This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5010-D Worksheet BC428

for the current year.

Form 5010-D Worksheet BC428 British Columbia (Large Print) - Canada

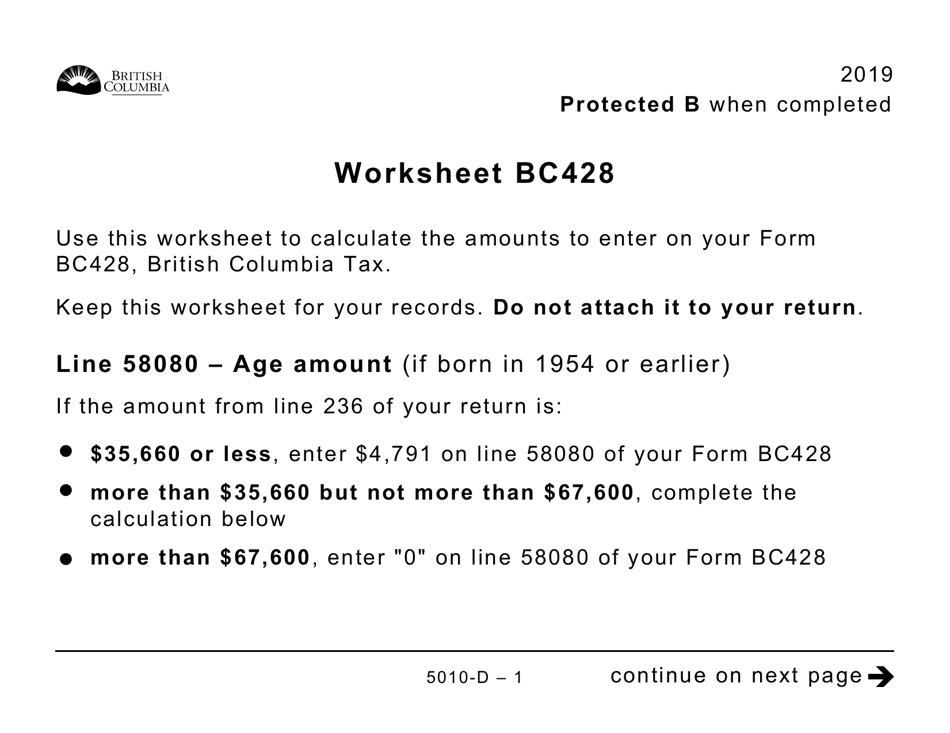

Form 5010-D Worksheet BC428 is a document specifically designed for residents of British Columbia in Canada. This particular version, labeled as "Large Print," is meant to provide individuals who have visual impairments with a more accessible format for completing the worksheet.

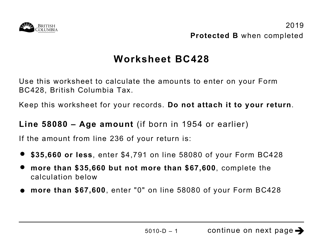

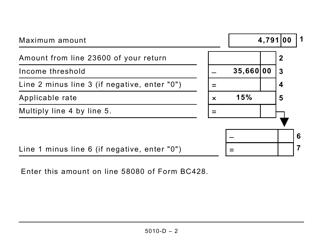

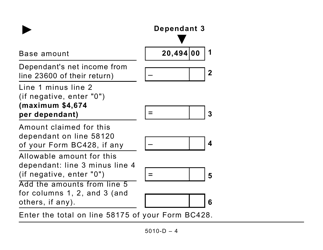

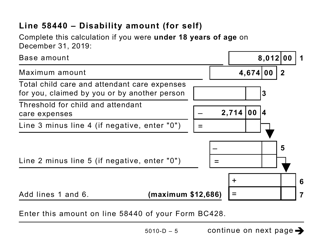

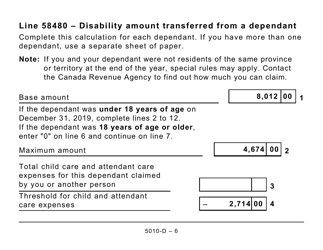

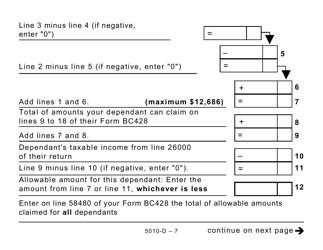

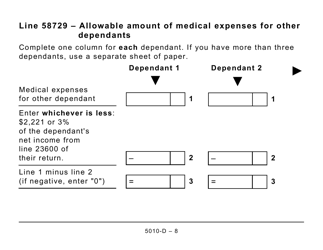

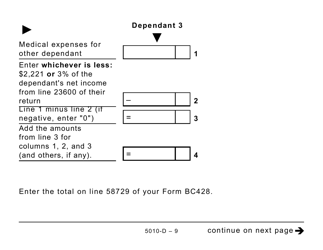

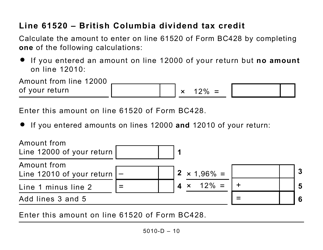

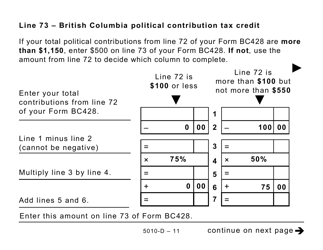

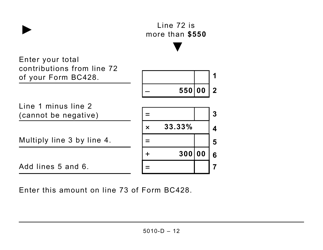

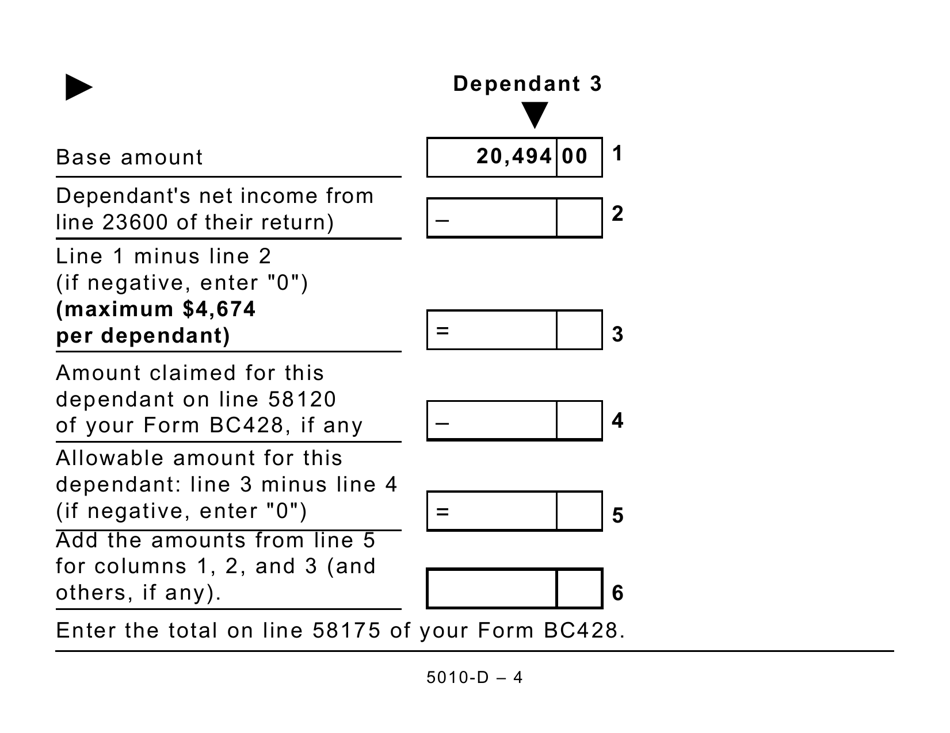

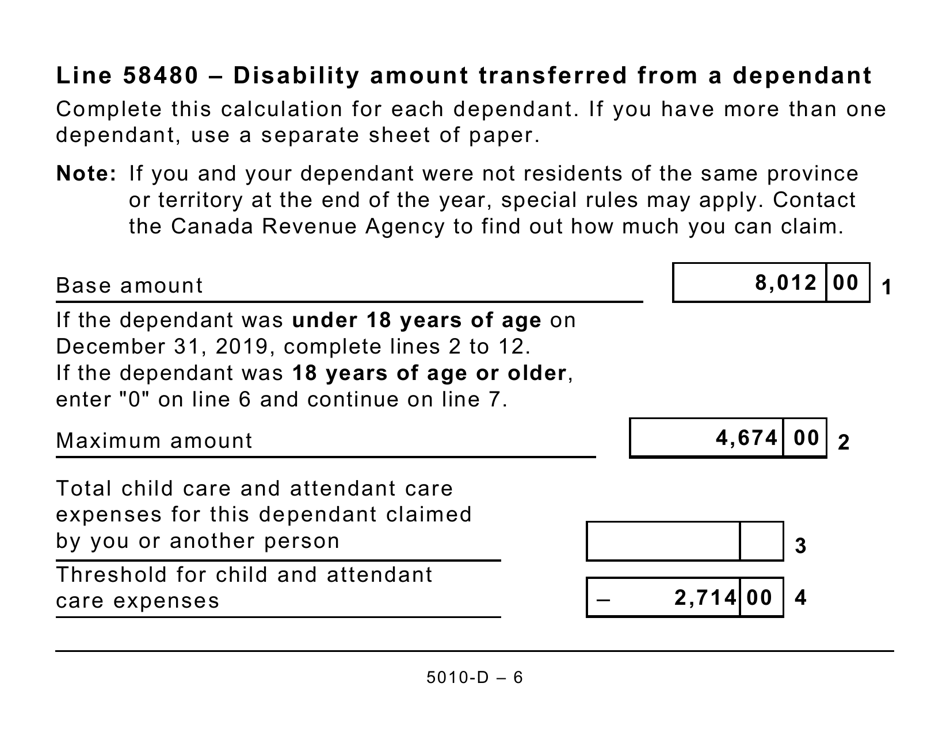

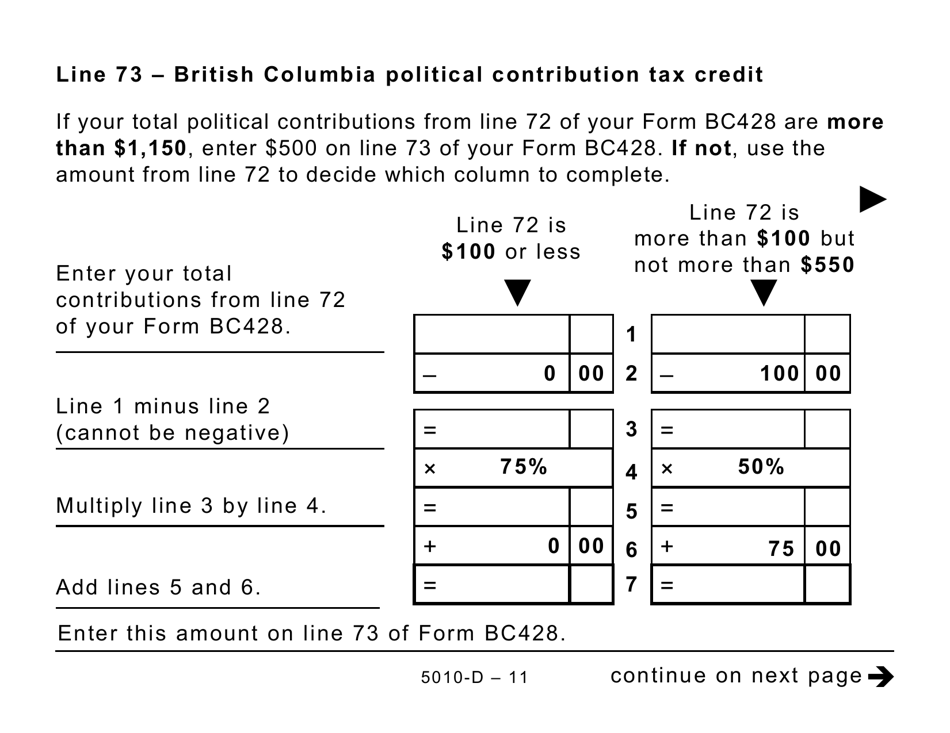

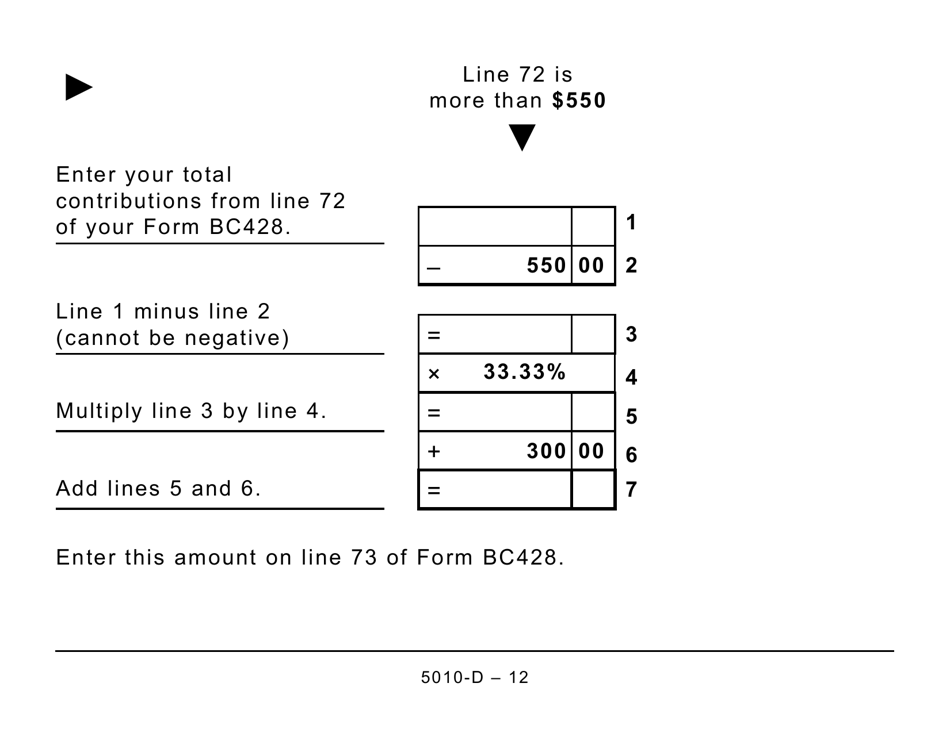

The purpose of the BC428 worksheet is to assist taxpayers in calculating their provincial tax credits and deductions in British Columbia. It includes various sections, such as the British Columbia Education Tax Credit, the British Columbia Employee's Tools Tax Credit, and the British Columbia Mining Flow-Through Share Tax Credit.

FAQ

Q: What is Form 5010-D Worksheet BC428 British Columbia?

A: Form 5010-D Worksheet BC428 is a tax form used by residents of British Columbia, Canada. It is used to calculate provincial credits and deductions for personal incometax purposes.

Q: Who should use Form 5010-D Worksheet BC428 British Columbia?

A: Form 5010-D Worksheet BC428 is specifically designed for residents of British Columbia who need to calculate their provincial tax credits and deductions.

Q: What is the purpose of Form 5010-D Worksheet BC428?

A: The purpose of Form 5010-D Worksheet BC428 is to help residents of British Columbia calculate and claim various provincial tax credits and deductions, such as the B.C. Basic Personal Amount, Low Income Climate Action Tax Credit, and Medical Expenses Credit.

Q: Is Form 5010-D Worksheet BC428 mandatory?

A: Form 5010-D Worksheet BC428 is not mandatory to fill out, but it is highly recommended for residents of British Columbia who want to claim provincial tax credits and deductions.

Q: How do I fill out Form 5010-D Worksheet BC428?

A: To fill out Form 5010-D Worksheet BC428, you will need to follow the instructions provided on the form. It requires you to enter various personal information, income details, and calculate the applicable tax credits and deductions.

Q: When is Form 5010-D Worksheet BC428 due?

A: The due date for submitting Form 5010-D Worksheet BC428 is the same as the deadline for filing your personal income tax return, which is usually April 30th of the following year.

Q: Can I claim both federal and provincial tax credits and deductions?

A: Yes, as a resident of British Columbia, you can claim both federal and provincial tax credits and deductions. Form 5010-D Worksheet BC428 specifically focuses on the provincial credits and deductions.

Q: What should I do if I have questions or need assistance with Form 5010-D Worksheet BC428?

A: If you have questions or need assistance with Form 5010-D Worksheet BC428, you can contact the Canada Revenue Agency directly or seek guidance from a tax professional or accountant.