This version of the form is not currently in use and is provided for reference only. Download this version of

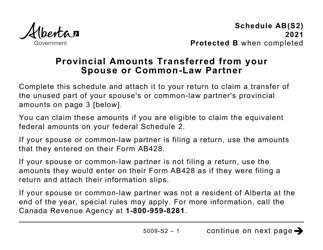

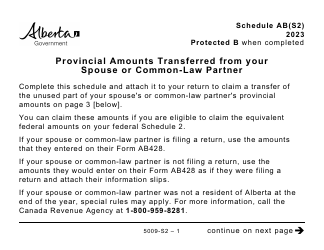

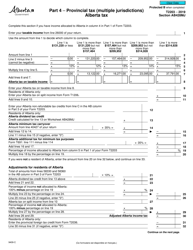

Form 5009-S2 Schedule AB(S2)

for the current year.

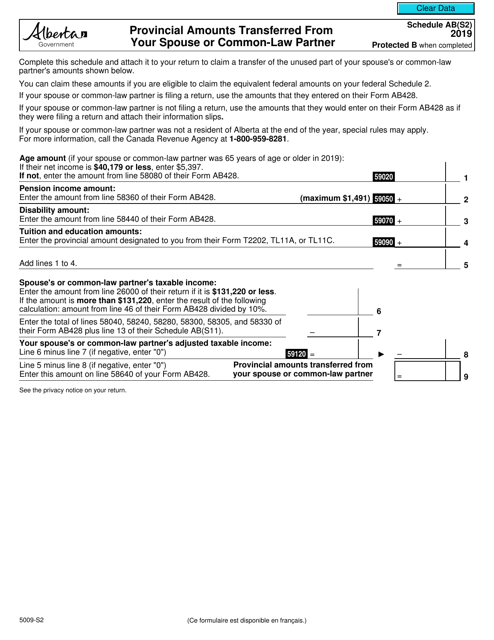

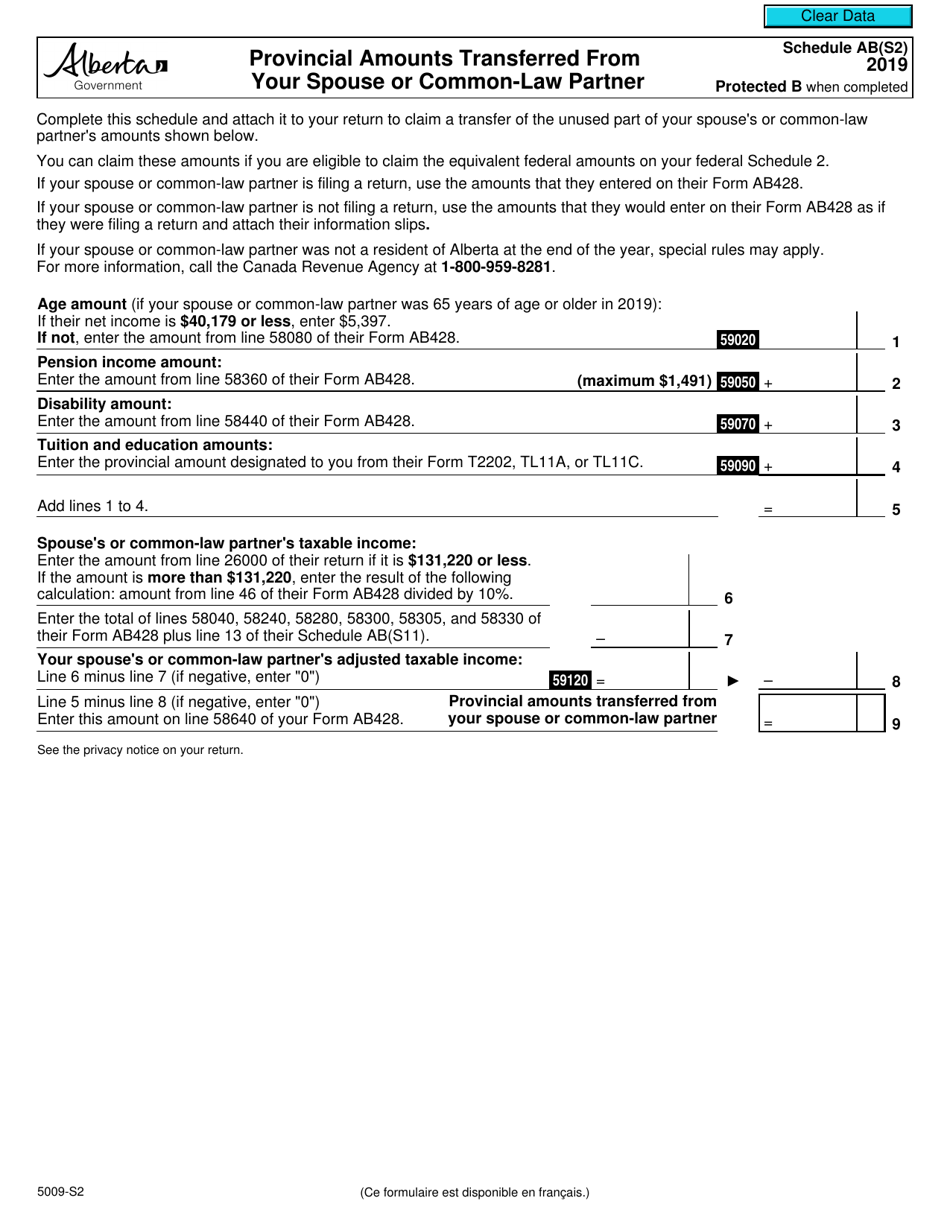

Form 5009-S2 Schedule AB(S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner - Alberta - Canada

Form 5009-S2 Schedule AB(S2) is used in Canada for reporting the provincial amounts transferred from your spouse or common-law partner in the province of Alberta.

FAQ

Q: What is Form 5009-S2 Schedule AB(S2)?

A: Form 5009-S2 Schedule AB(S2) is a tax form used in Canada.

Q: What is a Provincial Amount Transfer?

A: A Provincial Amount Transfer is when you transfer certain amounts from your spouse or common-law partner's tax return to your own.

Q: Which province does Schedule AB(S2) apply to?

A: Schedule AB(S2) applies to the province of Alberta in Canada.

Q: What information do I need to complete Schedule AB(S2)?

A: You will need your spouse or common-law partner's completed tax return and their consent to transfer the amounts.

Q: Why would I need to transfer amounts from my spouse or common-law partner?

A: Transferring amounts from your spouse or common-law partner can help reduce your taxes owing or increase your refund.

Q: Are there any restrictions on the amounts that can be transferred?

A: Yes, there are restrictions on the amounts that can be transferred. These restrictions are specified by the Canada Revenue Agency.