Form 5009-S14 Schedule 14 Climate Action Incentive - Alberta (Large Print) - Canada

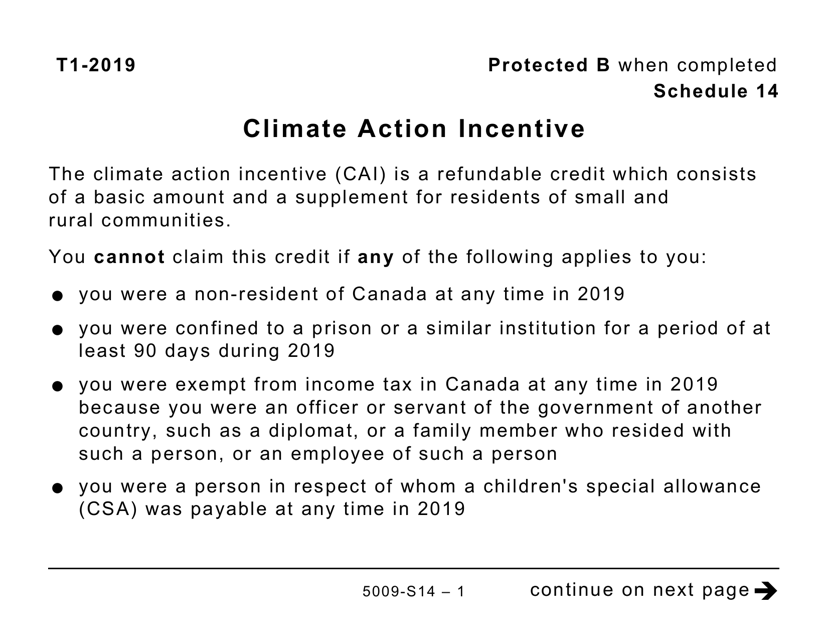

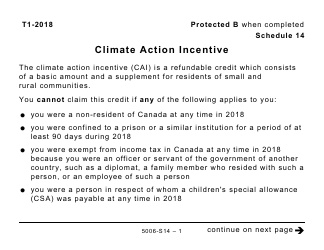

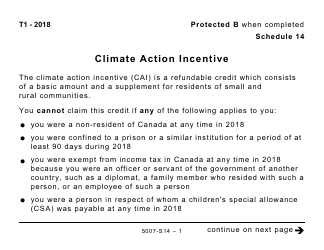

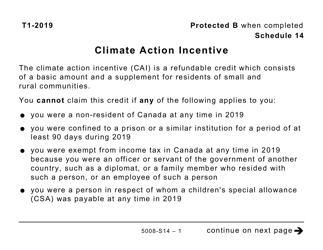

Form 5009-S14 Schedule 14 Climate Action Incentive - Alberta (Large Print) is a document specific to Canada. It is used to report and claim the Climate Action Incentive for individuals or businesses in the province of Alberta. This form is designed to promote and incentivize actions related to climate change mitigation and reduction of greenhouse gas emissions.

The Form 5009-S14 Schedule 14 Climate Action Incentive in Alberta (Large Print) is filed by individuals or businesses in Canada who are eligible for the climate action incentive.

FAQ

Q: What is Form 5009-S14 Schedule 14 Climate Action Incentive?

A: Form 5009-S14 Schedule 14 Climate Action Incentive is a tax form in Canada.

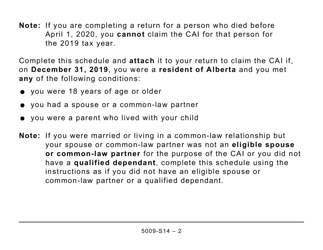

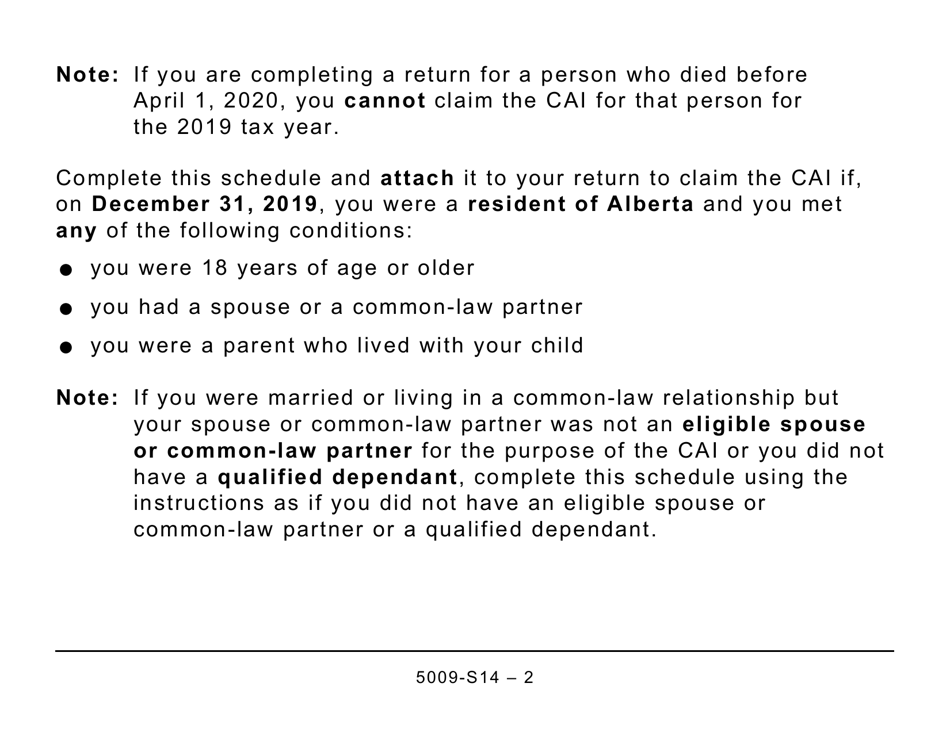

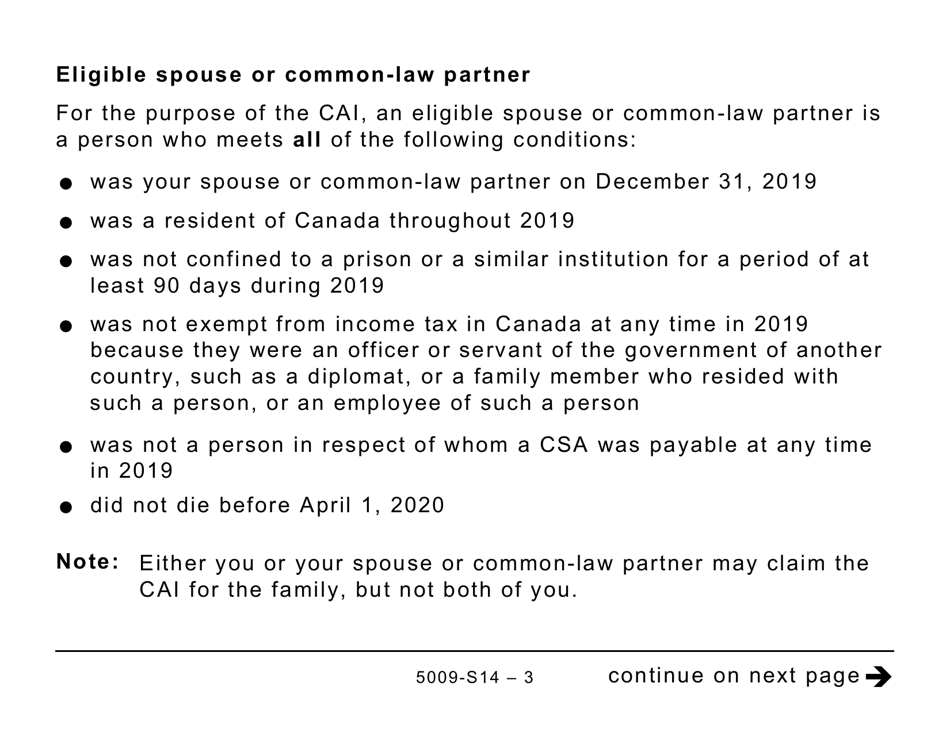

Q: Who is eligible to use Form 5009-S14 Schedule 14?

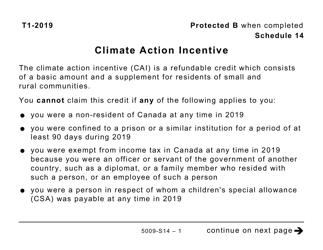

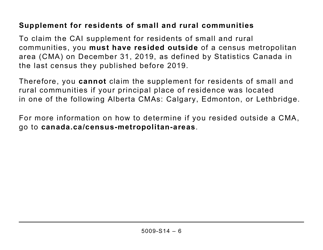

A: Residents of Alberta, Canada are eligible to use Form 5009-S14 Schedule 14.

Q: What is the purpose of Form 5009-S14 Schedule 14?

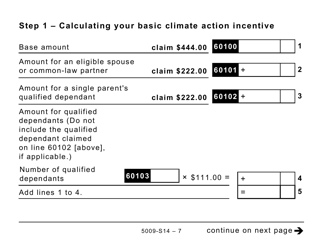

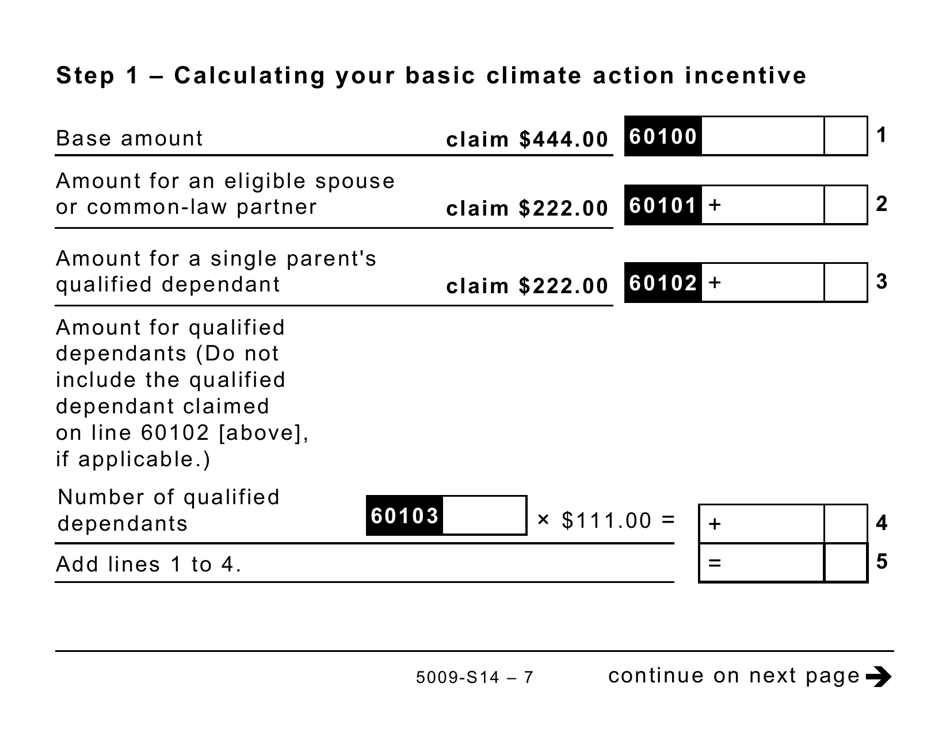

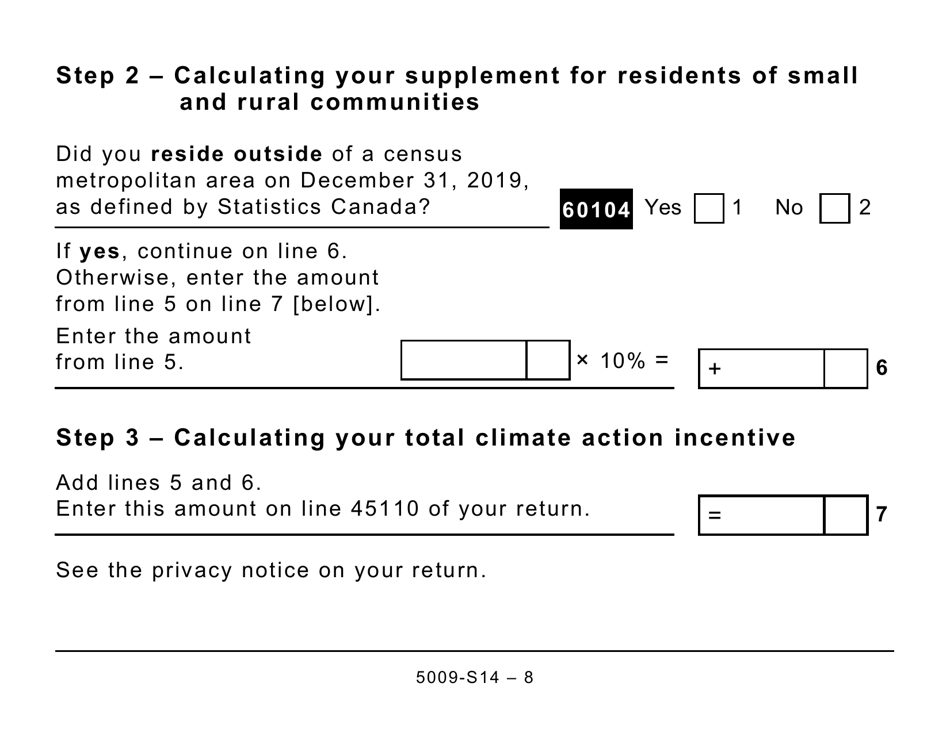

A: The purpose of Form 5009-S14 Schedule 14 is to claim the Climate Action Incentive tax credit.

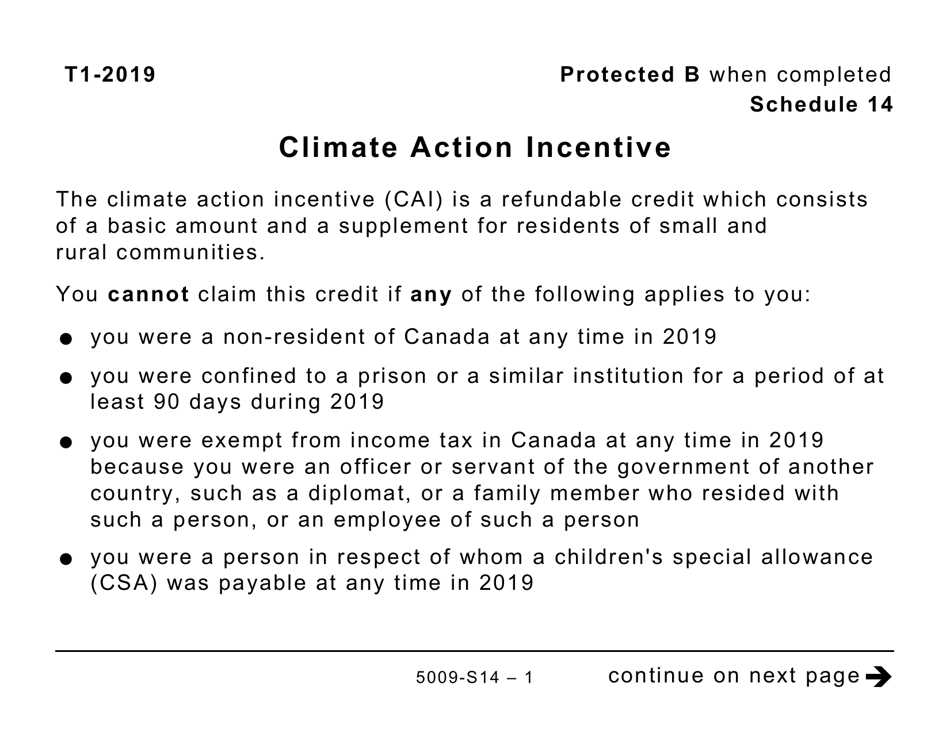

Q: What is the Climate Action Incentive?

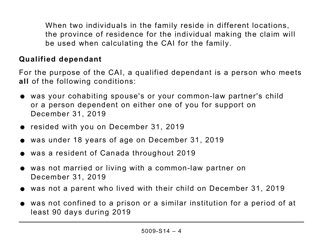

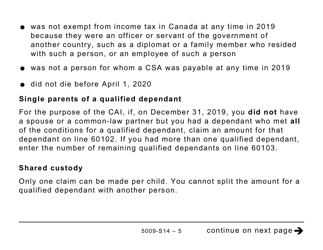

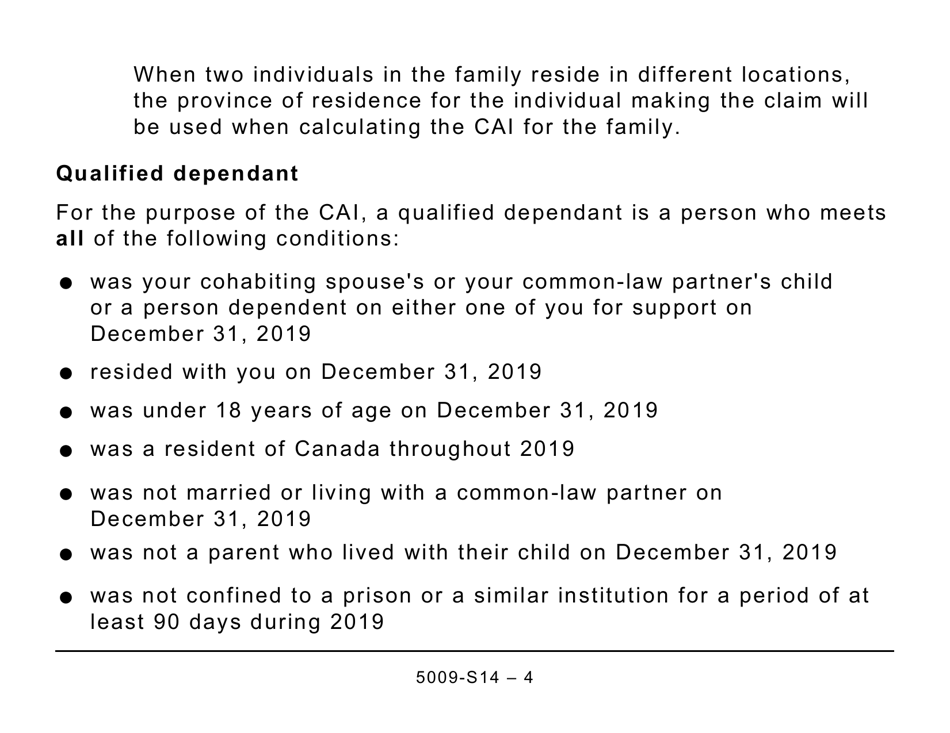

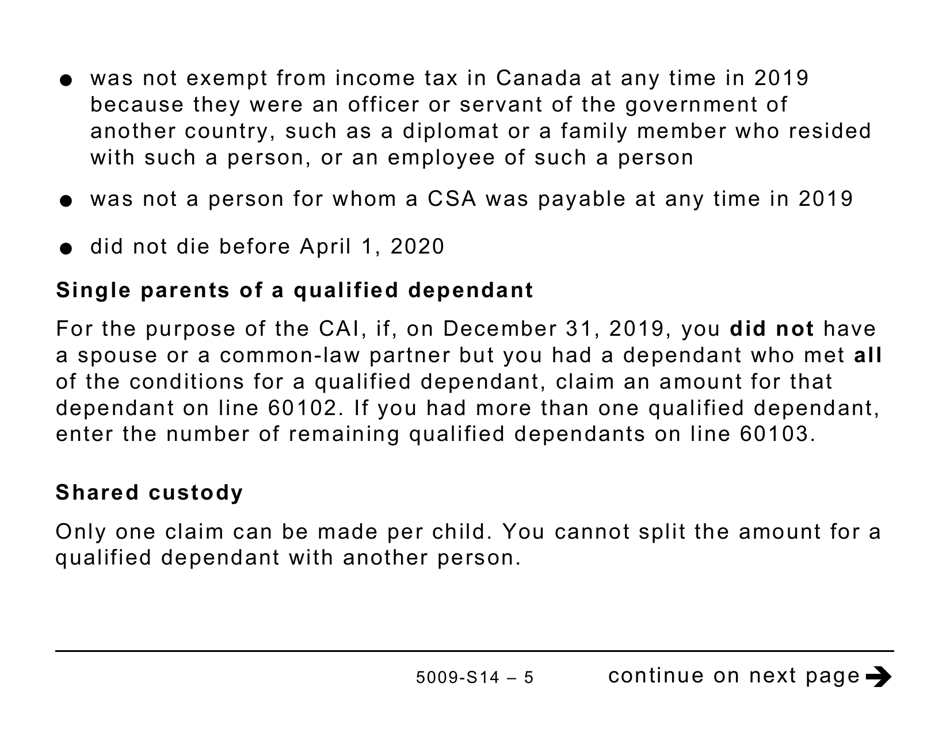

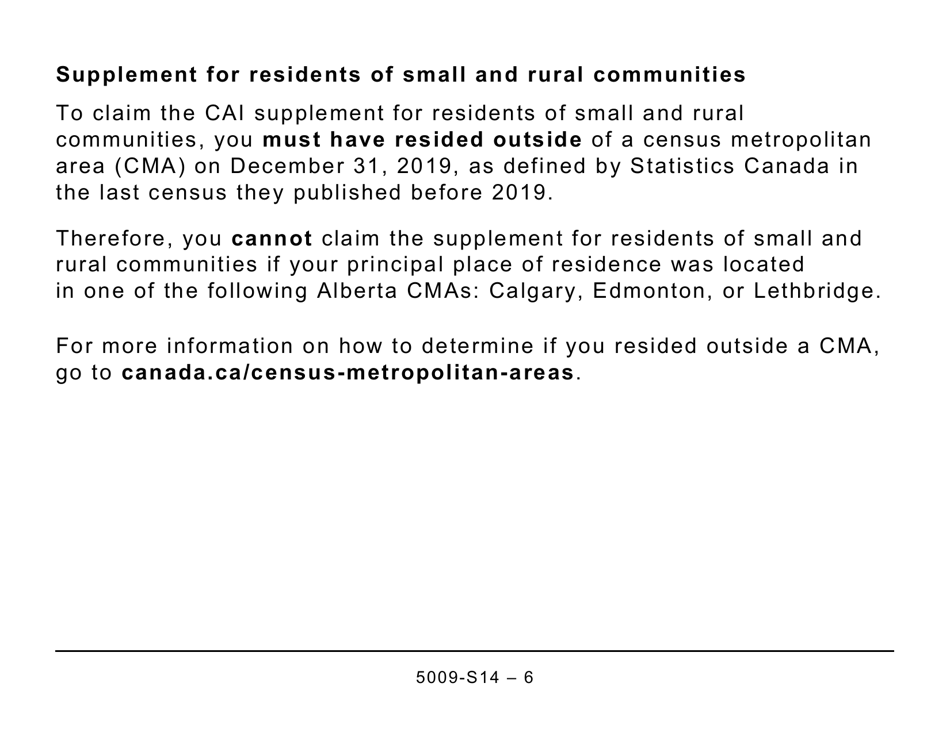

A: The Climate Action Incentive is a refundable tax credit provided to residents of provinces where the federal carbon pricing system is in place.

Q: How do I claim the Climate Action Incentive?

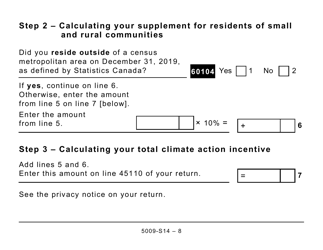

A: To claim the Climate Action Incentive, you need to complete Form 5009-S14 Schedule 14 and include it with your tax return.

Q: Is the Climate Action Incentive taxable income?

A: No, the Climate Action Incentive is not taxable income.

Q: Are there any specific instructions for filling out Form 5009-S14 Schedule 14?

A: Yes, there are instructions provided on the form itself to guide you through the process.

Q: When is the deadline to file Form 5009-S14 Schedule 14?

A: The deadline to file Form 5009-S14 Schedule 14 is the same as the deadline for your annual tax return, usually April 30th.

Q: Can I claim the Climate Action Incentive for previous years?

A: No, the Climate Action Incentive can only be claimed for the current tax year.