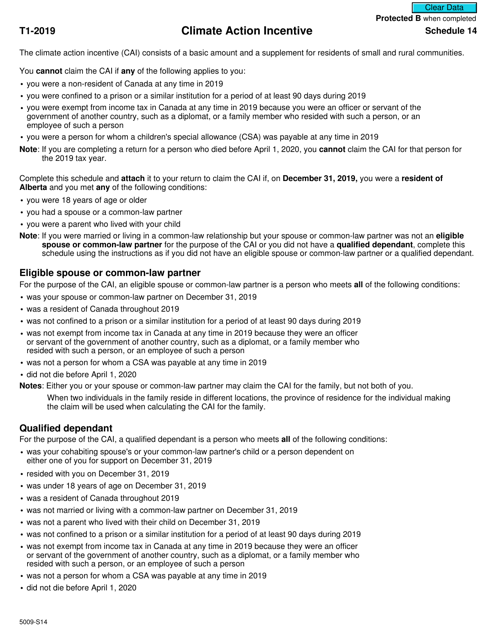

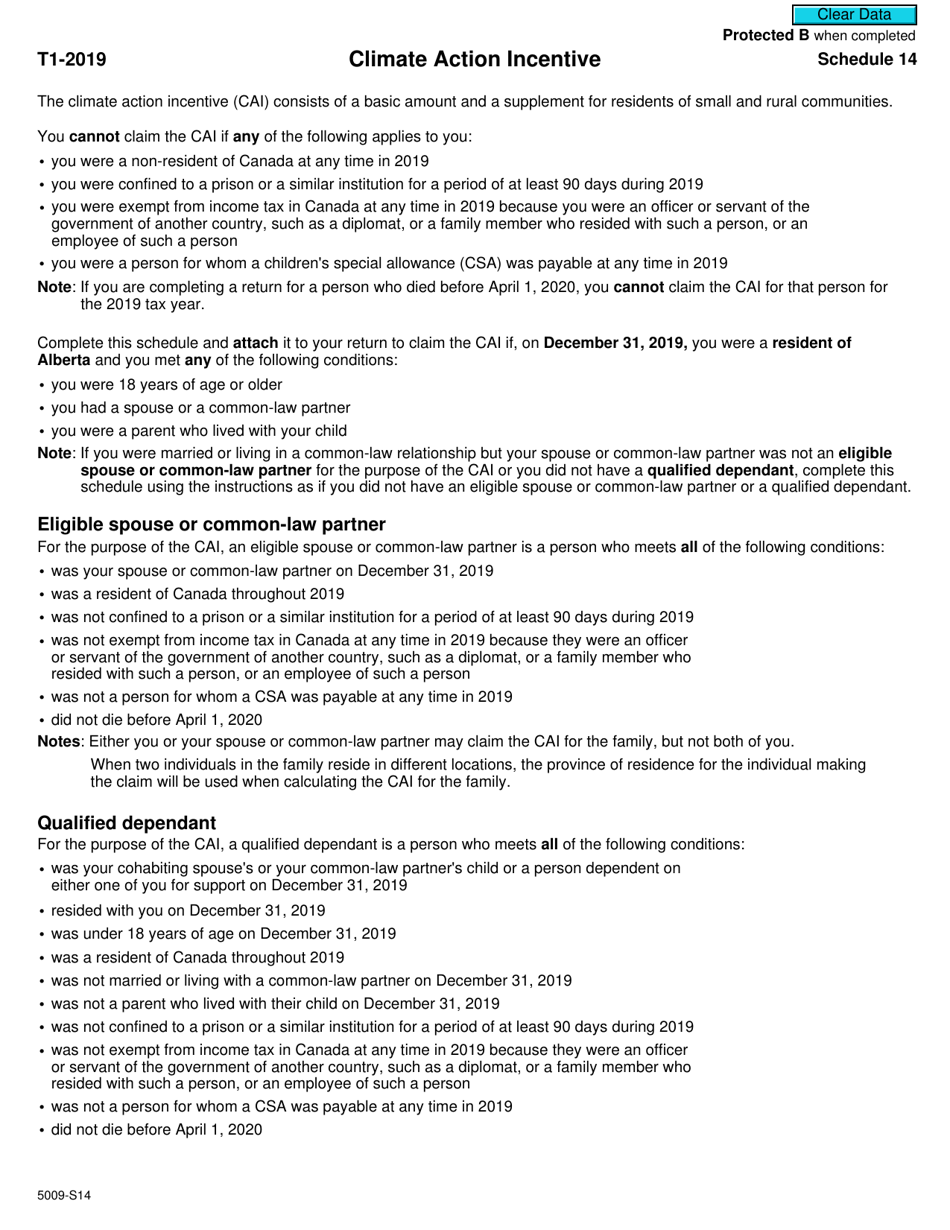

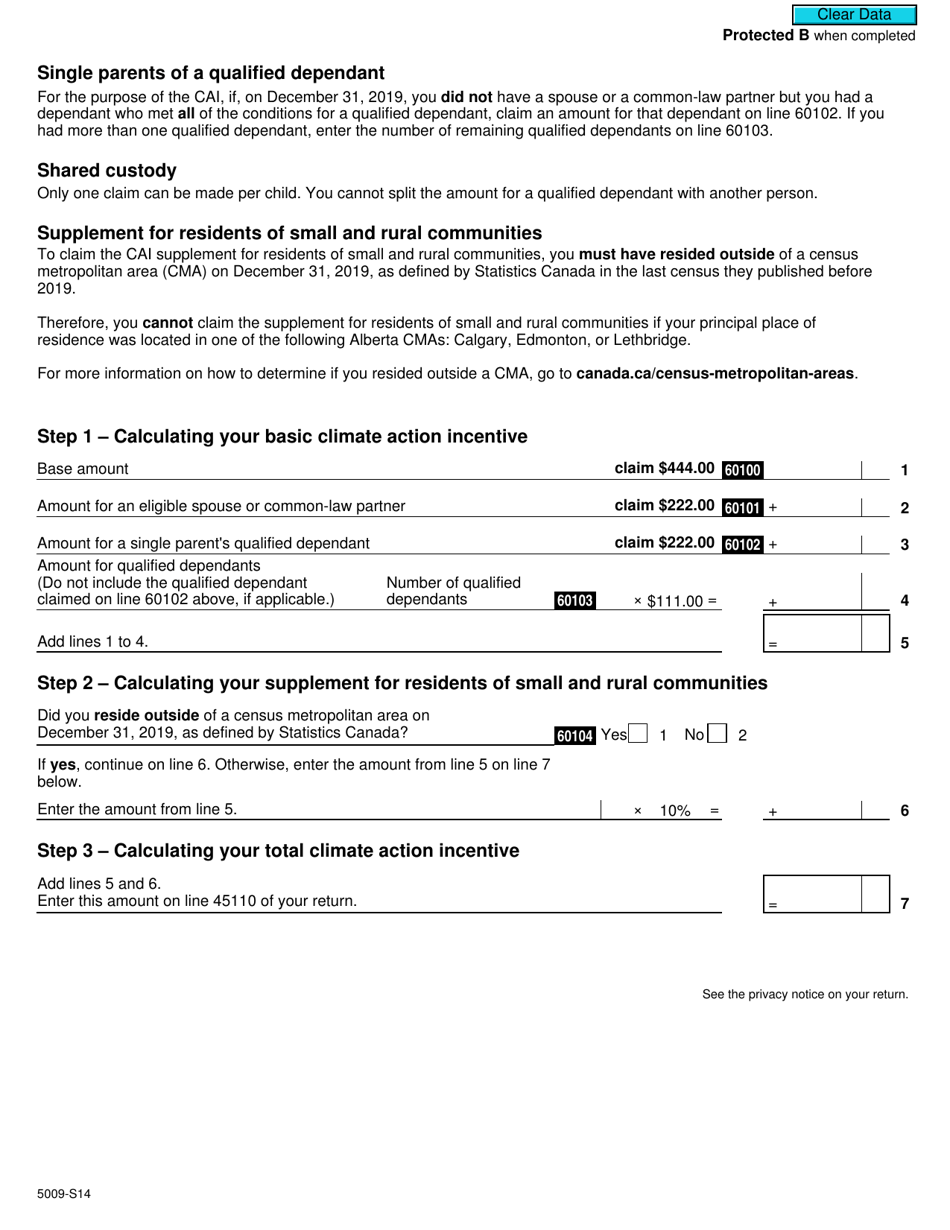

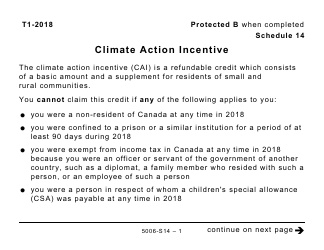

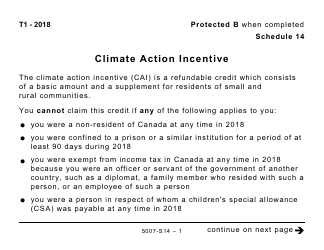

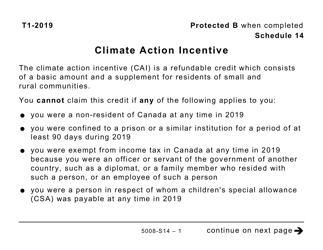

Form 5009-S14 Schedule 14 Climate Action Incentive - Alberta - Canada

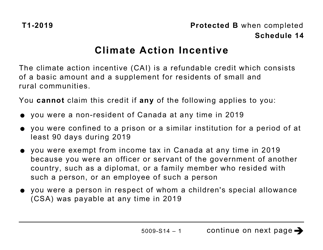

Form 5009-S14 Schedule 14 Climate Action Incentive - Alberta - Canada is used to claim the Climate Action Incentive in Alberta, Canada. It is a tax incentive to encourage individuals and businesses to take action against climate change.

The Form 5009-S14 Schedule 14 Climate Action Incentive - Alberta - Canada is typically filed by individuals or households residing in Alberta, Canada.

FAQ

Q: What is Form 5009-S14?

A: Form 5009-S14 is the Schedule 14 Climate Action Incentive for Alberta in Canada.

Q: What is the purpose of Form 5009-S14?

A: The purpose of Form 5009-S14 is to claim the climate action incentive in Alberta.

Q: Who should use Form 5009-S14?

A: Residents of Alberta in Canada who are eligible for the climate action incentive should use Form 5009-S14.

Q: What is the climate action incentive?

A: The climate action incentive is a refundable tax credit provided to residents of Alberta to offset the costs of the federal carbon levy.

Q: How can I claim the climate action incentive?

A: To claim the climate action incentive, you need to complete and file Form 5009-S14 with your tax return.

Q: When is the deadline for filing Form 5009-S14?

A: The deadline for filing Form 5009-S14 is the same as the deadline for filing your annual tax return, which is usually April 30th of the following year.

Q: Are there any eligibility requirements for the climate action incentive?

A: Yes, there are eligibility requirements to qualify for the climate action incentive. These requirements are determined by the government of Canada.

Q: What happens if I am eligible for the climate action incentive but don't file Form 5009-S14?

A: If you are eligible for the climate action incentive but don't file Form 5009-S14, you will not be able to receive the refundable tax credit.

Q: Can I claim the climate action incentive for previous years?

A: No, the climate action incentive can only be claimed for the current tax year and cannot be claimed for previous years.