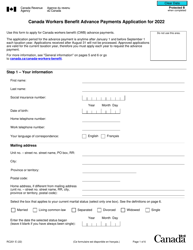

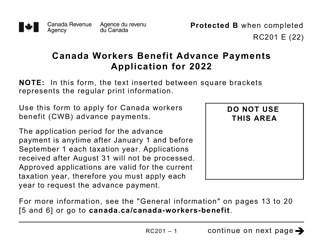

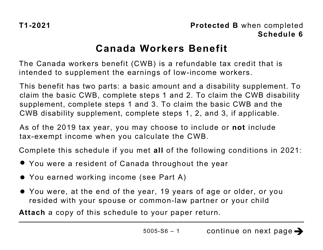

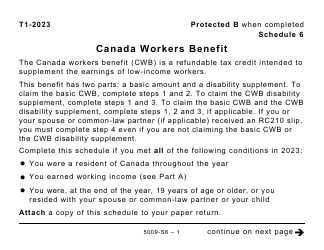

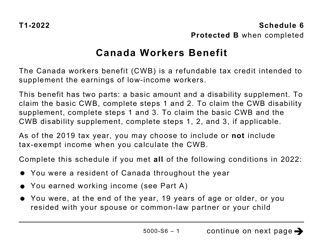

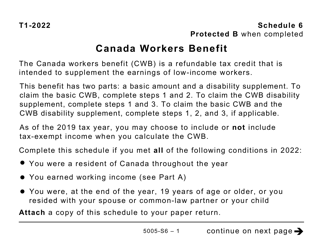

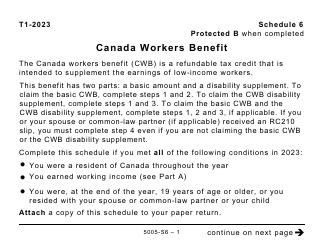

Form 5000-S6 Schedule 6 Canada Workers Benefit - Canada

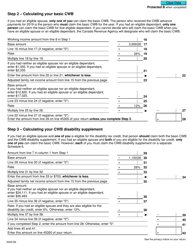

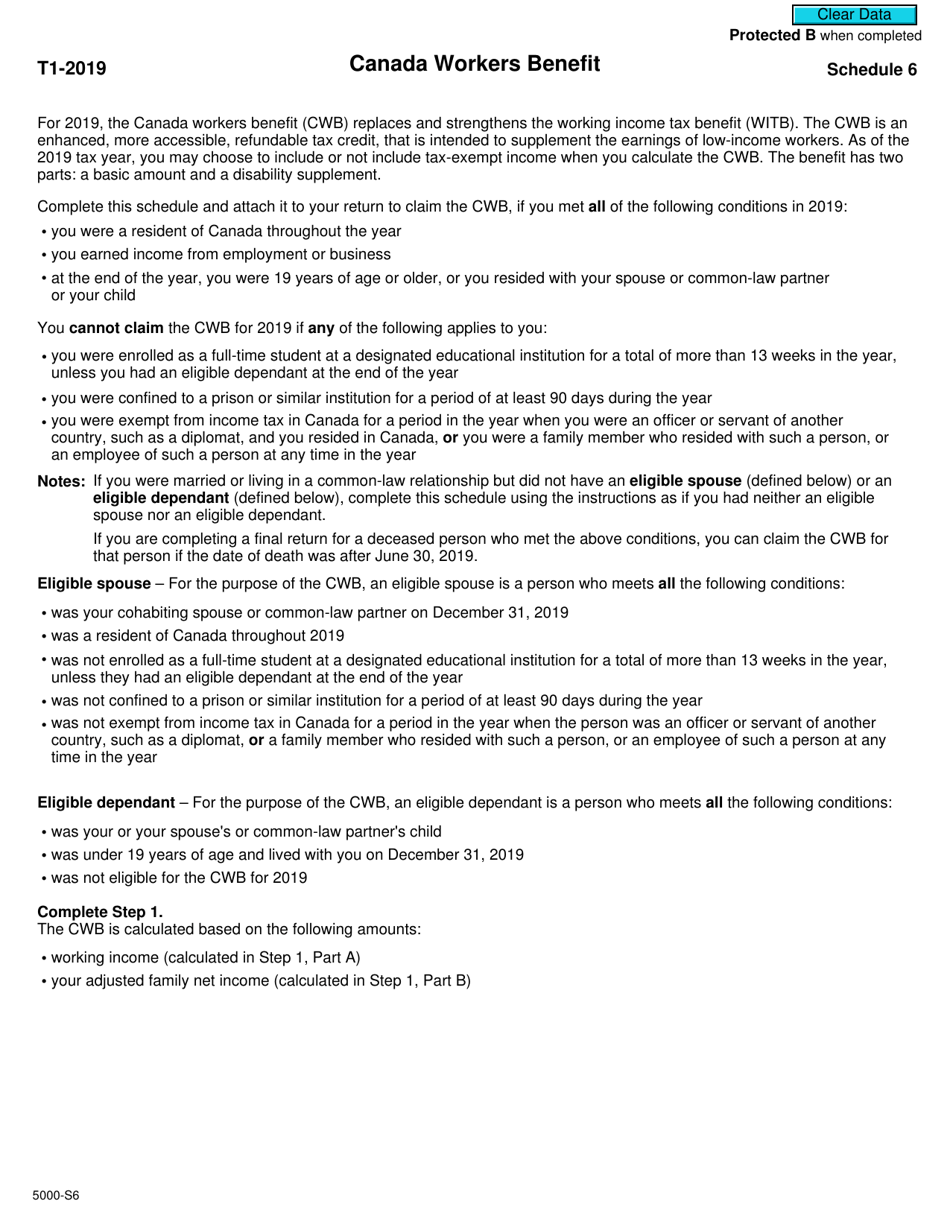

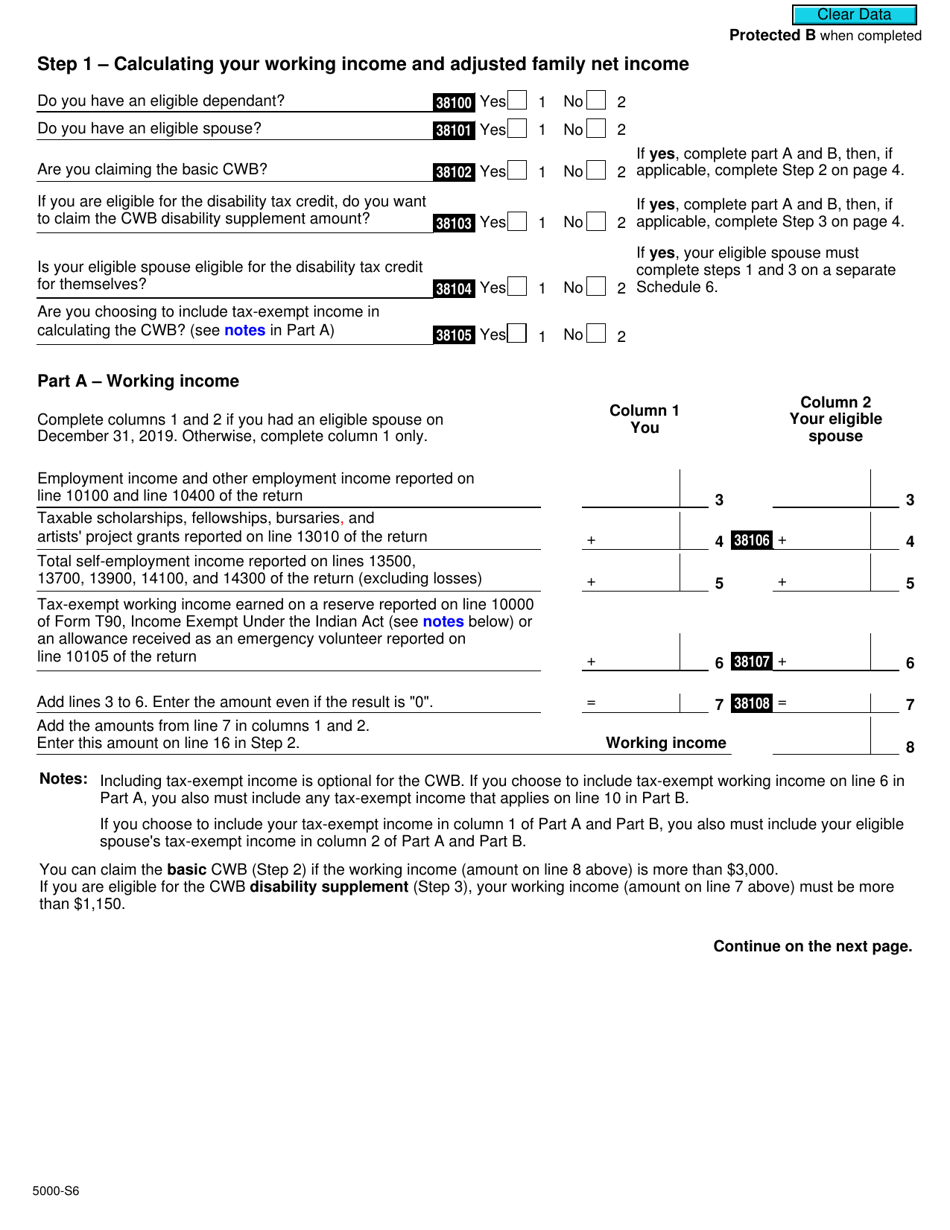

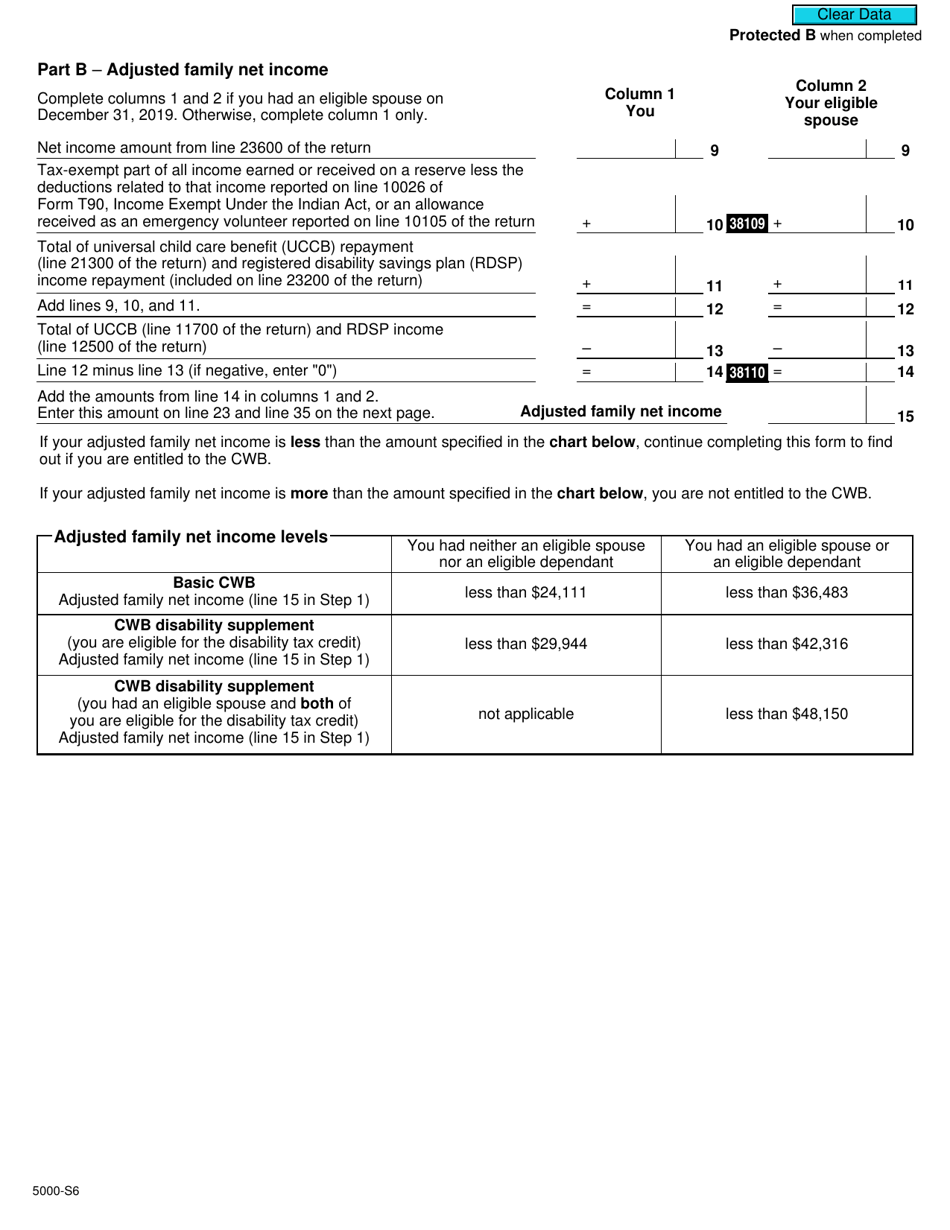

Form 5000-S6 Schedule 6 Canada Workers Benefit is used to calculate and claim the Canada Workers Benefit (CWB) in Canada. CWB is a tax-free benefit for working individuals and families with low incomes. It helps supplement their income and provides financial assistance.

The individual taxpayer or their authorized representative files the Form 5000-S6 Schedule 6 Canada Workers Benefit in Canada.

FAQ

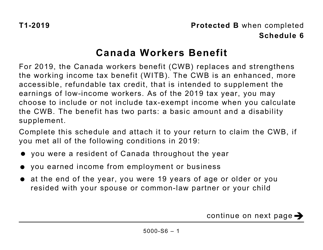

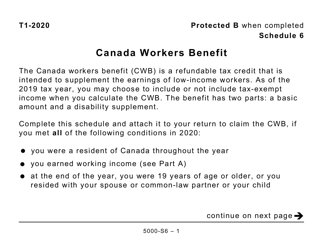

Q: What is Form 5000-S6 Schedule 6?

A: Form 5000-S6 Schedule 6 is a tax form used in Canada to claim the Canada Workers Benefit.

Q: What is the Canada Workers Benefit?

A: The Canada Workers Benefit is a refundable tax credit in Canada that provides additional income to low-income workers.

Q: Who is eligible for the Canada Workers Benefit?

A: Individuals who are employed and have an income below a certain threshold may be eligible for the Canada Workers Benefit.

Q: How do I claim the Canada Workers Benefit?

A: To claim the Canada Workers Benefit, you need to complete Form 5000-S6 Schedule 6 and include it with your tax return.

Q: When is the deadline to file Form 5000-S6 Schedule 6?

A: The deadline to file Form 5000-S6 Schedule 6 is the same as the deadline for filing your tax return, which is usually April 30th.

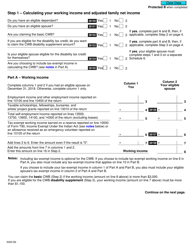

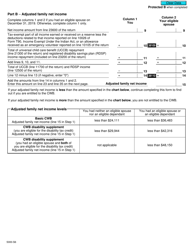

Q: What information do I need to complete Form 5000-S6 Schedule 6?

A: You will need information about your employment income, social assistance payments, and other relevant details to complete Form 5000-S6 Schedule 6.

Q: Can I claim the Canada Workers Benefit if I am self-employed?

A: Yes, self-employed individuals may also be eligible to claim the Canada Workers Benefit if they meet the income requirements.

Q: Will claiming the Canada Workers Benefit reduce my other government benefits?

A: No, claiming the Canada Workers Benefit should not reduce your other government benefits such as the GST/HST credit or the Canada Child Benefit.

Q: Is the Canada Workers Benefit taxable?

A: No, the Canada Workers Benefit is not taxable. It is a refundable tax credit that provides additional income to low-income workers.