This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5010-C (BC428)

for the current year.

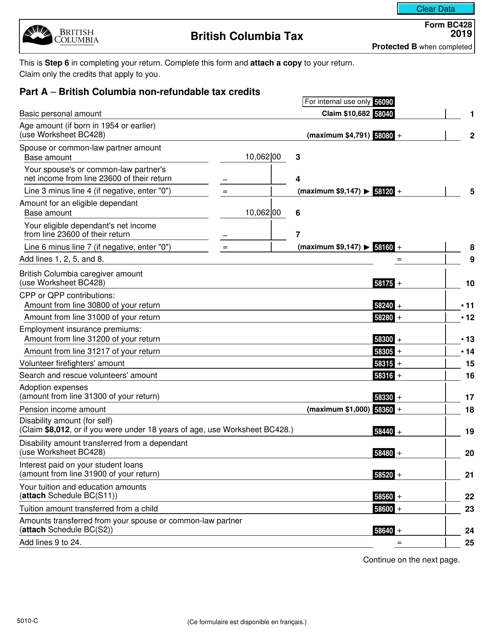

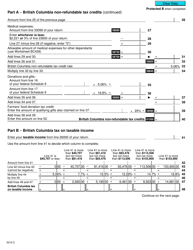

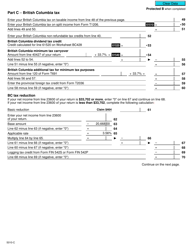

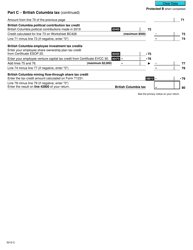

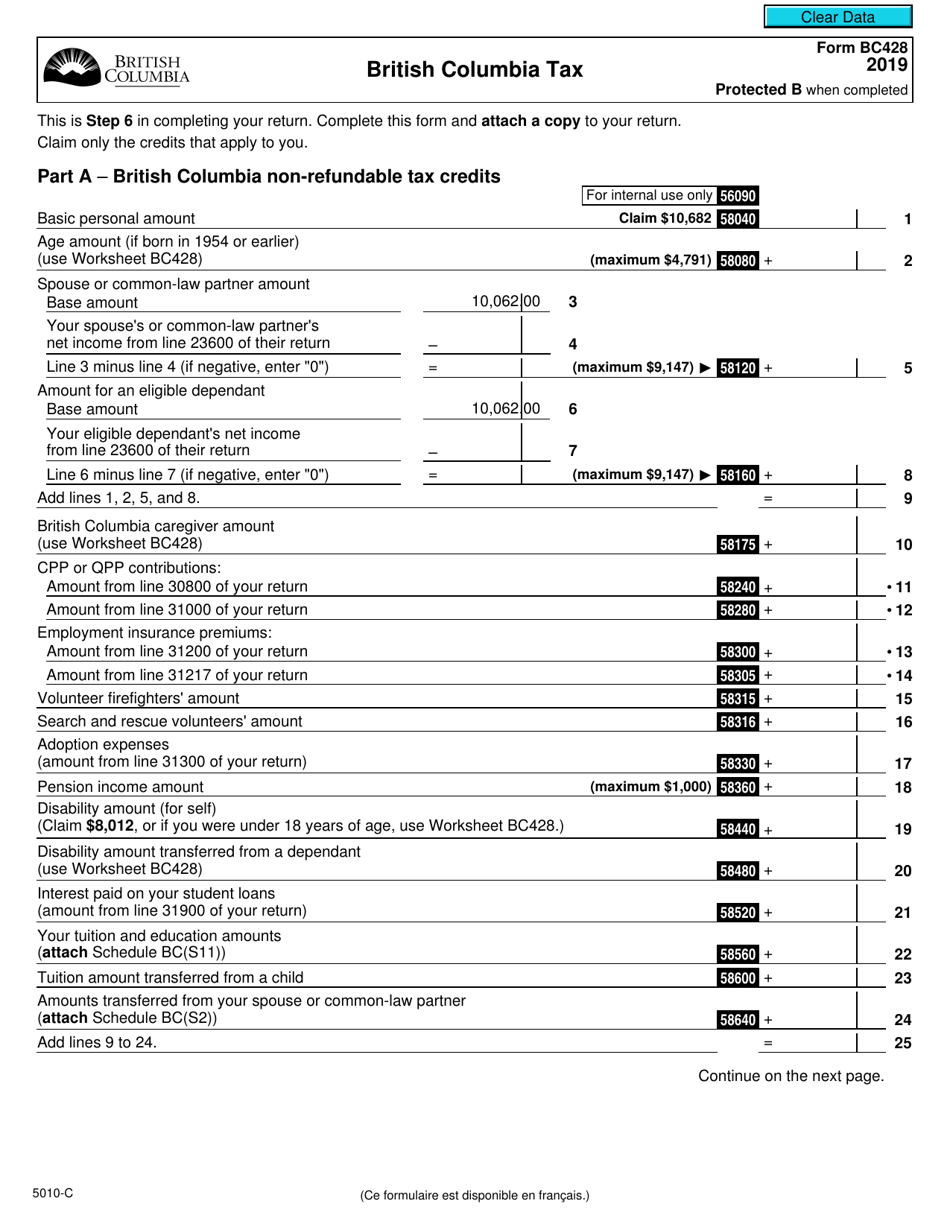

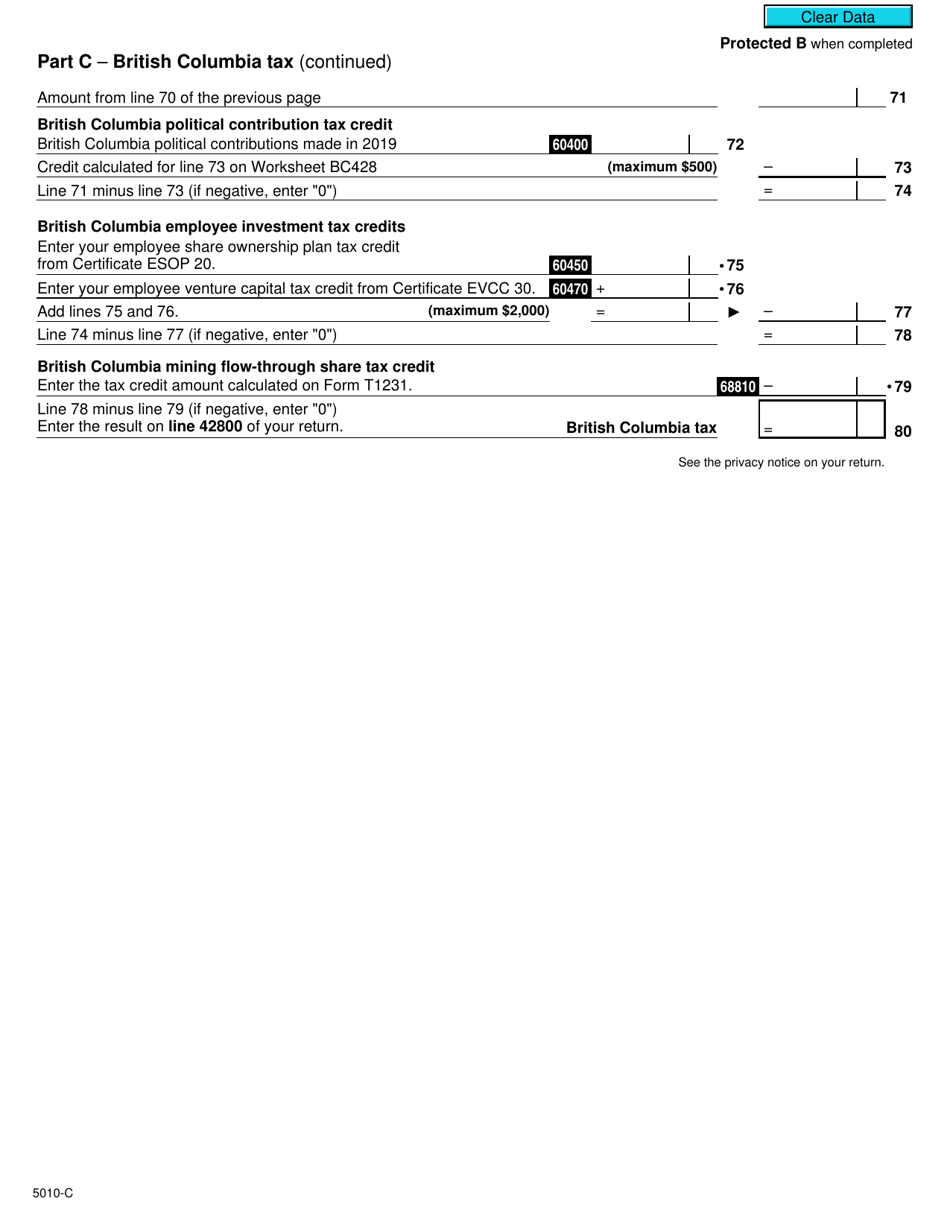

Form 5010-C (BC428) British Columbia Tax - Canada

Form 5010-C (BC428) is used to calculate and report British Columbia provincial taxes in Canada. It helps individuals or businesses in British Columbia to determine the amount of provincial tax they owe or are owed as a refund.

The Form 5010-C (BC428) British Columbia Tax in Canada is typically filed by individual taxpayers who are residents of British Columbia for reporting their provincial tax information.

FAQ

Q: What is Form 5010-C (BC428)?

A: Form 5010-C (BC428) is a tax form specific to the province of British Columbia in Canada.

Q: Why do I need Form 5010-C (BC428)?

A: You need Form 5010-C (BC428) to report your income, deductions, and credits for the province of British Columbia.

Q: Who needs to fill out Form 5010-C (BC428)?

A: Residents of British Columbia who have income to report and claim deductions or credits for the province.

Q: When is the deadline to file Form 5010-C (BC428)?

A: The deadline to file Form 5010-C (BC428) is usually April 30th, or June 15th if you or your spouse/common-law partner is self-employed.

Q: What if I don't file Form 5010-C (BC428) on time?

A: If you don't file Form 5010-C (BC428) on time, you may be subject to penalties and interest charges.

Q: Do I need to include all my supporting documents with Form 5010-C (BC428)?

A: You generally don't need to attach supporting documents when filing Form 5010-C (BC428), but you should keep them in case the CRA asks for them later.