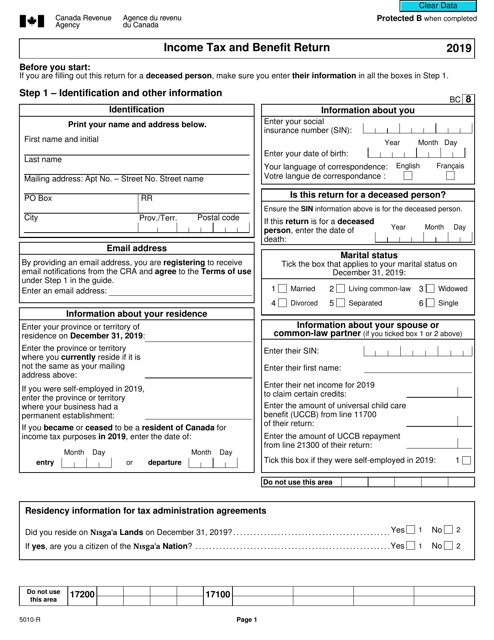

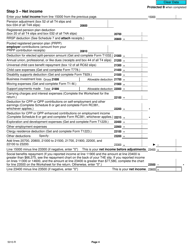

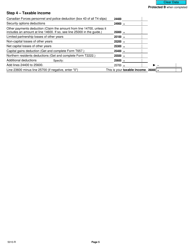

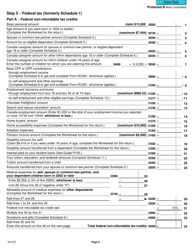

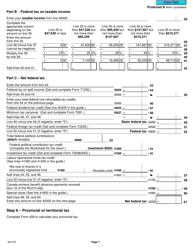

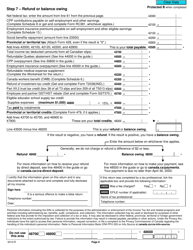

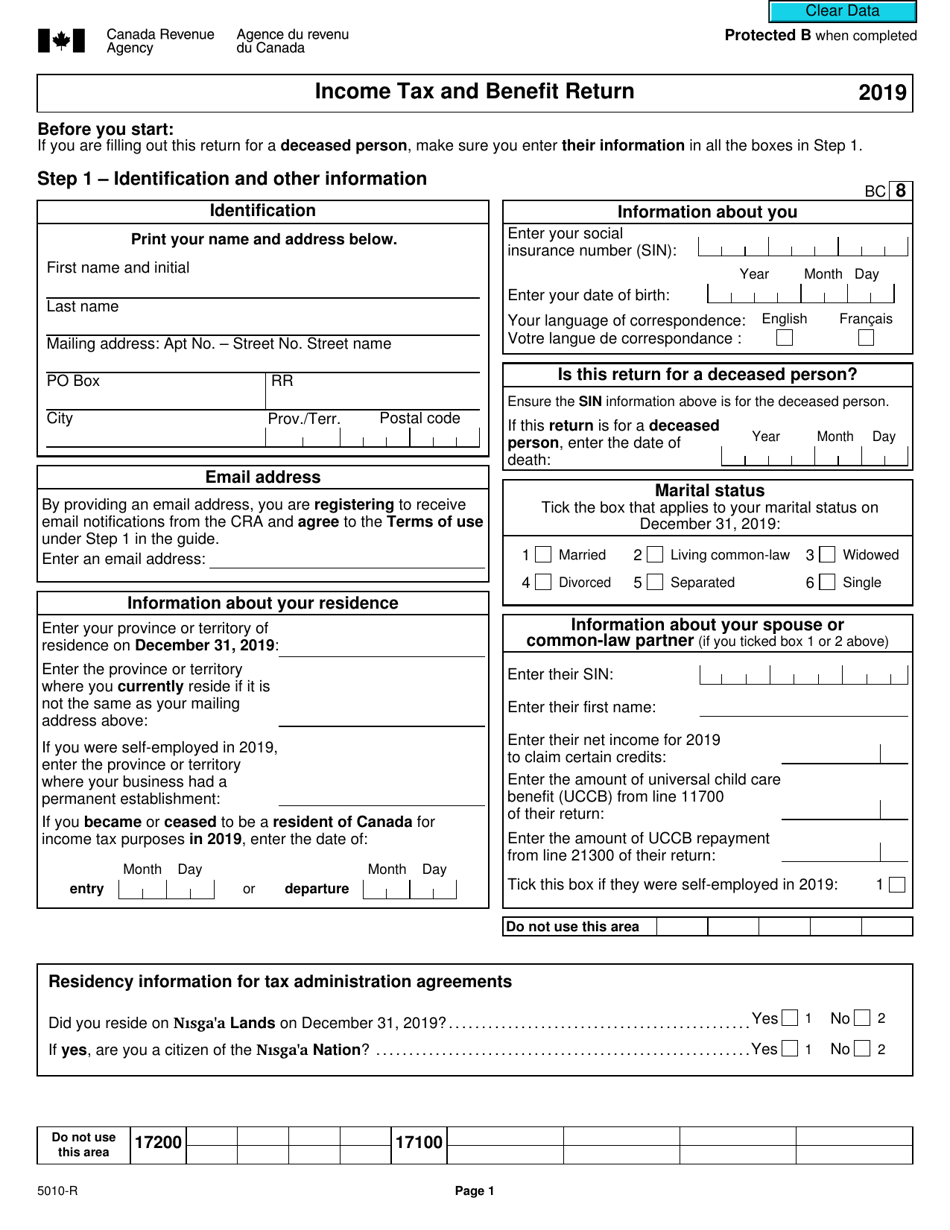

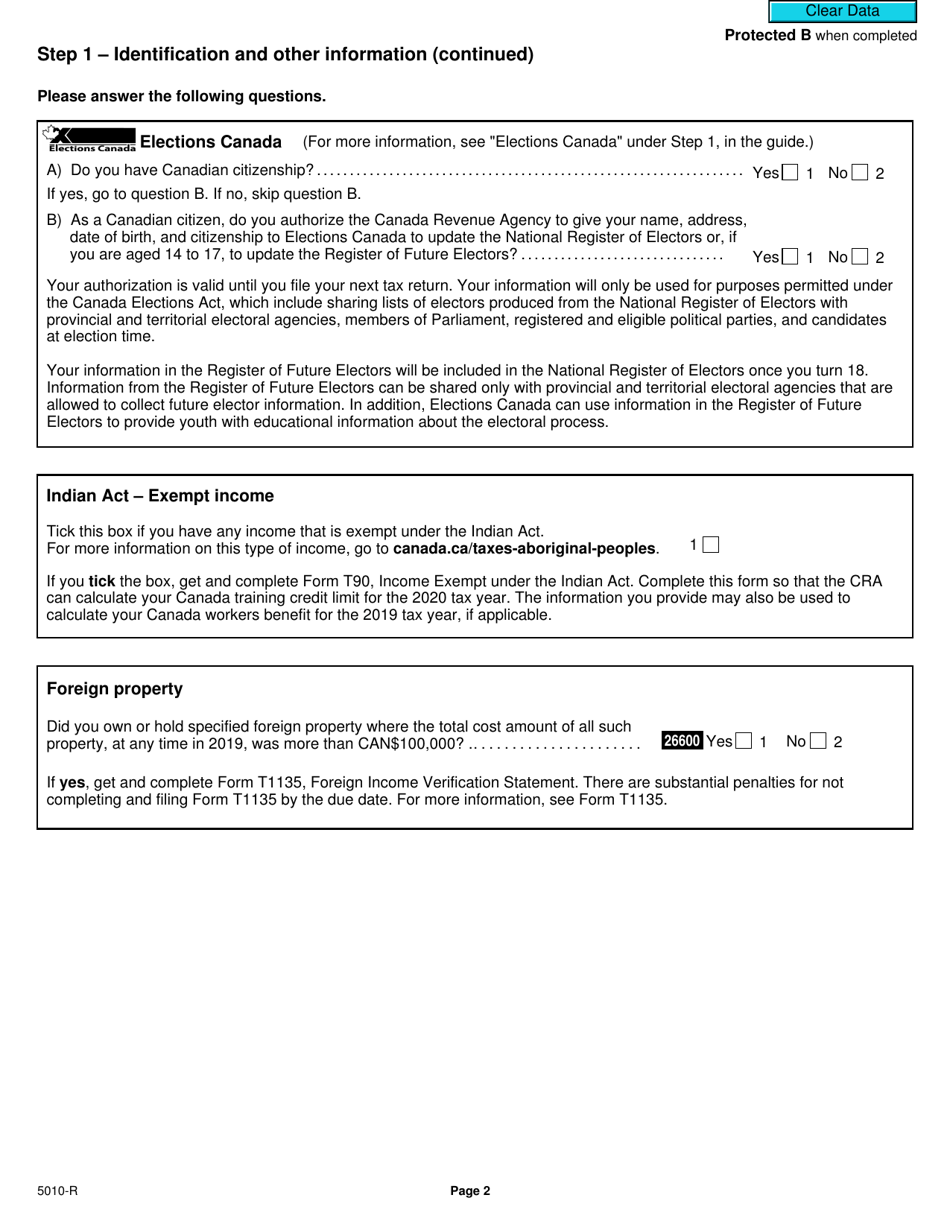

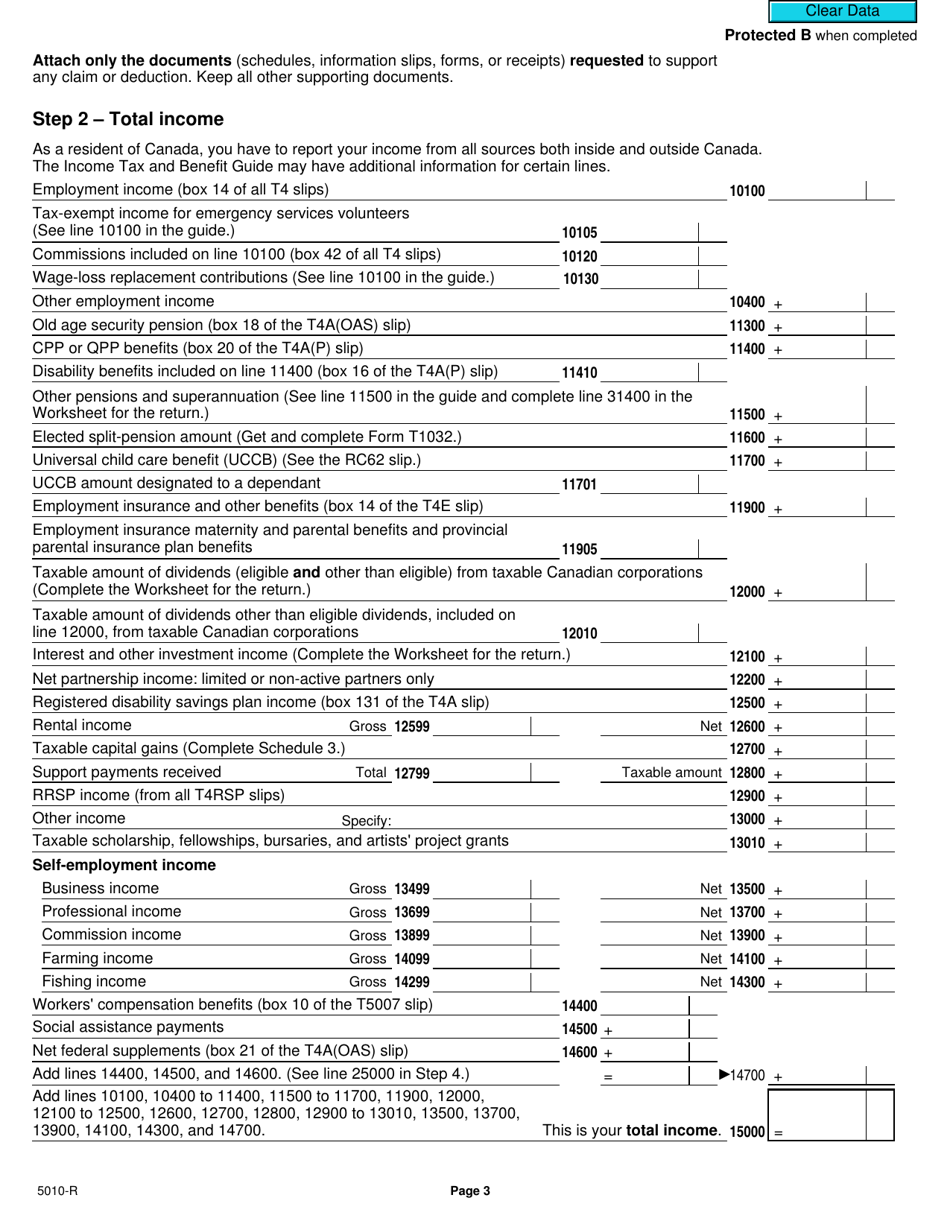

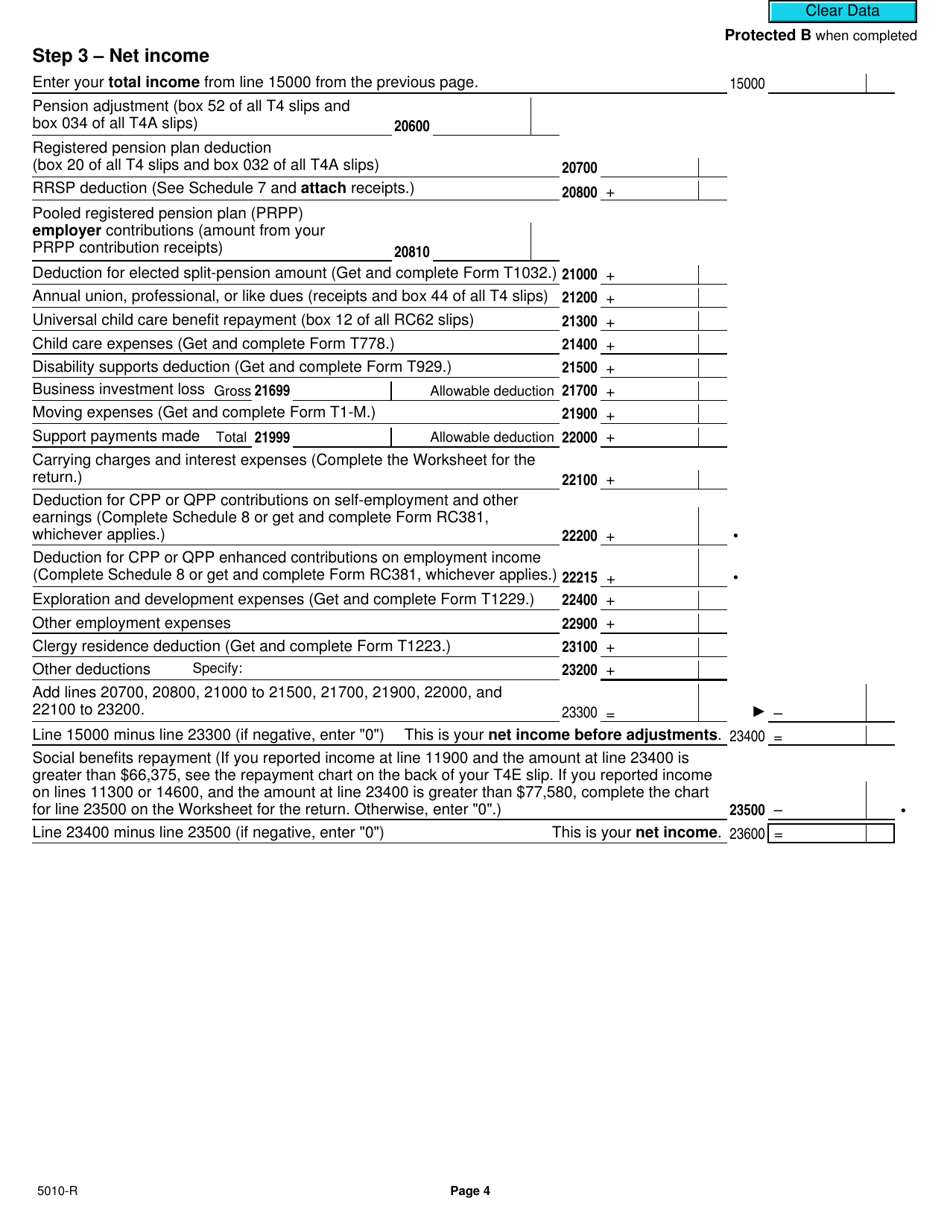

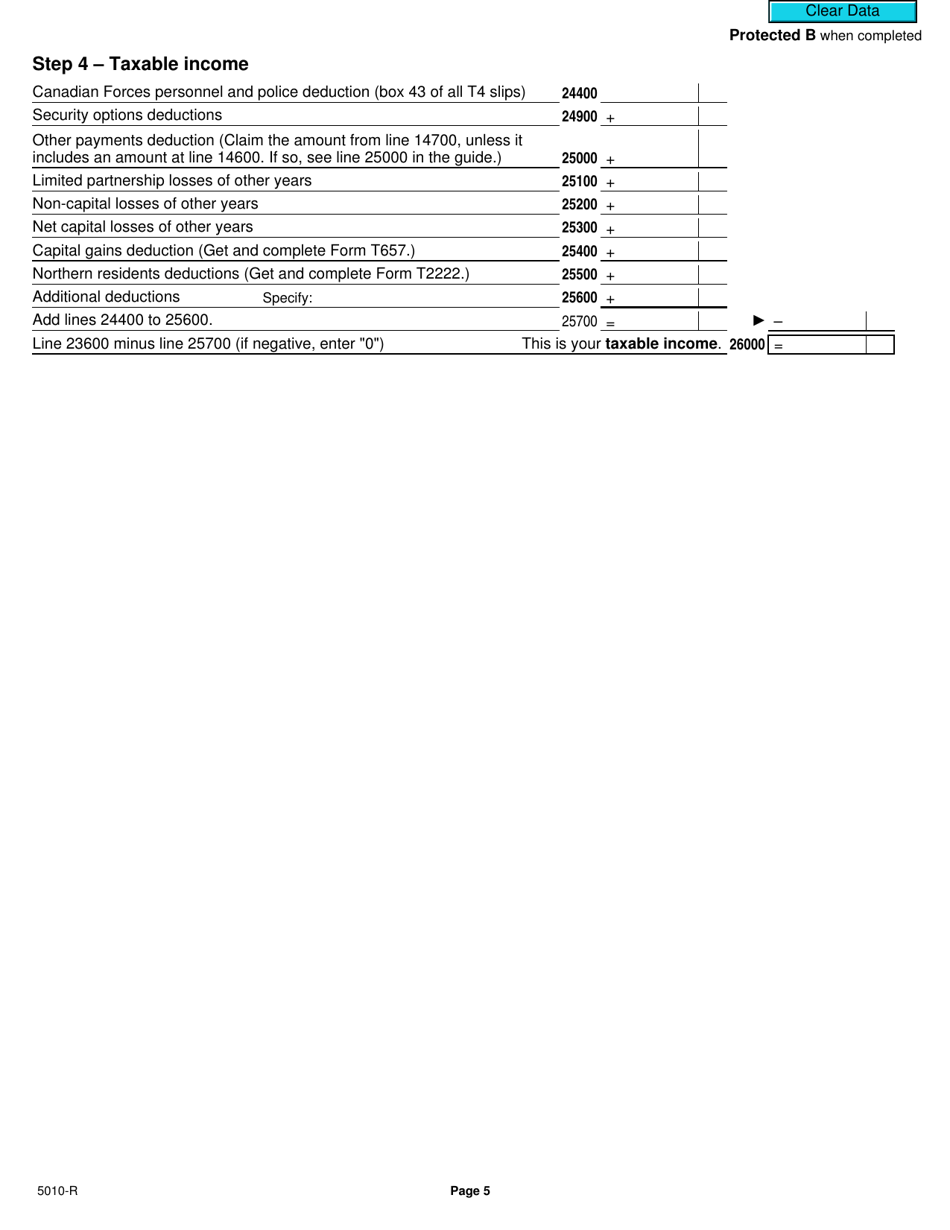

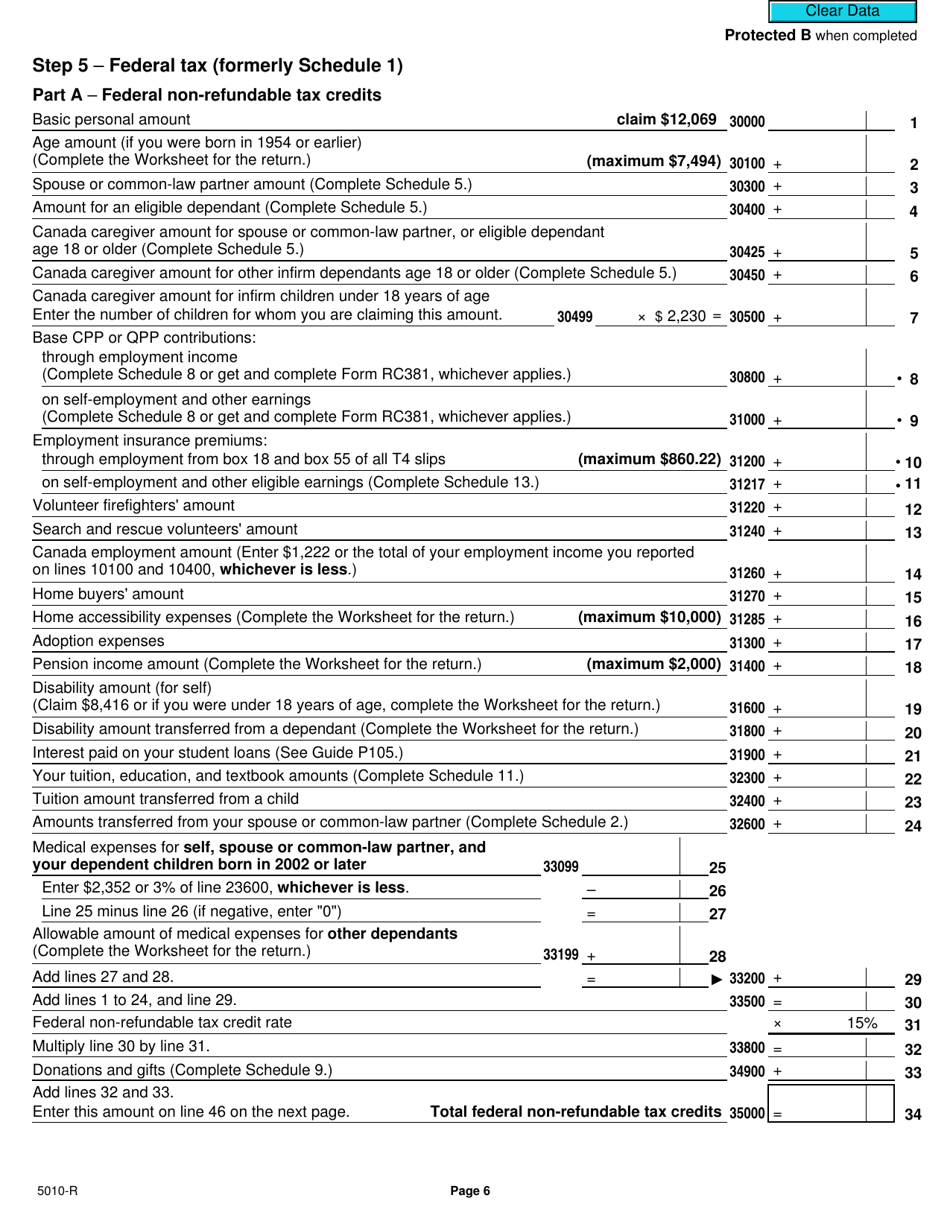

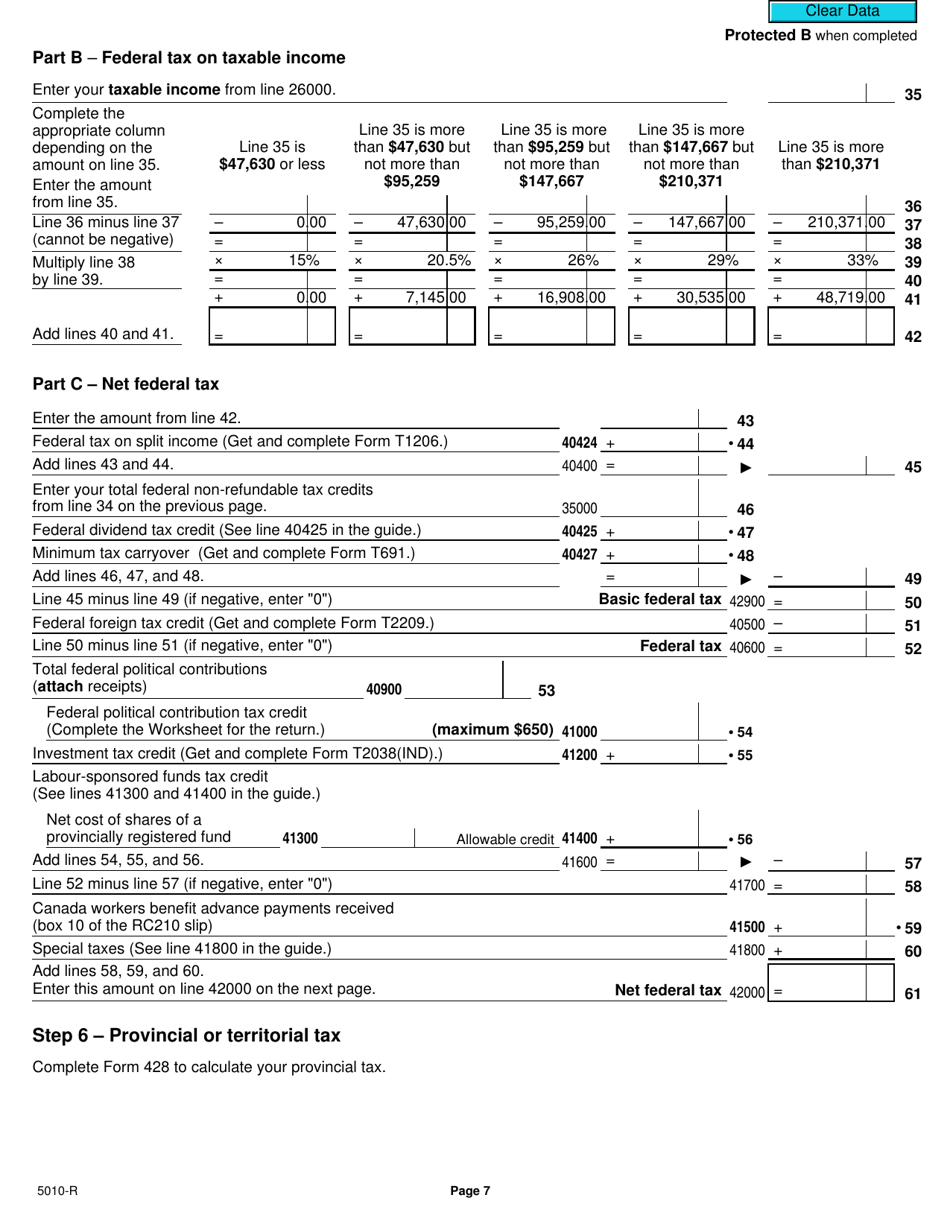

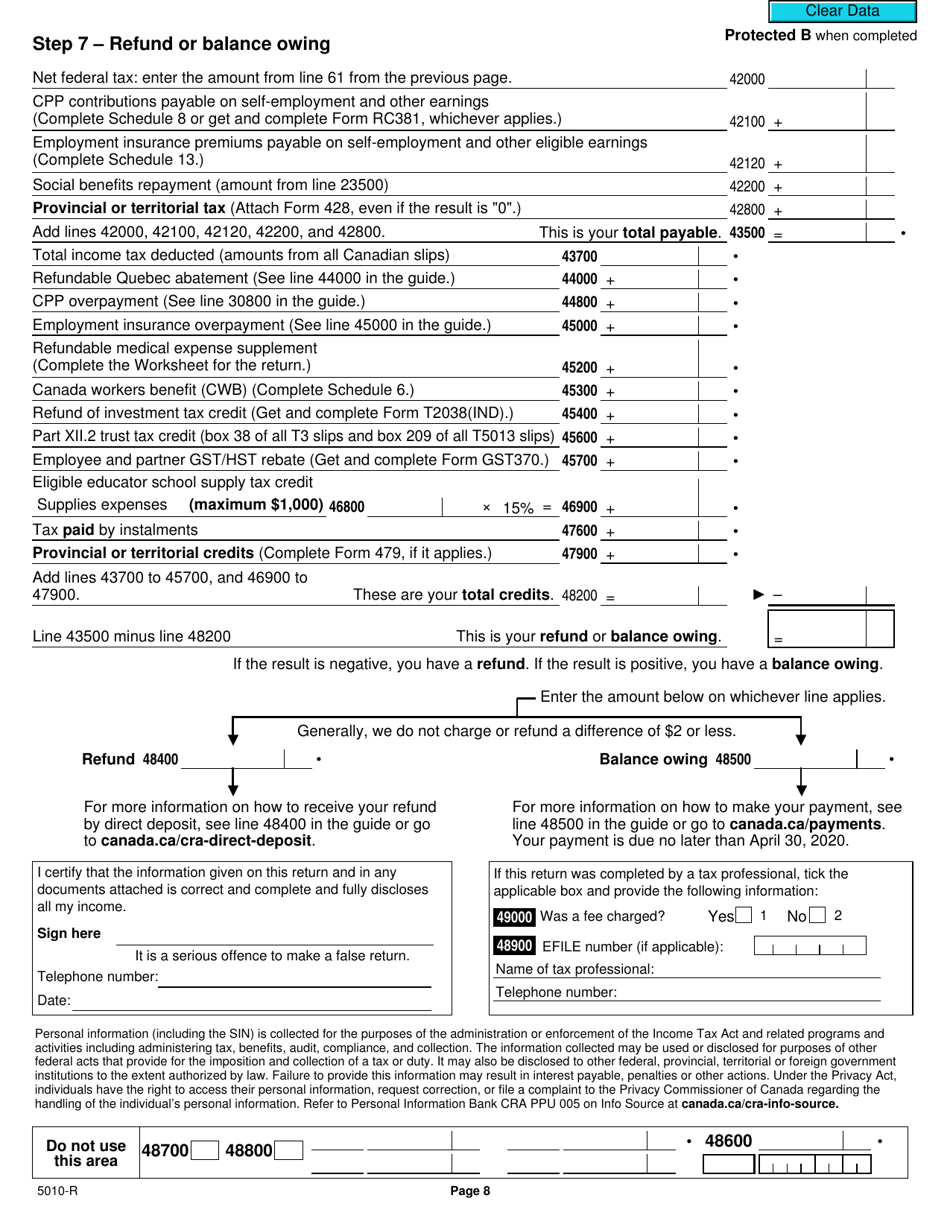

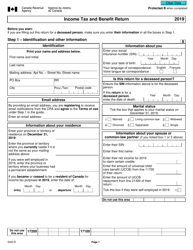

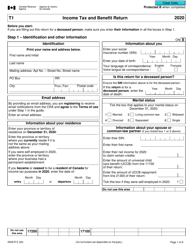

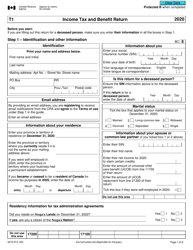

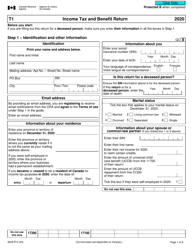

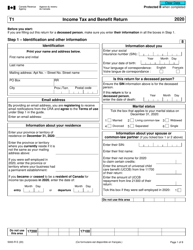

Form 5010-R Income Tax and Benefit Return - Canada (English / French)

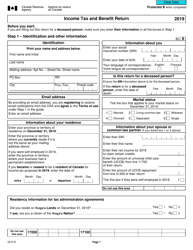

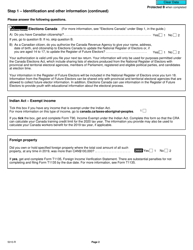

Form 5010-R Income Tax and Benefit Return is a document used in Canada to report your income, deductions, and tax credits to the Canada Revenue Agency (CRA). It is used to calculate your tax liability and determine if you are eligible for any tax refunds or benefits. It is available in both English and French to accommodate Canada's official languages.

The Form 5010-R Income Tax and Benefit Return in Canada can be filed by individual taxpayers to report their income and claim various tax credits and deductions.

FAQ

Q: What is Form 5010-R?

A: Form 5010-R is the Income Tax and Benefit Return form used in Canada.

Q: What does the form cover?

A: The form covers reporting your income and claiming tax benefits.

Q: Is the form available in both English and French?

A: Yes, Form 5010-R is available in both English and French.

Q: Who needs to fill out Form 5010-R?

A: Anyone who has to report their income and claim tax benefits in Canada needs to fill out this form.

Q: What is the purpose of the form?

A: The purpose of the form is to accurately report your income and claim any eligible tax benefits.

Q: Is Form 5010-R used for both personal and business tax returns?

A: No, Form 5010-R is used specifically for personal income tax returns.

Q: When is the deadline for filing Form 5010-R?

A: The deadline for filing Form 5010-R is April 30th of each year for most individuals.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing, such as interest charges and potential reduction of benefits.