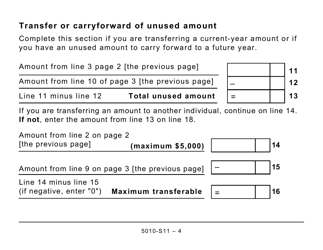

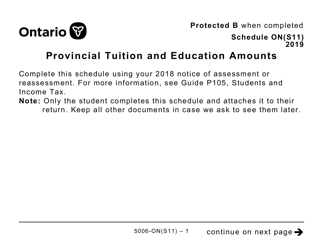

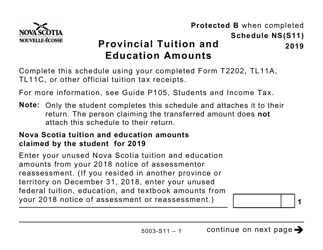

Form 5010-S11 Schedule BC(S11) Provincial Tuition and Education Amounts - British Columbia (Large Print) - Canada

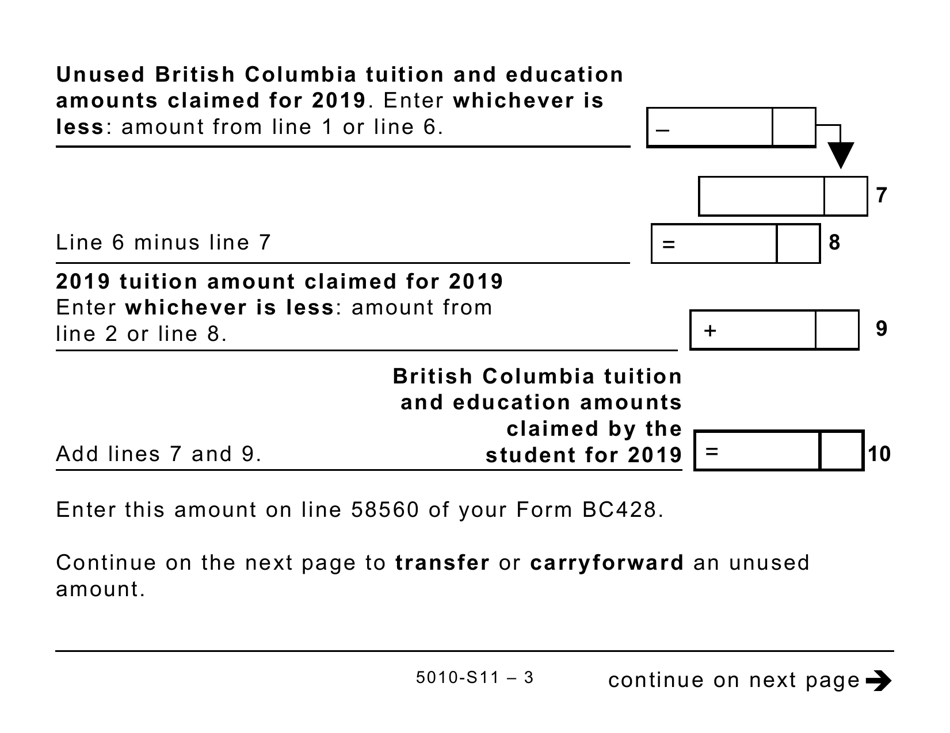

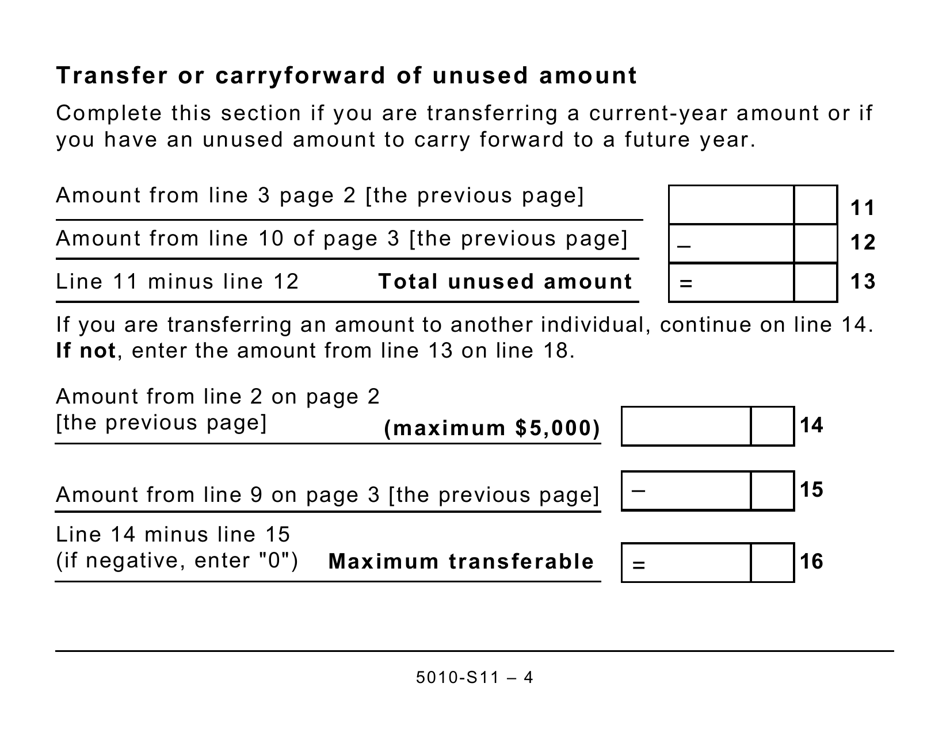

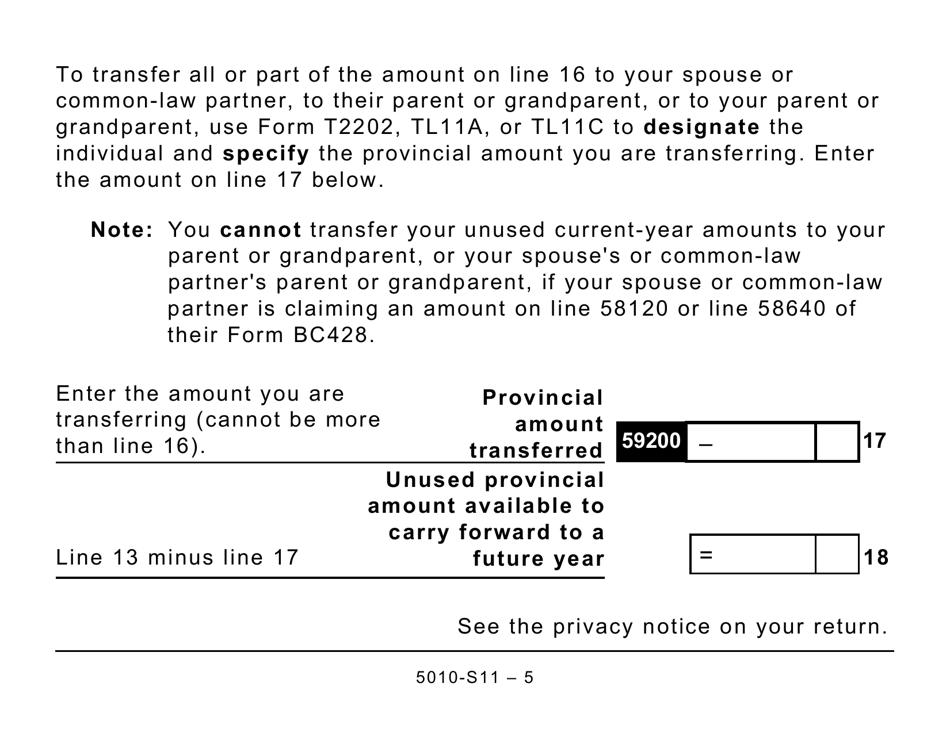

Form 5010-S11 Schedule BC(S11) Provincial Tuition and Education Amounts - British Columbia (Large Print) is a tax form used in Canada to claim tuition and education amounts specifically for the province of British Columbia.

The Form 5010-S11 Schedule BC(S11) Provincial Tuition and Education Amounts - British Columbia (Large Print) in Canada is filed by individual taxpayers who want to claim tuition and education amounts in the province of British Columbia.

FAQ

Q: What is Form 5010-S11?

A: Form 5010-S11 is a tax form used in Canada.

Q: What is Schedule BC(S11)?

A: Schedule BC(S11) is a specific part of Form 5010-S11.

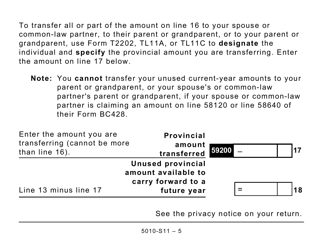

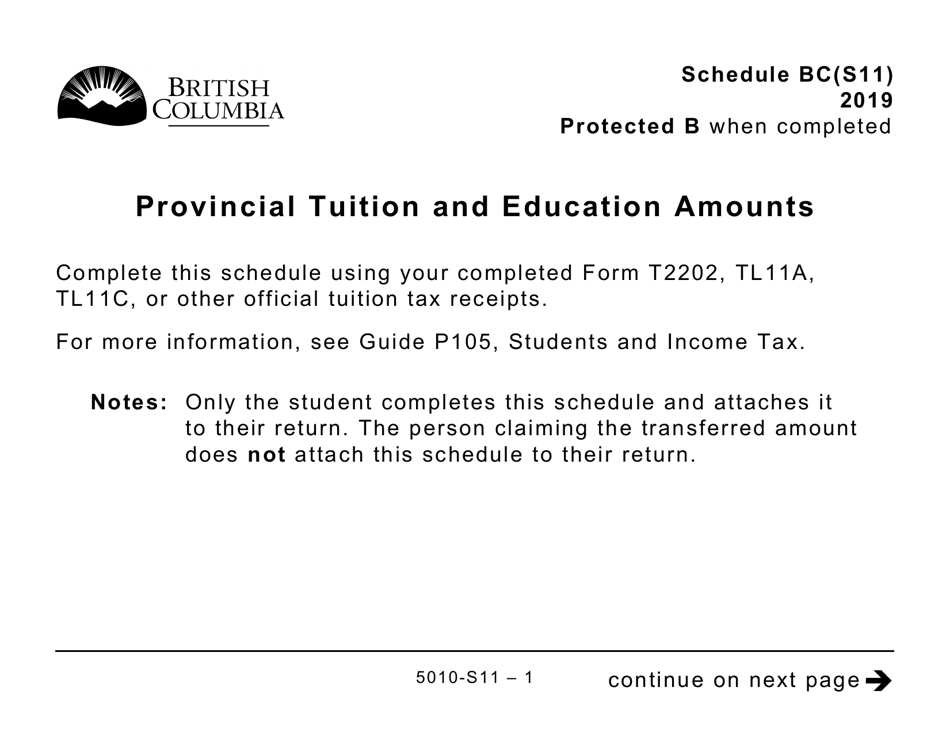

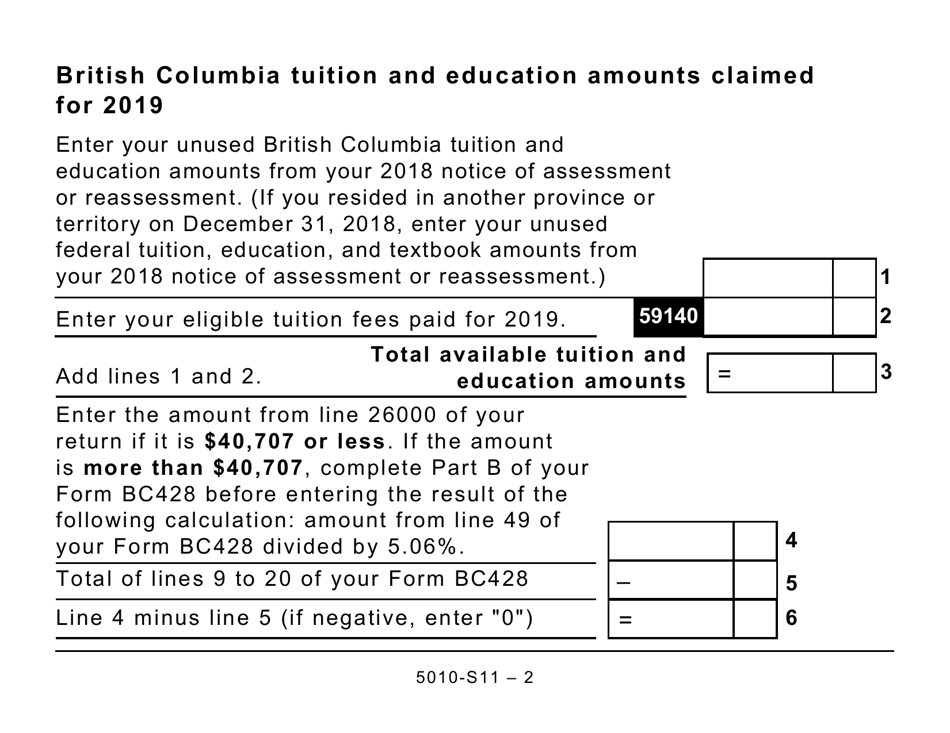

Q: What are Provincial Tuition and Education Amounts?

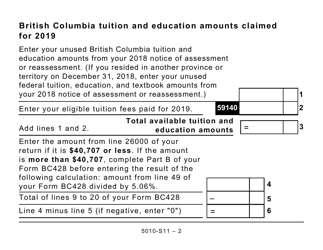

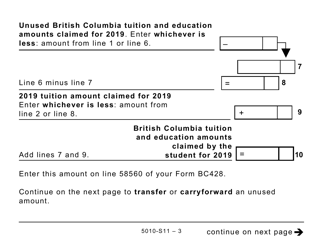

A: Provincial Tuition and Education Amounts are tax credits for educational expenses in British Columbia.

Q: Who is eligible for Provincial Tuition and Education Amounts?

A: Residents of British Columbia who incurred eligible educational expenses may be eligible.

Q: What is the purpose of this form?

A: This form is used to claim provincial tax credits for educational expenses in British Columbia.

Q: Is the form available in large print?

A: Yes, the form is available in large print for people with visual impairments.

Q: Do I need to submit any supporting documents with this form?

A: You may need to submit supporting documents such as receipts for educational expenses.

Q: When is the deadline for submitting this form?

A: The deadline for submitting this form is usually April 30th of the following year.

Q: Can I claim both federal and provincial education tax credits?

A: Yes, you can claim both federal and provincial education tax credits if you are eligible.